Okay, look. Wall Street analysts are, let’s be honest, frequently wrong. They’re like those people who confidently predict the weather based on whether their knee hurts. But sometimes, just sometimes, they stumble upon something useful. And right now, they’re whispering about Nvidia and Microsoft. Two trillion-dollar companies. Which, in the grand scheme of things, is a lot of money. Even for people who spend their days staring at spreadsheets.

The consensus? These aren’t just good companies; they’re potentially undervalued. Analysts are throwing around price targets suggesting a 40-50% upside in the next year. Which, if you’re not a math person, is a lot. The market, on average, gives you a measly 10%. So, yeah, these two are looking…interesting. It’s not a guarantee, of course. This isn’t like finding a twenty in your winter coat. But it’s better than most things you’ll find on the internet.

Nvidia: Still Printing Money (and Graphics Cards)

Nvidia. The name alone sounds like a Bond villain. But instead of world domination, they’re dominating the AI chip market. And people are buying. A lot. It’s like everyone suddenly decided they needed super-powered computers to…I don’t know, organize their sock drawers? Whatever it is, Nvidia is benefiting. Last quarter, their revenue jumped 72%. That’s the kind of growth rate that makes venture capitalists weep with joy. They’re a multi-trillion-dollar company behaving like a scrappy startup. It’s…unsettling, frankly. But also, good for investors.

Management is practically giddy. They’re predicting another 77% growth next quarter. And that’s before factoring in China, which, let’s face it, is always a wild card. It’s like they’re saying, “We’re already doing incredibly well, but we might do even better!” It’s a little boastful, but I’m not going to complain. The AI boom isn’t slowing down anytime soon, and Nvidia is perfectly positioned to ride that wave. Honestly, I wouldn’t be surprised if the stock price goes to the moon. (Please note: I am not a space travel advisor.)

Microsoft: Surprisingly Affordable (For Now)

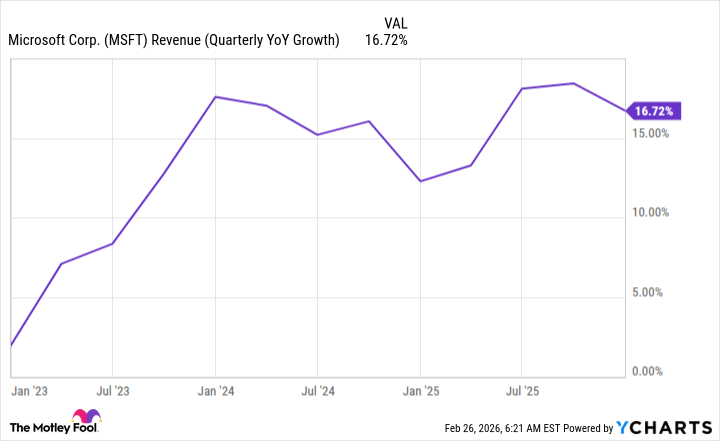

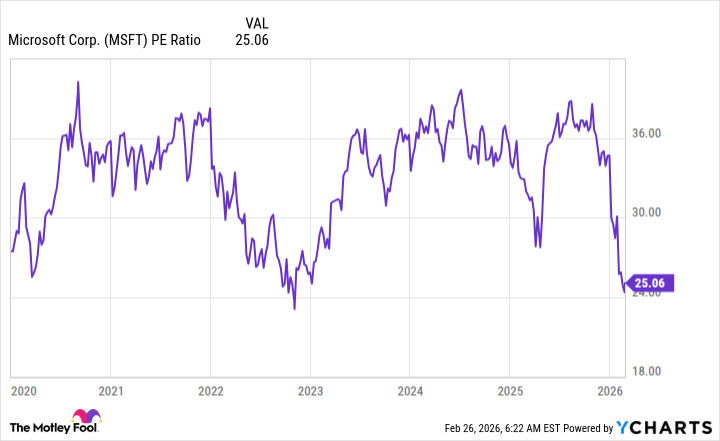

Microsoft. They’ve gone from being the evil empire to…a slightly less evil, but still very large, empire. They’re still crushing it, growing revenue at 17% last quarter. But the market, in its infinite wisdom, decided that wasn’t enough. So, the stock took a hit. Which, for the rest of us, is a bit of a gift. It’s trading at a multi-year low in terms of its price-to-earnings ratio. It’s like finding a designer handbag on clearance. You take it, and you don’t ask questions.

They weren’t even this cheap during the tariff wars or the COVID-19 pandemic. The market is fickle, people. It wants constant, exponential growth. It doesn’t care about solid fundamentals or long-term potential. It just wants more, more, more. Which, as an investor, I find both exhausting and occasionally profitable. Microsoft is currently trading at 25 times earnings. Is that expensive? Maybe. But it’s a company that consistently delivers, and that’s worth something. Analysts are projecting continued success and a return to its normal valuation range. If that happens, this stock will look like a steal. Even if it doesn’t, Microsoft is still a solid bet.

They’re expecting 16-15% revenue growth for the next two years. That’s enough to beat the market most years. So, yeah, I’m confident in this one. It’s not a flashy pick, but sometimes the best investments are the ones that quietly compound over time. Like a good cup of coffee. Or a well-maintained 401(k).

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Securing the Agent Ecosystem: Detecting Malicious Workflow Patterns

- DOT PREDICTION. DOT cryptocurrency

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- NEAR PREDICTION. NEAR cryptocurrency

- EUR UAH PREDICTION

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Top 15 Insanely Popular Android Games

- USD COP PREDICTION

2026-03-03 23:34