Becoming famous and wealthy doesn’t always happen by following a typical path, like finishing school. In fact, many well-known celebrities struggled in traditional classrooms before finding success. Some were even disciplined or expelled for things like pranks or not keeping up with their studies. Although leaving high school seemed like a failure at the time, it allowed them to fully dedicate themselves to their passions and careers. These stories show that a traditional education isn’t the only way to achieve success in the entertainment world.

Ryan Gosling

As a young boy in primary school, the actor got into serious trouble after being inspired by the movie ‘First Blood’. He brought steak knives to school one day and threw them at other students during recess. Teachers quickly stopped him, and the school decided to expel him due to his dangerous actions. His mother then decided to homeschool him for several years, which allowed him to concentrate on his personal growth and, ultimately, pursue his growing interest in acting.

Salma Hayek Pinault

As a student at a Catholic boarding school in Louisiana, this future celebrity quickly gained a reputation for being a troublemaker and pulling off complex pranks. She was ultimately kicked out of the Academy of the Sacred Heart due to her disruptive actions, including a memorable prank where she turned all the school clocks back three hours, causing confusion for everyone. School officials felt she was a bad fit for their religious environment. She went back to Mexico to finish her education before achieving worldwide recognition in the movie ‘Frida’.

Robert Pattinson

Before becoming famous in the ‘Twilight’ movies, the actor went to a prestigious private school in London. He was kicked out at age twelve after being caught selling adult magazines to classmates. He confessed to buying the magazines from a nearby shop and then selling them at school for a profit. Unfortunately, a teacher caught him during a sale, ending his short-lived business. He later transferred to a different school and found his love for acting through a local theater group.

Owen Wilson

The funny actor struggled with the rigid rules at his Texas boarding school. He was kicked out during his second year at St. Mark’s School of Texas after stealing a teacher’s textbook to cheat on a geometry test. The school had a zero-tolerance policy for cheating and immediately asked him to leave. He ended up completing high school at a military school, an experience that influenced his outlook on life and ultimately contributed to his success in films like ‘The Royal Tenenbaums’.

Cameron Diaz

Cameron Diaz, famous for movies like ‘The Mask,’ wasn’t a perfect student growing up in Long Beach. She often got into physical fights at school and was eventually expelled. Diaz has said she was a rebellious teenager who didn’t avoid conflict. After leaving high school, she started modeling, which soon led to an acting career. Despite leaving school early, she went on to become one of Hollywood’s highest-earning actresses.

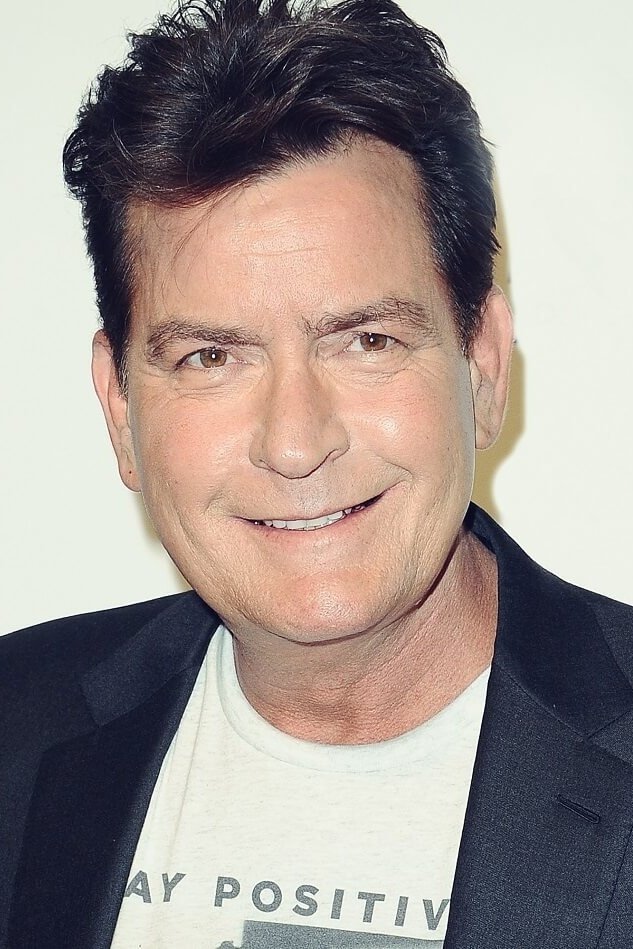

Charlie Sheen

The actor was about to graduate high school when he was expelled from Santa Monica High. He hadn’t been attending classes regularly and his grades were consistently failing. Although he was a talented baseball player, the school couldn’t ignore his poor academic performance any longer. He missed his graduation and didn’t receive his diploma until much later as an honorary gesture. This early experience with discipline foreshadowed a career marked by great achievements and frequent public attention.

Amy Winehouse

Before becoming a famous singer, she trained at the renowned Sylvia Young Theatre School. However, she was asked to leave due to not fully applying herself and for breaking the school’s rules by wearing a nose ring. While teachers recognized her incredible talent, they struggled with her rebellious attitude and lack of focus. This departure ultimately allowed her to fully dedicate herself to her music, eventually leading to the huge success of her album ‘Back to Black’ and establishing her as a leading voice of her generation.

Robert Downey Jr.

This Marvel actor didn’t have an easy time with school, and ultimately he was expelled from Santa Monica High School. His father told him he had to either start attending classes consistently or get a job and support himself. When his attendance didn’t improve, the school expelled him. Instead of going back to school, he moved to New York City to become an actor, a decision that eventually led to his famous role as Iron Man.

Lily Allen

Growing up, the British pop star was a bit of a troublemaker and moved around to more than a dozen schools. She got kicked out of several for things like smoking, drinking, and misbehaving. Her family was constantly worried because she just didn’t seem to fit in at traditional schools. Eventually, at fifteen, she dropped out completely to pursue her passion for writing songs and recording music. These experiences, and the challenges she faced, ended up inspiring much of the material on her first album, ‘Alright, Still’.

Marlon Brando

Often hailed as one of the best actors ever, he was known for being a rebel as a young man. He got kicked out of high school after riding a motorcycle down the hallways, and his father then sent him to military school hoping to straighten him out. That didn’t work either, and he was expelled from there too. These early acts of defiance helped shape the tough image and realistic acting style he became famous for in films like ‘A Streetcar Named Desire’. He ultimately didn’t finish traditional high school.

Snoop Dogg

Growing up in Long Beach, the famous rapper was kicked out of high school due to behavioral problems and trouble with the law. This led to time spent in juvenile detention. He turned to music as a way to express himself and cope with a difficult life. Eventually, he became a globally recognized star and an influential figure in music and television.

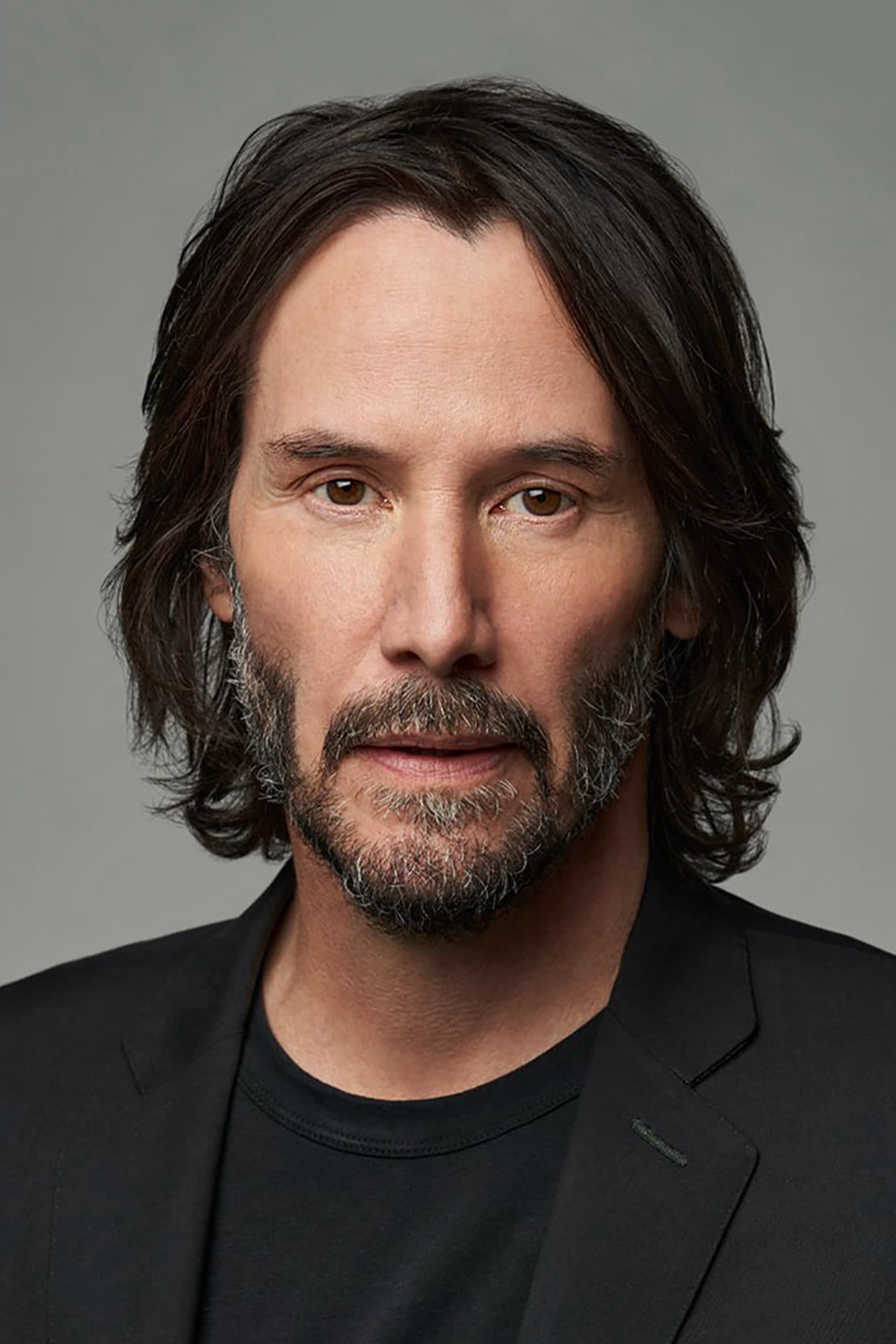

Keanu Reeves

Keanu Reeves has often talked about how much he struggled in school as a kid. He switched high schools four times in five years and was eventually kicked out of the Etobicoke School of the Arts. He’s said he was too energetic and didn’t really fit in with the way things were taught. School officials thought he was disruptive and asked him to leave. After that, he focused on pursuing acting and hockey before eventually moving to Los Angeles.

Naomi Campbell

This world-famous supermodel was actually kicked out of high school in London for being rebellious and often disagreeing with teachers and administrators. Her mother then sent her to a performing arts school, where she focused on dance and modeling. This turned out to be a great decision, as it set her on the path to a successful career as a fashion model. The school expulsion became a minor detail in the story of her rise to becoming a globally recognized fashion icon.

Slash

During high school, the Guns N’ Roses guitarist prioritized music and riding dirt bikes over his studies. He was eventually kicked out of school due to poor attendance and a lack of motivation. He spent his time perfecting his guitar skills and playing music rather than going to class. This expulsion actually allowed him to pursue music full-time, joining bands and ultimately forming the hugely successful Guns N’ Roses. He’s now celebrated as one of the greatest guitarists ever.

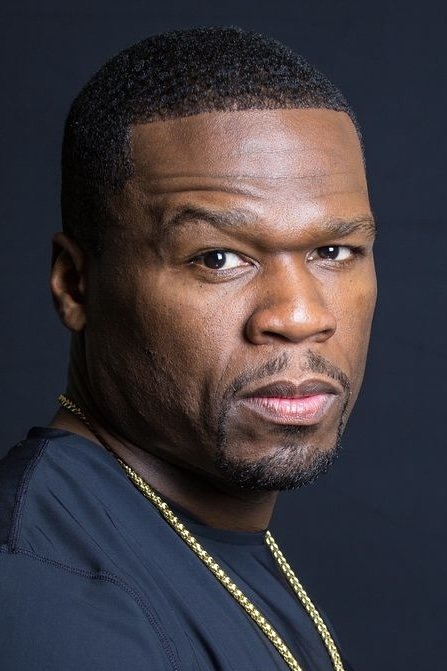

50 Cent

The rapper faced a tough childhood and got into a lot of trouble in school. He was kicked out of high school after being found with a gun and drugs, which led to his arrest and time in a juvenile detention center. He later got his GED and dedicated himself to music, building a successful career and public image. His experiences would eventually inspire the movie ‘Get Rich or Die Tryin’.

Courtney Love

The singer of the band Hole had a difficult childhood, moving between many foster homes and schools. She was kicked out of a boarding school in New Zealand for acting out and not following the rules. Her education was constantly disrupted, lacking any real consistency. Eventually, she found her passion in the punk rock world and became a leading voice in the nineties grunge scene. Her rebellious spirit and past experiences deeply shaped the honest and powerful lyrics of her music.

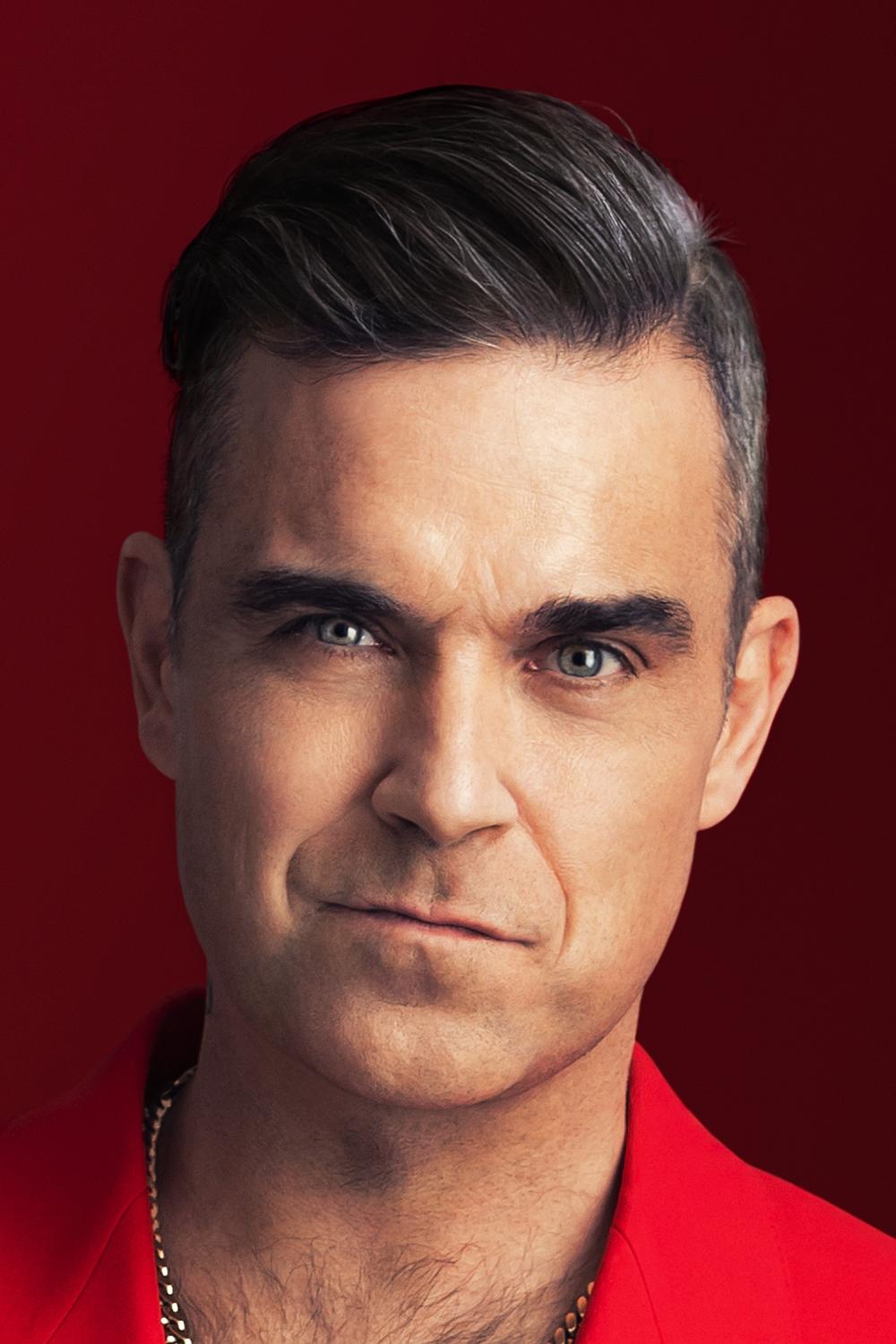

Robbie Williams

The British singer was kicked out of school right as he was starting his music career. He didn’t pass his exams and wasn’t interested in his schoolwork, and his rebellious behavior made it hard for him to fit in. Soon after leaving, he joined the band Take That and quickly became famous throughout Europe. He then went on to have an incredibly successful solo career, establishing himself as a pop icon.

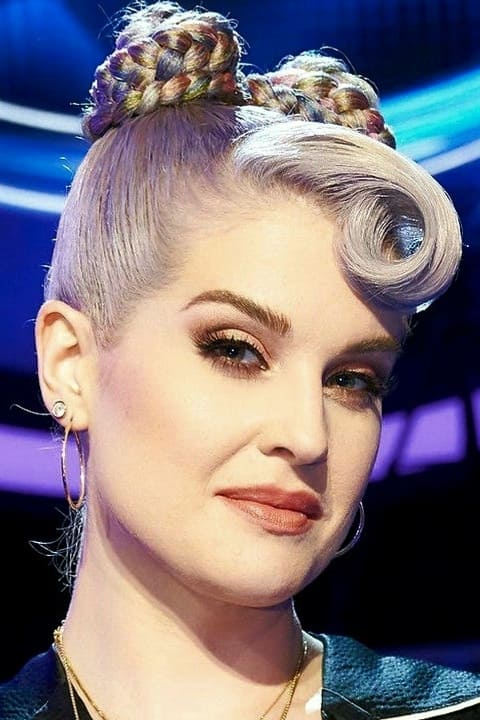

Kelly Osbourne

The singer and TV personality went to several private schools in the UK and the US, but she was kicked out of more than one for acting out and refusing to follow the rules. Growing up famous meant she was often under a lot of attention, which she responded to by being rebellious. She first became well-known on the reality show ‘The Osbournes’ and later moved into a career in fashion and hosting for different TV networks.

Pink

Even before she became famous, this singer was known for being a bit of a rule-breaker. She got kicked out of high school after being caught with drugs and had a history of getting into trouble. Her parents had a difficult time with her rebellious behavior as a teenager, especially since she was drawn to the local music world. After dropping out of school, she started performing in clubs and eventually landed her first big record contract. Now, she uses her fame to speak out about important social issues and inspire others.

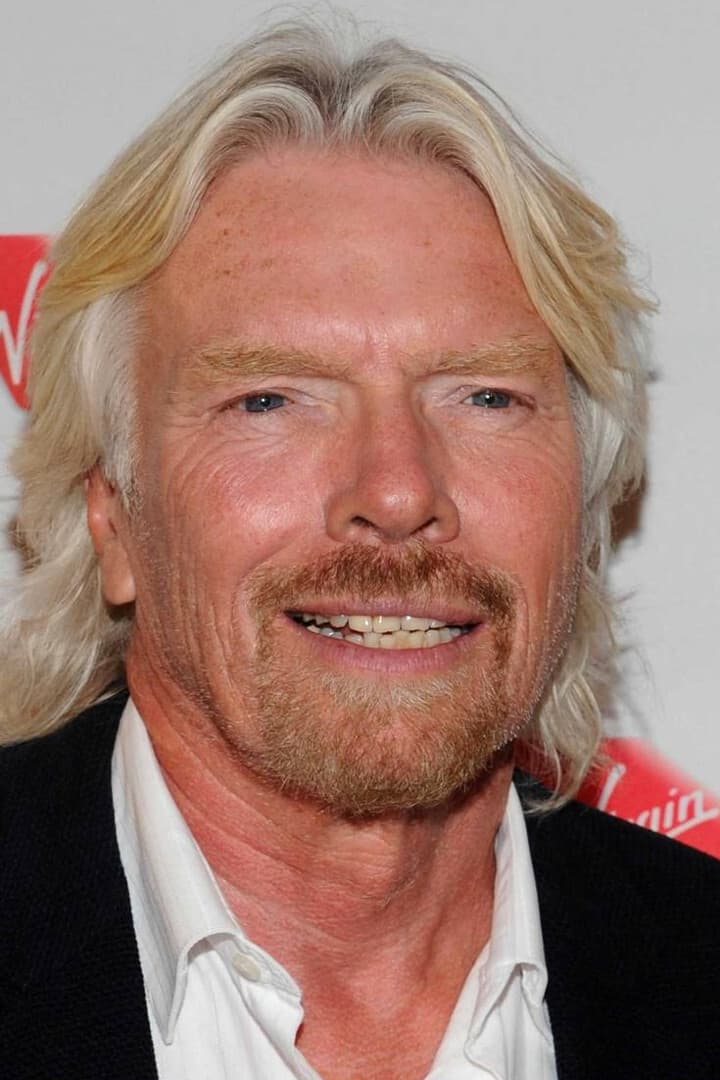

Richard Branson

Richard Branson, the founder of the Virgin Group, didn’t thrive in traditional schools. He was actually expelled at sixteen after getting into trouble in the headmaster’s daughter’s room. The headmaster famously predicted he’d either end up in prison or become very wealthy. Branson proved him right, starting with a magazine and ultimately creating a huge, worldwide business. His experience is a classic example of how failing at school doesn’t necessarily mean failing in business.

Jon Bon Jovi

The famous rock star wasn’t always popular, especially when he was in school in New Jersey. He was kicked out of his first high school after a fight with another student. This led him to transfer to a new school where he eventually met people who would become members of his band. Throughout his teenage years, he was dedicated to music, and this passion ultimately led to the creation of Bon Jovi. The band went on to achieve massive success, selling millions of albums and playing concerts in stadiums worldwide.

Liam Gallagher

Liam Gallagher, the singer who rose to fame with Oasis, was known for getting into trouble when he was a student in Manchester. He was kicked out of high school after a fight and for generally disrupting things. Teachers saw him as a very talented but difficult student who didn’t respect rules. Before joining his brother’s band, he did various physical jobs. His strong personality and distinctive voice became a key part of the Britpop sound of the 1990s.

Noel Gallagher

Like his brother, the songwriter for Oasis was also kicked out of school as a kid. He was expelled after throwing a bag of flour at a teacher in class. He’d already been known for skipping school and petty theft, and this incident was the final straw. While he was out of school, he taught himself to play guitar and started writing songs – songs that would eventually become some of rock’s most famous hits.

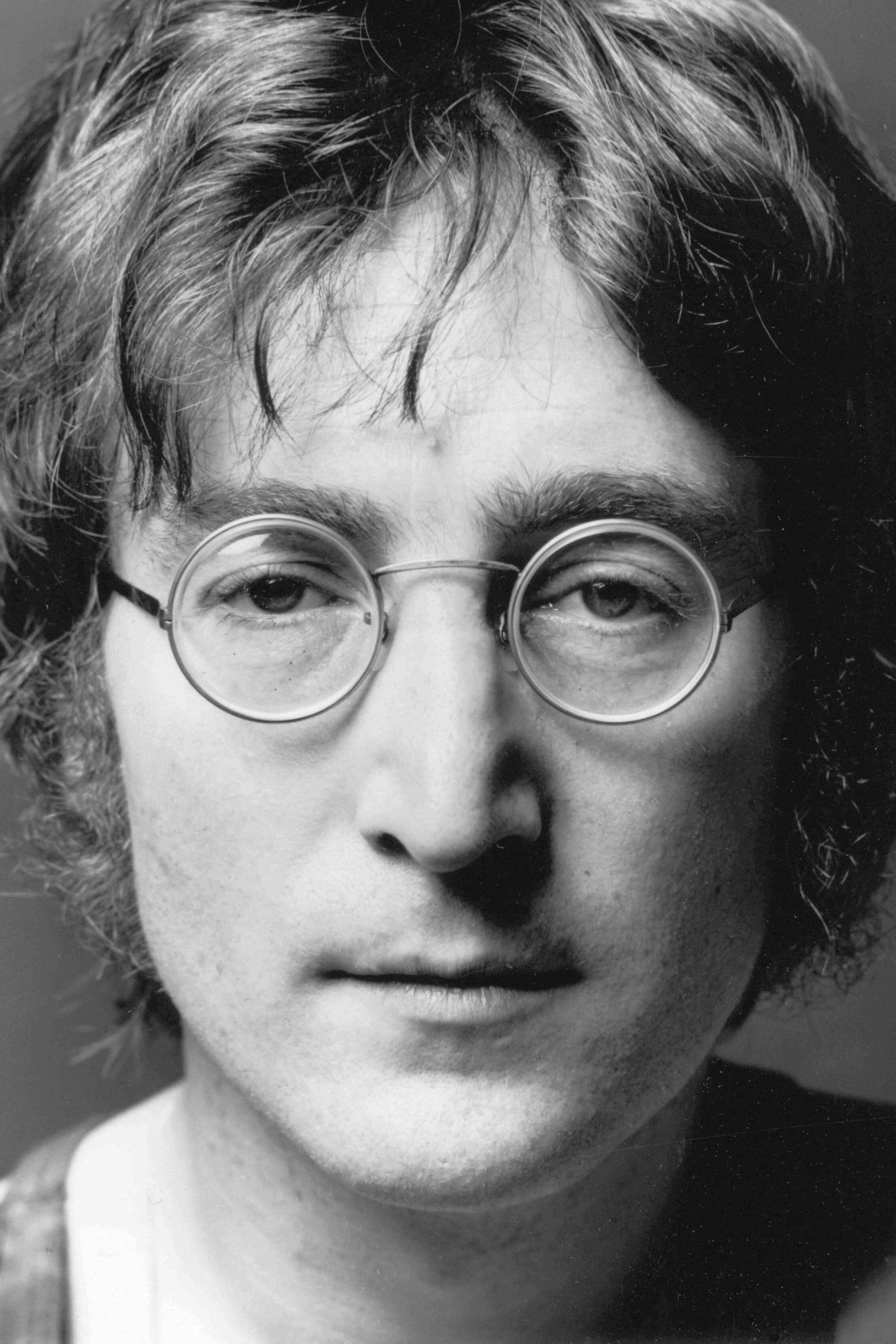

John Lennon

John Lennon, the famous Beatle, was known for his sharp humor and rebellious spirit, even as a child. He was kicked out of art school because of his disruptive behavior and failing grades – he cared more about music than his studies. This expulsion actually allowed him to fully focus on The Beatles as they prepared for a long gig in Hamburg, Germany. Ultimately, he revolutionized music through his songs and his dedication to social causes.

Ozzy Osbourne

You know, it’s amazing to learn about the early life of Ozzy Osbourne. Apparently, growing up, he really struggled with school – he wasn’t diagnosed with dyslexia, but it’s clear he had learning difficulties and just wasn’t interested in what they were teaching. Things got tough, and he ended up getting expelled at fifteen. Sadly, he even got into trouble with the law after leaving school, spending some time in prison for trying to commit a burglary. But looking back, those hard times seem to have really shaped him, giving him the edge and unique perspective that made him such an iconic frontman for Black Sabbath. It’s incredible how he turned things around to become one of the biggest names in heavy metal history!

Marilyn Manson

Growing up in Ohio, the musician known for his shocking stage shows went to a very strict Christian school. He was kicked out of Heritage Christian School for breaking the rules and expressing opinions that didn’t align with their religious beliefs. He later drew heavily on these experiences in his music and the image he created as a performer. After leaving the religious school, he transferred to a public high school, where he started pursuing journalism and music. He’s now become a famously controversial figure in the music world.

Mark Wahlberg

This actor and producer had a difficult upbringing marked by trouble with the law and at school. He was expelled from high school in Boston due to violence and drug use, and at sixteen, he was arrested and spent time in jail. He later transformed his life through music, becoming known as Marky Mark, and ultimately achieved success as a leading actor. Years later, he went back to school and finally earned his high school diploma in his forties.

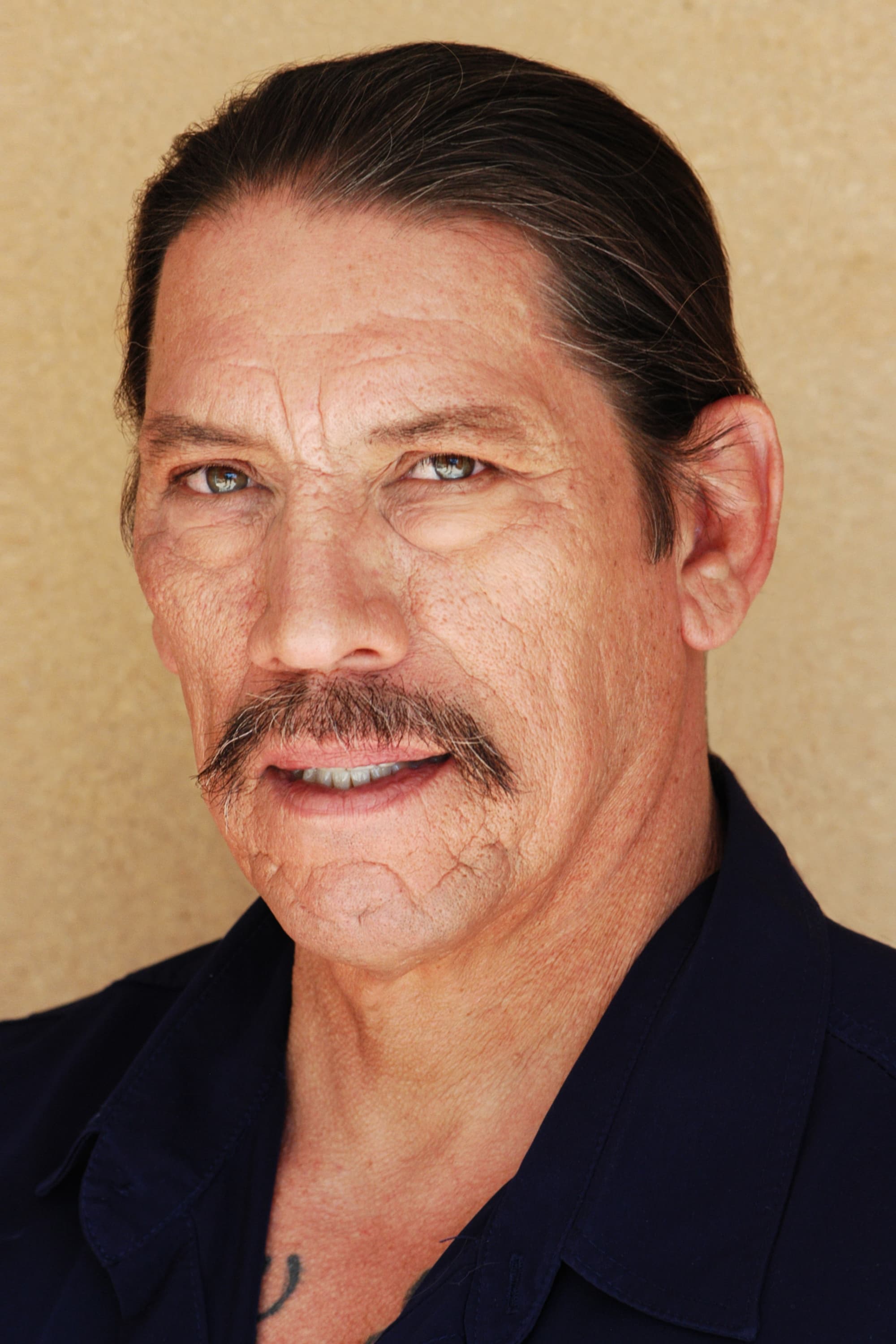

Danny Trejo

I’ve always been fascinated by actors with incredible life stories, and this guy’s is a real rollercoaster. He had a tough upbringing, bouncing around schools and getting into trouble with gangs – he was even kicked out of school early on and spent years in California prisons. But then, something amazing happened – he found film. It makes perfect sense, though. He just looks like a tough guy, and that’s why he became so popular in movies like ‘Machete’. What’s even more inspiring is what he’s done with his life since then. He’s become a successful businessman and is really dedicated to helping others get back on track, especially young people. He’s a true advocate for recovery and mentorship, and I really admire that.

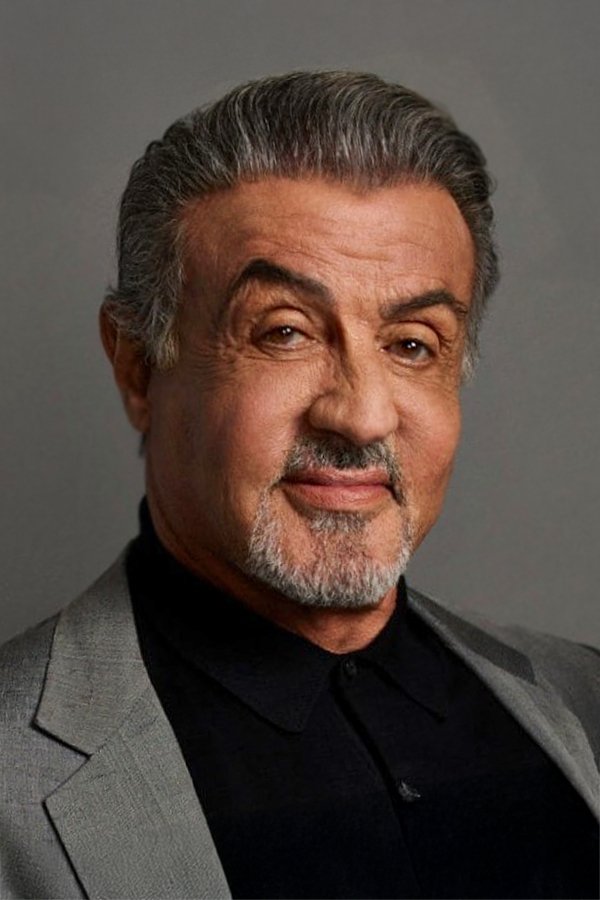

Sylvester Stallone

I’ve always been inspired by Sylvester Stallone’s story. Growing up, he really struggled in school. It’s hard to believe now, but he was kicked out of fourteen different schools! Teachers told his mom he wasn’t very bright and wouldn’t amount to much. Thankfully, he found a school that actually understood him, and that’s where he discovered his passion for acting and sports. He never gave up on himself, and look at him now – he created ‘Rocky’ and became a huge success! It just proves that anyone can achieve their dreams with enough determination.

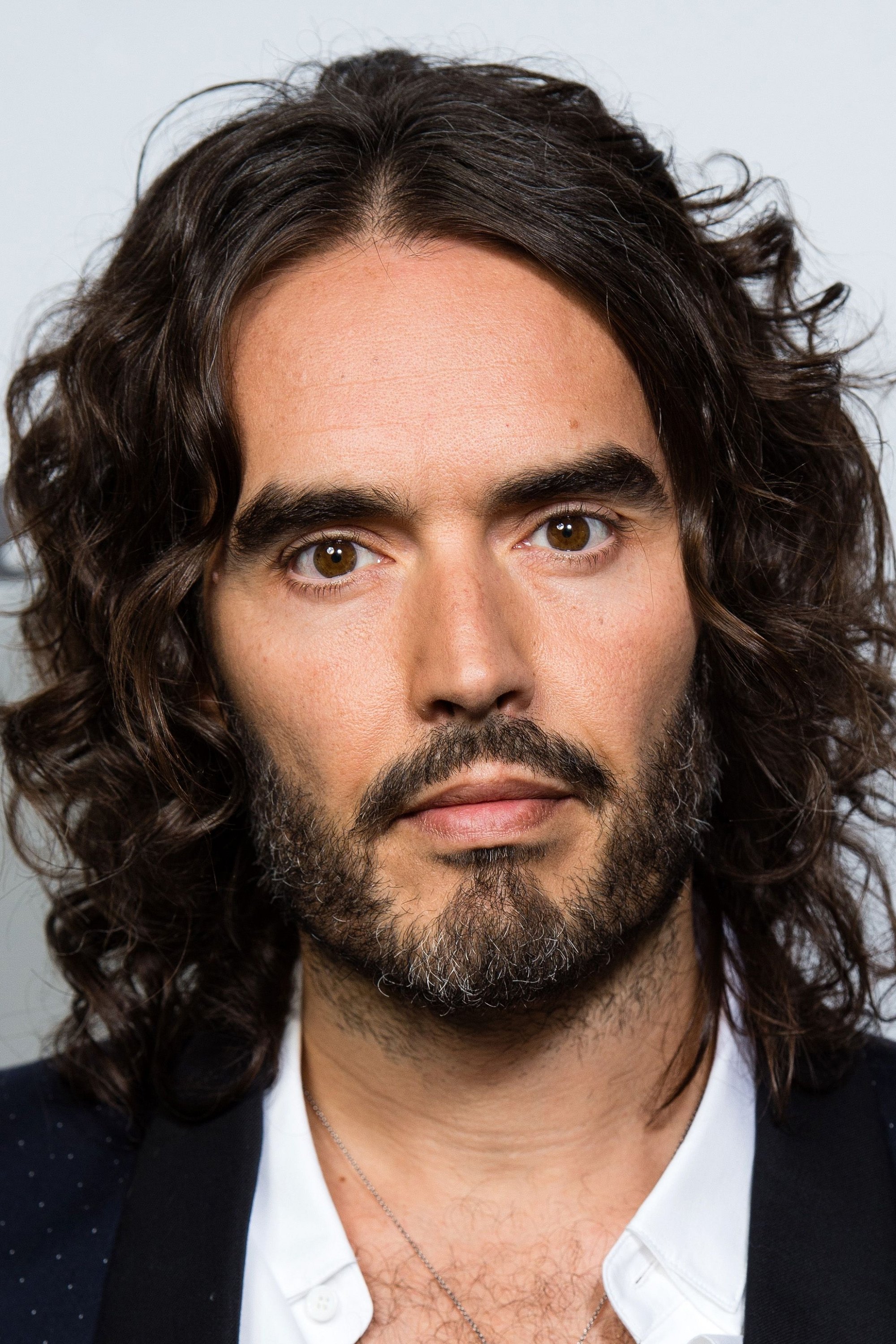

Russell Brand

This comedian and activist was a rebellious student who clashed with the strict rules of British schools. He got kicked out of multiple schools because of his unusual behavior and unwillingness to conform. It was during this time that he discovered his passion for performing, using it as an outlet for his creativity and a way to get noticed. Even after being expelled from the Italia Conti Academy of Theatre Arts, he went on to achieve huge success with stand-up comedy and acting roles in films like ‘Forgetting Sarah Marshall’.

Drew Barrymore

This actress rose to fame as a young star, but her childhood was far from typical and included significant difficulties. She faced public struggles with substance abuse and a rebellious attitude, leading to her expulsion from school. Instead of traditional classes, she received treatment in rehab and a mental health facility during her teenage years. After overcoming these challenges, she successfully relaunched her career, becoming a prominent actress and producer. Her journey is often highlighted as one of Hollywood’s most remarkable comeback stories.

Mickey Rourke

Mickey Rourke, known for his role in ‘The Wrestler,’ was a talented athlete in high school, but he had trouble with academics. He was kicked out of school after getting into fights and struggling with discipline. He then tried professional boxing before moving to New York to pursue acting. His commitment to acting brought him praise in the 1980s and a successful comeback later in his career. Being expelled from school was just the first of many ups and downs in a remarkable life.

Christian Slater

The actor rose to fame as a teen idol in the 1980s after appearing in the movie ‘Heathers’. While growing up, he was kicked out of the Dalton School in New York due to misbehavior and frequently missing class. He struggled to juggle his growing acting career with the rigorous demands of a traditional private school, so he transferred to a professional school designed for working children. Despite leaving traditional schooling early, he went on to become one of the most well-known actors of his generation.

Kiefer Sutherland

Kiefer Sutherland, known for his role in ’24’, went to several boarding schools in Canada and the UK while growing up. He was kicked out of one school because he was rebellious and didn’t follow the rules. He’s said he was a challenging teen who often questioned his teachers. Eventually, he dropped out of school to become an actor, like his parents, and it turned out to be a great decision – he became a successful film and television star.

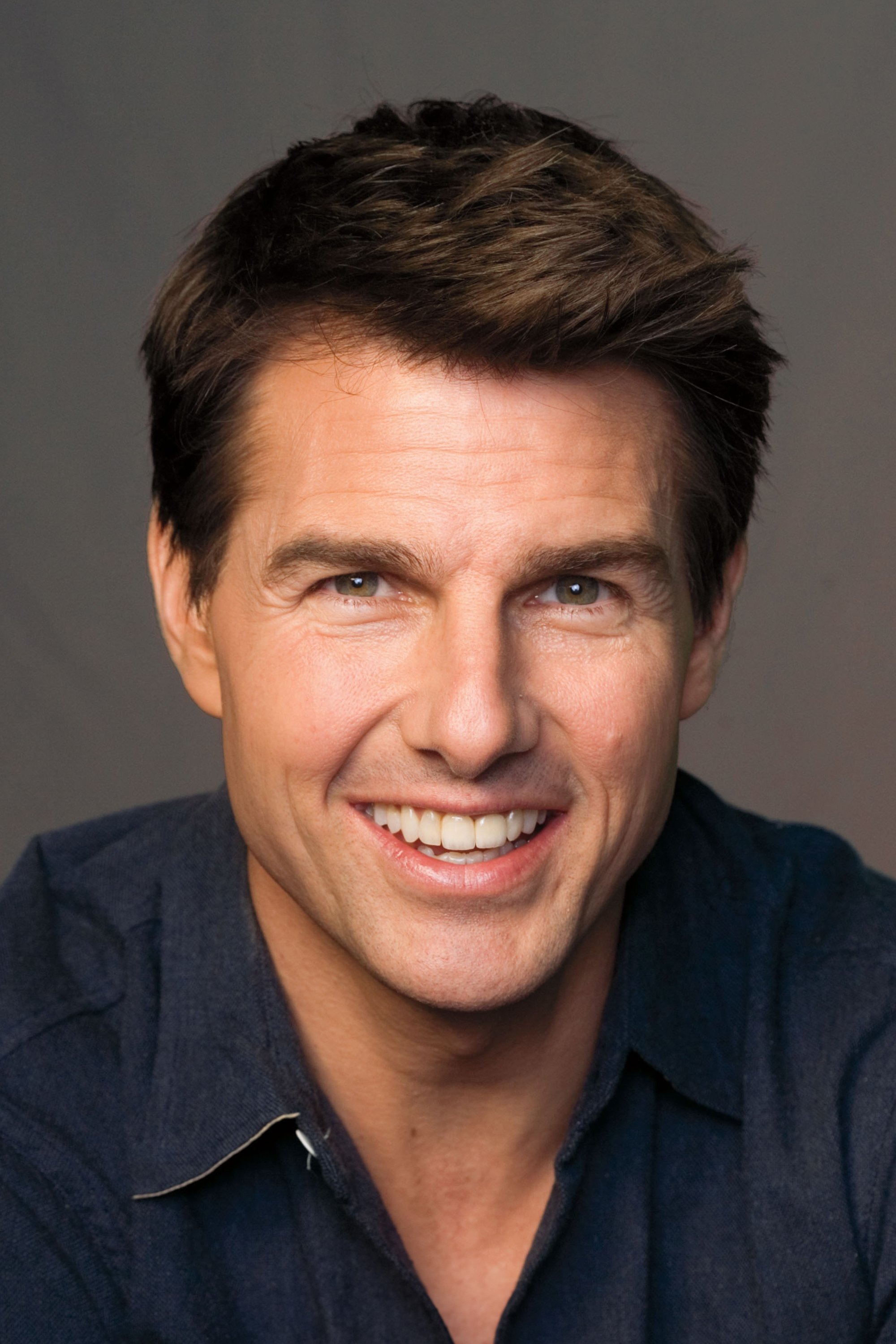

Tom Cruise

Before becoming a world-famous actor, he seriously considered becoming a priest. He initially joined a Franciscan seminary in Ohio on a scholarship, but was asked to leave after getting into trouble. He and a friend were expelled for stealing and drinking liquor from the school’s supply. This experience ended his plans for religious life and, during high school, led him to discover his passion for acting. He was so determined to pursue a career in acting that he eventually dropped out of high school and moved to New York to chase his dreams.

Cary Grant

A beloved Hollywood actor had a surprisingly tough start to life. He was kicked out of school at fourteen after being caught in the girls’ locker room, which led him to join a traveling acrobatic group. Eventually, this brought him to the United States, where he reinvented himself and became a sophisticated film star, known for movies like ‘North by Northwest’. Despite his success, he never finished his formal education, having left school so young.

Stephen Fry

The British actor and writer had a difficult upbringing and spent time in trouble with the law. He was kicked out of Uppingham School after stealing a credit card and going on a shopping spree, which resulted in a three-month jail sentence and a period of uncertainty. He later got his life back on track, gaining admission to the University of Cambridge where he met the people he would eventually collaborate with in comedy. Today, he’s known as one of the most intelligent and gifted performers in British entertainment.

Boy George

Even before becoming famous, Boy George, the singer of Culture Club, was known for his bold and unconventional personality. He was kicked out of school in London because his unique style and rebellious behavior caused too much disruption. Teachers struggled to manage him and his refusal to follow dress code rules. After leaving school, he became involved in London’s nightlife and developed the look that would become iconic of the New Romantic era. He then rose to international fame with songs like ‘Karma Chameleon’.

Adele

This talented singer developed her skills at a performing arts school in London. But before that, she was kicked out of a different school after a fight with another student. The argument started because they disagreed about a TV talent show. School officials felt her behavior was serious enough to warrant permanent expulsion. She later thrived at the BRIT School, which ultimately led to the release of her hugely successful first album, ’19’.

Robert De Niro

The Academy Award-winning actor grew up in New York City and attended a number of private schools, but he was often expelled for not applying himself and for being a bit of a quiet rebel. He spent a lot of time with a neighborhood gang, where people called him Bobby Milk. Eventually, he found his calling in acting and left high school at sixteen to train at the Stella Adler Conservatory. His dedication led to iconic roles in films such as ‘Taxi Driver’.

Al Pacino

Growing up in a difficult part of the Bronx, the actor known for ‘The Godfather’ didn’t thrive in traditional schooling. He was kicked out of the High School of Performing Arts after failing all his classes except English. He wasn’t focused on academics, as he prioritized acting and dealt with personal struggles at home. After being expelled, he took on odd jobs to help his mother while continuing to pursue his passion for acting in smaller theaters. Ultimately, he became one of the most celebrated actors in film history.

Whoopi Goldberg

The award-winning entertainer struggled in school because she had dyslexia that wasn’t recognized, and her teachers didn’t know how to help her learn. They often mistakenly thought she was unmotivated or slow. Eventually, she was kicked out of school due to poor grades and absences. She faced hardship, living on the streets and taking various jobs, before discovering her passion for performing. Her distinctive viewpoint and incredible talent ultimately led to success, including a memorable role in ‘The Color Purple’.

Kevin Spacey

This actor often got into trouble at school, moving between several institutions due to disciplinary problems. He was expelled from Northridge Military Academy after reportedly hitting a classmate with a tire during a drill. His parents then sent him to a Los Angeles high school, where he discovered a talent for acting. Despite his difficult early behavior, he went on to achieve significant success as an actor in theater and film, becoming a well-known figure before experiencing some very public difficulties later in his career.

Billy Idol

This rock star was a central part of the first wave of punk music and had a rebellious personality to match. He got kicked out of school because teachers didn’t approve of his attitude and his involvement in the growing punk scene. He wasn’t interested in traditional schoolwork, preferring to concentrate on his music and developing his own distinct style. Leaving school allowed him to start the band Generation X and later build a successful career as a solo artist. He became a popular fixture on MTV with songs like ‘White Wedding’.

Kid Rock

Growing up in a comfortable Detroit suburb, the musician intentionally created a rebellious persona, which frequently caused conflict with those in charge. After getting kicked out of high school for consistently misbehaving and refusing to follow the rules, he turned his attention to Detroit’s hip hop community. He started performing as a DJ and rapper locally, and this expulsion actually became a pivotal moment, helping him develop the unique sound that would later bring him fame. He ultimately found multi-platinum success with his album, ‘Devil Without a Cause’.

Lil Wayne

As a kid, the rapper was a bright student, but getting involved with music and street life caused problems. He was kicked out of school when a gun was found in his backpack during a search. He’d already begun his music career with Cash Money Records at a young age. After being expelled, he dedicated himself fully to music and became a hugely successful hip hop artist. While touring, he later earned his GED with the help of a tutoring program.

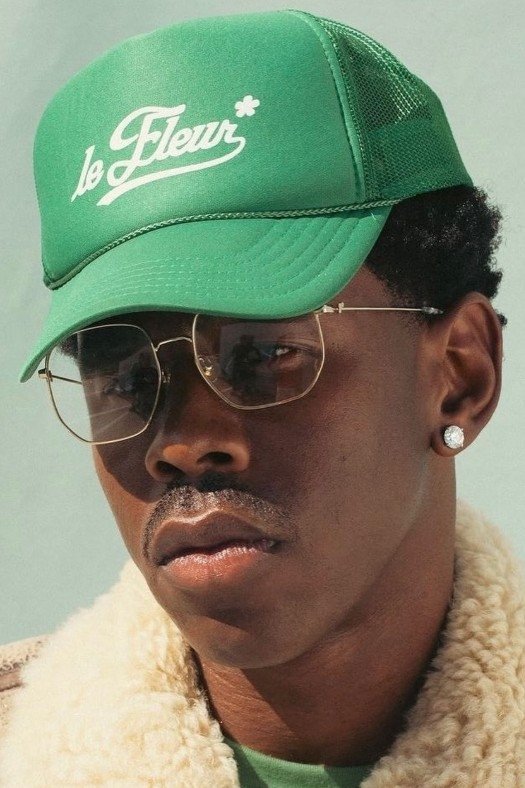

Tyler, the Creator

Growing up in Los Angeles, the artist switched schools twelve times. He got kicked out of a few for being disruptive and acting out, feeling like traditional schooling didn’t allow him to express his creativity. After dropping out, he started a group called Odd Future and began making and releasing his own music and videos. Eventually, his distinct style earned him critical praise and a Grammy Award as a solo artist.

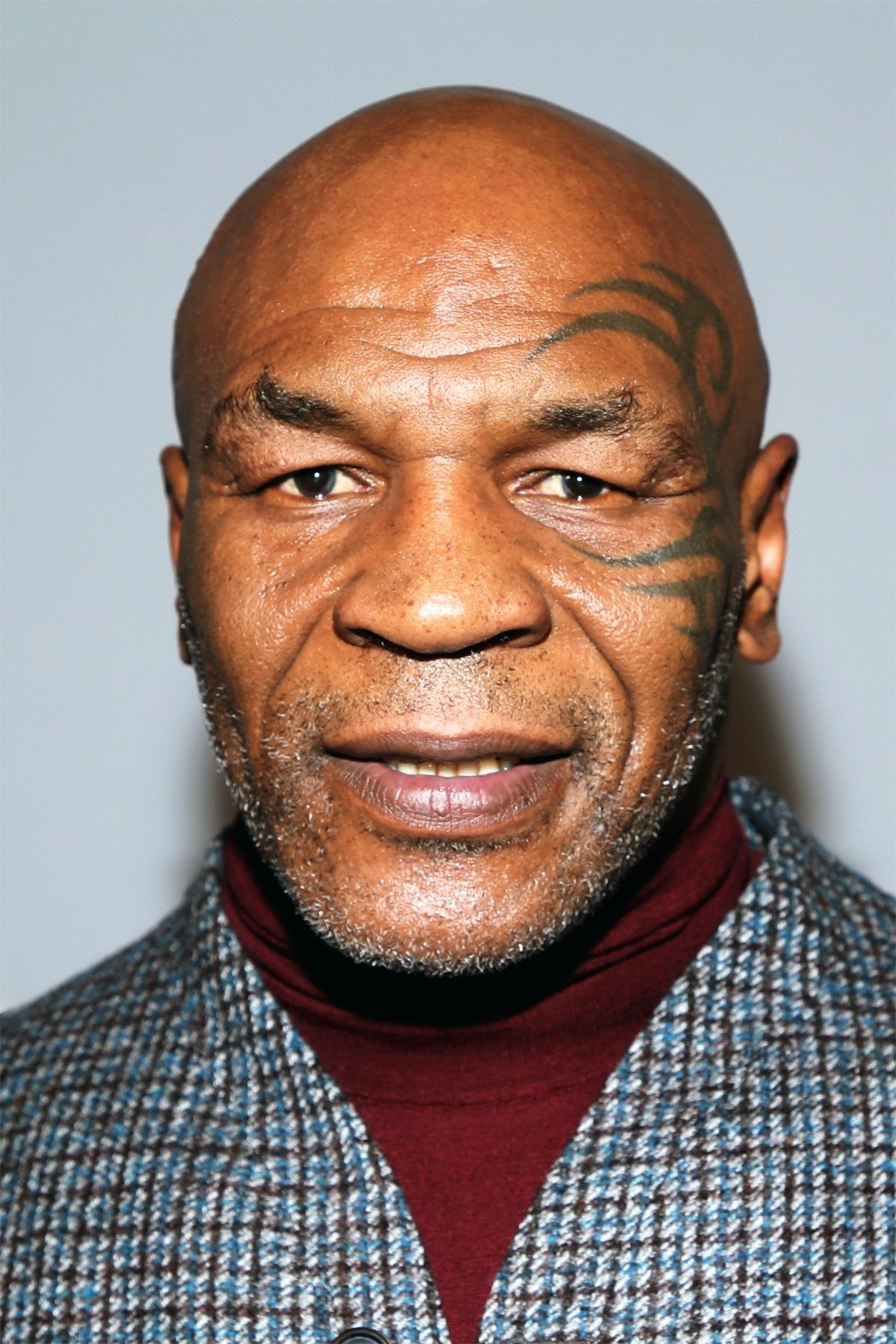

Mike Tyson

I’ve always been fascinated by this boxer’s story. He grew up incredibly tough in Brooklyn, getting into a lot of trouble and even getting arrested often. He didn’t do well in school, getting kicked out early because of fights and getting mixed up in crime. Things turned around when he was sent to reform school – that’s where someone noticed he had real talent in boxing. This led him to Cus D’Amato, a famous trainer who eventually became his legal guardian and really shaped him. It’s amazing to think about how disciplined he became in the ring, considering how much trouble he had with authority figures when he was younger.

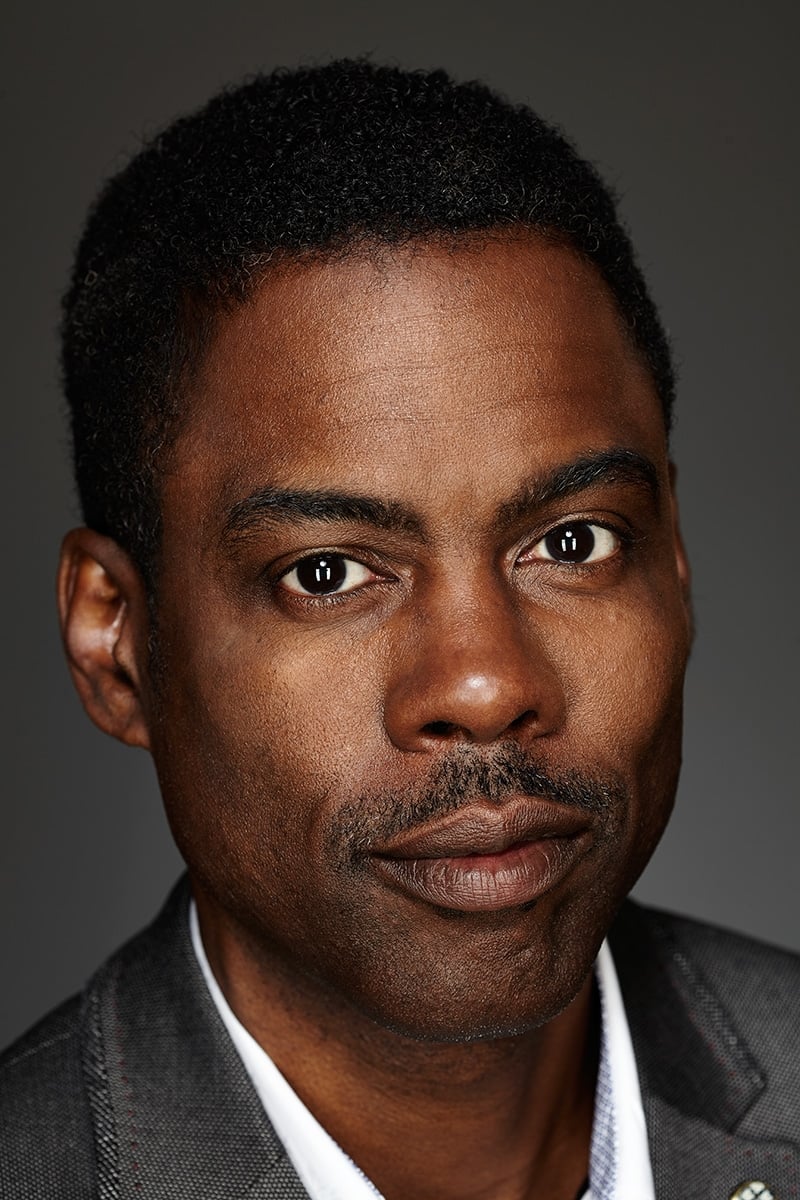

Chris Rock

I’ve heard the comedian talk a lot about how tough it was going to school in Brooklyn – it was mostly white students, and he really didn’t fit in. Things got so bad with bullying and fighting that they ended up kicking him out, saying he was more trouble than he was worth. He’s explained that all the racial tension and harassment made it impossible to concentrate on schoolwork. So, he got his GED instead and started doing stand-up at clubs around town. A lot of what happened to him back then – feeling like an outsider – became the basis for his show, ‘Everybody Hates Chris’.

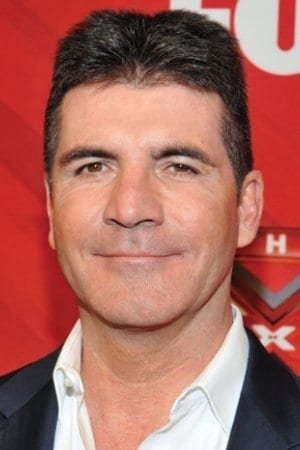

Simon Cowell

The famous music executive and TV personality wasn’t an easy student. He bounced around to several boarding schools and was kicked out of a few for misbehaving and not applying himself. He’s said he cared more about having fun and earning money than about schoolwork. Leaving school eventually led him to a mailroom job at a record label, which surprisingly launched a hugely successful career and made him a major power player in the entertainment industry.

Share your thoughts on these celebrity success stories in the comments.

Read More

- Gold Rate Forecast

- Securing the Agent Ecosystem: Detecting Malicious Workflow Patterns

- NEAR PREDICTION. NEAR cryptocurrency

- DOT PREDICTION. DOT cryptocurrency

- Wuthering Waves – Galbrena build and materials guide

- USD COP PREDICTION

- Silver Rate Forecast

- EUR UAH PREDICTION

- USD KRW PREDICTION

- Games That Faced Bans in Countries Over Political Themes

2026-03-02 04:51