As a movie critic, I’ve always been fascinated by the stories behind the stars, and Hollywood history is full of them – particularly the wild ones! It seems a lot of famous actors have a knack for turning luxurious hotel suites into disaster zones. We’re talking serious parties, emotional breakdowns, and a whole lot of broken furniture and glass. It’s a pattern that’s repeated over and over, from the Golden Age legends right up to today’s biggest blockbuster names. These hotel room antics consistently make headlines, and honestly, it’s a side of fame that’s hard to ignore.

Johnny Depp

In 1994, Johnny Depp was arrested for trashing a hotel suite at The Mark Hotel in New York City. He was staying with Kate Moss at the time and caused over $9,000 in damage. Depp initially claimed an armadillo was responsible, but police found no proof. He ultimately paid for the repairs to avoid further legal issues. This incident contributed to his early image as a rebellious figure in Hollywood.

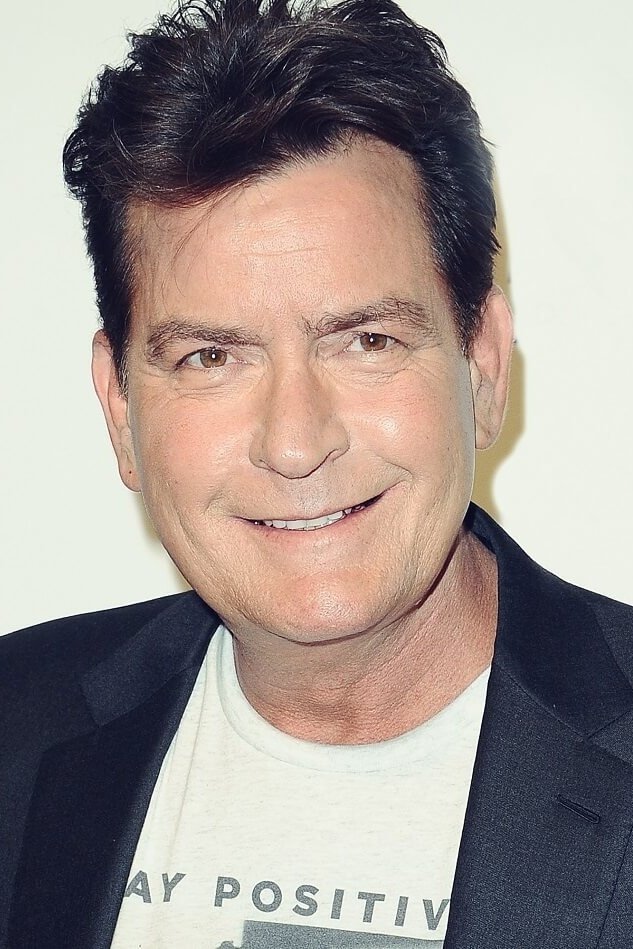

Charlie Sheen

In 2010, Charlie Sheen caused significant trouble at The Plaza Hotel while on vacation with his family. Hotel security discovered him naked and confused in a badly damaged room, with thousands of dollars worth of furniture and fixtures broken. The incident followed a night of heavy partying that led to police being called and Sheen needing to go to the hospital. Although he wasn’t formally charged with any crime, the hotel had a huge mess to clean up. This was just one of several public incidents that occurred during his time starring in ‘Two and a Half Men’.

Nicolas Cage

In 2011, Nicolas Cage was arrested in New Orleans after a public argument escalated inside a hotel. Witnesses say he was drunk and caused a disturbance, damaging cars and the hotel lobby. He reportedly dared police to arrest him after the damage occurred. Cage was later charged with domestic abuse and disturbing the peace. This incident occurred during a difficult time for the actor, who was facing both personal and financial challenges.

Christian Slater

I remember when the news broke about Christian Slater back in 1997! It was crazy. Apparently, he had a really wild party at the Parker Meridien Hotel, and things just spiraled out of control. He ended up completely trashing his hotel room and even got into a physical altercation with a police officer – all fueled by drugs, from what I read. People at the scene said it was total chaos, with furniture everywhere and damage all over the walls. He actually went to jail for it, which was a shock at the time. It’s good to hear he’s talked about getting his life back on track since then, and how he’s moved past those really difficult years. It’s amazing to see how much people can change, especially someone like him who was so known for being a bit of a rebel.

Shia LaBeouf

Shia LaBeouf caused a stir while staying at a London hotel during filming for ‘Fury’. To get into character as a soldier, he stopped showering and reportedly damaged his hotel room. He also had several disagreements with hotel staff and other guests, creating a difficult environment for everyone. This was just one of a series of unusual public behaviors from the ‘Transformers’ star.

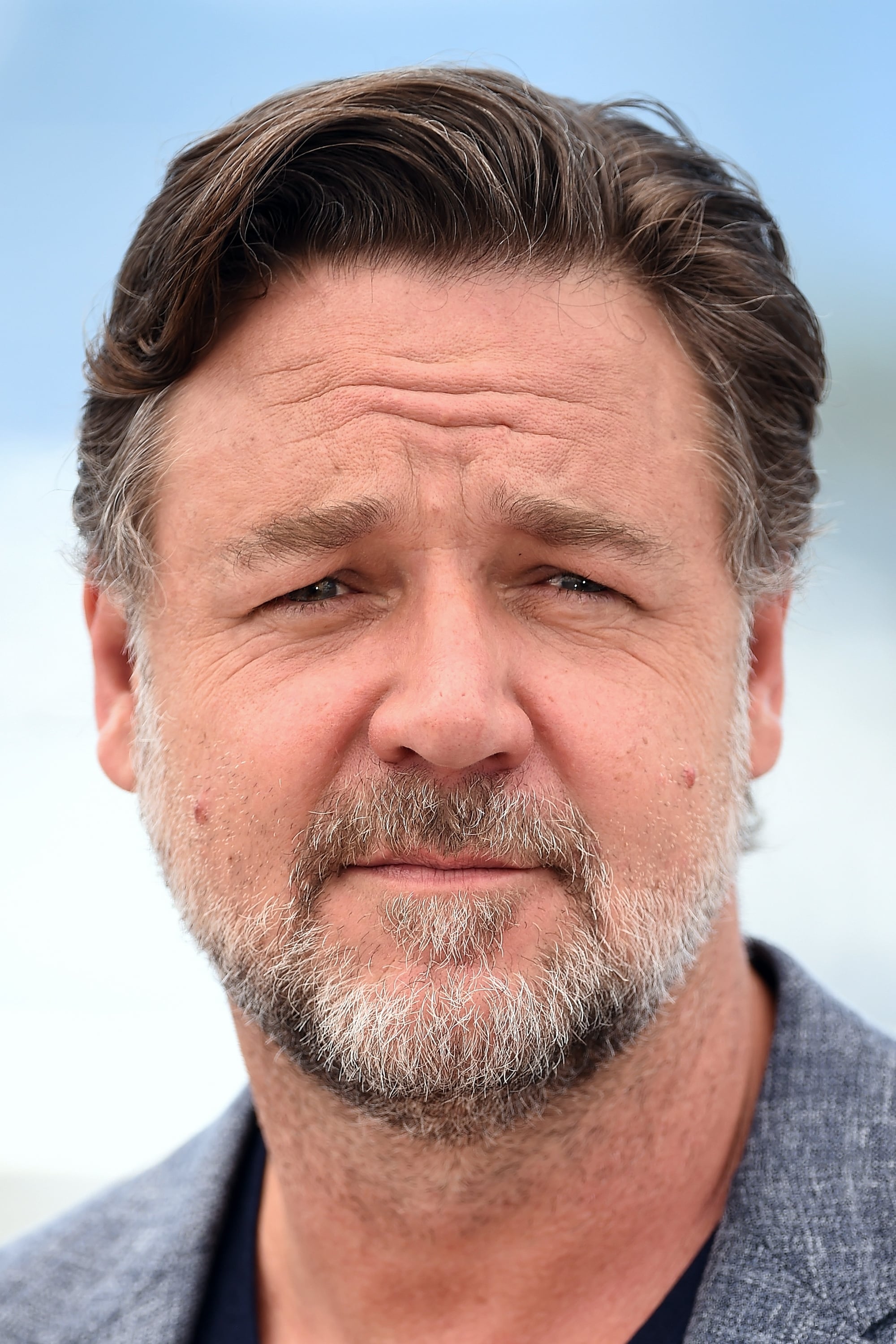

Russell Crowe

In 2005, Russell Crowe was involved in a public incident at a London hotel. He became angry when the phone in his room didn’t work and threw it at a staff member, leading to his arrest and an assault charge. Crowe later apologized for his actions and reached a private settlement. The incident caused damage to his reputation, and he worked to rebuild public trust after the widely reported confrontation.

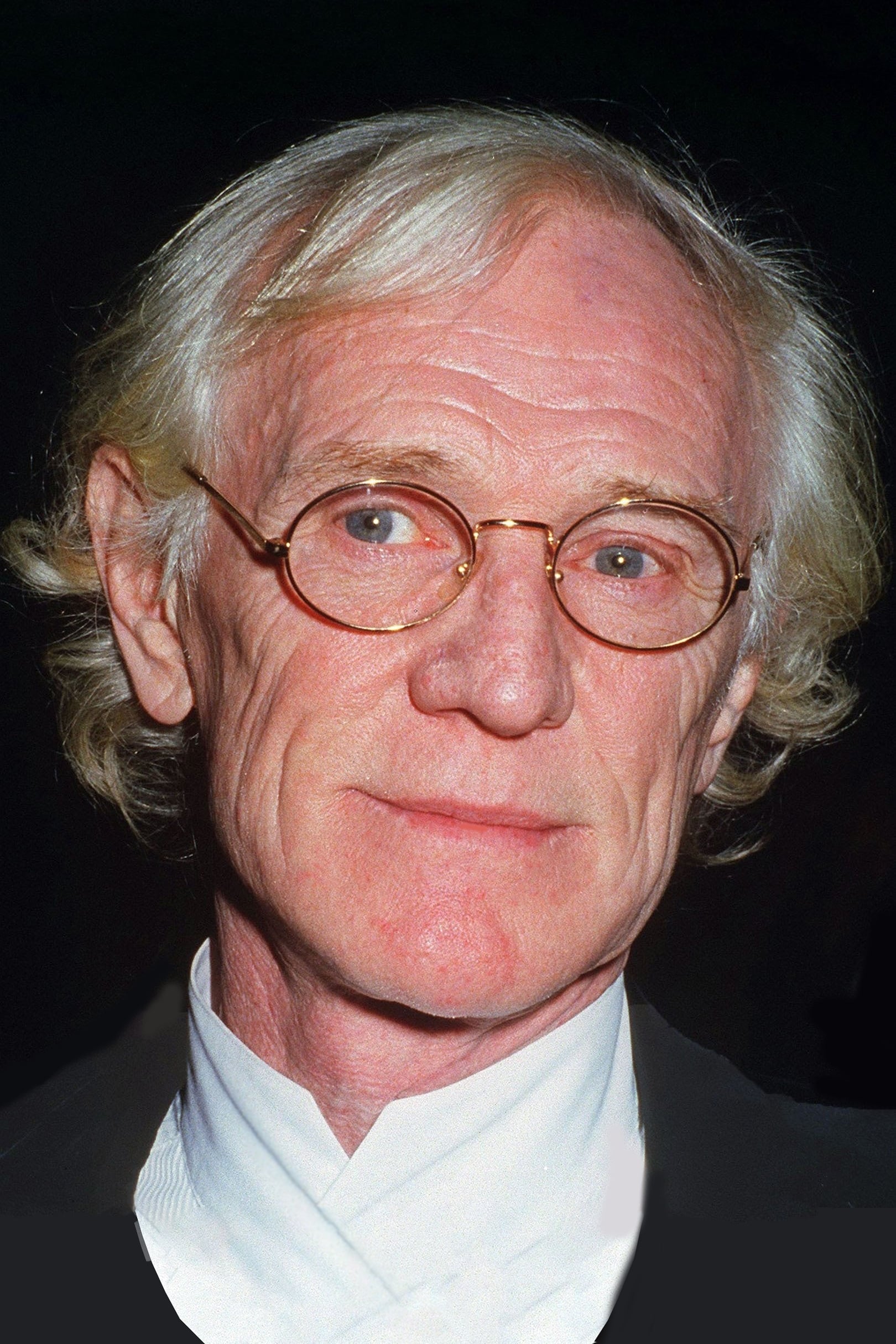

Richard Harris

Richard Harris, the original Dumbledore in the ‘Harry Potter’ films, was well-known for his boisterous behavior and the messes he made in hotels. He frequently entertained friends in expensive hotel suites, and his antics at places like The Savoy in London were both celebrated and dreaded by the staff. There are stories of him being carried out on a stretcher while proclaiming his brilliance, and his repair bills often matched the cost of his stay.

Oliver Reed

Oliver Reed gained a notorious reputation as a hotel troublemaker. The actor, best known for his role in ‘Gladiator,’ was famous for damaging hotel rooms – throwing furniture out windows and holding wild drinking competitions that left suites in disarray. Because of his unpredictable and often violent behavior when drunk, many hotels around the world banned him. Reed actually considered a wrecked hotel room a sign of a good time. He was known for this destructive behavior until his death in 1999.

Richard Burton

Richard Burton and Elizabeth Taylor were famous for their turbulent relationship and a habit of trashing hotel rooms. They often rented whole floors of hotels, only to have loud, destructive fights. Burton, especially when drinking, was known for breaking glasses and furniture. After one particularly bad argument, he reportedly spent thousands of dollars to fix a hotel suite. The actor, best known for his role in ‘Who’s Afraid of Virginia Woolf,’ led a restless life and frequently caused damage to property.

Peter O’Toole

Peter O’Toole, famous for films like ‘Lawrence of Arabia,’ was well-known as a hard drinker. He frequently woke up to find hotel rooms he’d stayed in were completely wrecked, with no recollection of what he’d done. This kind of wild, destructive behavior was common among many British actors of his generation. There are stories of O’Toole even trying to pay for a hotel room after he’d trashed it, and he often managed to avoid serious trouble thanks to his considerable charm.

Robert Downey Jr.

Robert Downey Jr. faced a difficult period with addiction in the 1990s, leading to several public incidents, including an arrest in 1996. He was found asleep in a neighbor’s hotel room after wandering in while under the influence, causing disruption at the hotel. This was part of a pattern of legal issues and time spent in rehab. Eventually, he overcame these challenges and achieved massive success as the star of ‘Iron Man’.

Mickey Rourke

In 1994, Mickey Rourke was arrested after causing significant damage – over $20,000 worth – to a room at New York’s Plaza Hotel. The incident happened during a late-night party that escalated, leaving the hotel suite completely wrecked with broken items and stained carpets. At the time, Rourke was known for his rebellious behavior. He’s since successfully revived his acting career, earning praise for roles in films like ‘The Wrestler’.

Ezra Miller

In recent years, Ezra Miller faced several incidents while staying at hotels in Hawaii. They were arrested following reports of disruptive behavior and harassment, with witnesses describing aggressive actions and property damage. These incidents resulted in restraining orders and considerable negative media attention. Miller later apologized publicly and began receiving treatment for mental health challenges.

Tom Sizemore

Tom Sizemore battled a long-term addiction that frequently led to destructive behavior, particularly in hotel rooms. The actor, known for his role in ‘Saving Private Ryan,’ was often the subject of police calls from hotels throughout Los Angeles. After periods of heavy drug use, his rooms were typically found damaged and in disarray. Throughout the 2000s, Sizemore faced repeated legal issues stemming from this behavior, which also made it difficult to sustain a consistent acting career.

Gary Busey

Gary Busey is famous for his unusual and sometimes chaotic behavior, particularly when staying in hotels. He’s been involved in multiple incidents where his energetic and unpredictable personality resulted in damage to property. Hotel staff have recounted instances of strange and aggressive outbursts from the actor, known for his role in ‘Lethal Weapon.’ Though these incidents haven’t always led to arrests, they’ve become well-known stories within Hollywood. Busey continues to be a distinctive and often controversial figure in the entertainment world.

John Belushi

John Belushi was a frequent guest at the Chateau Marmont hotel, and he was known for his wild and unpredictable behavior. The ‘Saturday Night Live’ star famously threw lively parties in his bungalow, often causing significant mess and disregarding the hotel’s rules about noise and respecting the property. He spent his final days at the Chateau Marmont, where he tragically died in 1982. Belushi is remembered for his incredible comedic talent and his reputation for a daring, unconventional lifestyle.

Chris Farley

Like his comedy hero John Belushi, Chris Farley lived a wild and self-destructive life. The star of ‘Tommy Boy’ was infamous for damaging hotel rooms while on tour, often breaking furniture and creating a mess as he battled addiction and weight issues. Though deeply loved by fans, Farley’s personal life mirrored the chaotic energy of his on-screen characters. He tragically died in 1997 after a period of living intensely on the road.

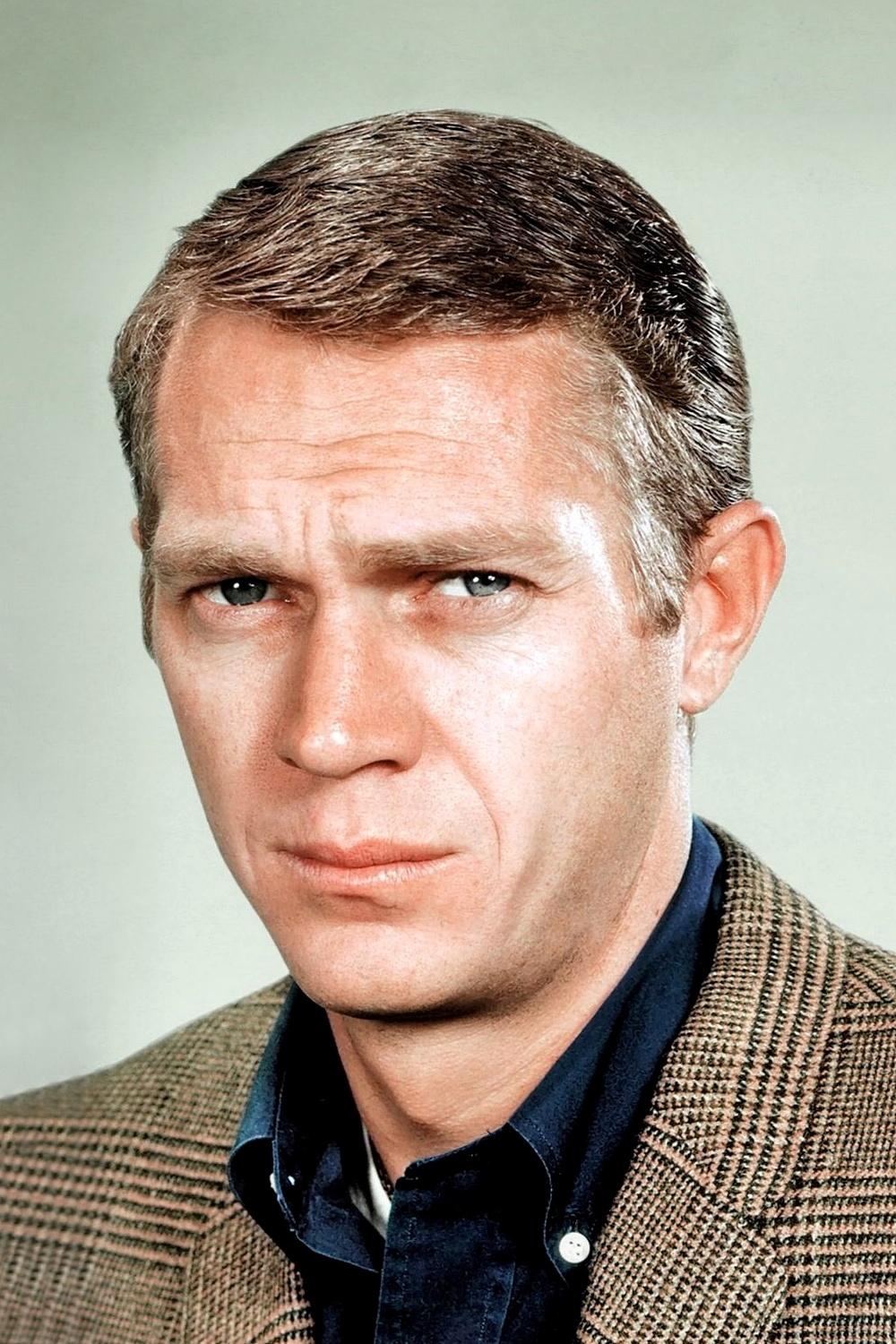

Steve McQueen

Steve McQueen was Hollywood’s definition of cool, but he had a reputation for causing trouble in hotels. Famous for movies like ‘Bullitt,’ he frequently threw parties that damaged property and annoyed other guests. He had a rebellious attitude and didn’t seem to value nice hotels, sometimes even racing motorcycles through the hallways! Despite all the chaos, his popularity as a leading man usually kept hotels from kicking him out.

Marlon Brando

Marlon Brando was famous for being a demanding and unpredictable hotel guest. He frequently left his rooms very messy, and had a habit of making strange requests. Stories circulated about his destructive behavior when things didn’t meet his expectations, including significant damage to a room at The Peninsula in Hong Kong. While a brilliant actor, Brando’s intense personality and disregard for rules often caused problems both during filming and in his personal life.

Errol Flynn

Errol Flynn, the star of ‘The Adventures of Robin Hood,’ was Hollywood’s original wild child. He was known for his hard-partying lifestyle, spending much of his time in hotels and clubs. His legendary drinking and parties often resulted in hefty bills for hotels throughout Europe and America, due to broken items and damaged furniture. Flynn’s pursuit of pleasure ultimately harmed his health and career, and he’s still the benchmark for celebrity bad behavior in hotels today.

John Barrymore

John Barrymore came from a famous acting family, but struggled with alcoholism and a tendency to destroy property. The celebrated actor was notorious for his angry outbursts, often breaking mirrors and throwing things in hotel rooms, either in a rage or while intoxicated. Despite frequently staying in luxurious hotels, his behavior often led to him being asked to leave. He’s remembered as an incredibly talented performer whose life was ultimately marked by self-destructive habits.

Kiefer Sutherland

In 2005, Kiefer Sutherland famously got into trouble with a Christmas tree at a London hotel. Video footage showed him wrestling with the tree in the hotel lobby while intoxicated. He also damaged his hotel room and behaved disruptively, which became an international news story. Sutherland later joked about the incident, but it highlighted a period of more rebellious behavior. Since then, he’s concentrated on his work as an actor and musician, with fewer public mishaps.

Randy Quaid

In 2010, actor Randy Quaid and his wife were arrested for illegally living in and damaging a guest house they had previously owned. They caused several thousand dollars worth of damage before being discovered by the new owners, who reported a break-in and destruction of property. This was just one of a series of legal issues for Quaid, ultimately leading him to apply for asylum in Canada. The incident significantly changed his public perception, shifting him from a beloved comedic actor to a more troubled public figure.

Michael Madsen

Michael Madsen, known for his role in ‘Reservoir Dogs,’ has a history of arrests, often happening in hotels. One incident in Malibu resulted in damage to hotel property after an argument. He’s faced personal challenges that have sometimes led to public altercations and legal problems. While often portraying tough characters in movies, Madsen’s real life has sometimes reflected that same intensity. Despite these issues, he continues to work on independent films.

Val Kilmer

During the early 1990s filming of ‘The Doors,’ Val Kilmer was known as a challenging actor to work with. He fully immersed himself in the role of Jim Morrison, even living like a rock star off-camera – which included damaging hotel rooms and remaining in character constantly. This behavior created a lot of tension for both the film crew and hotel staff. Since then, Kilmer has gained recognition for his creative work and his public struggle with throat cancer.

Sacha Baron Cohen

Sacha Baron Cohen is well-known for a chaotic incident during the filming of ‘Bruno’. While playing his over-the-top fashionista character, he deliberately trashed a hotel room to film the staff’s reactions as part of a prank. The room was left completely messy and damaged. Hotel staff were initially shocked and upset, not realizing it was all for the movie. This event highlighted Cohen’s dedication to pushing boundaries for comedic effect.

Woody Harrelson

Woody Harrelson had a strange experience in London that began in a taxi and finished at his hotel. After a disagreement with the driver, he apparently damaged a door and some property. Police chased him, and he was eventually arrested when they caught up to him at his hotel. Harrelson has previously discussed his issues with anger and how he’s been working towards a calmer life. Ultimately, he resolved the situation and wasn’t seriously charged.

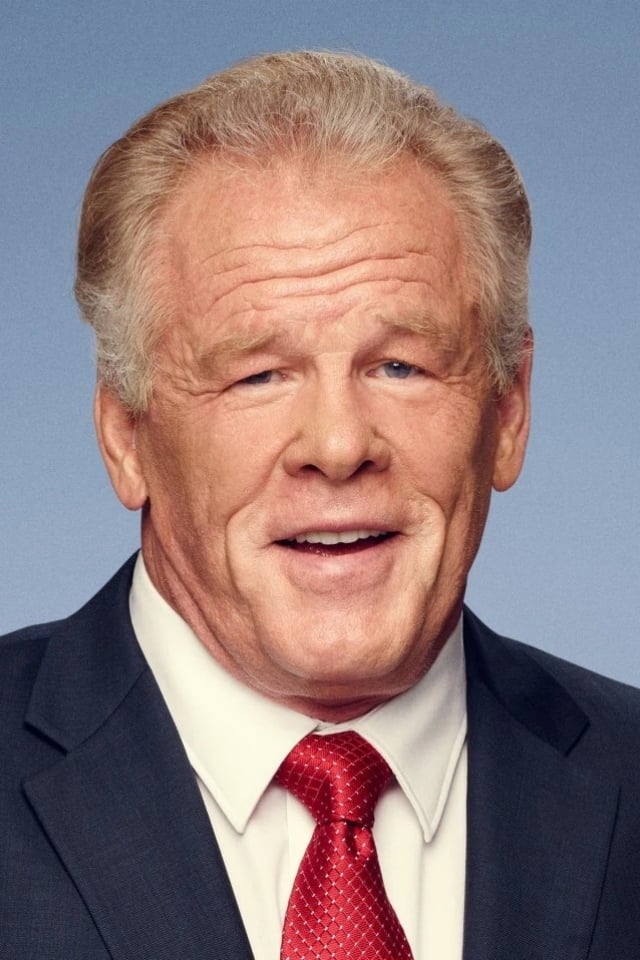

Nick Nolte

I remember being shocked by the photos of Nick Nolte back in the late 90s. He just seemed so… lost. There were stories about his hotel rooms being a mess, a real sign of his struggles with addiction. That mugshot, with him in a Hawaiian shirt, really stuck with me – it just felt like a glimpse into a difficult time. It’s amazing to see how far he’s come, though. He’s really turned things around and is still earning praise for his work. Despite everything, he’s earned a lot of respect in Hollywood, and I admire his resilience.

Rip Torn

Rip Torn was a remarkably talented actor, but also known for his fiery temper and destructive outbursts. He frequently got into trouble, including an arrest in 2010 for breaking into a bank while drunk, and had a pattern of incidents in hotels. When angered or intoxicated, Torn was prone to fights and damaging property. Though he won accolades for his role in ‘The Larry Sanders Show,’ his personal behavior was often unpredictable and chaotic. He was a powerful personality who didn’t conform to typical social norms.

David Hasselhoff

A video of David Hasselhoff, the star of ‘Baywatch,’ looking unwell on a hotel floor in London became a viral sensation. It later emerged that he was battling alcoholism and had damaged his hotel room. The incident served as a turning point for Hasselhoff, prompting him to seek help and address his personal struggles. He continues to be a well-known figure in television and entertainment.

George C. Scott

George C. Scott was a powerful and talented actor, but also known for his quick temper. He famously broke a hotel mirror after a performance he felt wasn’t good enough, showing how intensely he felt about failure and how easily frustrated he became. While he was the first actor to decline an Oscar, his behavior off-camera was just as well-known. He created a fantastic collection of work, but also gained a reputation for being challenging to work with.

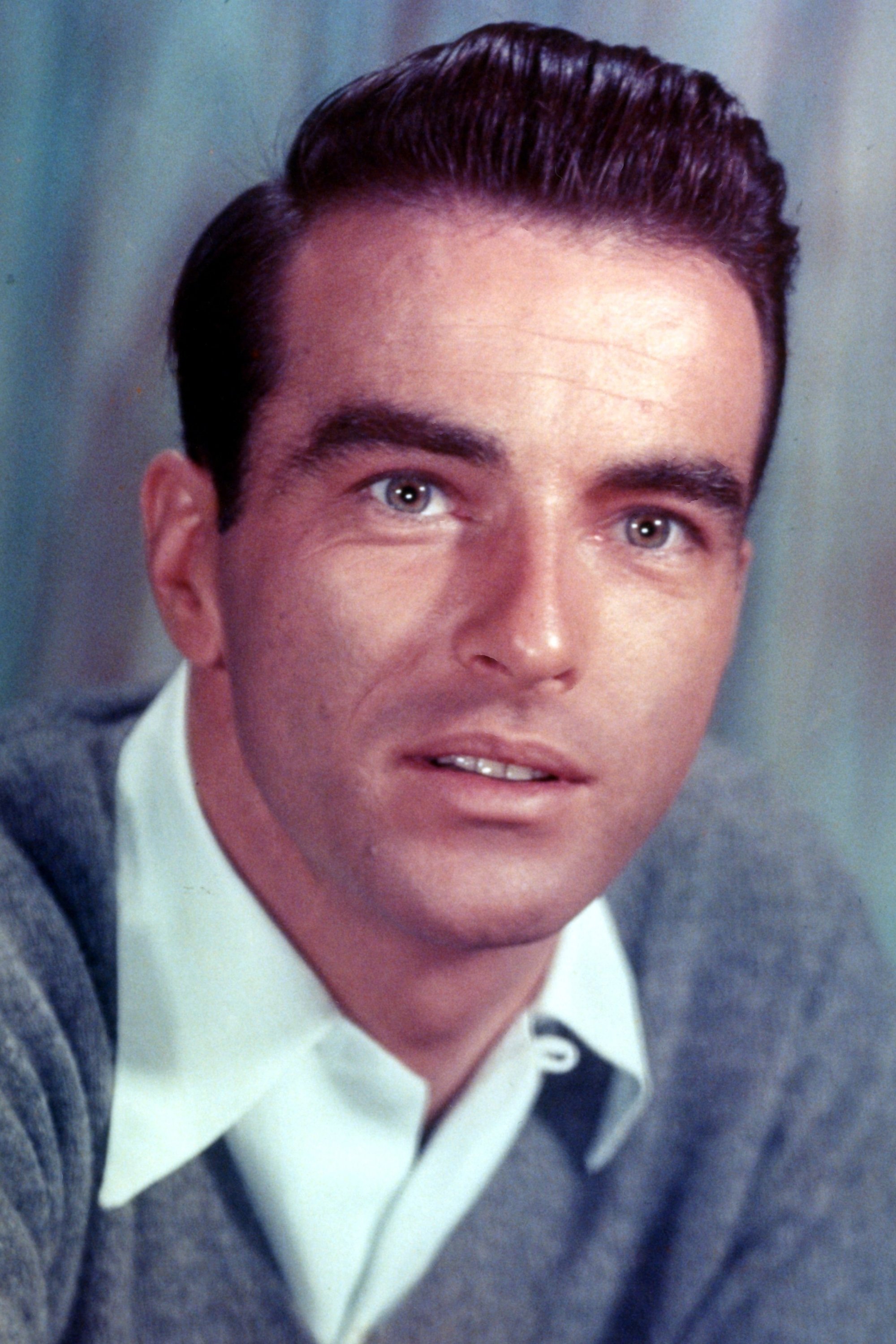

Montgomery Clift

Montgomery Clift was a remarkably handsome and gifted actor, but his life was sadly derailed by a car accident. Afterward, he struggled with depression and substance use, which led to unpredictable behavior, including damaging hotel rooms. Known for his role in ‘From Here to Eternity,’ he would often spend hours pacing and breaking things when frustrated. His health deteriorated quickly, worrying those close to him. Though he died at a young age, Clift had a lasting impact on a generation of actors who embraced the method acting approach.

Klaus Kinski

Klaus Kinski was famously unpredictable and had a reputation for explosive outbursts. He was known for his destructive behavior, often damaging hotel rooms if he was unhappy with the service or felt disrespected. His working relationship with director Werner Herzog was particularly turbulent, marked by arguments and damaged property. Despite his troubled nature, Kinski was a remarkably talented actor who seemed to constantly struggle with the world around him.

Mickey Rooney

Mickey Rooney was a famous actor from a very young age, enjoying a decades-long career. As a young man, he was known for being a bit of a wild child and often caused damage in high-end hotels. He lived a fast-paced life filled with parties and fast cars, which frequently resulted in costly repairs. Rooney was married multiple times, and his personal life was often featured in gossip magazines. Despite being short in stature, he had a larger-than-life personality and a knack for unintentionally breaking things.

Peter Sellers

Peter Sellers was a remarkably funny actor, but he struggled with big shifts in his emotions and a lack of self-confidence. He was famous for his unpredictable behavior, sometimes even damaging hotel rooms when he was unhappy with a film or his personal life. There’s a story about him completely wrecking a hotel suite simply because he didn’t like the curtains! This made him challenging to work with for his family and colleagues. Despite his difficult personality, Sellers remained a popular and successful actor throughout his career, though he gained a reputation for being a troublesome hotel guest.

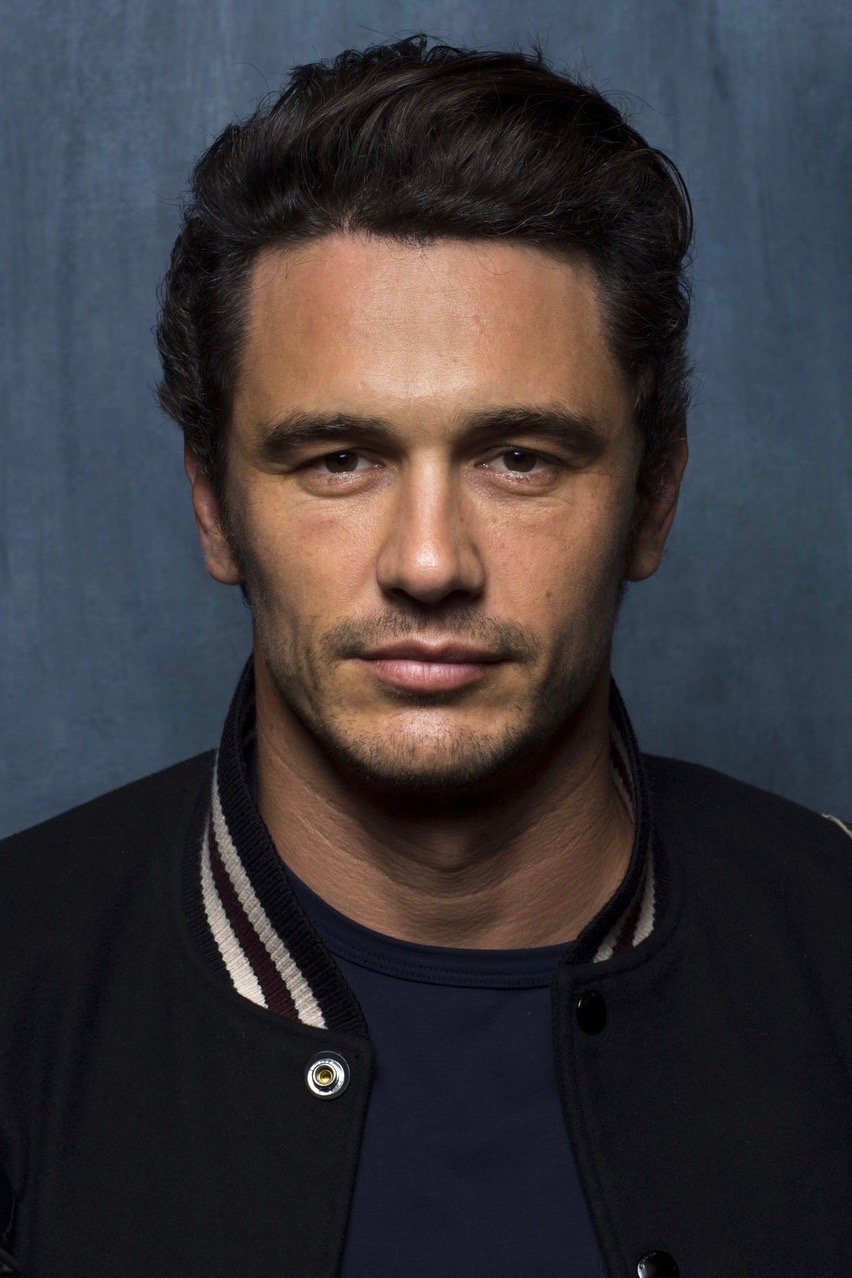

James Franco

James Franco was temporarily banned from the Chateau Marmont Hotel after an incident involving property damage during a stay. He was a frequent guest known for enjoying the hotel’s lively atmosphere, and this incident added to a pattern of controversial behavior throughout his career, both professionally and personally. Despite the controversies, Franco remains a busy and often debated figure in both the film industry and academic circles.

Benicio Del Toro

Benicio Del Toro is known for a somewhat rebellious reputation, and stories about his antics at the Chateau Marmont hotel are common. One popular tale claims he and an actress caused significant damage to a room during a lively night. While these stories might be embellished, Del Toro is generally seen as a free-spirited actor who embraces the Hollywood scene. The Academy Award winner is highly regarded for his powerful performances and continues to be a mysterious and captivating figure in film.

Jude Law

In the early 2000s, Jude Law was frequently in the British tabloids due to his lively social life. There were occasional reports of messy hotel rooms following nights out with friends, and paparazzi often hounded him, making his hotel stays stressful. Though he was never arrested for damaging property, he gained a reputation as a fun-loving partygoer. Since then, Law has taken on more serious acting roles and is now a highly respected actor.

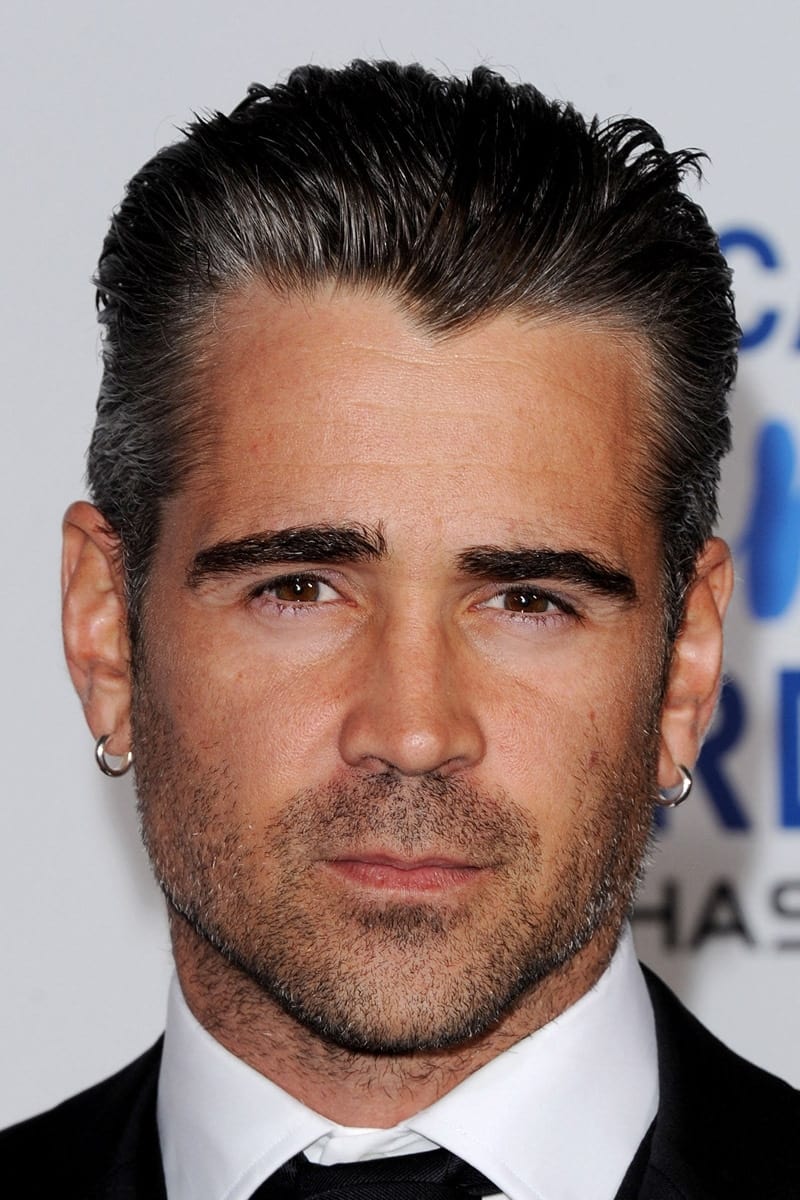

Colin Farrell

Colin Farrell was known as a rebellious figure in the early 2000s, and his behavior often led to hefty hotel bills. He gained a reputation for heavy drinking and damaging hotel rooms worldwide, once paying a large sum to cover the costs of a completely destroyed suite. Farrell later chose to get sober and has since become a highly respected and successful actor, frequently sharing his past experiences as a warning to up-and-coming stars.

Ewan McGregor

After finding fame with ‘Trainspotting,’ Ewan McGregor had a bit of a rebellious streak. During film festivals and premieres, he was known for being boisterous and causing some trouble in hotels. Though he wasn’t as destructive as some other young British actors at the time, he definitely played a part in their wild reputation. Now a global star thanks to roles in ‘Star Wars’ and other big franchises, McGregor is recognized for being a professional and his passion for travel.

Joaquin Phoenix

Joaquin Phoenix famously staged an elaborate hoax during the making of ‘I’m Still Here’. He acted as if he was deliberately ruining his acting career and behaving erratically, even pretending to become a rapper. He appeared unkempt and was said to have caused damage in public and private places, leading many to believe his behavior was genuine. It was later revealed to be a mockumentary, and Phoenix is now widely considered one of the best actors of his generation.

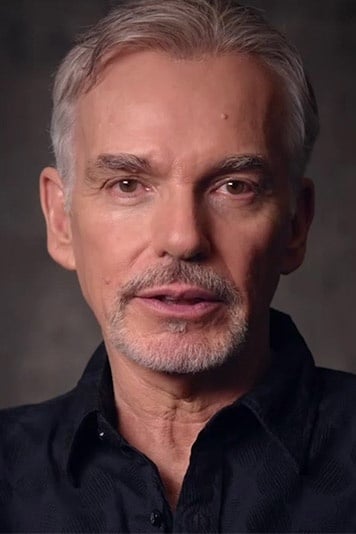

Billy Bob Thornton

Billy Bob Thornton is famous for being a bit unusual and having very particular needs when he stays in hotels. Stories say he’s sometimes left hotel rooms messy, either when his requests weren’t met or just because he was feeling a certain way. The actor, best known for ‘Sling Blade,’ has discussed his fears and how they make traveling difficult. He’s not known for deliberately damaging property, but he does have a reputation for being a demanding and untidy hotel guest. Despite this, Thornton is still a well-regarded actor and musician.

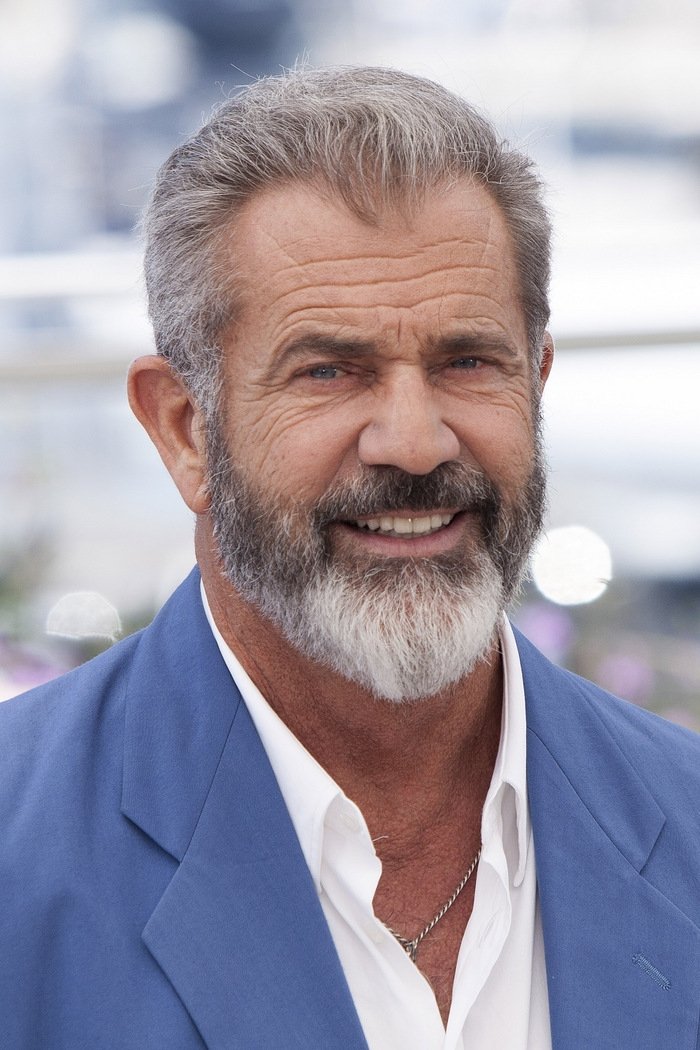

Mel Gibson

Mel Gibson is known for several public displays of anger, often happening at or near hotels. He has a reputation for a quick temper, which has sometimes led to damaged property and arguments with hotel staff. These incidents have caused considerable public criticism, and Gibson has worked for years to repair his career and image after multiple arrests and the release of damaging recordings. Despite the ongoing controversies, he continues to be a successful and influential filmmaker.

James Woods

James Woods is known for being a high-energy and sometimes difficult guest at hotels. He’s reportedly caused problems and damaged property during stays in places like Las Vegas. The actor, famous for his role in ‘Casino,’ is known for his strong opinions, which can sometimes lead to disagreements. He’s also been involved in legal issues related to his behavior and what he posts online. Even though he doesn’t work as often now, he remains a well-known face in Hollywood.

Sean Penn

Sean Penn used to be known for his confrontational behavior, especially with the media. When he was younger, he frequently had altercations in hotels, even damaging cameras and getting into physical fights. There were also reports of him destroying hotel rooms during difficult times. While he’s now dedicated to humanitarian work, he still has a reputation for being quick-tempered. Despite this fiery past, Penn is widely regarded as one of the most talented actors of his generation.

Alec Baldwin

Alec Baldwin has a long-standing pattern of public altercations, often happening in hotels. Throughout his career, he’s been known to get into heated arguments and occasionally cause minor damage. He frequently clashes with the paparazzi, who often invade his personal space. These confrontations have sometimes resulted in him being asked to leave planes or hotels. Despite frequent tabloid coverage, Baldwin continues to be a prominent actor in both television and film.

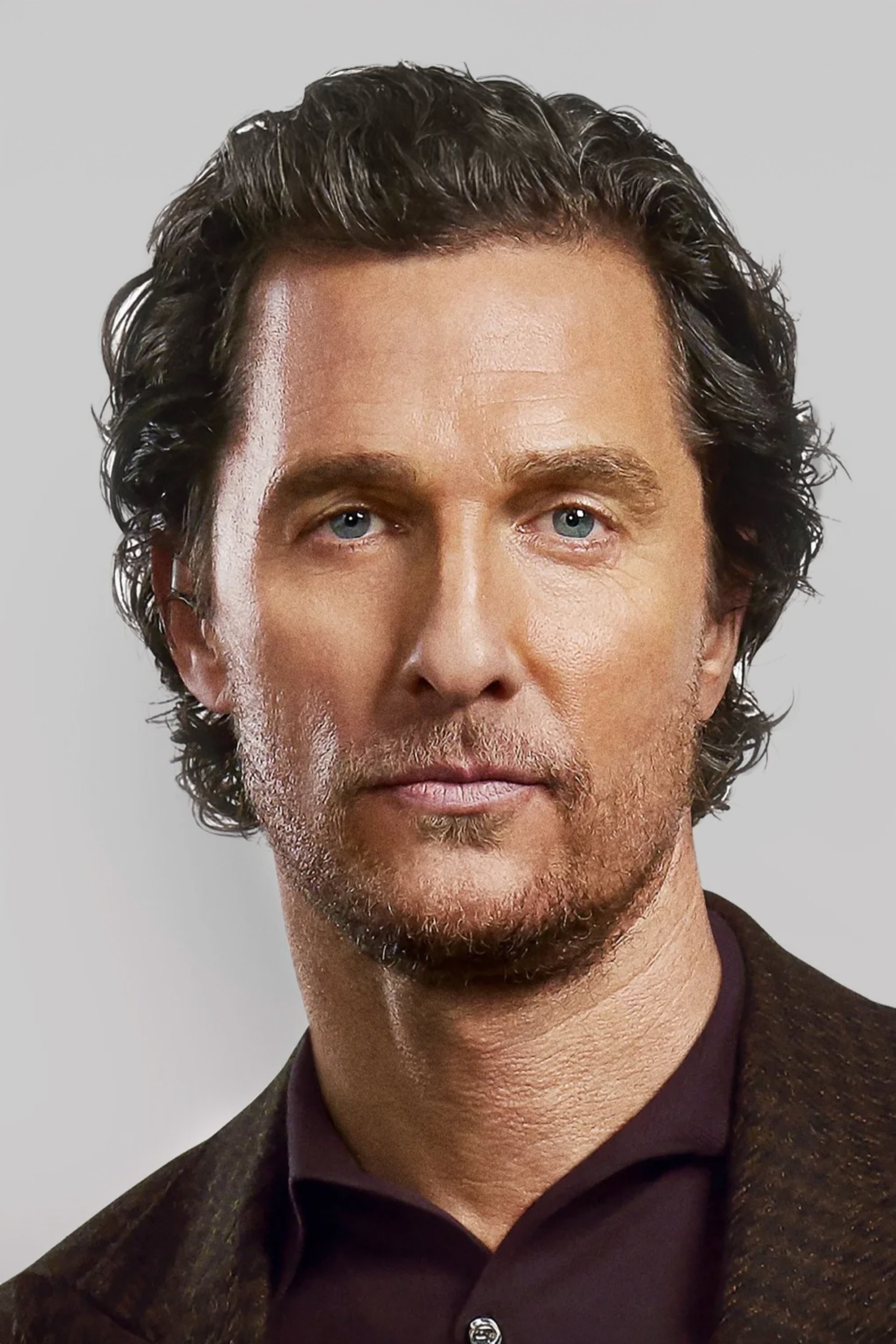

Matthew McConaughey

In 1999, Matthew McConaughey gained notoriety when he was arrested for playing the bongos naked in his home, which was set up like a hotel for visitors. Though it wasn’t a public hotel, the incident reinforced his image as someone who enjoyed a wild lifestyle. He faced charges of resisting arrest and possessing drug-related items. Since then, McConaughey has successfully transformed his career, becoming known as a respected dramatic actor and inspirational speaker. He now often jokes about the infamous arrest.

Peter Fonda

Peter Fonda was a prominent voice in the counterculture movement and lived his life accordingly. During his peak fame after ‘Easy Rider,’ he became known for deliberately trashing hotel rooms as a form of protest against mainstream society. He and his friends would often leave luxury hotel suites in disarray, filled with broken items and graffiti, seeing it as a way to rebel against conventional expectations. He continued to be a well-regarded actor and activist until his passing in 2019.

Dennis Hopper

Dennis Hopper had a reputation as a challenging actor, largely due to struggles with drug use and a volatile temper. For years, he was known for destructive behavior, including damaging hotel rooms around the globe. At his worst, fueled by paranoia and intoxication, he would reportedly carry weapons and break furniture. However, he later overcame his addiction and experienced a significant career comeback in the 1980s with the film ‘Blue Velvet’. Today, he’s remembered as a groundbreaking artist who successfully navigated a difficult time in his life.

Jack Nicholson

During the 1970s and 80s, Jack Nicholson was famous for his wild behavior in Hollywood. The star of ‘The Shining’ threw incredible parties, often in hotel suites, that were known for causing damage. He was frequently seen with a golf club, and famously broke a car window with it during a road rage incident. Nicholson fully embraced life, and his hotel stays often included hefty charges for repairs and extra cleaning. As one of the most recognizable actors ever, his outrageous stories have become part of Hollywood lore.

Please share your thoughts on these infamous celebrity hotel incidents in the comments.

Read More

- Gold Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- Silver Rate Forecast

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Top 15 Insanely Popular Android Games

- EUR UAH PREDICTION

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2026-03-01 03:21