Hulu is adding a lot of new movies and shows this weekend, including both brand new releases and beloved classics. Subscribers can look forward to a wide range of genres – from exciting international thrillers and funny comedies to intense survival stories and highly-anticipated dramas coming out in 2025. There’s something for everyone to enjoy, offering plenty of high-quality entertainment options for a great weekend at home.

‘Tornado’ (2025)

The daughter of a traditional Japanese puppet master gets caught up in a dangerous criminal world when her performances unexpectedly intersect with a powerful gang. Led by the ruthless Sugarman and his son, known as Little Sugar, the syndicate pulls her into a web of danger. She must then find her way through this treacherous underworld to protect herself. The film blends the beauty of classic puppet shows with the excitement and tension of a modern crime thriller.

‘Kiss of the Spider Woman’ (2025)

This movie, set in an Argentine prison in the 1980s, tells the story of an unlikely connection between a revolutionary activist and a gay window dresser who become cellmates. Starring Jennifer Lopez and Diego Luna, the film examines how they use imagination to cope with their difficult circumstances, blurring the lines between what’s real and what isn’t. It’s a fresh take on a well-known story that’s been previously presented in a novel and on stage.

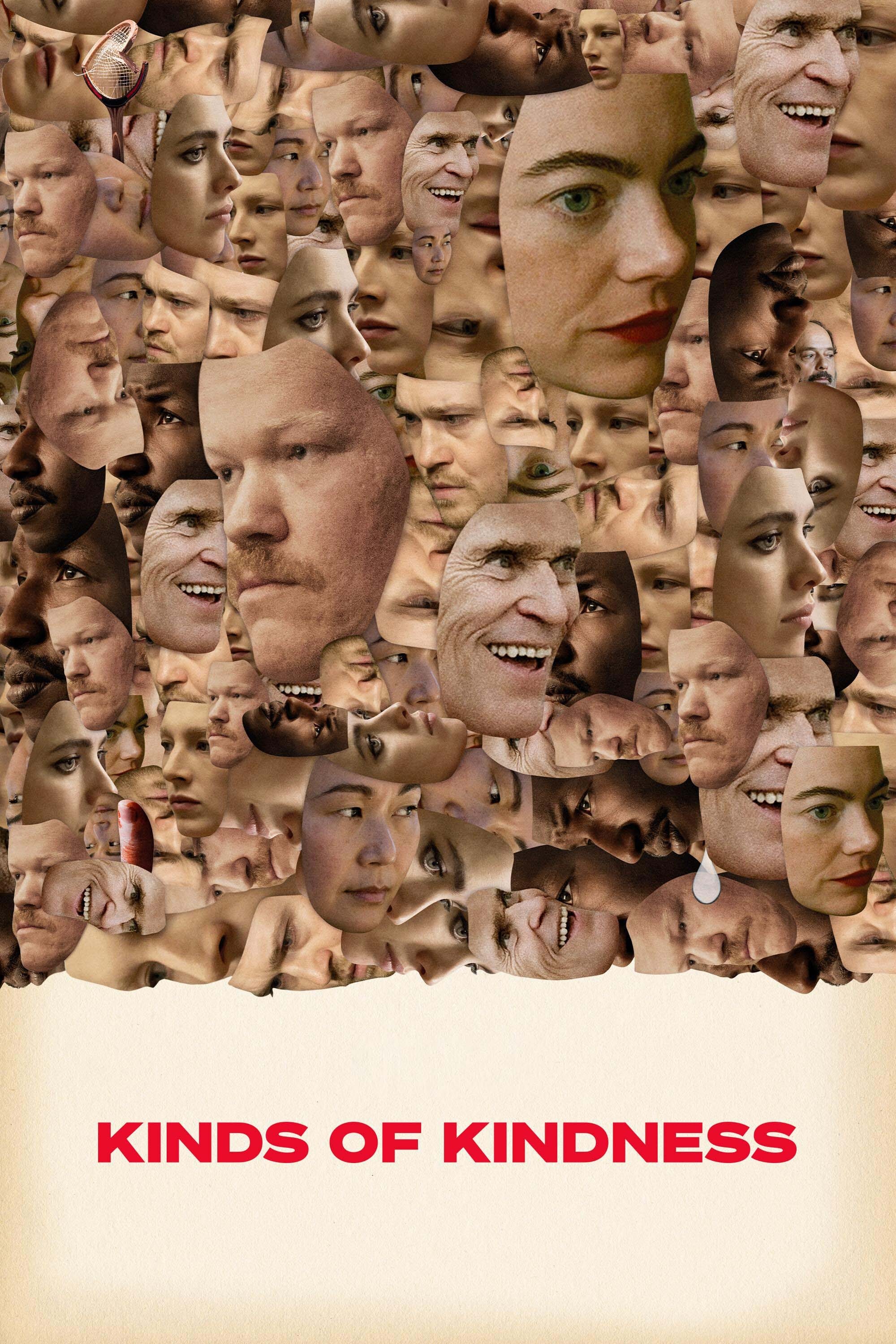

‘Kinds of Kindness’ (2024)

Yorgos Lanthimos directs this unusual film, which tells three connected stories. It looks at complicated relationships, who has power, and how far people will go with their beliefs, all set in today’s world. Emma Stone is part of a group of actors who play different roles in each of the three parts. The film is strange and funny, and it makes you think deeply about the characters and what’s happening.

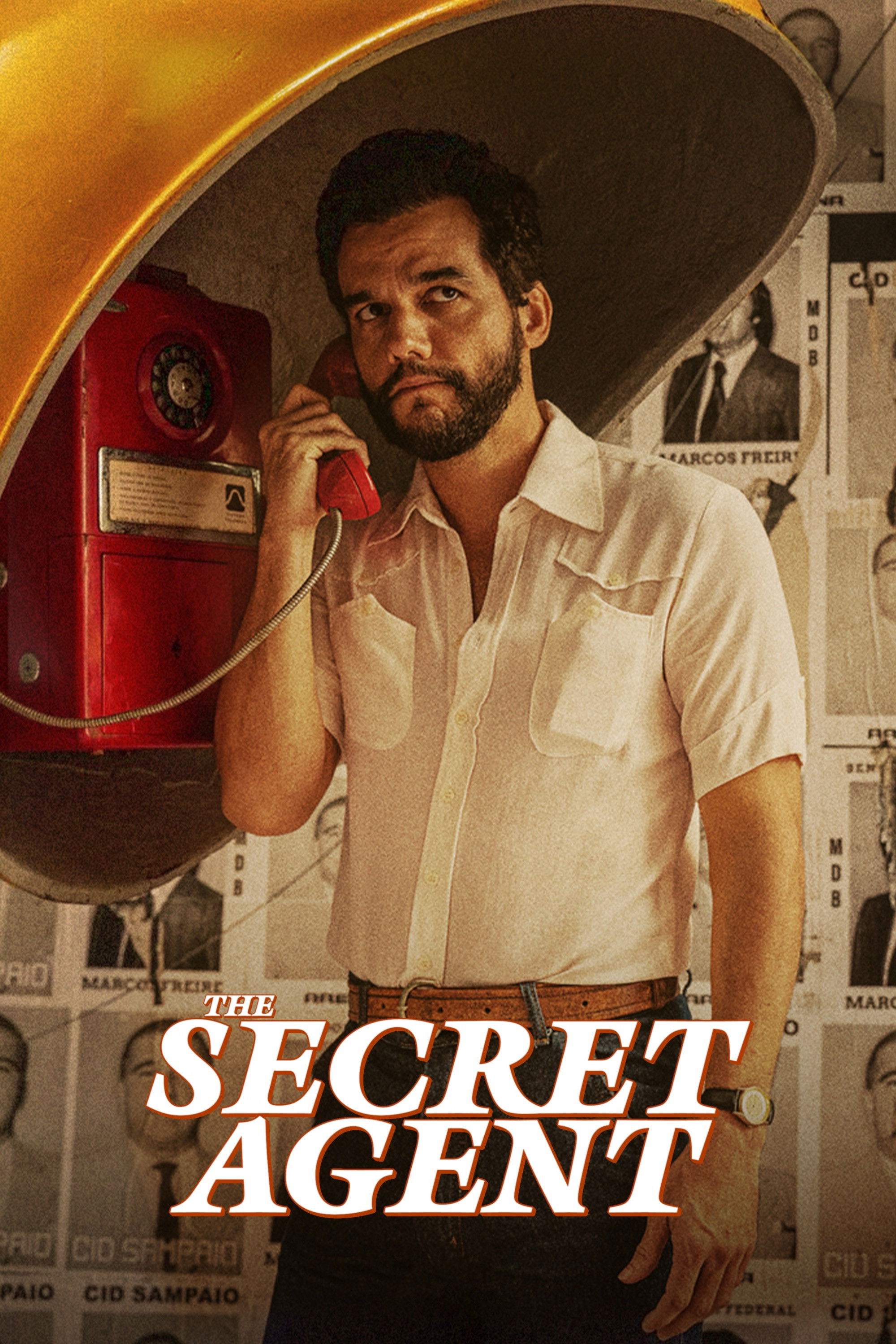

‘The Secret Agent’ (2025)

Directed by Kleber Mendonça Filho, this gripping thriller is set against the backdrop of Brazil’s military dictatorship. It follows Armando, a former professor played by Wagner Moura, as he tries to escape the government’s crackdown while fighting against the oppressive regime. The film powerfully portrays the personal sacrifices people made when resisting the government during this turbulent time.

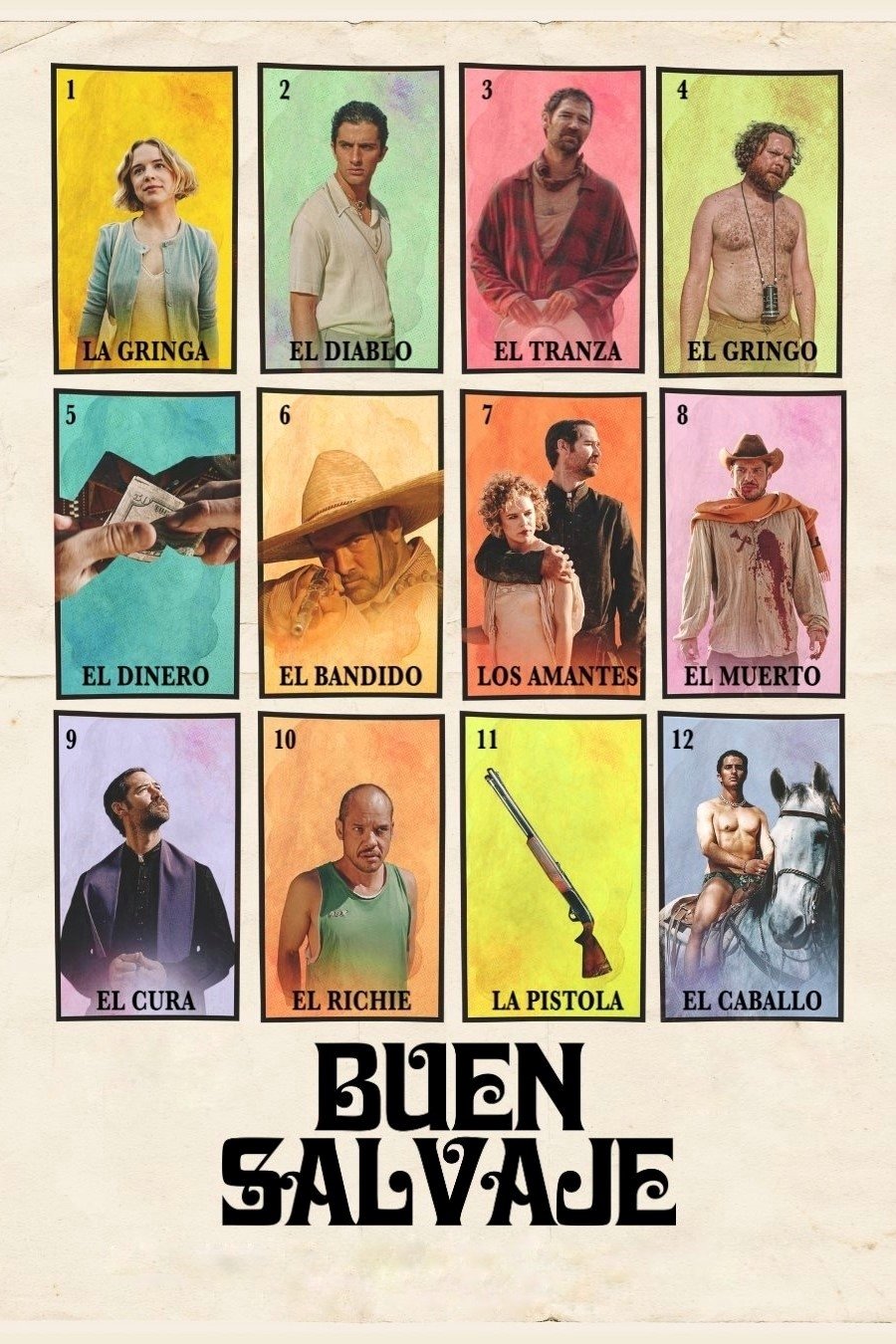

‘Good Savage’ (2025)

This darkly funny Mexican film tells the story of an American artist couple who move to a small town in Mexico hoping to find inspiration for their work. But as they get to know the quirky locals and grapple with their own personal issues, their creative dreams begin to fall apart. The film explores the challenges of cultural differences and questions how meaningful artistic goals really are. It’s directed by Santiago Mohar Volkow and stars Manuel Garcia-Rulfo and Naian González Norvid.

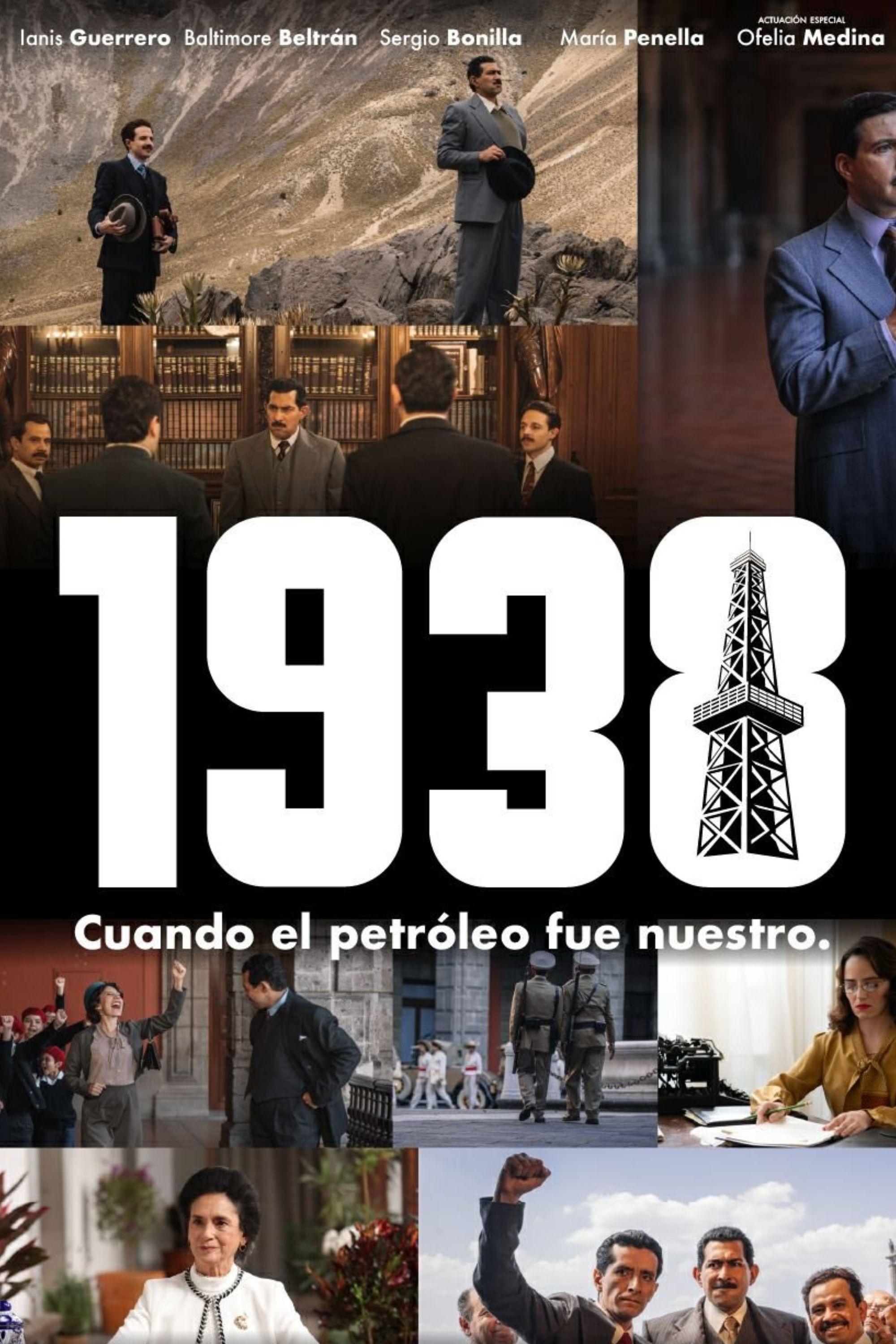

‘1938: When Mexico Recovered Its Oil’ (2025)

This historical drama, directed by Sergio Olhovich, tells the story of Lázaro Cárdenas and his presidency, a crucial period for Mexico. The film centers on his controversial decision to take control of the oil industry for the benefit of ordinary Mexicans. Ianis Guerrero plays Cárdenas as he faces strong resistance from large foreign companies trying to safeguard their profits. It’s a dramatic retelling of a key moment that shaped Mexico’s economy and politics.

‘It Was Just an Accident’ (2025)

This darkly funny and suspenseful thriller follows the wild consequences of a simple mistake. Produced by Jafar Panahi Productions, the film creates a gripping sense of tension as it explores the ridiculousness of the situation. What starts as a small incident quickly escalates, forcing the characters into increasingly dangerous and morally challenging circumstances. The story shows just how easily things can fall apart when unexpected accidents happen.

‘The Revenant’ (2015)

This thrilling historical adventure takes place in the 1820s and tells the story of Hugh Glass, a frontiersman who is attacked by a bear and abandoned by his fellow travelers. Fueled by a burning need for revenge, Glass embarks on a dangerous journey across a harsh, frozen landscape to find those who left him to die. The film, directed by Alejandro G. Iñárritu, is beautifully shot with realistic lighting and creates a powerfully immersive experience. Leonardo DiCaprio gives a physically demanding performance, perfectly portraying the incredible strength and resilience needed to survive in the American wilderness.

‘Birdman or (The Unexpected Virtue of Ignorance)’ (2014)

Birdman, starring Michael Keaton, tells the story of Riggan Thomson, a former movie star famous for playing a superhero, who’s trying to revive his career with a Broadway play. The film follows his desperate and often chaotic attempts to create a meaningful production, all while struggling with his own insecurities and a harsh inner critic. It’s filmed in a way that makes it look like one continuous shot, capturing the intense and confined atmosphere of the theater. The film won multiple Academy Awards, including Best Picture.

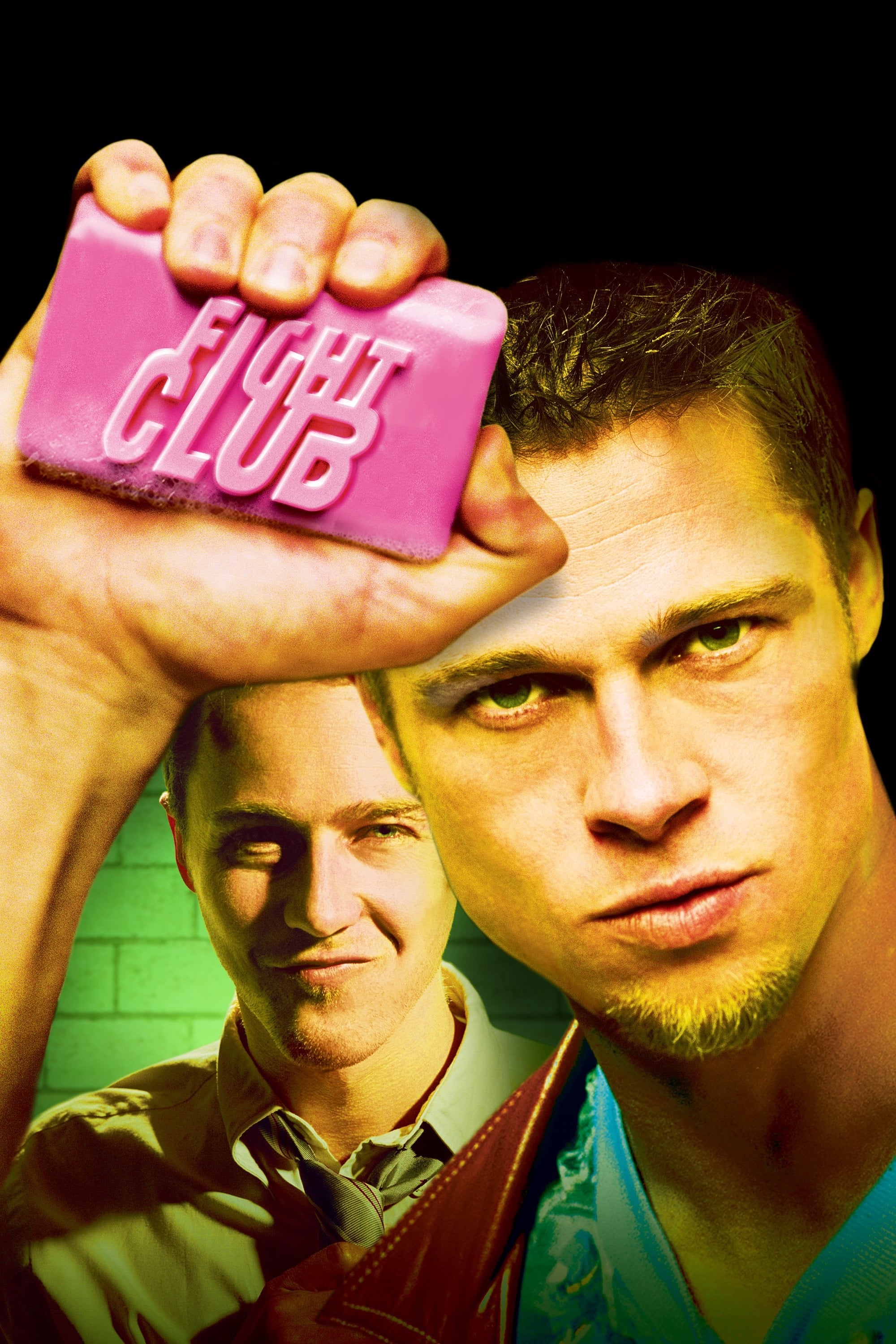

‘Fight Club’ (1999)

A man struggling with insomnia and a boring job meets Tyler Durden, a captivating soap salesman. They start a secret club where men fight each other for fun, hoping to feel more alive. This club grows into a larger, more extreme group called Project Mayhem, which actively rebels against consumer culture. Directed by David Fincher, the film has become a beloved classic known for its exploration of what it means to be a man, the dangers of buying too much stuff, and feeling disconnected from society.

Tell us which of these new Hulu additions you are most excited to stream in the comments.

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2026-02-27 21:45