Bruce Campbell shared with his fans on Monday that he is battling cancer.

He says it’s considered “treatable,” not “curable,” and admits the news shocked him, too.

He says he’s keeping details private

The Evil Dead actor and producer says he’s not going into any more detail about the diagnosis.

The point of the post is to get ahead of the news and avoid false information spreading.

Summer convention appearances are being canceled

He’s having to cancel some appearances this summer because his medical treatment schedule doesn’t always fit with his work commitments. He explained that his health needs to be his priority right now, and that means stepping back from conventions and work for the time being.

He hopes to be well enough to tour for his new movie this fall

Campbell plans to spend the summer recovering so he can promote his new film, Ernie & Emma, when it tours in the fall.

“Not trying to enlist sympathy” and says he expects to be around

He emphasizes that he doesn’t want pity or suggestions. Describing himself as resilient and fortunate, he anticipates a continued presence. He concludes by expressing gratitude to his fans and looking forward to reconnecting with them in the future.

— Bruce Campbell (@GroovyBruce) March 3, 2026

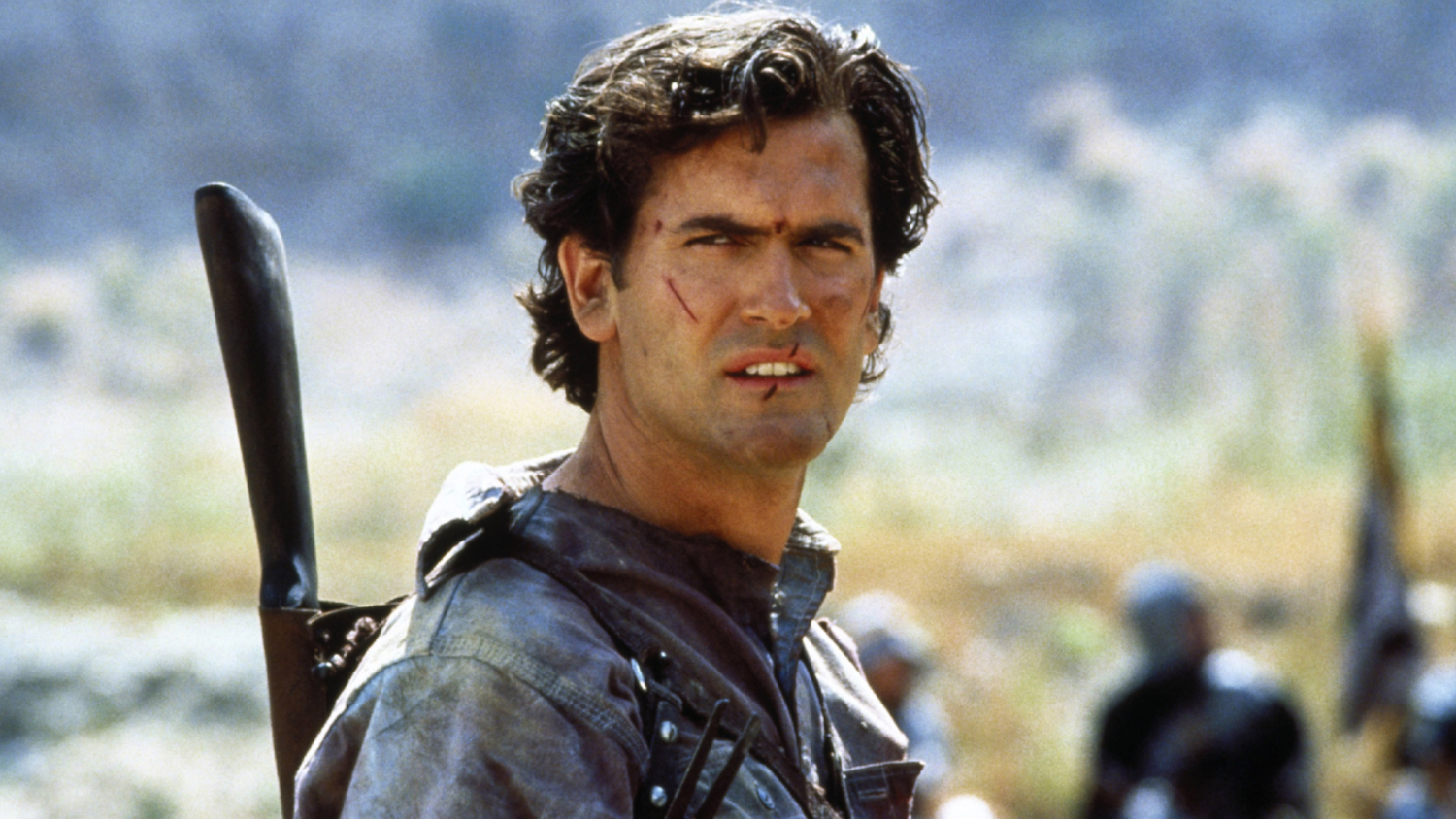

Bruce Campbell’s legacy: Evil Dead icon, producer, and Raimi regular

Bruce Campbell is most famous for playing Ash Williams, the character who fights monsters with a chainsaw in Sam Raimi’s Evil Dead movies. This role made him a well-known figure in the horror genre.

Although Bruce Campbell no longer appears as Ash in the films, he remains involved with the Evil Dead series as a producer on the recent movies.

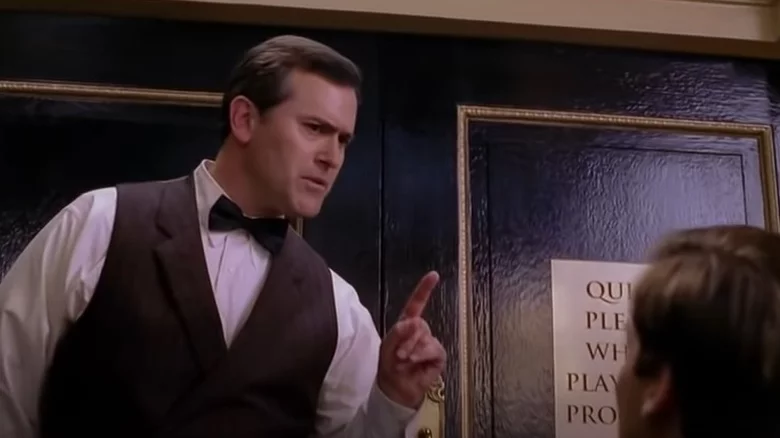

He’s worked with director Sam Raimi for many years, not just on horror films. He’s known for making brief appearances in Raimi’s movies, like the Spider-Man trilogy, where his cameos are so memorable that fans continue to quote them and try to find them when rewatching the films.

Read More

- Building 3D Worlds from Words: Is Reinforcement Learning the Key?

- Securing the Agent Ecosystem: Detecting Malicious Workflow Patterns

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The Best Directors of 2025

- Games That Faced Bans in Countries Over Political Themes

- TV Shows Where Asian Representation Felt Like Stereotype Checklists

- 📢 New Prestige Skin – Hedonist Liberta

- SEGA Sonic and IDW Artist Gigi Dutreix Celebrates Charlie Kirk’s Death

- The Most Anticipated Anime of 2026

2026-03-03 06:01