Many years later, when the servers themselves began to whisper of obsolescence and the dust motes danced in the cooling fan’s breath, old Mateo, the technician, would recall the year AMD dared to embrace the future – or, perhaps, the ghost of it. It was a year of impossible promises and shimmering heat, a time when the scent of silicon and ambition hung heavy in the air, and the markets, fickle as they ever were, seemed poised on the edge of a dream. The company, having tasted a victory over the titan Nvidia in the previous cycle – a fleeting triumph, as all things are – now found itself tethered to a bargain struck in the shadows, a pact with the enigmatic OpenAI, a company that promised to unlock the secrets of intelligence itself, or perhaps, merely to amplify the echoes of our own desires.

The year had begun brightly enough. AMD’s shares, buoyed by a surge of optimism, had soared, leaving Nvidia trailing in its wake. It was a reversal of fortunes, a momentary defiance of the established order. But as the months wore on, a disquiet settled upon the investors, a subtle unease that mirrored the growing anxieties surrounding the relentless pursuit of artificial intelligence. While Nvidia, the established power, merely dipped, AMD, the ambitious challenger, began to falter, its decline steeper, more pronounced. It wasn’t merely a correction, some reasoned; it was a premonition.

The Weight of Promises

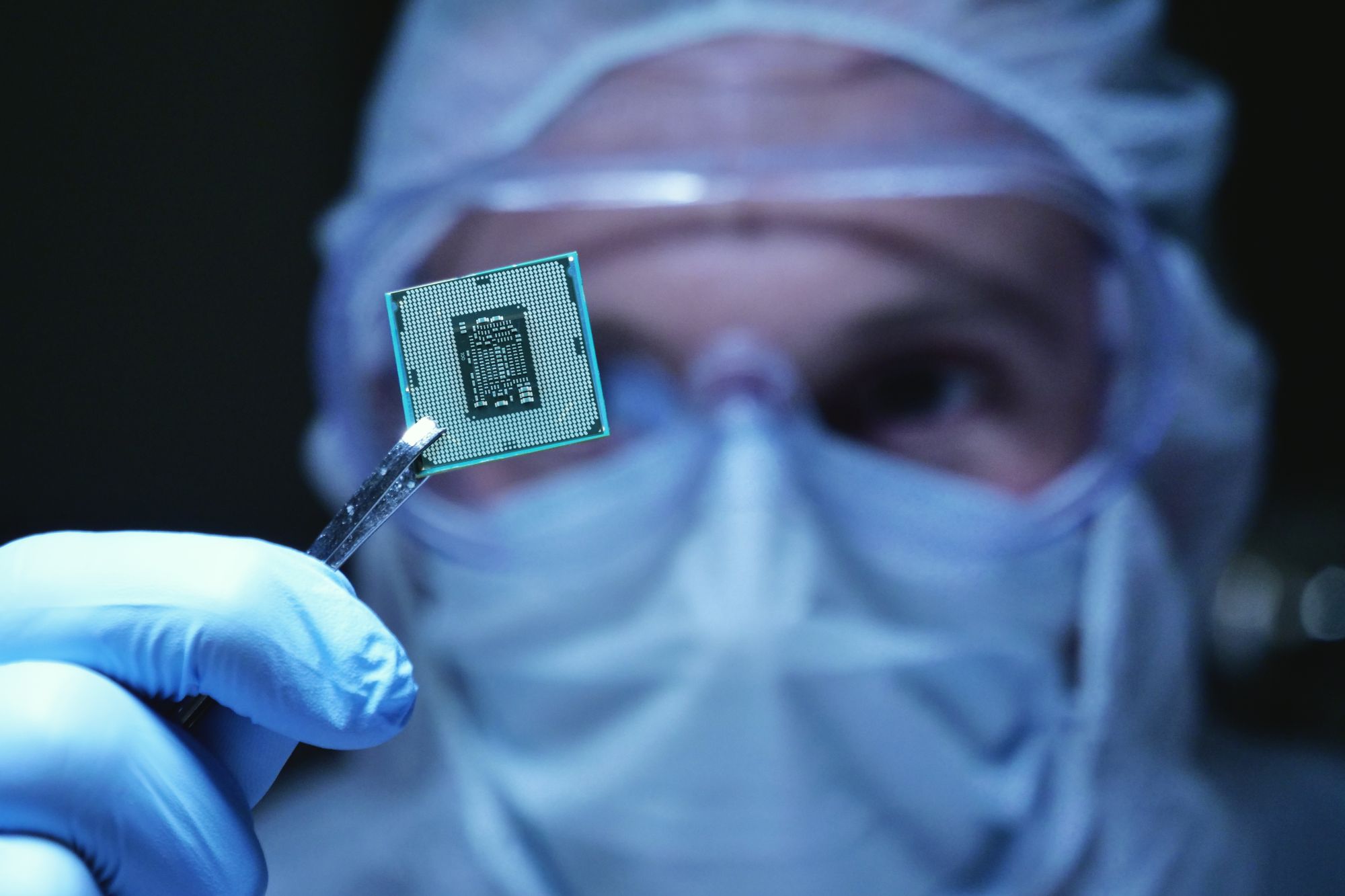

The bargain with OpenAI, announced late in the previous year, was a curious one. Six gigawatts of AMD’s chips, pledged to fuel the insatiable hunger of OpenAI’s algorithms. A substantial commitment, a leap of faith into the uncharted territories of machine learning. And, as if to seal the pact, warrants were granted, a potential ten percent stake in AMD itself offered as collateral. It was a gamble, a dance with a phantom, and the market, ever watchful, began to murmur its doubts.

The concern wasn’t merely about the financial viability of OpenAI – though whispers of delayed profitability, stretching out to the distant horizon of 2030, were enough to give any investor pause. It was about dependency, about placing one’s fate in the hands of a company whose ambitions, while vast, remained shrouded in mystery. Oracle, too, had ventured down this path, tying its fortunes to OpenAI with a cloud deal of staggering proportions, and the markets, unforgiving as the desert sun, had responded with a swift and brutal rebuke. A similar fate, some feared, awaited AMD. The echoes of Oracle’s decline, a cautionary tale whispered among the trading floors, hung heavy in the air.

A Year of Reckoning

This year, 2026, promises to be a crucible for AMD. The company’s chips, once hailed as a potential disruptor, must now prove their mettle against the established dominance of Nvidia. Last year, a surge in revenue – a thirty-four percent increase to $34.6 billion – offered a glimmer of hope. But that growth, a fleeting bloom in the harsh landscape of the semiconductor industry, followed a period of relative stagnation. Can AMD sustain this momentum, or will it succumb to the gravitational pull of Nvidia’s market share?

The spotlight, of course, remains fixed on OpenAI. The company’s success, or failure, will inevitably cast a long shadow over AMD’s fortunes. At seventy-five times its earnings, the stock is hardly cheap, and the burden of proof lies squarely on AMD’s shoulders. For now, a cautious approach seems prudent. The scent of damp earth, the oppressive heat, the whispers of the servers – they all suggest a year of uncertainty, a year of reckoning. It is a time for observation, for patience, for waiting to see if AMD can truly defy the ghosts in the machine.

Read More

- Building 3D Worlds from Words: Is Reinforcement Learning the Key?

- Gold Rate Forecast

- Securing the Agent Ecosystem: Detecting Malicious Workflow Patterns

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Wuthering Waves – Galbrena build and materials guide

- The Best Directors of 2025

- TV Shows Where Asian Representation Felt Like Stereotype Checklists

- Games That Faced Bans in Countries Over Political Themes

- 📢 New Prestige Skin – Hedonist Liberta

- SEGA Sonic and IDW Artist Gigi Dutreix Celebrates Charlie Kirk’s Death

2026-03-03 01:07