Full Burst RPG —BrownDust2.

A live update is scheduled for March 5th (UTC).

Please refer to the details below.

■ Update Schedule: March 5th, 12:00 AM (UTC)

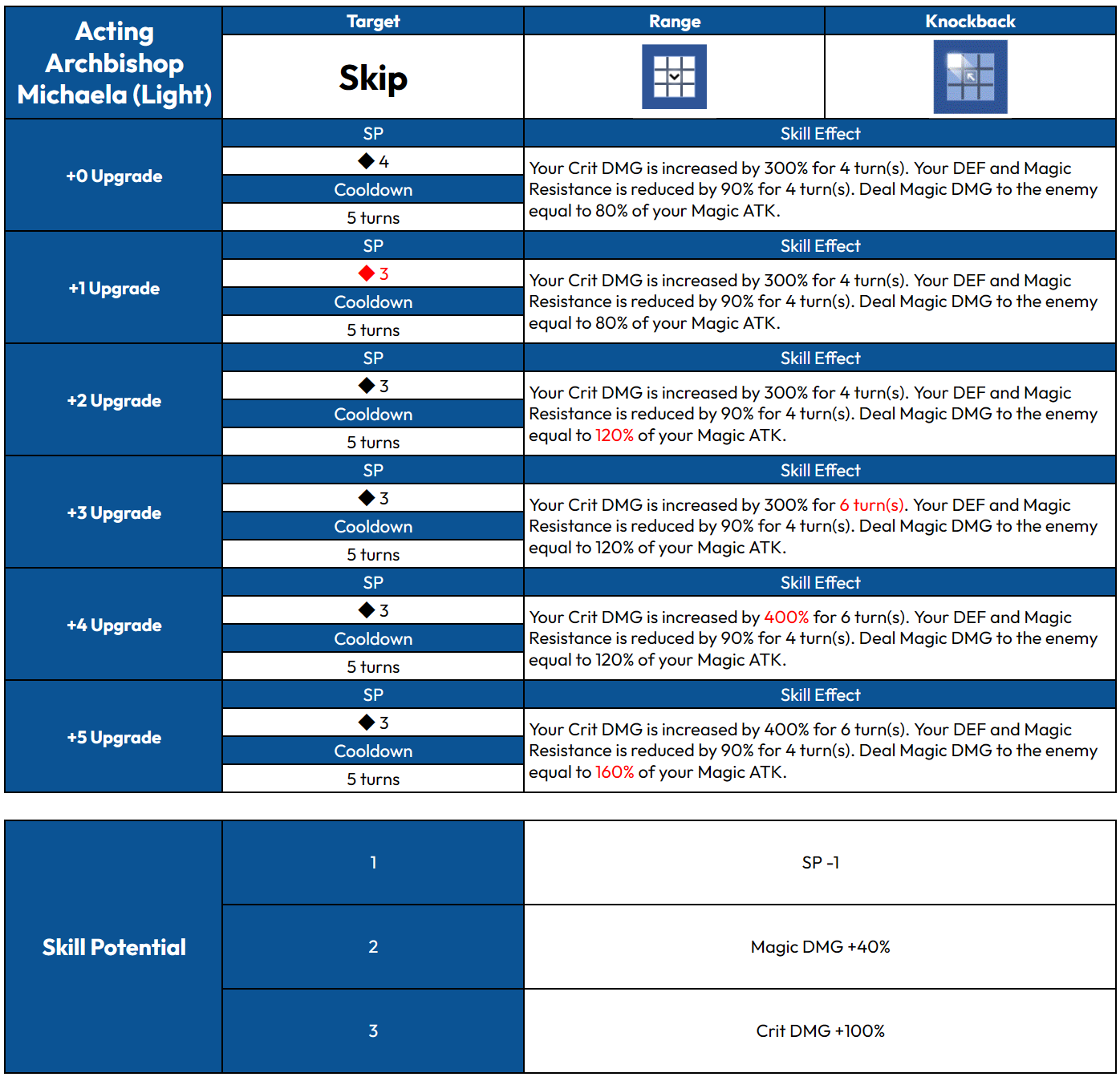

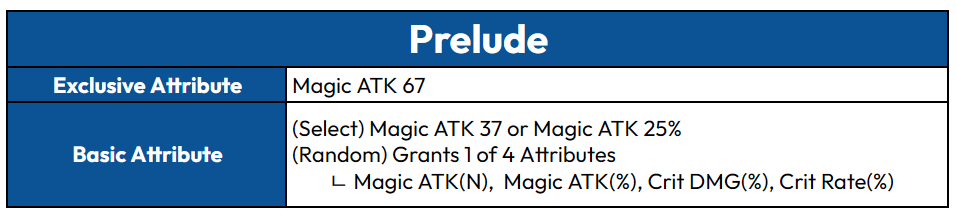

You can now pick up the Acting Archbishop Michaela costume and her exclusive gear, ‘Prelude’. This pickup will be available from March 5th at 12:00 AM UTC until March 18th at 11:59 PM UTC.

You can find more detailed game stats and information in the Collection menu. The costume for Acting Archbishop Michaela will be available in the Powder of Hope shop after the game update on March 25th.

2) Prelude : After March 5th, 12:00 AM (UTC) – March 18th, 11:59 PM (UTC)

This information is based on the first time obtaining the UR-grade Prelude. For complete details and stats, please refer to the Collection menu within the game.

Thank you.

Read More

- Building 3D Worlds from Words: Is Reinforcement Learning the Key?

- Securing the Agent Ecosystem: Detecting Malicious Workflow Patterns

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The Best Directors of 2025

- Games That Faced Bans in Countries Over Political Themes

- TV Shows Where Asian Representation Felt Like Stereotype Checklists

- 📢 New Prestige Skin – Hedonist Liberta

- SEGA Sonic and IDW Artist Gigi Dutreix Celebrates Charlie Kirk’s Death

- The Most Anticipated Anime of 2026

2026-03-03 10:37