It’s common for celebrities to use their platform to share opinions that differ from what most people believe. Some advocate for causes, while others have gained attention by supporting conspiracy theories that generate a lot of discussion. Several actresses have publicly expressed beliefs about things like aliens, questioned established science, and challenged historical accounts. While sharing these views can be controversial, it demonstrates the wide range of perspectives within the entertainment industry. This article looks at prominent actresses who have openly supported and defended these unusual ideas throughout their careers.

Jenny McCarthy

I’ve always been fascinated by Jenny McCarthy, though I don’t necessarily agree with her views. She really became well-known for speaking out about vaccines and suggesting they might be connected to autism. I remember seeing her on TV and at events, passionately sharing what she believed about health and medicine. It’s been interesting to watch her become such a public figure, even though scientists and health professionals have strongly disagreed with her stance. She’s definitely one of the most recognizable celebrity voices when it comes to questioning conventional medical wisdom these days.

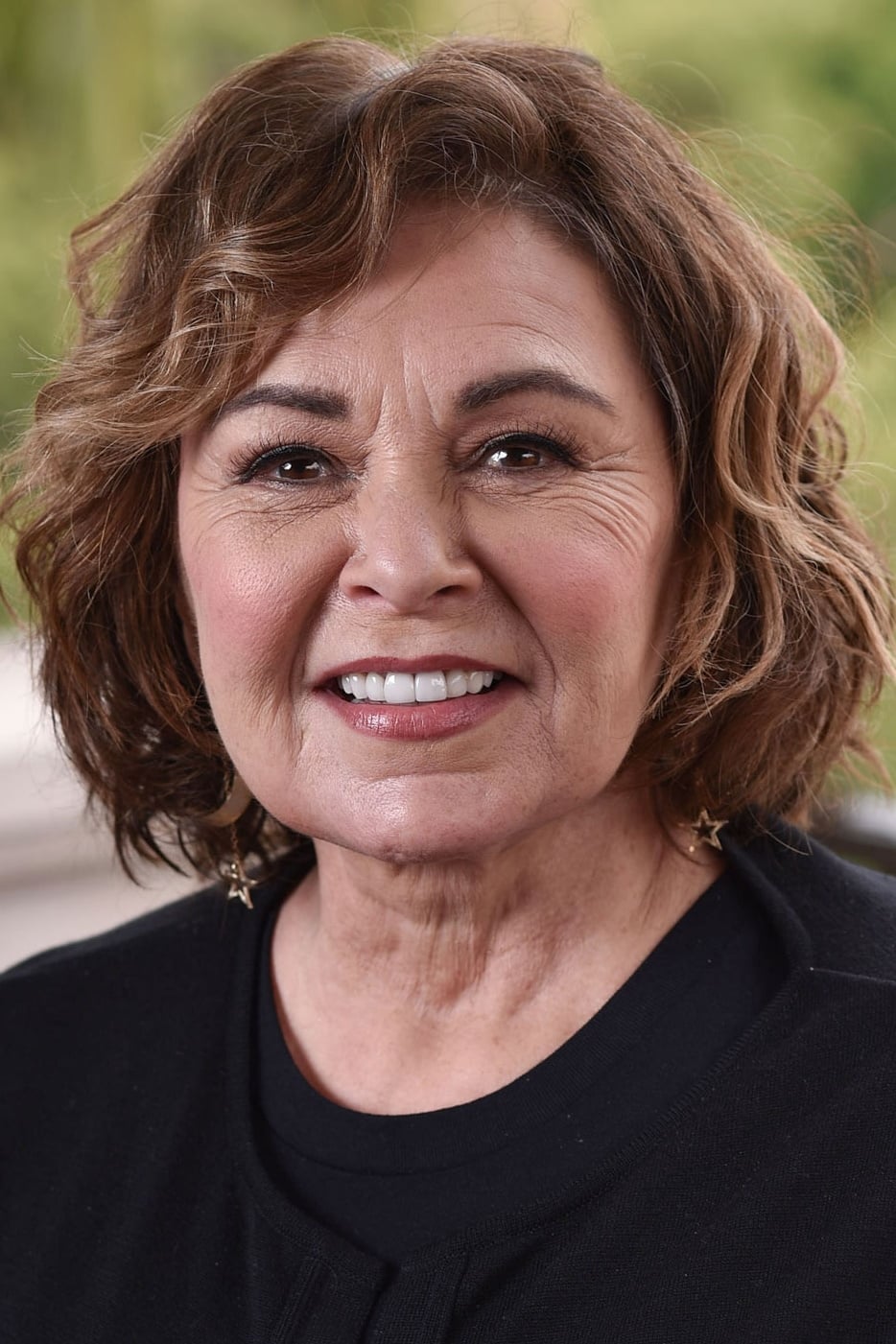

Roseanne Barr

Roseanne Barr is famous for her role in the sitcom ‘Roseanne’ and for speaking her mind about politics. She’s often shared posts related to the QAnon conspiracy theory online. Barr has also made contentious statements about elections and claims of secret government activity. These public comments have caused professional problems and sparked considerable public discussion.

Fran Drescher

Fran Drescher, best known for starring in ‘The Nanny’ and leading the actors union, has shared a surprising story: she and her ex-husband claim they were abducted by aliens when they were teenagers. Drescher believes the aliens put tracking devices under their skin, and she points to scars on her body as proof of the experience.

Marion Cotillard

Marion Cotillard, an Academy Award-winning actress, has publicly wondered if the official story of the September 11th attacks is accurate. She once proposed that the World Trade Center towers might have been brought down by controlled demolitions, not just the planes hitting them. In interviews, she also expressed doubts about whether the moon landing actually happened. Cotillard later explained that she didn’t intend to cause offense or spread false information with these comments.

Alicia Silverstone

Alicia Silverstone, famous for her role in the movie ‘Clueless’ and her vegan lifestyle, has also become known for questioning common medical practices. She’s written about her concerns regarding childhood vaccines and procedures, and has spoken out about potential health risks from chemicals in traditional tampons. Her promotion of natural and alternative ways of living sometimes overlaps with unproven medical ideas.

Letitia Wright

Letitia Wright, known for her roles in ‘Black Panther’ and its sequels, sparked controversy when she shared a video online during the pandemic. The video raised questions about vaccine safety and ingredients, and also included comments considered transphobic and expressed doubts about scientific evidence. Following significant public and professional criticism, Wright removed her social media accounts.

Gina Carano

Gina Carano was a cast member on ‘The Mandalorian’ but was later removed from the show after sharing controversial opinions online. She posted about the 2020 election, expressing doubts about the results, and drew parallels between the current political situation in the US and events from history. Her online activity often reflected ideas commonly found in right-wing conspiracy theories.

Lisa Bonet

I’ve always admired Lisa Bonet, not just for her amazing work on shows like ‘The Cosby Show’ and ‘High Fidelity,’ but also for how openly she shares her beliefs. She’s been really vocal about her concerns regarding vaccines for a long time, and it all comes from her deep commitment to natural health. She believes introducing things into your body that aren’t natural could potentially cause problems down the line, and she’s talked a lot about this in interviews – it’s just part of her overall philosophy of holistic living and being mindful about medical treatments.

Jessica Biel

I’ve always been a fan of Jessica Biel – she’s great in movies like ‘The Illusionist’ and I really enjoyed her performance in ‘The Sinner’! But I was surprised to learn she got involved in a debate about vaccines. Apparently, she spoke out against a California bill that would have limited medical exemptions, saying she believes in medical freedom and parents’ rights to choose what’s best for their kids. It ended up connecting her to some of the bigger conversations happening around vaccines in Hollywood, which was a bit unexpected.

Demi Lovato

Okay, so I’ve been a fan of Demi Lovato since her Disney Channel days – ‘Camp Rock’ and ‘Sonny with a Chance’ were totally my jam! But what’s really fascinating is her interest in UFOs. She’s a huge believer in extraterrestrial life and has actually seen things, or at least she thinks she has. She even hosted this docuseries, ‘Unidentified with Demi Lovato,’ where she dove deep into all that stuff. And it’s cool because she’s really thoughtful about the language we use – she actually prefers calling them ‘beings’ instead of ‘aliens’ because she thinks ‘alien’ is kind of a disrespectful term.

Stacey Dash

Stacey Dash first became famous for her role in the movie ‘Clueless,’ but later became known for sharing her political opinions. She’s publicly supported ideas about hidden groups controlling the entertainment world and has made debatable statements about the goals of civil rights movements and government actions. Because she’s very direct and often controversial, she’s become a divisive figure in both Hollywood and politics.

Rose McGowan

Rose McGowan was a key figure in bringing the #MeToo movement to light, drawing from her own experiences in Hollywood. She’s often spoken about a hidden network within the film industry that shields powerful people from accountability. McGowan argues that corruption exists at the highest levels of many organizations, and those in power work to suppress anyone who speaks out. Her public comments frequently combine her personal story with wider beliefs about systemic issues and conspiracies.

Megan Fox

Megan Fox is known for her roles in popular movies like ‘Transformers’ and ‘Teenage Mutant Ninja Turtles’. She’s fascinated by the idea that history might be different than we think, and specifically believes ancient civilizations may have been impacted by extraterrestrial life. Fox thinks governments are covering up archaeological discoveries that could prove this, and she’s been independently researching these theories by visiting historical locations.

Donna D’Errico

Donna D’Errico, known for her role on the 1990s TV show ‘Baywatch,’ traveled to Turkey to search for Noah’s Ark on Mount Ararat. She believes the Ark was a real ship and is determined to find it. Her challenging expedition and the difficult conditions she faced were recorded as she searched for this ancient relic.

Goldie Hawn

Goldie Hawn, the famous actress from movies like ‘Private Benjamin’ and ‘Cactus Flower’, once shared a story about what she believes was an encounter with aliens when she was younger. She described feeling like something was physically near her and hearing strange, high-pitched noises. Hawn continues to be fascinated by the idea of life on other planets and the power of the universe.

Shirley MacLaine

Shirley MacLaine is a celebrated actress known for iconic films such as ‘The Apartment’ and ‘Terms of Endearment’. Beyond her acting career, she’s widely recognized for her beliefs in reincarnation and the possibility of life beyond Earth. MacLaine has shared her spiritual experiences and claims of encounters with extraterrestrial beings in several books, and she believes governments have been secretly communicating with aliens for many years.

Marla Maples

Marla Maples, known for her acting and TV appearances – including a role in ‘Executive Decision’ – recently shared posts suggesting a possible connection between 5G technology and the spread of viruses. She’s a longtime proponent of alternative and natural healing practices, often preferring them to conventional medicine. Maples frequently uses social media to discuss her beliefs about potential risks hidden within everyday things like our infrastructure and food.

Samaire Armstrong

Samaire Armstrong, known for her acting in shows like ‘The O.C.’ and ‘Dirty Sexy Money,’ has recently become very vocal about her political beliefs. She’s publicly supported ideas related to the 2020 election and the Black Lives Matter movement, and has often defended viewpoints connected to the QAnon conspiracy theory. This change in her public stance has drawn a lot of attention and sparked debate online, with both supporters and critics reacting to her views.

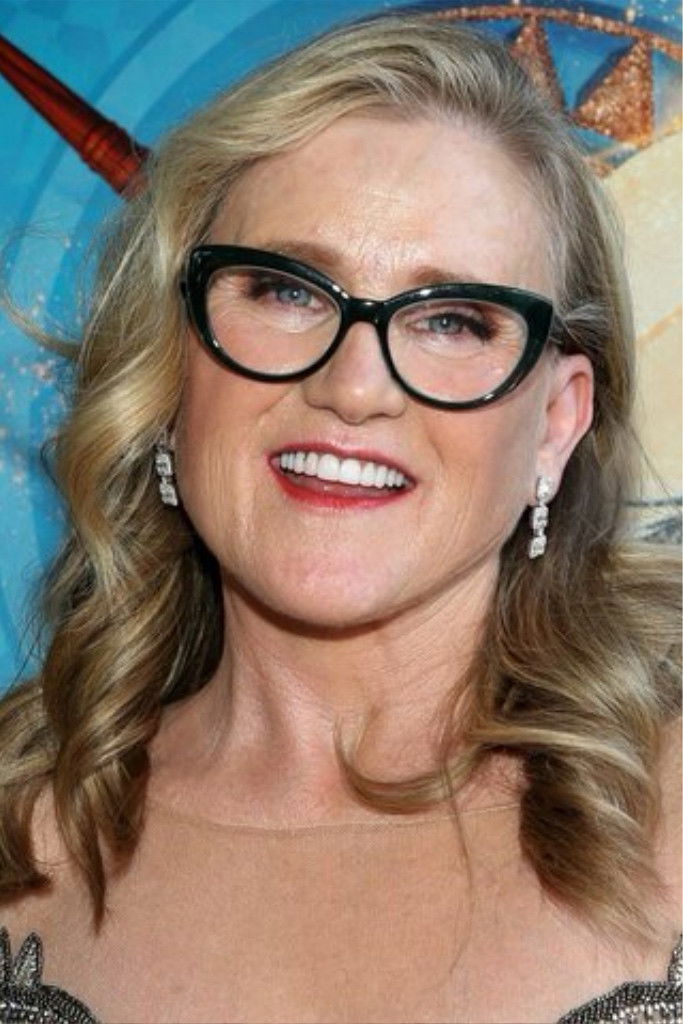

Kristy Swanson

Kristy Swanson, best known for playing the lead role in the movie ‘Buffy the Vampire Slayer,’ has often publicly disagreed with official explanations of health rules and political happenings. She regularly posts information from sources that support unconventional ideas about excessive government power, and continues to be a prominent voice among entertainers who question what’s reported in mainstream media.

Drea de Matteo

As a big fan of ‘The Sopranos,’ I was surprised to learn Drea de Matteo has become really outspoken about things like medical mandates and the power of Big Pharma. She seems convinced there’s a coordinated effort happening between the government and the media to mislead people, and she’s been sharing her thoughts pretty consistently on her podcast and through videos online. It’s definitely a different side of her than Adriana, but it’s interesting to see her speak out about what she believes in.

Suzanne Somers

Suzanne Somers first became famous as an actress on ‘Three’s Company,’ and later became known for writing about health. For many years, she championed alternative approaches to treating cancer and questioned conventional medicine. Somers has long maintained that powerful interests are hiding natural cures to protect the profits of drug companies. These beliefs have frequently caused disagreements with doctors and established medical groups.

Shailene Woodley

Shailene Woodley is known for her roles in the ‘Divergent’ movies and the TV show ‘Big Little Lies’. She’s also a strong believer in natural health methods, including practices like eating clay to cleanse the body and getting sunlight in unique ways to support hormone balance. Woodley often explores lifestyle choices and ideas that differ from typical medical recommendations.

Kirstie Alley

Kirstie Alley, known for her roles in ‘Cheers’ and the ‘Look Who’s Talking’ movies, was a committed follower of Scientology. As such, she agreed with the organization’s view that psychiatry is harmful and based on false information. She often spoke out about what she believed were the damaging effects of psychiatric medications, and later in life, she publicly questioned the outcomes of several elections.

Victoria Jackson

Victoria Jackson started her career as a comedian on ‘Saturday Night Live’ but later became known for her conservative political views. She has publicly stated that Barack Obama was secretly working to establish Islamic law in the United States, and frequently discusses her belief that communist ideas are spreading within American schools and the government. Jackson presents these ideas as crucial for protecting the country.

Evangeline Lilly

Evangeline Lilly, famous for her work on ‘Lost’ and the ‘Ant-Man’ movies, gained attention during the early days of the pandemic for not following social distancing guidelines and participating in protests against mandates. She expressed concerns that the government was using health issues as an excuse to limit people’s freedoms. This caused a lot of discussion about what celebrities and other public figures should do during a crisis.

Juliette Lewis

Juliette Lewis is known for her roles in popular films like ‘Natural Born Killers’ and the TV show ‘Yellowjackets’. She’s also a vocal supporter of Scientology, a belief system with ideas about human history and beings from other planets. Lewis is a strong advocate for alternatives to traditional mental health treatments like prescription drugs, believing her spiritual beliefs help her understand what she sees as the dishonesty in today’s world.

Mayim Bialik

Mayim Bialik, known for her roles in ‘Blossom’ and ‘The Big Bang Theory’ (where she played a neuroscientist), used to be hesitant about vaccines and wrote about delaying her children’s immunizations. While she’s changed her views since then, she still supports alternative approaches to healthcare. Because of her scientific background, her earlier skepticism sparked a lot of public conversation.

January Jones

January Jones is famous for her role as Betty Draper on the popular TV show ‘Mad Men’. She’s also publicly talked about eating her own placenta after childbirth, believing it’s good for her health. Jones frequently shares her wellness practices, including homeopathic treatments – which aren’t generally accepted by traditional doctors – with her social media followers.

Michelle Stafford

Michelle Stafford is a well-known actress on ‘The Young and the Restless’. She’s publicly associated with the Church of Scientology and has spoken in support of its beliefs, even when they’ve been debated. Stafford frequently posts about holistic health and wellness, and she often questions conventional medical advice. Overall, her public image suggests she embraces ideas that differ from widely accepted norms.

Lindsay Lohan

Lindsay Lohan became famous as a young actress in movies like ‘The Parent Trap’ and ‘Mean Girls’. She once announced plans to create her own private island in Dubai, envisioning it as a self-governed retreat. Lohan is also known for her interest in unconventional ideas about the world and achieving spiritual understanding. Throughout her career, she’s often made statements that are both puzzling and captivating to the public.

Rosanna Arquette

Rosanna Arquette is a well-respected actress, famous for her roles in films like ‘Desperately Seeking Susan’ and ‘Pulp Fiction’. She’s also known for publicly discussing her belief that powerful, hidden forces manipulate politics and business. Arquette frequently shares her ideas about who really controls the global economy and uses social media to reveal what she believes is the truth behind important events.

Anne Heche

As a film critic, I remember Anne Heche from movies like ‘Six Days Seven Nights’ and ‘Donnie Brasco,’ but she was so much more than just an actress. For years, she openly shared some incredibly personal and, frankly, unusual beliefs. She famously claimed to be the daughter of God and spoke about having an alter ego who was an alien from another planet. She really believed she could talk to extraterrestrials and that she was here on a mission to save the world. These weren’t just fleeting comments; they became a significant and well-known part of who she was in the public eye for quite some time.

Gwyneth Paltrow

Gwyneth Paltrow, an Oscar-winning actress, created the lifestyle brand Goop. She’s known for promoting unconventional ideas, like the belief that water has emotions or that stickers can improve health. Paltrow and her brand often receive criticism for selling products that supposedly shield people from imaginary dangers. Goop has become a leading source of alternative health and wellness trends, particularly among celebrities.

Candace Cameron Bure

Candace Cameron Bure, famous for playing D.J. Tanner on ‘Full House’ and its continuation, has spoken out about what she sees as a silencing of religious and conservative perspectives in the media. She frequently posts content questioning the reasons behind decisions made by companies and the government, and believes there’s a deliberate attempt to shift the country’s long-held values.

Daryl Hannah

I’ve always been a huge fan of Daryl Hannah – she’s amazing in movies like ‘Splash’ and ‘Kill Bill’! But beyond acting, I really admire her dedication to protecting the environment. She’s incredibly outspoken, and she’s shared some really thought-provoking ideas about how powerful companies and governments might be deliberately covering up the damage being done to our planet. She doesn’t just talk about it either – she’s willing to put herself on the line, even engaging in acts of civil disobedience, to raise awareness about what she believes is a massive global cover-up.

Alicia Witt

Alicia Witt, known for her roles in ‘Dune’ and ‘The Walking Dead’, is also vocal about her health beliefs. She believes certain diets can be healing and warns against the potential harm of food additives. Witt suggests that a lack of openness within the food industry contributes to many health problems today, and she chooses a lifestyle focused on natural, unprocessed foods.

Mischa Barton

Mischa Barton rose to fame as a teen star on the early 2000s TV show ‘The O.C.’ Since then, she’s sometimes posted puzzling messages about fame and how the media works. Barton has implied that her own difficulties were manipulated by others, and she often suggests that there are secret motivations at play within the entertainment world.

Vanessa Hudgens

Vanessa Hudgens first became well-known through the ‘High School Musical’ movies and later moved on to more mature acting roles. During the COVID-19 pandemic, she shared opinions that downplayed the seriousness of the virus and the need for restrictions. She seemed to suggest that deaths were unavoidable and shouldn’t limit individual liberties. Many people saw her comments as support for unconventional and potentially harmful ideas about public health.

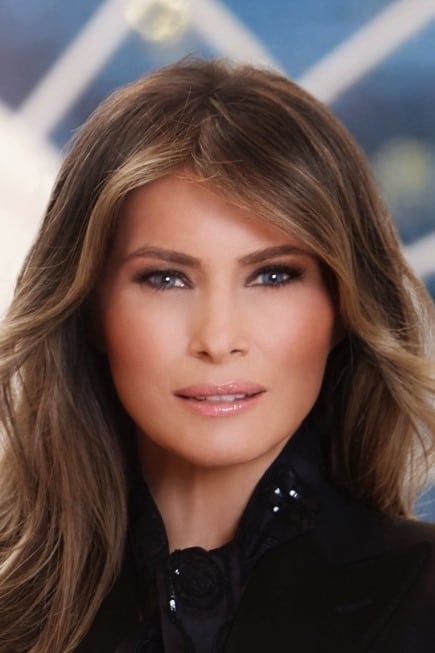

Melania Trump

Before becoming involved in politics, Melania Trump worked as a model and appeared in a few movies and TV shows. She later became well-known for publicly supporting the ‘birther’ conspiracy theory, which falsely questioned where Barack Obama was born. She frequently appeared on television asking for Obama’s birth certificate to be released, and this issue played a key role in her first steps into public political life.

Bridget Marquardt

I’ve always been fascinated by Bridget Marquardt – she’s so much more than just her time on ‘The Girls Next Door’! What really draws me in is her genuine interest in the unexplained. She truly believes in ghosts and the paranormal, and isn’t afraid to explore things like alien theories and even mythical creatures. It’s amazing that she shares all of this on her podcast, diving into these bizarre and supernatural stories. I love listening to her perspective!

Kesha

Kesha has acted in movies, including ‘A Ghost Story,’ and starred in her own reality TV shows. She’s publicly talked about having intimate experiences with ghosts and strongly believes spirits are all around us. She also discusses her thoughts on life beyond Earth and claims to have seen UFOs. These beliefs in the supernatural and unexplained often find their way into her music and art.

Nancy Cartwright

As a longtime observer of pop culture, I’ve always been fascinated by the people behind the voices we know so well. Nancy Cartwright, the incredibly talented woman who is Bart Simpson, is one of those figures. Beyond the iconic character, she’s a dedicated member of the Church of Scientology, and she’s been very vocal in its defense. In fact, she’s used her platform – that instantly recognizable voice – to share the church’s beliefs, which are pretty far out when it comes to how they view the universe. From what I gather, she truly believes Scientology offers the only real route to finding inner peace and understanding.

Catherine Bell

Catherine Bell is a popular actress known for her work on shows like ‘JAG’ and ‘The Good Witch’. She’s been involved with the Church of Scientology for a long time and has often talked about how it’s helped her. Bell supports the church’s differing opinions on traditional psychiatry and its unique approach to understanding people. She believes her career success is thanks to the spiritual support she gets from the church.

Erika Christensen

As a film buff, I recognize Erika Christensen from movies like ‘Traffic’ and the TV show ‘Parenthood’. What’s less known is that she grew up as a Scientologist, and she’s been very vocal about defending it. She feels the media often unfairly criticizes Scientology because its ideas about science and history are different from what most people believe. She genuinely believes that the church offers a special way to understand what it means to be human, something she thinks is missing in mainstream culture.

Elisabeth Moss

Elisabeth Moss is a celebrated actress famous for her roles in shows like ‘Mad Men’ and ‘The Handmaid’s Tale’. She’s spoken out in defense of her connection to Scientology, explaining that she believes it champions religious liberty and personal growth. Moss has often been asked about how Scientology’s beliefs connect to the ideas explored in her acting work. She remains a supporter of the church and its perspectives on reality and human potential.

Tell us which of these celebrity conspiracy theories you find most surprising in the comments.

Read More

- Gold Rate Forecast

- Securing the Agent Ecosystem: Detecting Malicious Workflow Patterns

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- NEAR PREDICTION. NEAR cryptocurrency

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- USD COP PREDICTION

2026-03-01 16:19