The tiers of valuation are, of course, arbitrary constructs. Yet, the so-called ‘$4 trillion club’—a designation as meaningless as it is coveted—currently houses only one entity: Nvidia. Apple and Alphabet, having briefly occupied that space, now circle like supplicants at a distant gate. I observe this, not with anticipation of their return, but with a peculiar focus on Microsoft. It is a company, presently valued at approximately $2.9 trillion, that has experienced a…correction. A subtraction, if you will, from a previously inflated sum. A sum, I might add, that felt, even at its height, like a temporary suspension of the natural order.

The recent decline – a 27% reduction in assessed worth – is not, as the more excitable among us might presume, indicative of a fundamental flaw. Rather, it is a necessary descent. A procedural lowering of expectations, as if the market itself has decided Microsoft was, for a fleeting moment, too successful. The implications are, naturally, unclear. But clarity, one learns, is rarely a feature of these proceedings.

The Absence of Explanation

Typically, a diminution of this magnitude is accompanied by a narrative. A justification. A scandal, perhaps, or a disappointing quarterly report. But here, there is only…silence. The numbers, when examined, reveal nothing untoward. Revenue for the fiscal 2026 second quarter—ending December 31, 2025—reached $81.3 billion, exceeding the projected range of $79.5 to $80.6 billion. A surplus, one might say. Yet, the market remains…unimpressed. It is as if the rules have changed, and no one bothered to inform us.

Nor has Microsoft signaled any alteration in its strategic direction. The commitment to artificial intelligence remains steadfast. The cloud infrastructure – Azure – continues to accumulate a backlog of $625 billion. A figure so vast it borders on the abstract. And yet, the stock price…descends. It is a paradox, certainly. But then, so is existence.

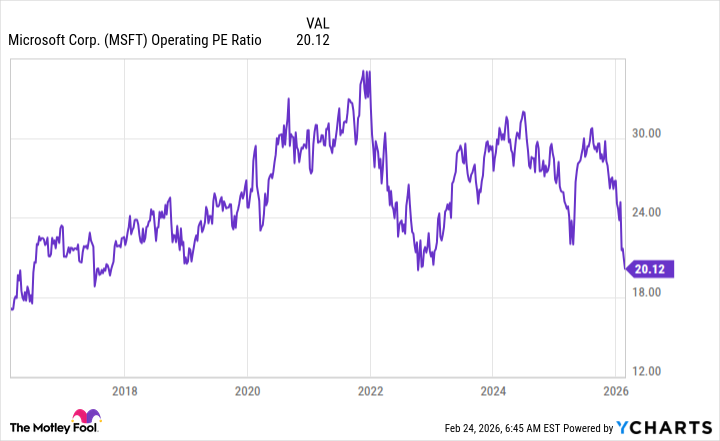

This, then, is the peculiarity of the situation. The absence of a discernible cause. The stock is, quite simply, cheaper. And my assessment, based on the operating price-to-earnings ratio, suggests it is, historically, unusually so. It is as if the market has decided that Microsoft, despite all evidence to the contrary, is no longer deserving of its former valuation. A bureaucratic decision, perhaps, enacted by unseen forces.

Therefore, the accumulation of shares at this juncture feels…not optimistic, precisely, but…logical. A response to an illogical situation. An attempt to capitalize on a temporary misalignment. The opportunity, I suspect, will not persist. The market, after all, has a habit of correcting its own absurdities. And when it does, the price will inevitably…ascend. Whether that ascent is justified is, of course, another matter entirely. But justification, I have learned, is rarely a prerequisite for market behavior.

Read More

- Gold Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- Silver Rate Forecast

- EUR UAH PREDICTION

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2026-03-01 03:42