Becoming a Hollywood star usually takes years of hard work, like auditions and acting lessons. However, some major actors actually got their big break by accident. They were often just doing regular jobs or supporting friends at auditions when someone noticed them. Their stories show that luck – being in the right place at the right time – can be just as important as skill and effort. This list shares the surprising beginnings of actors who didn’t initially plan to become movie or TV stars.

Harrison Ford

Before becoming a famous actor, Harrison Ford was a carpenter. He built some cabinets for director George Lucas, and Lucas then asked him to help read lines with actors auditioning for his new movie, ‘Star Wars’. Lucas liked Ford’s reading so much that he gave him the role of Han Solo. That part made Ford a star and helped him become one of the most famous actors in Hollywood.

Jason Statham

Before becoming a famous actor, Jason Statham made a living selling inexpensive jewelry and perfume on the streets of London. When director Guy Ritchie was casting his first film, ‘Lock, Stock and Two Smoking Barrels,’ he needed someone who truly understood street life. He met Statham through a modeling connection and was impressed by his genuine background. During his audition, Statham even convinced Ritchie he was a skilled salesman by successfully selling him a piece of fake jewelry.

Danny Trejo

Danny Trejo turned his life around after a difficult past, becoming a drug counselor after being a boxing champion while incarcerated. While supporting a client on the set of ‘Runaway Train,’ a producer noticed him and recognized his boxing skills. He was hired to train the actors, and his distinctive appearance and powerful presence ultimately led to him landing an acting role in the movie.

Johnny Depp

Johnny Depp first came to Los Angeles hoping to make it as a rock musician. While supporting a friend at an audition for ‘A Nightmare on Elm Street,’ the director, Wes Craven, spotted him and asked him to try out. Depp got the role of Glen Lantz and unexpectedly shifted his focus from music to a career in acting.

Matthew McConaughey

Matthew McConaughey’s acting career began unexpectedly while he was studying film at the University of Texas. He struck up a conversation with a casting director at a hotel bar, and she invited him to audition for a small part in the movie ‘Dazed and Confused’. Although the role was originally meant to be minor, his talent for improvisation led to a much larger part. This chance encounter ultimately launched his career and led to his memorable performance in the film.

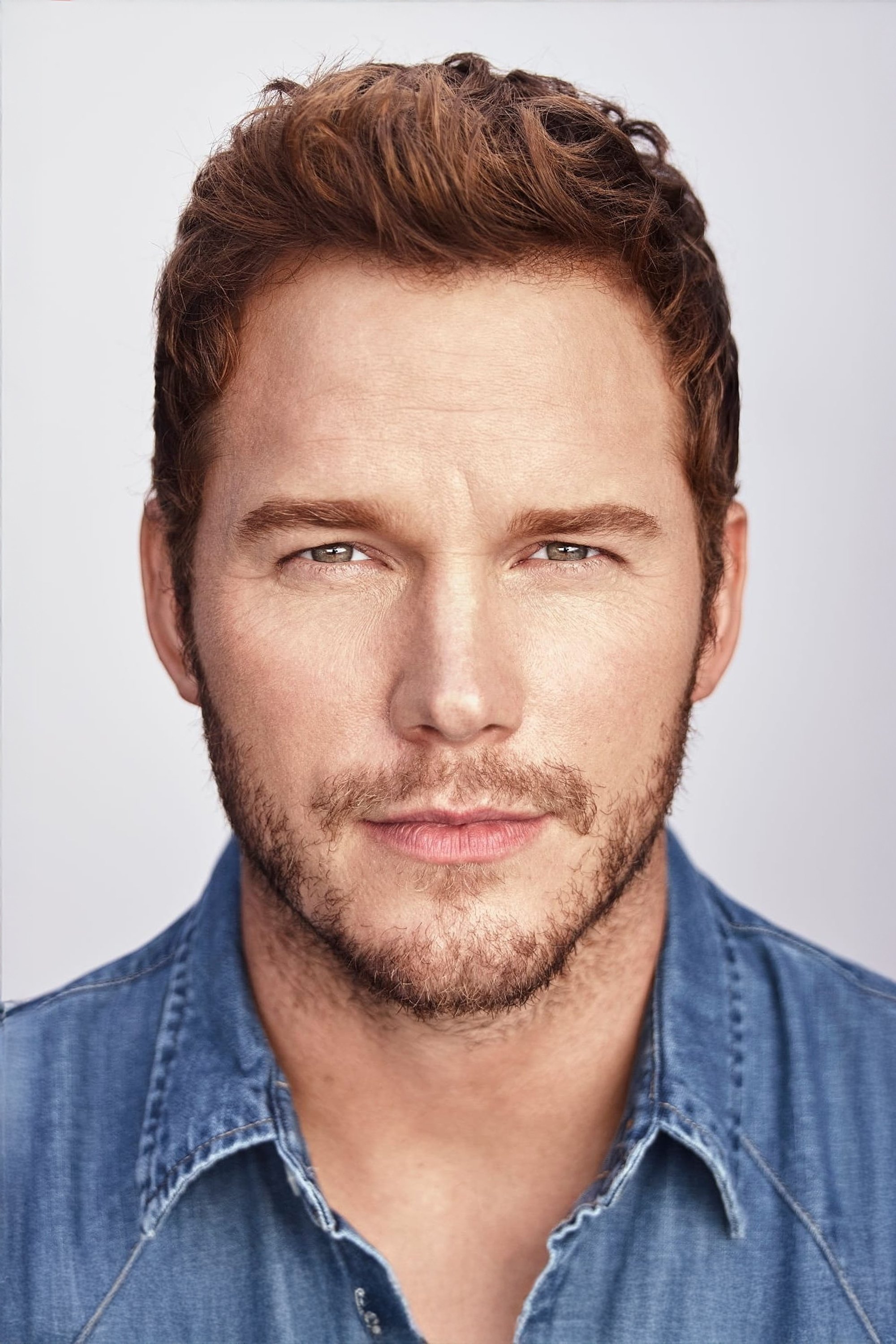

Chris Pratt

While working as a waiter at a Bubba Gump Shrimp Company in Hawaii, Chris Pratt met actress Rae Dawn Chong. She was impressed by his personality and looking for someone new for her first directing project. She cast him in her short horror film, ‘Cursed Part 3,’ and helped launch his acting career by bringing him to Los Angeles. This unexpected encounter changed Pratt’s life, taking him from being homeless and waiting tables to becoming a famous action star.

Will Smith

I always loved hearing the story of how Will Smith became a superstar! Apparently, before he was a huge actor, he was already making music, but a wrong turn in a parking lot completely changed his life. He asked this man for directions, and it turned out to be Benny Medina, a really influential producer. Right there, in the parking lot, Medina described a sitcom idea based on his own experiences, and pitched it to Will. That simple conversation? It led to ‘The Fresh Prince of Bel-Air,’ and launched Will Smith into the stratosphere! It’s just incredible how a chance encounter can create something so iconic.

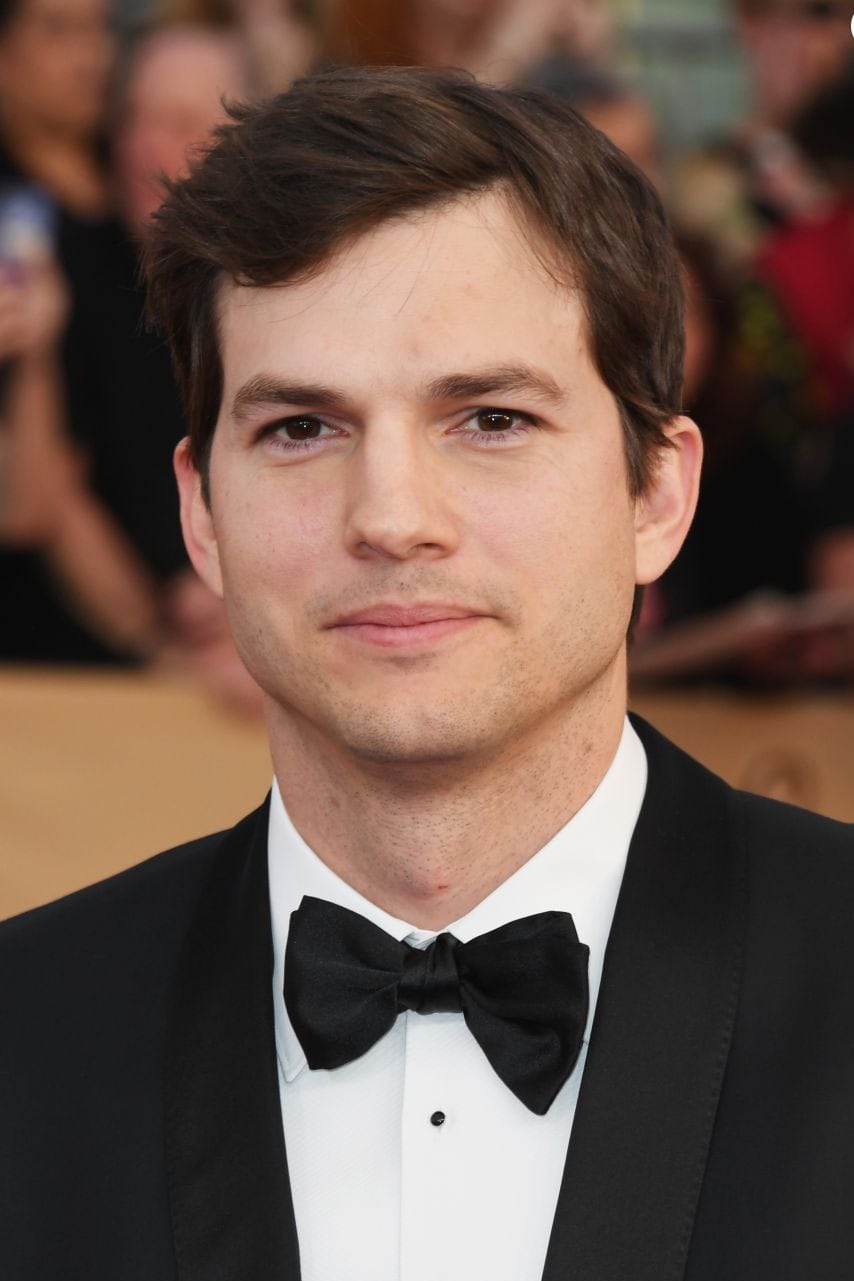

Ashton Kutcher

Ashton Kutcher was studying to be an engineer in college when someone spotted him at a bar in Iowa and suggested he try modeling. He entered and won a modeling competition, which launched his career in New York. This eventually led to his big break on ‘That 70s Show’. He hadn’t planned on becoming an actor; he was simply trying to raise money to help cover his sister’s medical bills.

Channing Tatum

Channing Tatum was discovered in Miami by a talent scout while simply walking down the street, and was first offered modeling work. He gained experience appearing in commercials and music videos before moving into acting. His athletic ability and dance skills eventually led to the role of a lead in the movie ‘Step Up’, which launched his career and opened doors to many successful films, establishing him as a prominent actor in Hollywood.

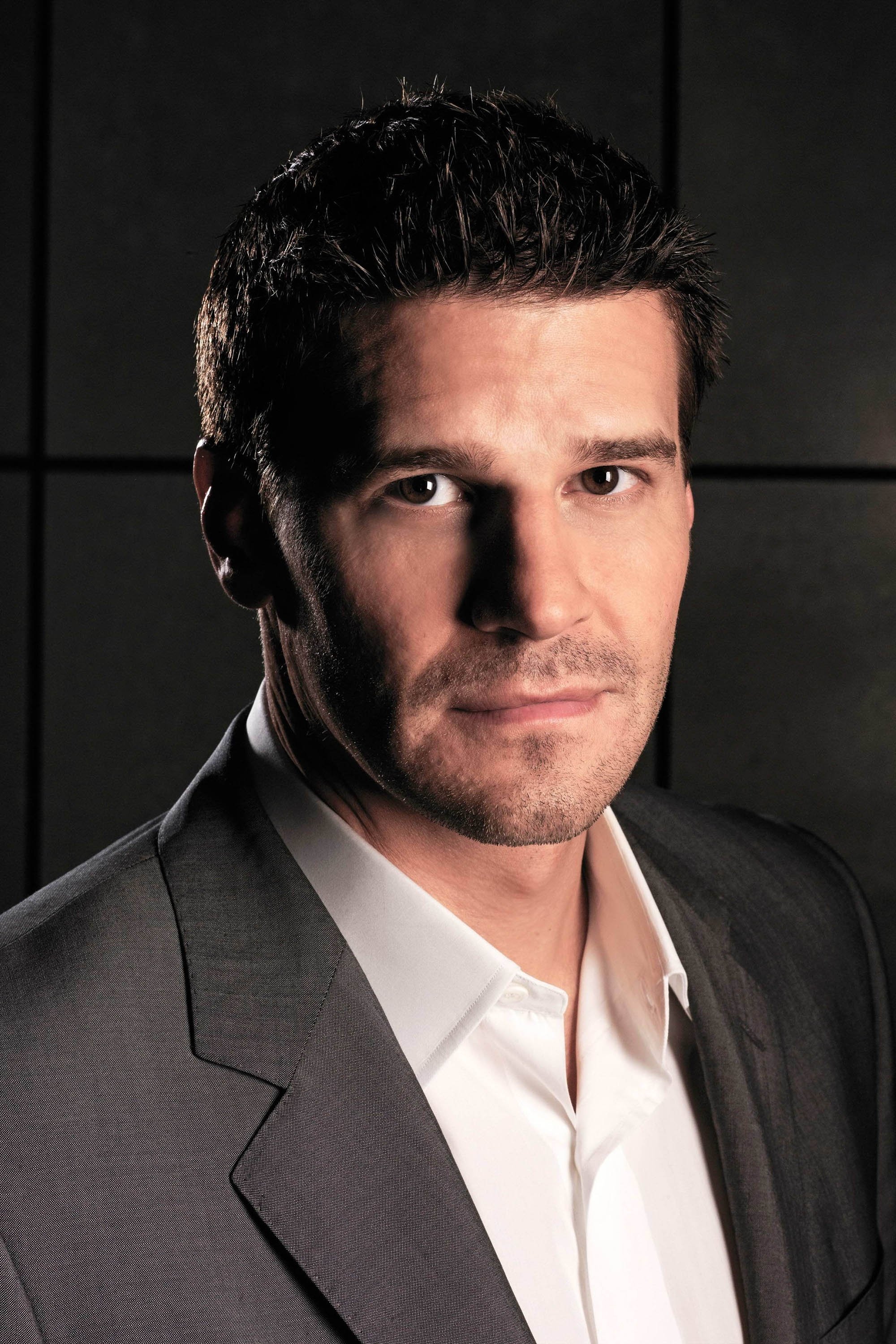

David Boreanaz

David Boreanaz’s acting career began quite by chance. While walking his dog in Los Angeles, a talent scout spotted him and was impressed by his looks and natural authority. This led to an audition for ‘Buffy the Vampire Slayer’, and what started as a small part quickly grew into a regular role on that show, and eventually his own spin-off series.

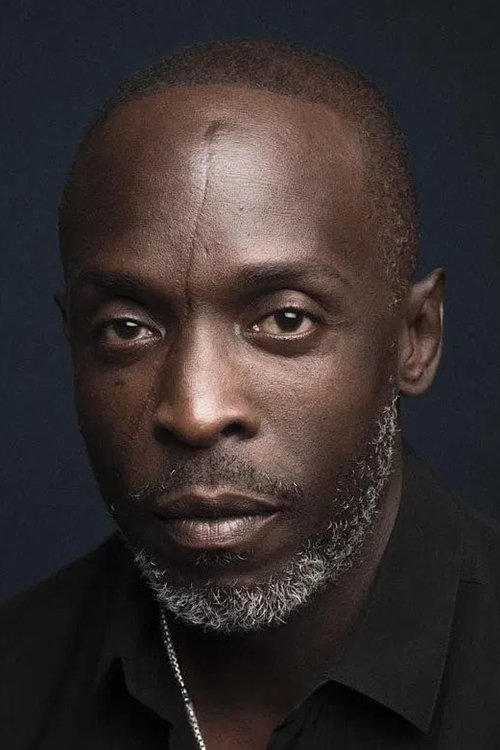

Michael Kenneth Williams

Michael K. Williams began his career as a dancer, but his first acting role came about after Tupac Shakur noticed a photo of him. Tupac was struck by a facial scar Williams had gotten in a bar fight and thought it gave him the right look for a character in the film ‘Bullet’. This role as a tough criminal launched his acting career, and he later became widely known for playing Omar Little in the acclaimed series ‘The Wire’.

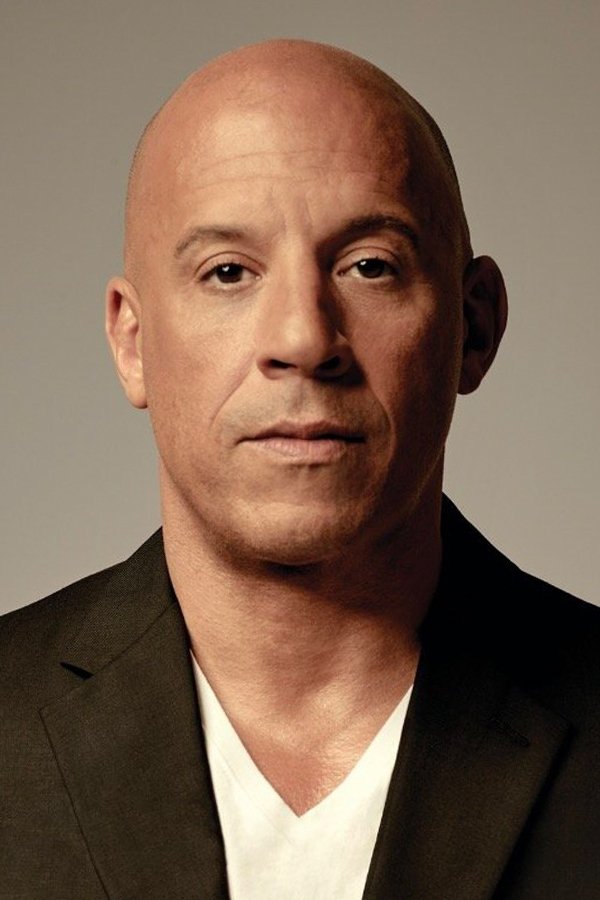

Vin Diesel

As a teenager, Vin Diesel and his friends attempted to vandalize a New York City theater. Surprisingly, instead of getting them in trouble, the theater’s artistic director offered them parts in a play. This unexpected opportunity gave Diesel his first real taste of acting and changed the course of his life. He continued to develop his skills and eventually became a well-known action movie star.

Steven Seagal

Steven Seagal taught martial arts in Japan before opening his own school, a dojo, in California. One of his students happened to be a well-connected Hollywood agent who thought Seagal had what it takes to be a movie star. The agent set up a screen test for him with the head of Warner Brothers, and the test impressed them enough to give Seagal the lead role in the action movie ‘Above the Law’.

Burt Reynolds

Burt Reynolds was a skilled athlete with dreams of playing professional football, but injuries forced him to change course. He took an acting class simply to meet a school requirement and discovered he was a natural. Encouraged by his teacher, he earned a scholarship to a summer theater program. This unexpected shift from sports led him to become one of Hollywood’s biggest stars.

John Wayne

I’ve always been a huge John Wayne fan, and it’s amazing to learn about how he started! He didn’t just appear as a star overnight, you know. He actually began working behind the scenes at Fox, moving props and even being an extra. Luckily, he met director John Ford, who immediately recognized something special about him – his strong build and that incredible voice. Ford gave him little parts at first, but then he took a chance on him in ‘Stagecoach,’ and that’s when everything changed! That movie, and their partnership, really shaped the Western genre and made John Wayne the legend we all know and love.

Bruce Willis

Before becoming a movie star, Bruce Willis worked as a bartender in New York City, at a place where celebrities often went. He was known for being charming and funny with customers, which caught the attention of someone scouting for actors. He was encouraged to try out for acting jobs, starting with a play, and this eventually led to his breakout role in ‘Moonlighting’ and a successful career in films.

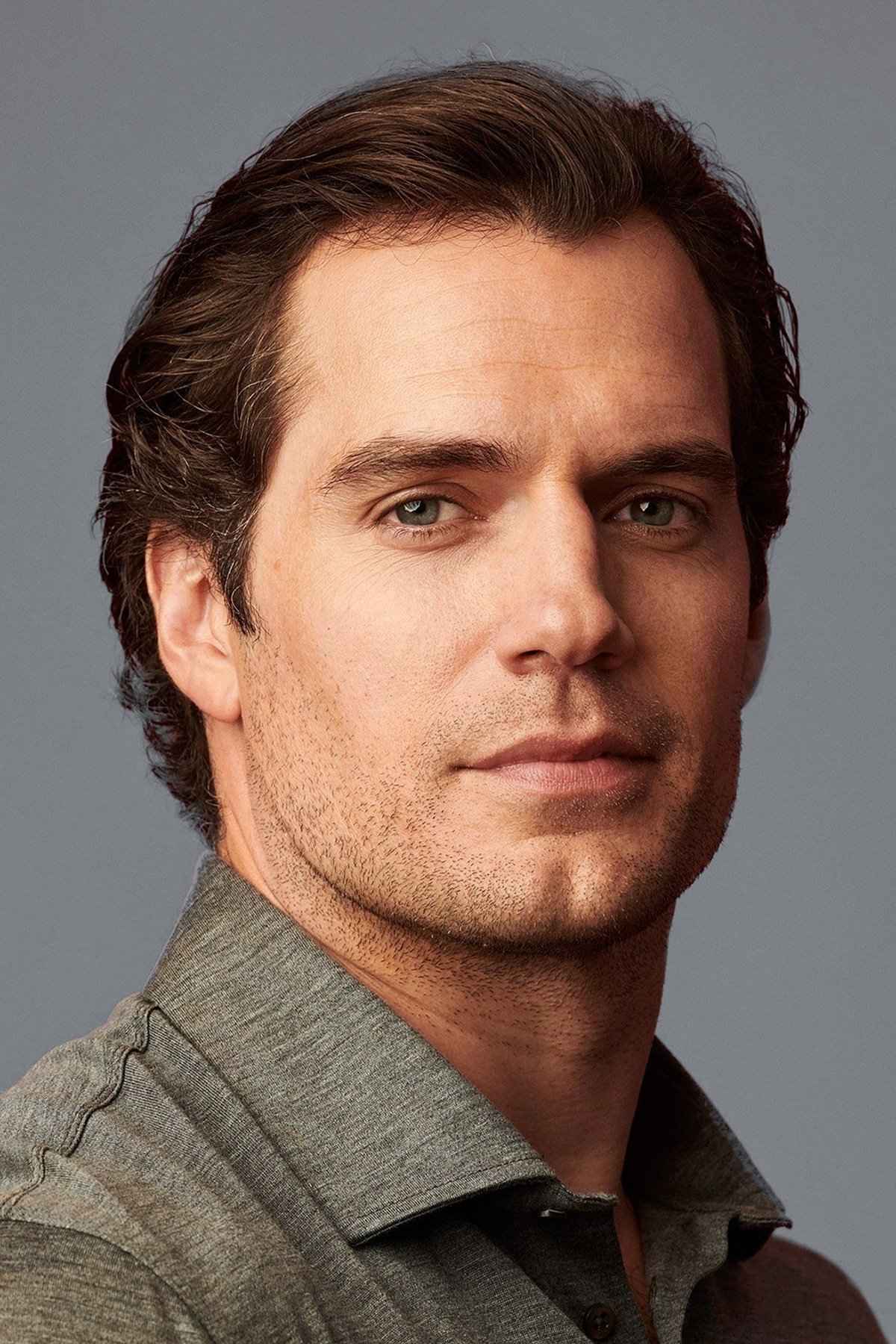

Henry Cavill

When Henry Cavill was in boarding school, Russell Crowe filmed a movie on campus. Henry, wanting to become an actor himself, bravely approached Russell for advice and made a memorable impression. Years later, Russell remembered their short conversation and sent Henry a signed photo with encouraging words. This support deeply motivated Henry to chase his acting dreams, ultimately leading to him landing the iconic role of Superman.

Barkhad Abdi

Barkhad Abdi was a Minnesota limo driver and DJ when he saw a news story about a movie needing Somali actors. The film, ‘Captain Phillips’, was casting for pirates, and despite never having acted before, Abdi went to the audition with friends. He landed the main pirate role and received an Academy Award nomination for his very first performance.

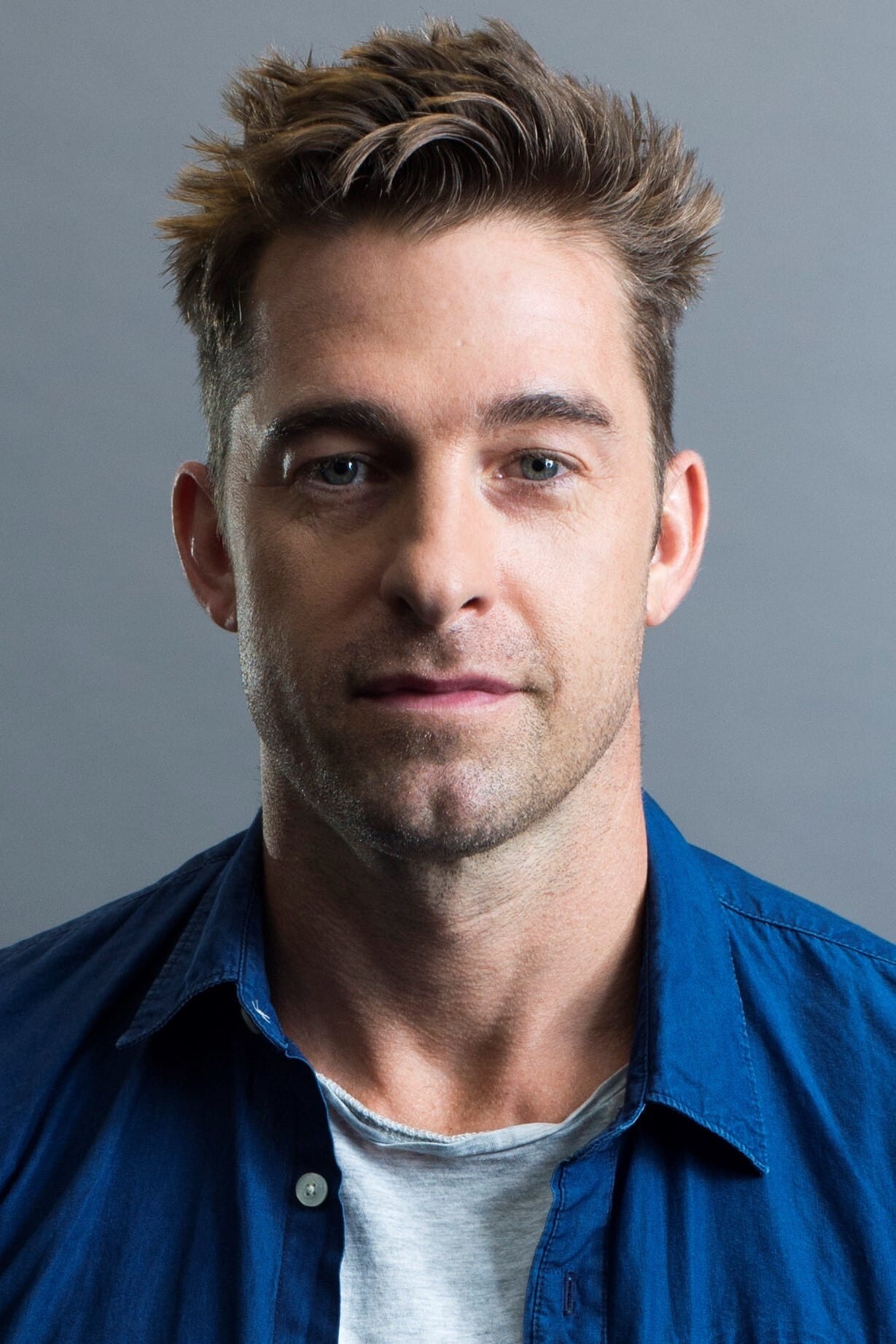

Scott Speedman

Scott Speedman was a swimmer who jokingly went to an audition for the role of Robin in ‘Batman Forever’. He didn’t get the part, but the audition led to him being discovered by industry professionals. He quickly started appearing in TV shows and became well-known for his role in ‘Felicity’. This spontaneous decision unexpectedly launched his career, shifting his path from athletics to acting.

Josh Hartnett

Josh Hartnett wasn’t initially focused on acting; he tried out for a school play as an alternative to football. He discovered a passion for performing and stayed involved with theater throughout high school. After relocating to Los Angeles, he quickly began landing roles in TV and movies. He gained widespread recognition with the horror film ‘Halloween H20: Twenty Years Later,’ which launched his career as a promising young actor.

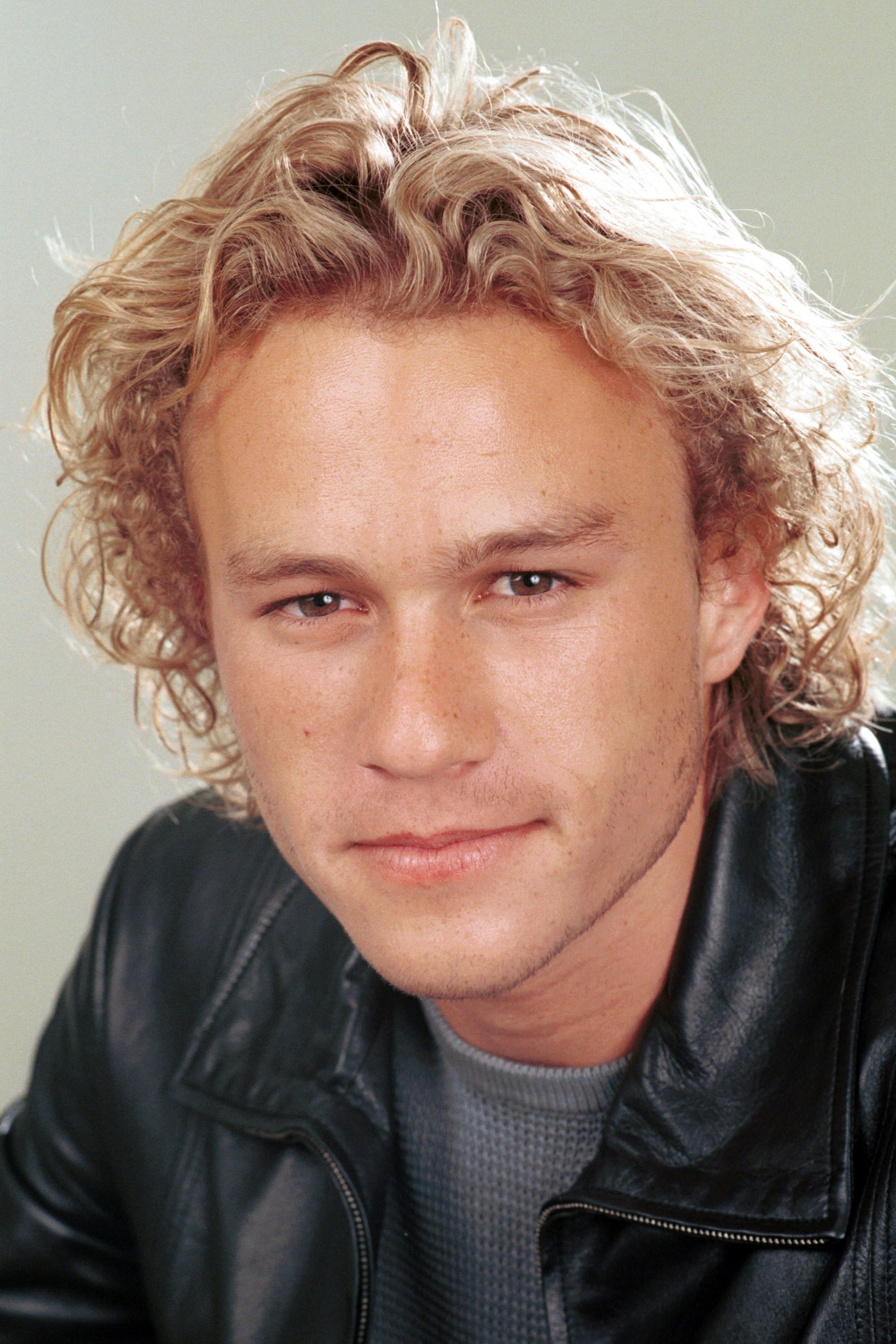

Heath Ledger

Heath Ledger, a young Australian, moved to Sydney with a friend hoping to become an actor. He started auditioning with little money and no professional training, but his natural talent and charisma quickly impressed casting directors. This courageous decision launched his acting career and eventually led him to Hollywood.

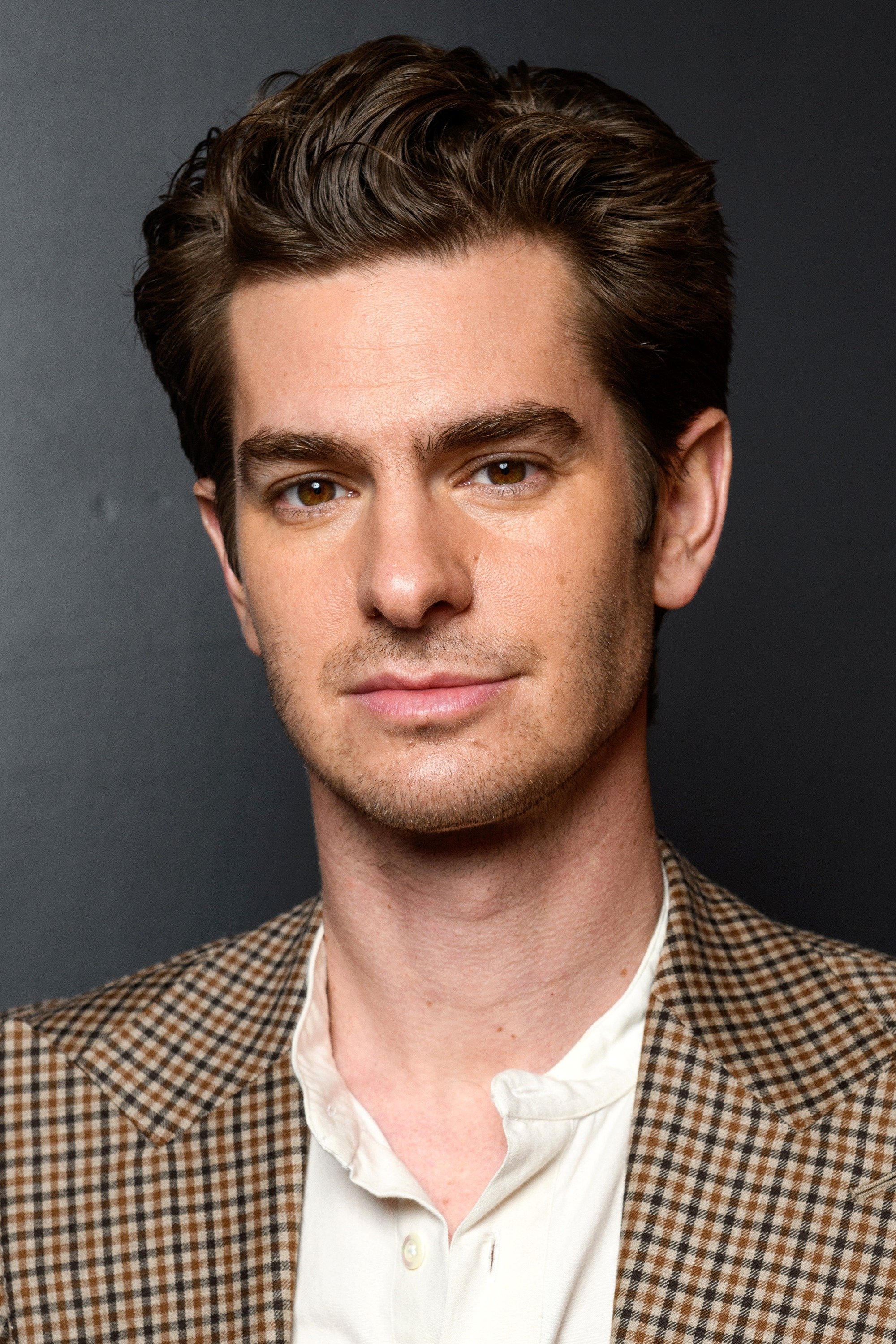

Andrew Garfield

Andrew Garfield wasn’t initially focused on acting. As a teenager, he was more interested in gymnastics and business. However, a teacher recognized his talent for expression and encouraged him to try a theater class. Though hesitant at first, Garfield soon fell in love with performing, and this single class ultimately launched his career as a highly respected actor in both theater and film.

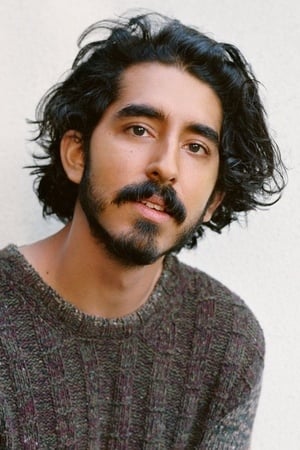

Dev Patel

When Dev Patel was a teenager in London, his mother spotted an ad for auditions for the TV show ‘Skins’. Despite having no prior acting experience, she took him along, and his lively audition caught the producers’ attention. He landed the role of Anwar Kharral, which ultimately led to his starring role in ‘Slumdog Millionaire’ and launched his international career.

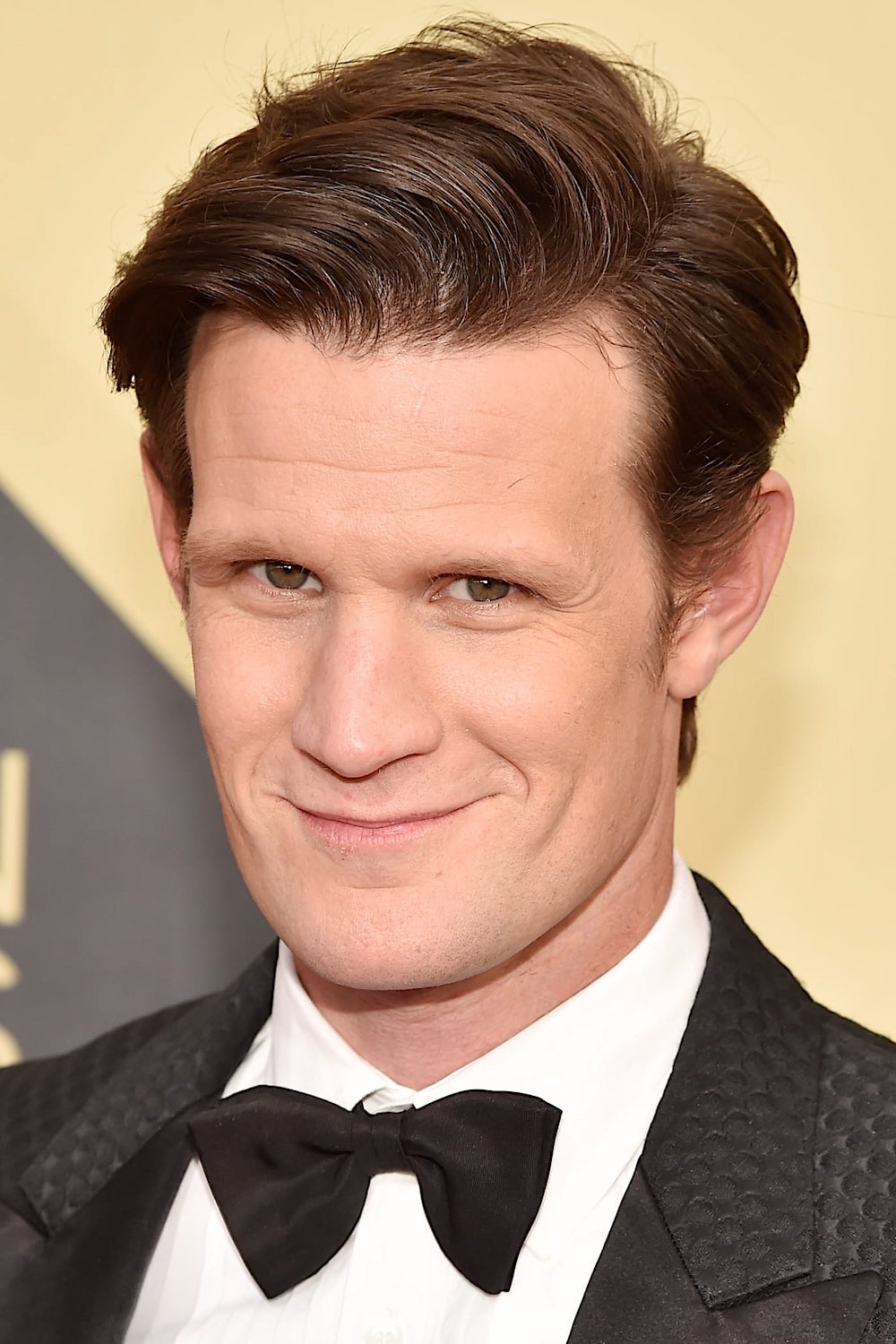

Matt Smith

Matt Smith dreamed of being a professional soccer player, but a severe back injury ended his athletic career. Luckily, his drama teacher recognized his talent and encouraged him to try acting, even signing him up for plays without asking! Though he initially saw himself as an athlete, Smith eventually fell in love with acting and went on to become the youngest person to play the iconic role of ‘Doctor Who’.

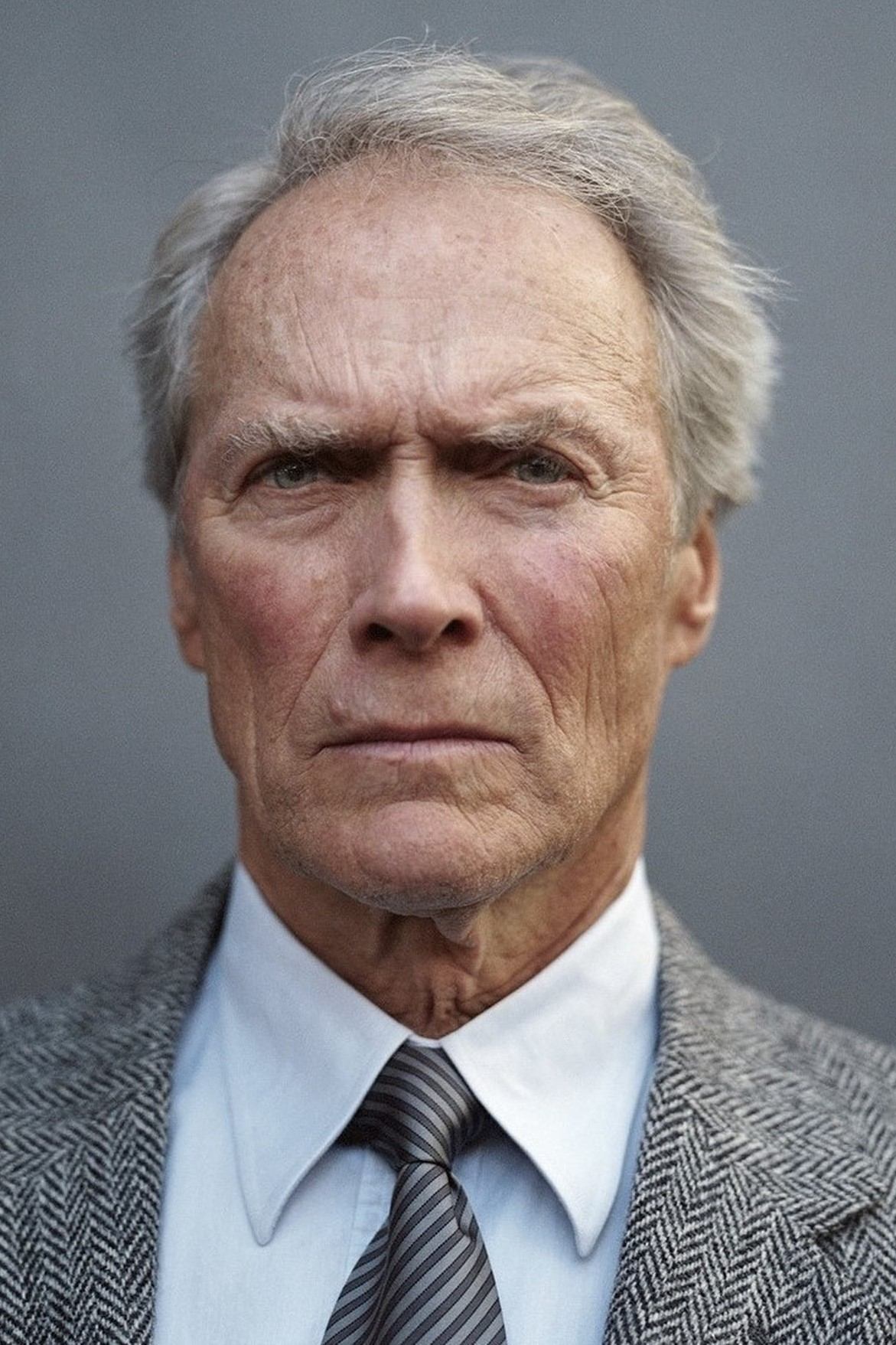

Clint Eastwood

While serving in the Army, Clint Eastwood met someone who worked in the movie business. After leaving the military, he went to Universal Studios and caught the eye of a director who thought he had a striking appearance. He was offered a contract and began taking acting classes at the studio. This ultimately paved the way for his famous roles in Western films and his successful career as a director.

Robert Mitchum

Before becoming a famous actor, Robert Mitchum held various jobs, including working with machinery and digging ditches. He got involved with a theater group hoping to write, but ended up performing when one of the actors couldn’t. His natural and unique delivery quickly caught people’s attention, and he soon transitioned into a successful career playing strong, often cynical characters in classic Hollywood films.

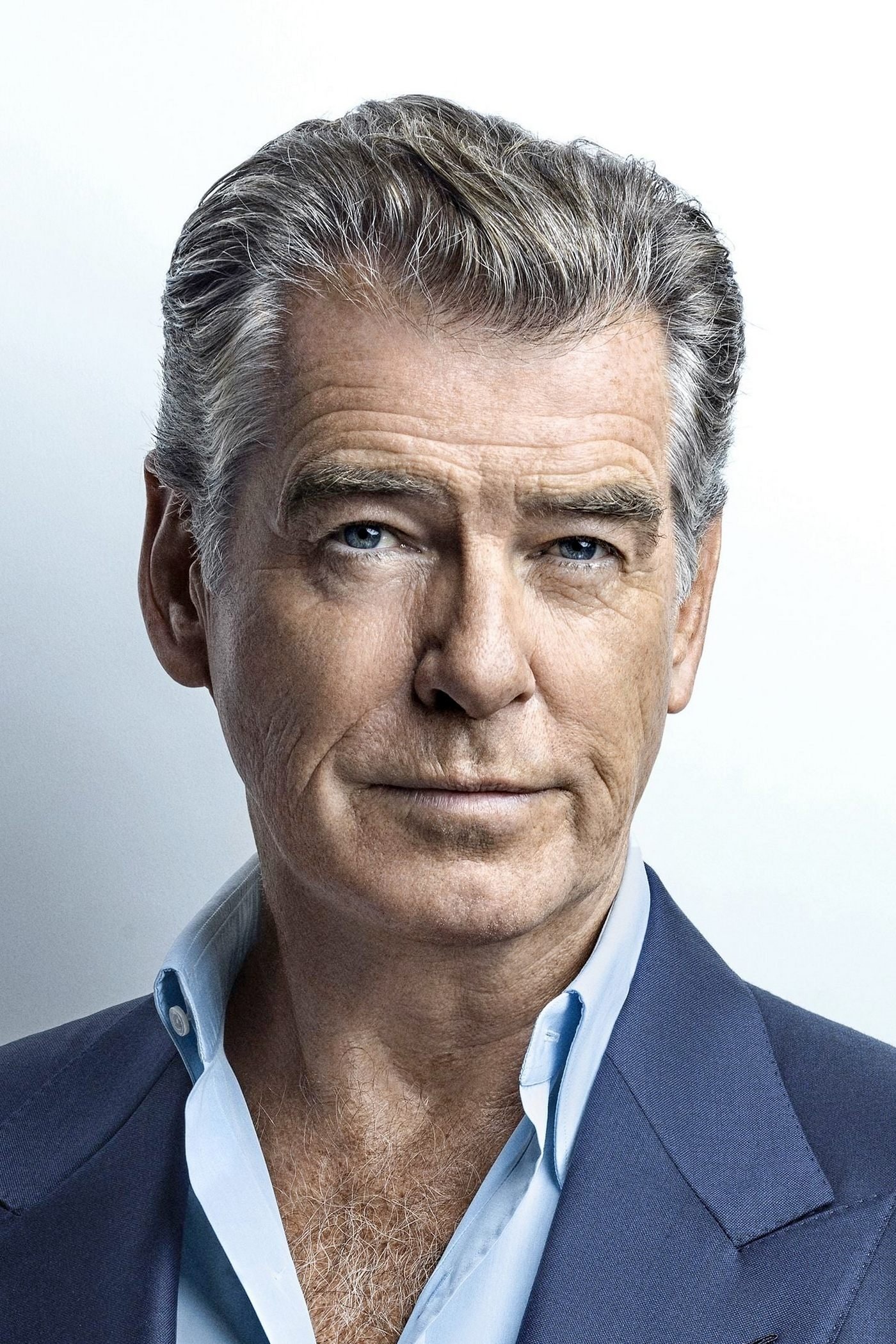

Pierce Brosnan

Pierce Brosnan began his career as a commercial artist, but he also joined a theater workshop where he learned skills like fire eating, even performing at local shows. His talent and good looks caught the eye of an agent, leading to roles in plays and on TV. Eventually, this path led him to become known worldwide as James Bond.

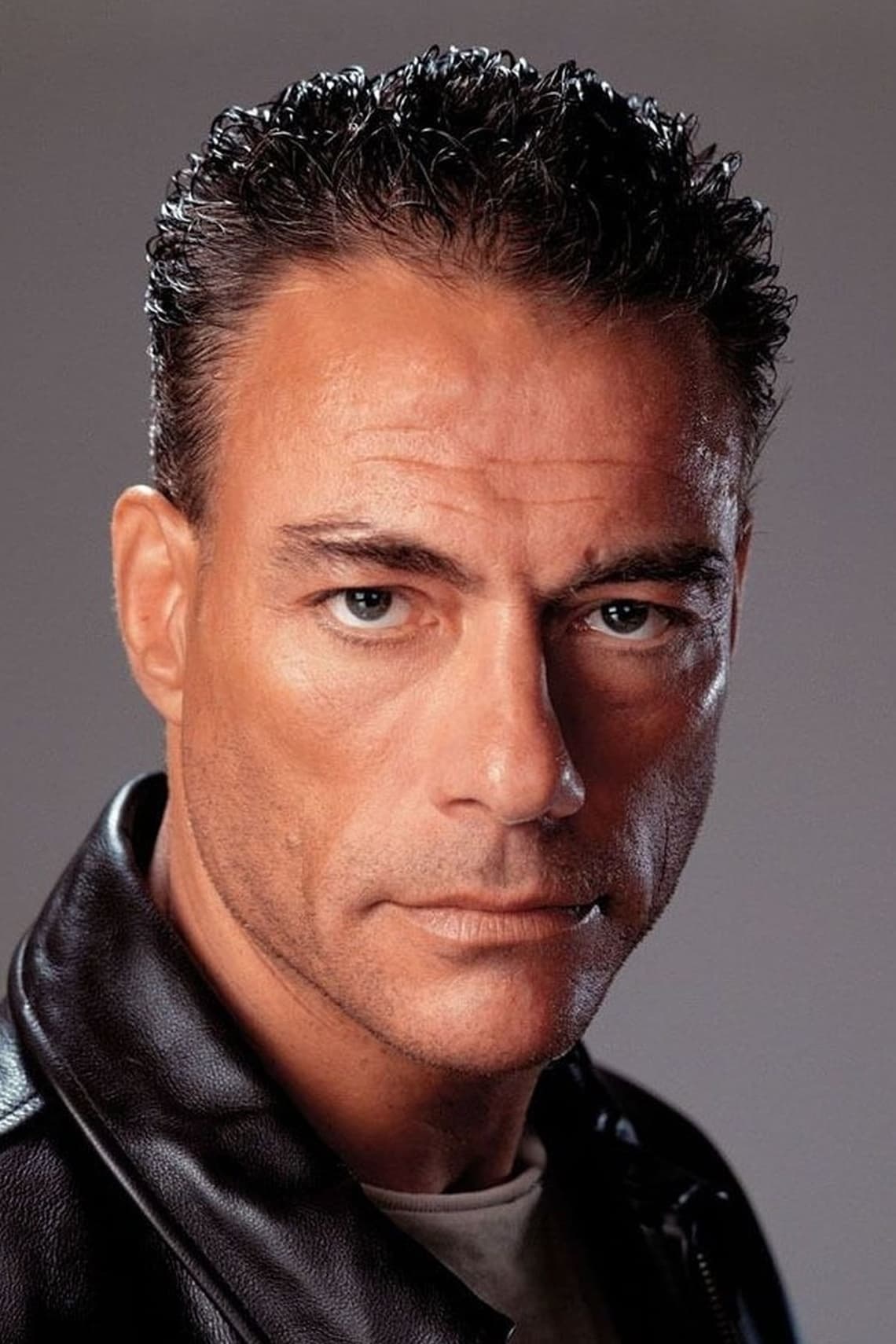

Jean-Claude Van Damme

Jean Claude Van Damme arrived in Los Angeles with limited funds but a big goal: to become a martial arts star. He famously took a chance when he saw producer Menahem Golan dining out, performing a spectacular high kick right in front of him. Golan was impressed by this daring display and gave Van Damme an audition. This opportunity landed him the starring role in ‘Bloodsport,’ launching his career and turning him into a worldwide action star.

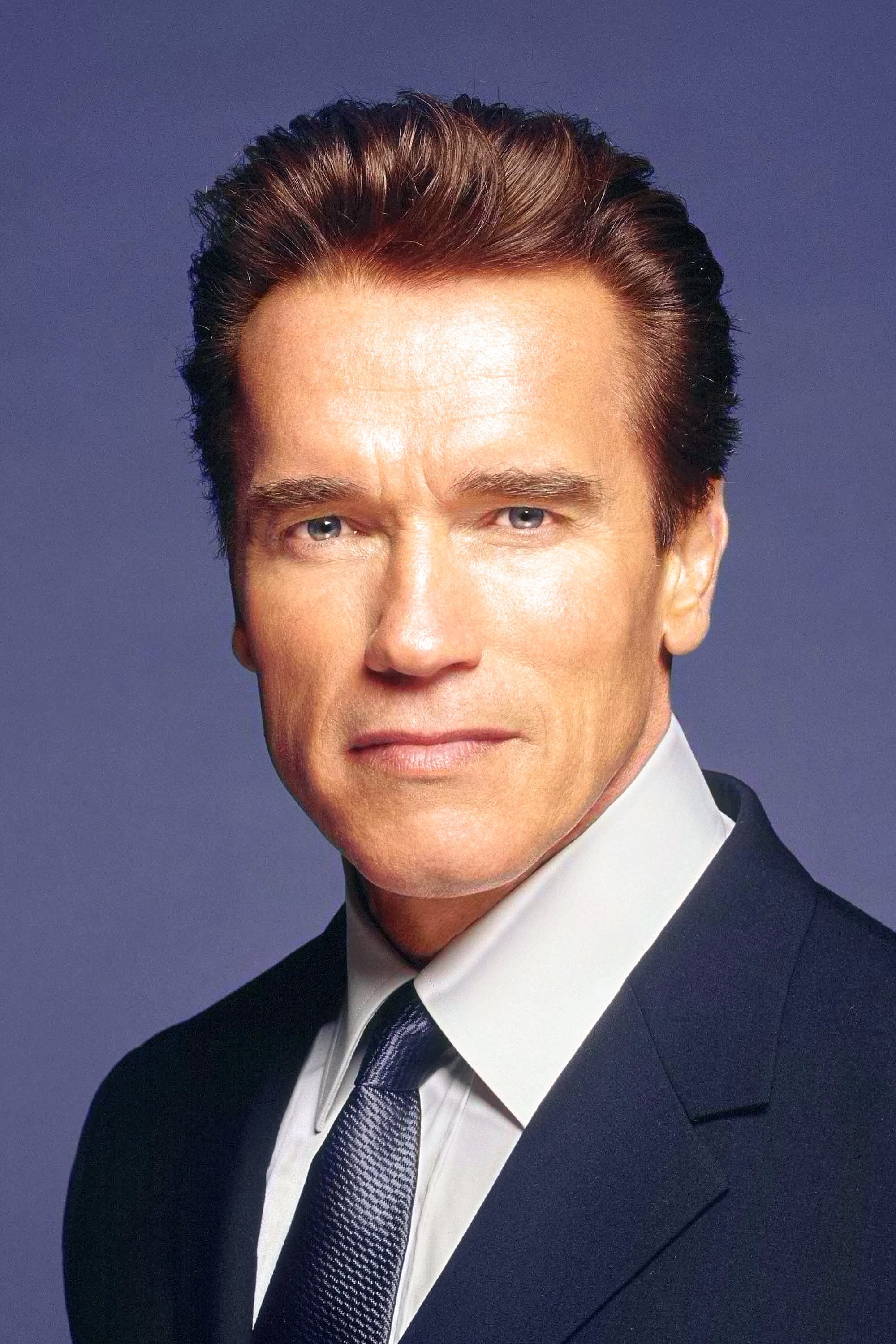

Arnold Schwarzenegger

Arnold Schwarzenegger first gained fame as a world-class bodybuilder, dedicated to winning championships. His impressive physique and distinctive accent soon attracted the attention of movie producers, leading to his debut role in ‘Hercules in New York’. Ultimately, he became much more famous as an actor, achieving significant success both in Hollywood and later in politics.

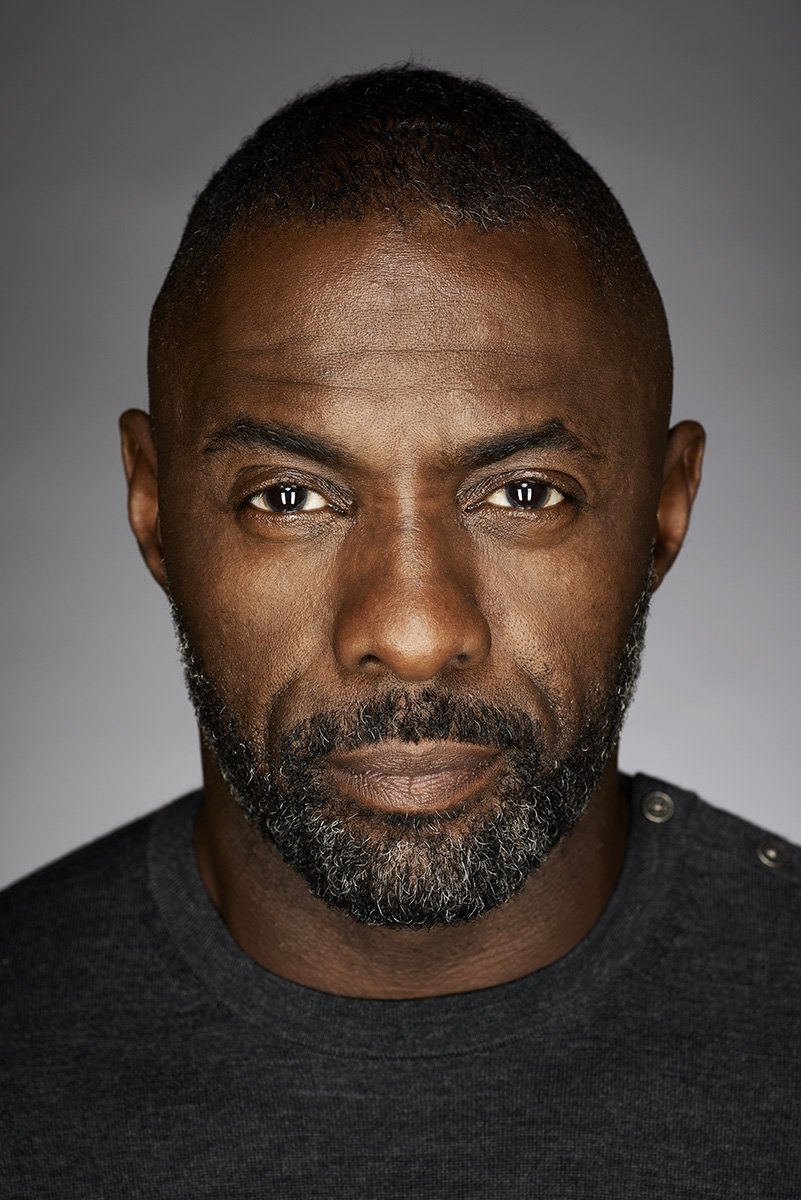

Idris Elba

Idris Elba faced challenges early in his acting career, working as a DJ and doorman in London while trying to land roles. After limited success in the UK, he moved to New York City and continued taking on various jobs to support himself. His big break came with his role in the highly praised TV series ‘The Wire,’ which demonstrated his talent and launched a successful career in film and television.

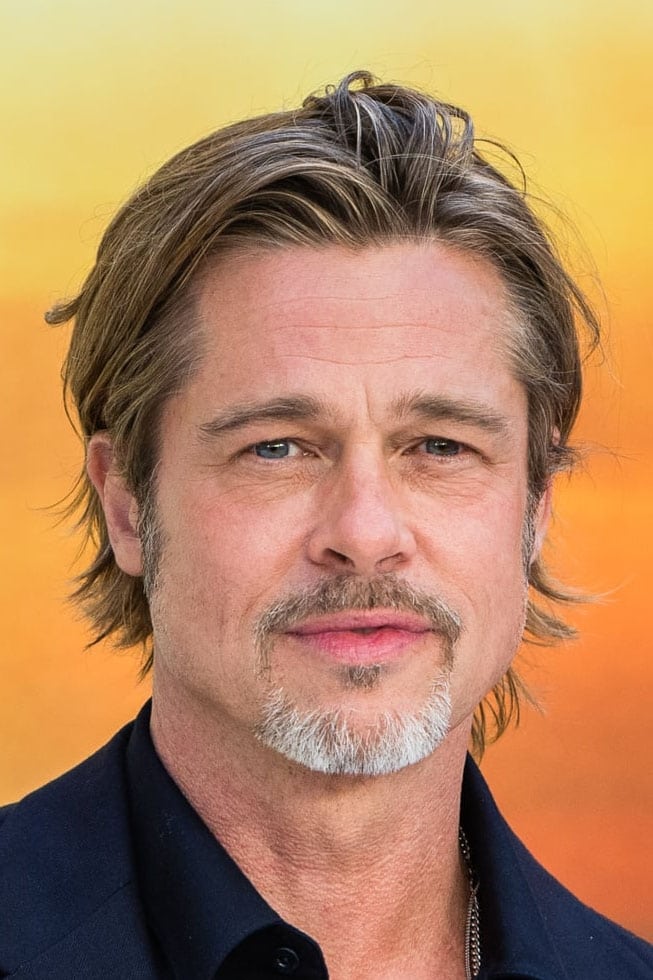

Brad Pitt

Brad Pitt began his college education but left before finishing, needing only a few more credits to earn his degree. He moved to Los Angeles and worked various jobs – even driving a limousine – to pay the bills while pursuing his dream of becoming an actor. He initially went to an audition with a friend, but it was Brad who impressed a talent agent. This connection opened doors to small roles on TV and eventually led to his big break in the film ‘Thelma & Louise’.

Jeremy Renner

Jeremy Renner initially signed up for a drama class in college expecting an easy A. However, he surprisingly found he had a talent for acting and switched his major to theater. After relocating to Los Angeles, he supported himself as a makeup artist while pursuing acting roles in independent films. His hard work ultimately paid off with a starring role in ‘The Hurt Locker’ and opportunities within the Marvel Cinematic Universe.

Nick Cannon

Nick Cannon started his career doing stand-up comedy at a club where his dad worked. A Nickelodeon producer spotted his performance and was impressed with his humor and how comfortable he was on stage. He was first hired to get studio audiences excited before tapings, and then he got his own show. This unexpected beginning in a comedy club launched his successful career in both television and music.

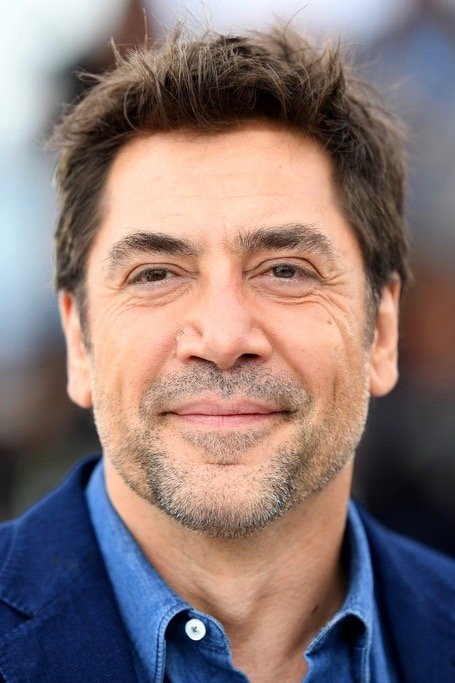

Javier Bardem

Javier Bardem surprisingly began his athletic career playing rugby for Spain, with no intention of becoming an actor. He initially took a small film role just to help his artistic family financially. However, the director quickly recognized his acting potential and encouraged him to pursue larger parts. He rapidly gained recognition as a leading actor in Spain and eventually became world-renowned.

Benicio Del Toro

Benicio Del Toro initially studied oceanography in college, but he unexpectedly took an acting class and discovered a real passion for it. He left school to focus on acting, and his distinctive style and powerful performances quickly gained him recognition. He went on to star in both small independent films and large-scale blockbusters, eventually winning an Academy Award and becoming one of the most respected character actors in the industry.

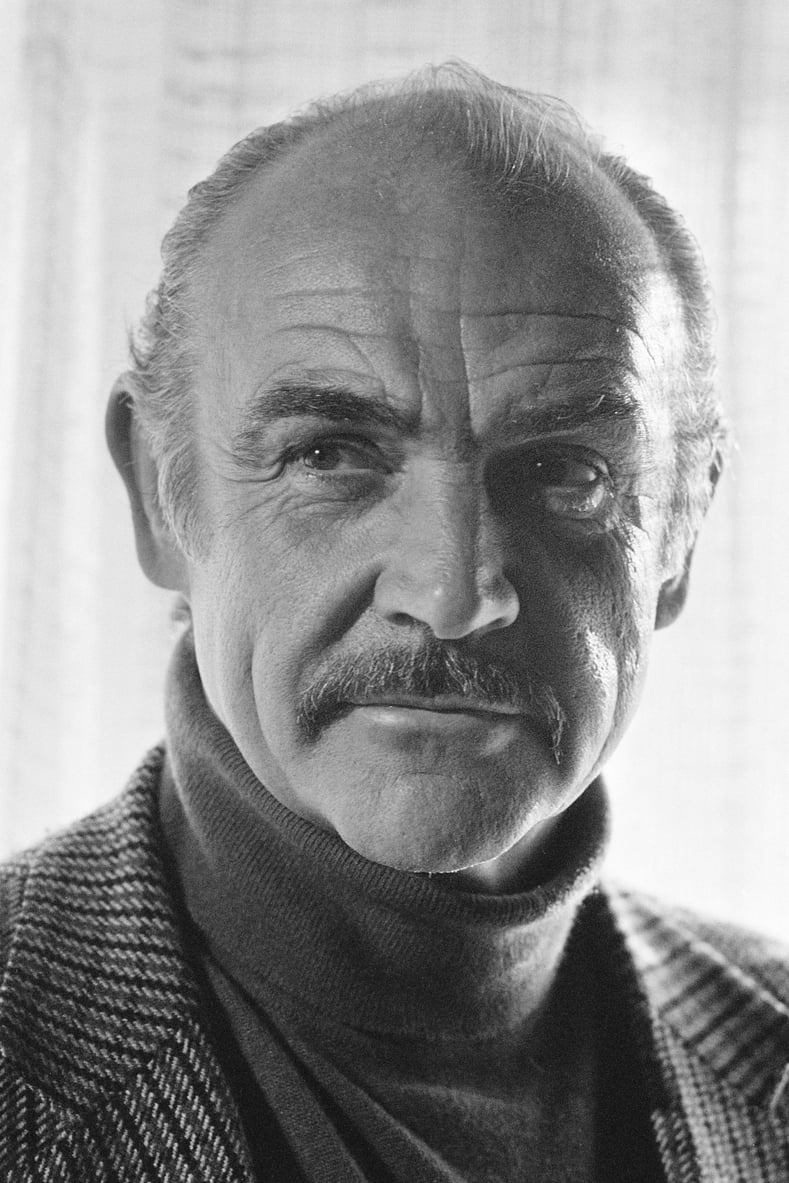

Sean Connery

Sean Connery started as a bodybuilder, even competing in Mr. Universe. A casting director spotted him and suggested he try out for the musical ‘South Pacific’, where he got a small role. This experience ignited his passion for acting, and he began to study it seriously. Ultimately, his strong physique and natural charm led to the role that made him famous: James Bond.

Michael Caine

Michael Caine started his career doing office work and manual labor. He stumbled into acting when he saw a job ad for an assistant stage manager at a nearby theater, which sometimes required him to fill in as an actor. This sparked a passion for performing, and he began auditioning for parts in TV and films all over London. His performance in ‘Zulu’ launched his career, and he’s been a successful actor for many decades.

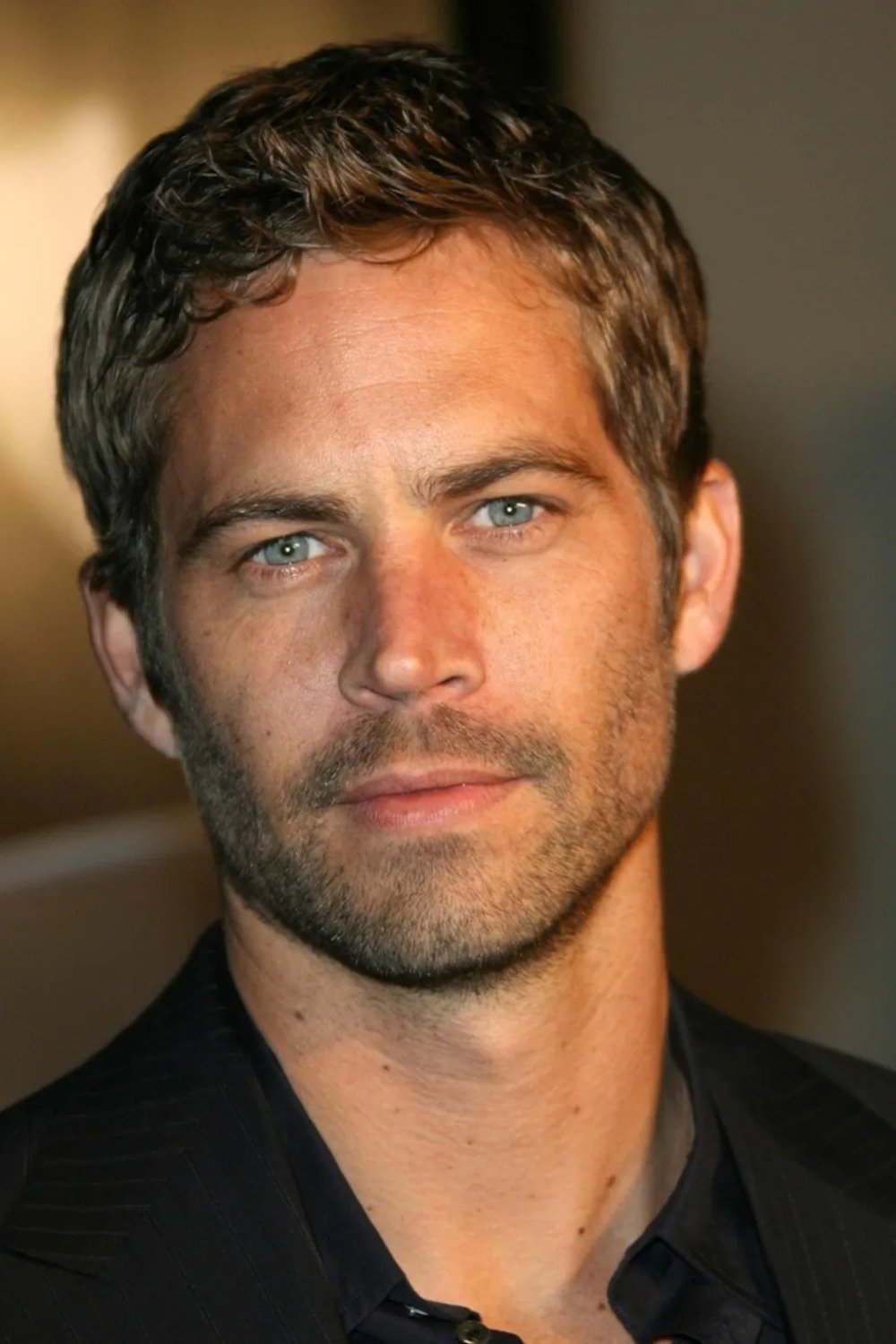

Paul Walker

Paul Walker started his career young, discovered while shopping with his mom. He did commercials and appeared on TV shows as a kid, learning as he went. He continued acting in teen and action films, but it was his part in ‘The Fast and the Furious’ that launched him to international fame and made him a popular action movie star.

Liam Neeson

Before becoming a famous actor, Liam Neeson had a surprising job – he drove a forklift at a brewery. He’d always enjoyed the arts, but hadn’t thought about becoming a professional actor. Luckily, his tall stature and strong voice were perfect for the stage. Director John Boorman noticed his talent and gave him a role in ‘Excalibur’, which started his career in film.

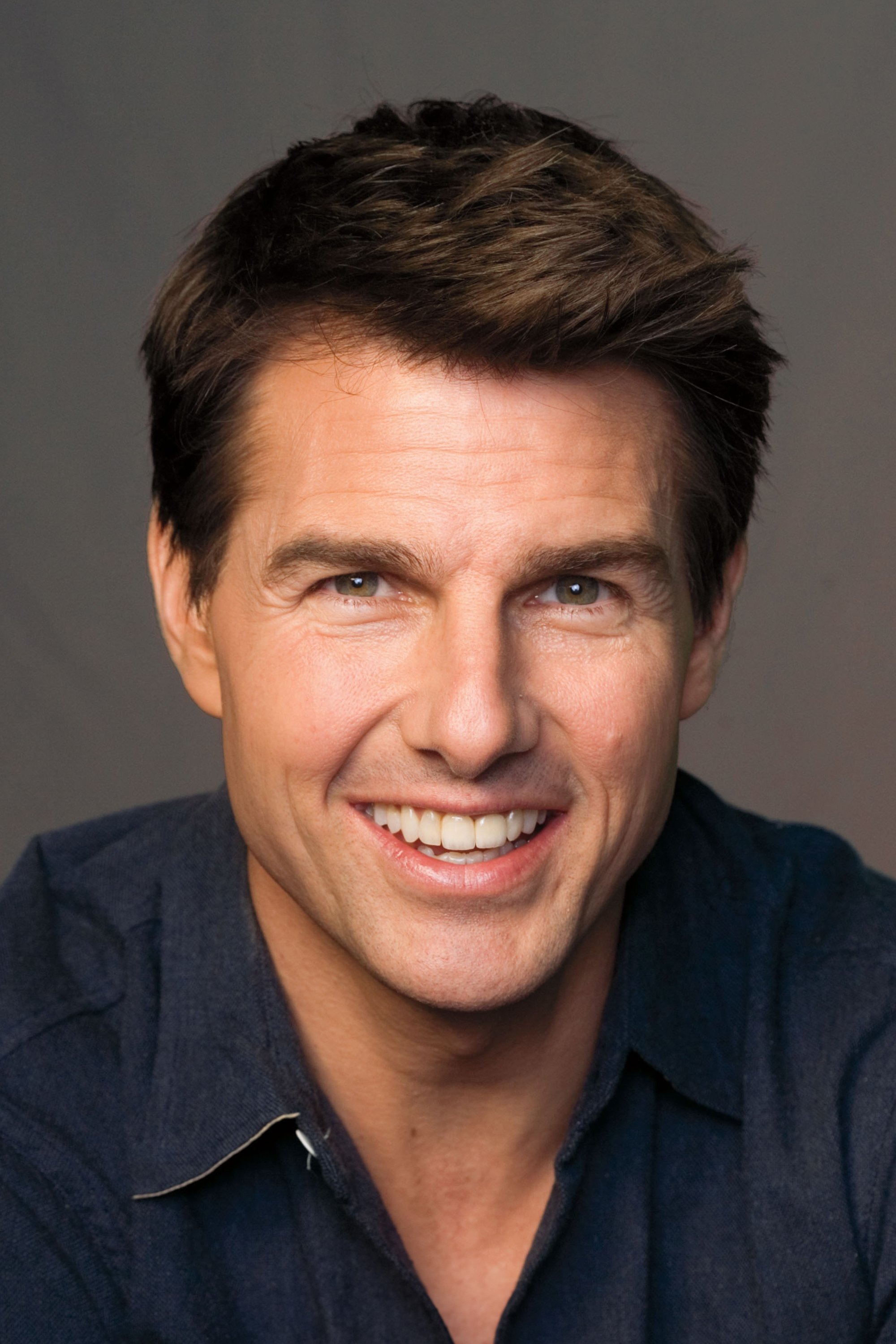

Tom Cruise

Tom Cruise was a high school wrestler who had to stop playing after injuring his knee. To keep busy, he tried out for the school musical, ‘Guys and Dolls,’ and unexpectedly fell in love with acting. After graduating, he moved to New York City to become a professional actor and quickly got his first movie role. This shift from sports to entertainment ultimately launched a hugely successful Hollywood career.

Tell us which of these surprise discoveries shocked you the most in the comments.

Read More

- Top 15 Insanely Popular Android Games

- EUR UAH PREDICTION

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Silver Rate Forecast

- Gold Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2026-03-03 07:19