Celebrity hotel mishaps have a long and wild history, often involving damaged property and outrageous behavior. While most stars enjoy the perks of luxury hotels, some have become infamous for destroying furniture and causing significant damage. These incidents usually lead to hefty repair costs and lifetime bans from top hotels. From musicians to actors, many famous faces have turned their hotel rooms into chaotic messes. This compilation highlights some of the most well-known cases of celebrities trashing hotel rooms over the years.

Johnny Depp

In 1994, Johnny Depp was arrested for trashing a suite at The Mark Hotel in New York City. He was staying with Kate Moss at the time, and police found him intoxicated amidst broken furniture and glass. Depp ultimately paid around $10,000 to cover the damages. The incident is still remembered as a famous example of a celebrity damaging a hotel room.

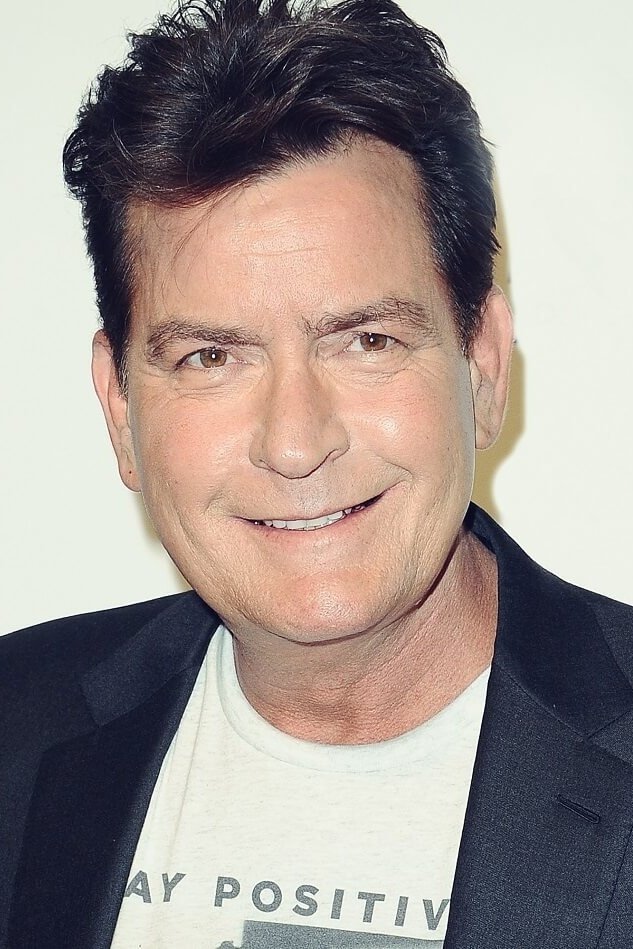

Charlie Sheen

I remember back in 2010 when the news broke about Charlie Sheen having a really rough night at The Plaza Hotel in New York. Apparently, things got out of hand in his suite – security had to call the police because of all the yelling and furniture being broken. When the police arrived, they found him really upset and the room was a mess. He ended up needing to go to the hospital to get checked out. It was a costly night for him, too, because he had to pay a lot to fix all the damage to the room.

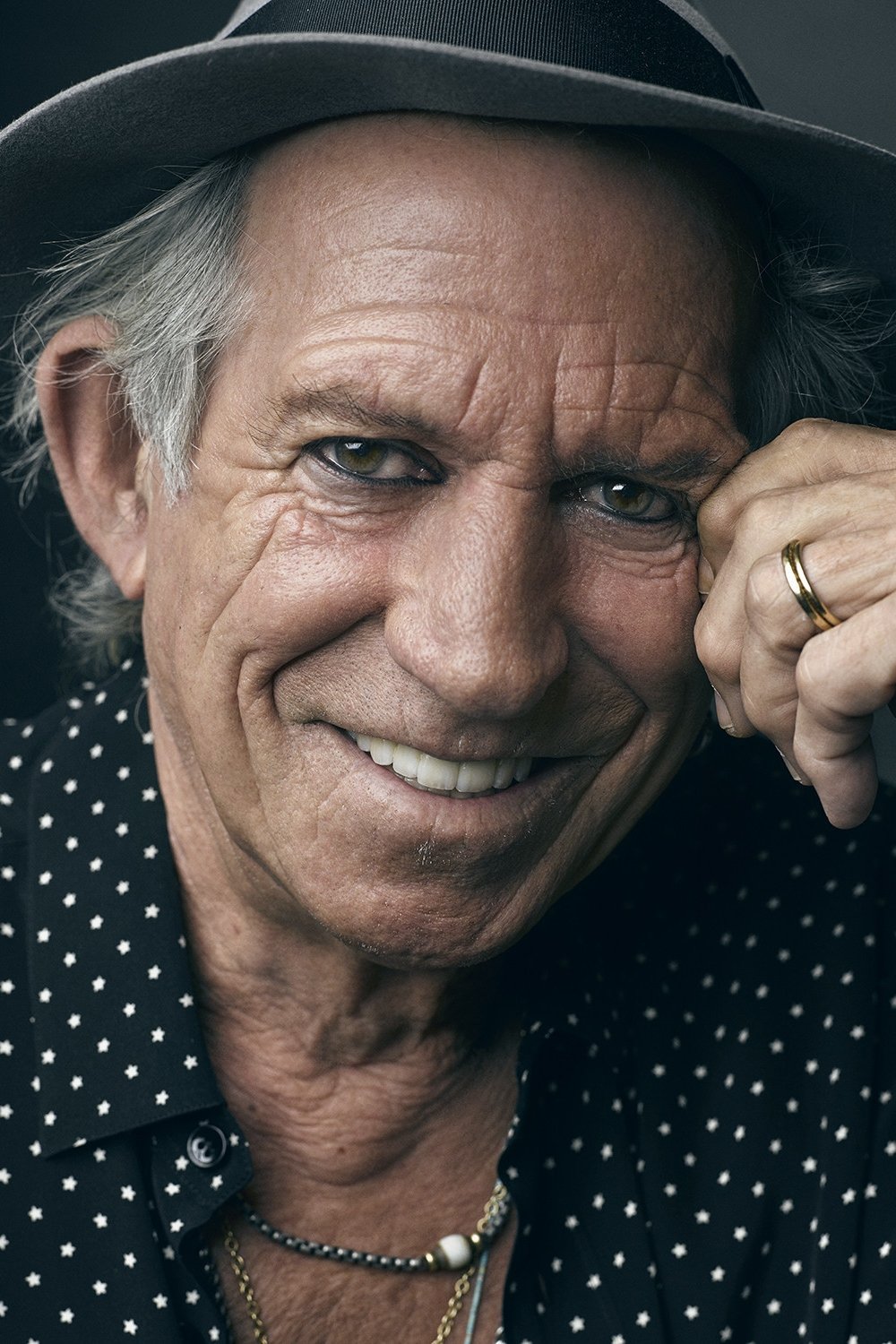

Keith Moon

Keith Moon, the drummer for The Who, became notorious for his wild behavior on tour. He was famous for causing significant damage to hotel rooms, often using explosives like cherry bombs to destroy bathrooms and furniture. There are stories of him throwing TVs out of windows and even driving a car into a hotel pool during a party. His antics became so costly that many hotel chains prohibited The Who from staying at their properties. Moon didn’t see this destruction as malicious; he considered it a form of playful entertainment.

Keith Richards

I remember hearing stories about Keith Richards and his wild side – the most famous one is about him throwing a TV out of a hotel window at the Continental Hyatt House in West Hollywood! It was even filmed and really became the image of rock and roll excess back in the 70s. Apparently, he and the Rolling Stones were notorious for causing trouble in hotels all over the world when they were touring. He’d often trash rooms, leaving everything broken and stained. It got so bad that over the years, he was actually banned for life from a lot of big hotel chains!

Courtney Love

In 2007, Courtney Love was prohibited from returning to London’s Claridge’s hotel after severely damaging her room. Reports say she left the suite extremely messy and accidentally started a small fire, leaving significant stains on the furniture and walls. Throughout her career as a musician and actress, Love has had similar incidents involving damage to hotel properties, often coinciding with personal struggles or demanding tour schedules.

Lindsay Lohan

In 2007, the Shutters on the Beach hotel in California sued Lindsay Lohan, claiming she severely damaged one of their rooms. The hotel said she left behind burns and broken belongings, and they sought a significant amount of money to pay for cleaning and repairs. As a result, Lohan was prohibited from staying at the hotel again. This incident was one of many legal and personal difficulties she experienced at the time.

Pete Doherty

Look, I’ve followed Pete Doherty for years, and while I admire his music, it’s impossible to ignore the trouble he’s gotten into. I’ve heard so many stories about the state he’d leave hotel rooms in all over Europe – covered in graffiti and just generally trashed. Apparently, furniture was constantly overturned and things broken, costing hotels a fortune. It led to him being arrested a few times and having to pay big fines. Honestly, it’s become a big part of his public image – he’s known as one of the more unpredictable musicians out there, and it’s a shame, because his talent is undeniable.

Christian Slater

In the mid-1990s, Christian Slater was arrested at the Parker Meridien Hotel in New York City after a disruptive incident. He damaged his hotel room and the hallway, leading to a confrontation with staff and police. Authorities reported that Slater appeared to be under the influence at the time. He was charged with assault and vandalism. The event was widely publicized in the tabloids and proved to be a challenging time early in his career.

Sid Vicious

Sid Vicious was notorious for his wild and damaging behavior, and he spent a lot of time at New York’s Hotel Chelsea. He was known for destroying hotel furniture and leaving his rooms completely wrecked, often starting fires and breaking windows with his girlfriend, Nancy Spungen. The hotel staff put up with much of this because the building had a reputation for attracting a rebellious crowd. His stay ultimately ended with a tragic event that would forever be linked to his place in punk rock history.

Liam Gallagher

During an Oasis tour, Liam Gallagher got into a huge fight at a hotel in Munich, causing significant damage and losing some teeth. The band had a reputation for being destructive, often clashing with hotel staff and damaging property. This led to many hotels in the UK and Europe refusing to accommodate them. Liam often justified this behavior as simply part of being a rock star.

Noel Gallagher

Noel Gallagher contributed to Oasis’ wild reputation by being involved in many fights in hotel rooms. He often talked about how the band would trash their rooms after gigs. The brothers were known for turning their hotel rooms into chaotic scenes during their frequent arguments. Noel has said they’d have to pay for the damage out of their tour money. Stories of broken mirrors and flipped furniture from their travels around the world are common.

Axl Rose

Axl Rose, the lead singer of Guns N’ Roses, had a reputation for a fierce temper and was notorious for damaging hotel rooms. If he wasn’t satisfied with his accommodations, he would often throw things and break furniture. There’s a famous story about him throwing a television through a glass door after an argument with hotel staff. Because of his history of destructive behavior, many high-end hotels either created special rules for him or simply refused to let him book a room. Hotel workers remember him as a problematic, though iconic, guest.

Billy Idol

During a three-week stay in Bangkok, Billy Idol reportedly caused extensive damage to a suite at the Oriental Hotel. He allegedly refused to check out and racked up thousands of dollars in costs while breaking furniture and causing structural damage. Local authorities had to intervene when he wouldn’t pay for the repairs. This incident is remembered as one of the most notorious examples of rock star behavior in Asian hotels.

Florence Welch

Florence Welch shared that she accidentally started a fire at the Bowery Hotel in New York while celebrating with friends. A candle caused a significant blaze in her hotel suite, and she also chipped a tooth during the lively night. Although the fire wasn’t intentional, it caused considerable damage, and Welch covered all the costs for repairs. She has apologized for the incident.

Nicolas Cage

Nicolas Cage had a run-in with the law in New Orleans after a public argument and some property damage. Witnesses said he became upset near a hotel and damaged a parked car. He also reportedly caused a disturbance inside a guest house. Police stepped in to prevent further issues, and Cage later resolved the legal problems and continued working on his films.

Steven Tyler

During Aerosmith’s tours in the 1970s, Steven Tyler was part of the notorious trend of hotel room destruction. He and his bandmates gained a reputation for throwing everything imaginable – from furniture to food – out of hotel windows. Tyler would even take apart fixtures, creating problems for hotel staff. The media often captured these incidents, contributing to the band’s wild image. Looking back, Tyler acknowledges this period as a time of excessive and pointless destruction.

Mick Jagger

Mick Jagger and The Rolling Stones were among the first British rock stars to change how hotels expected to be treated in the 1960s. They became known for leaving their hotel suites completely wrecked – often with broken glass and damaged furniture. Although Jagger later developed a more sophisticated public image, the band’s early, rebellious behavior contributed to their decades-long reputation as being wild and unpredictable.

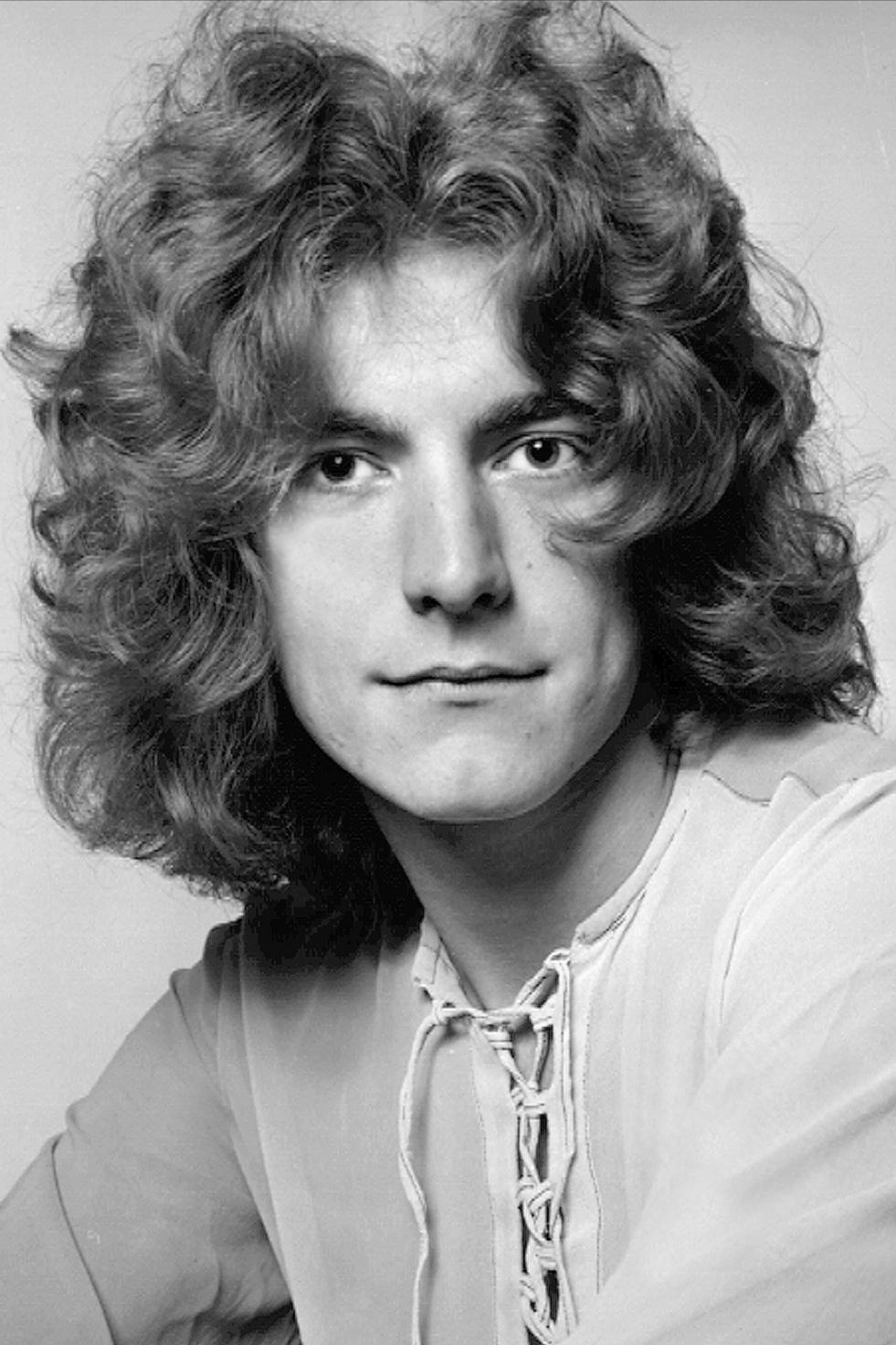

Robert Plant

Robert Plant and Led Zeppelin became well-known for their wild behavior while staying at the Continental Hyatt House, which earned the nickname “Riot House.” Plant often witnessed his bandmates throwing furniture from their hotel balconies and joined in the destructive fun, with rooms frequently damaged by water and general mayhem. Their antics ultimately led to bans from numerous major hotel chains due to the incredibly high repair bills. Plant has often talked about these incidents as examples of the over-the-top lifestyle common in the classic rock scene.

Tommy Lee

During their most popular years, Motley Crue was famous for wild and damaging behavior, and drummer Tommy Lee was a key part of it. He was notorious for recklessly modifying hotel rooms – often with power tools like chainsaws – without getting permission. The band as a whole gained a reputation for vandalism, including spray-painting walls and breaking everything made of glass. This led to numerous bans from hotels and costly legal battles. Lee himself saw this destruction as a way to express his creativity while on exhausting tour schedules.

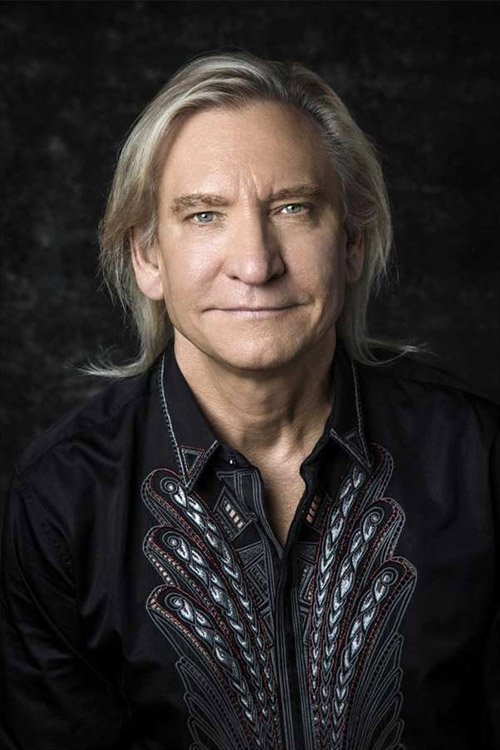

Joe Walsh

Joe Walsh, the Eagles guitarist, gained a reputation for wildly destructive behavior in hotels. Stories circulated that he once even brought a chainsaw on tour to help him trash rooms when he was bored. He famously caused significant damage with John Belushi, and later felt bad about the wastefulness. While Walsh eventually calmed down, he’s still remembered as a notorious hotel vandal in rock and roll history. He even joked that he sometimes spent more money fixing hotel rooms than he earned!

Ozzy Osbourne

Ozzy Osbourne was famous for trashing hotel rooms during his career, both with Black Sabbath and as a solo artist. He was known for extreme behavior, like throwing a TV out a window – which almost hit someone! He often used force and even fire to damage hotel accommodations worldwide. Because of this reputation, hotels frequently demanded large security deposits from his team before letting him stay. These wild antics helped build his image as the ‘wild man’ of heavy metal.

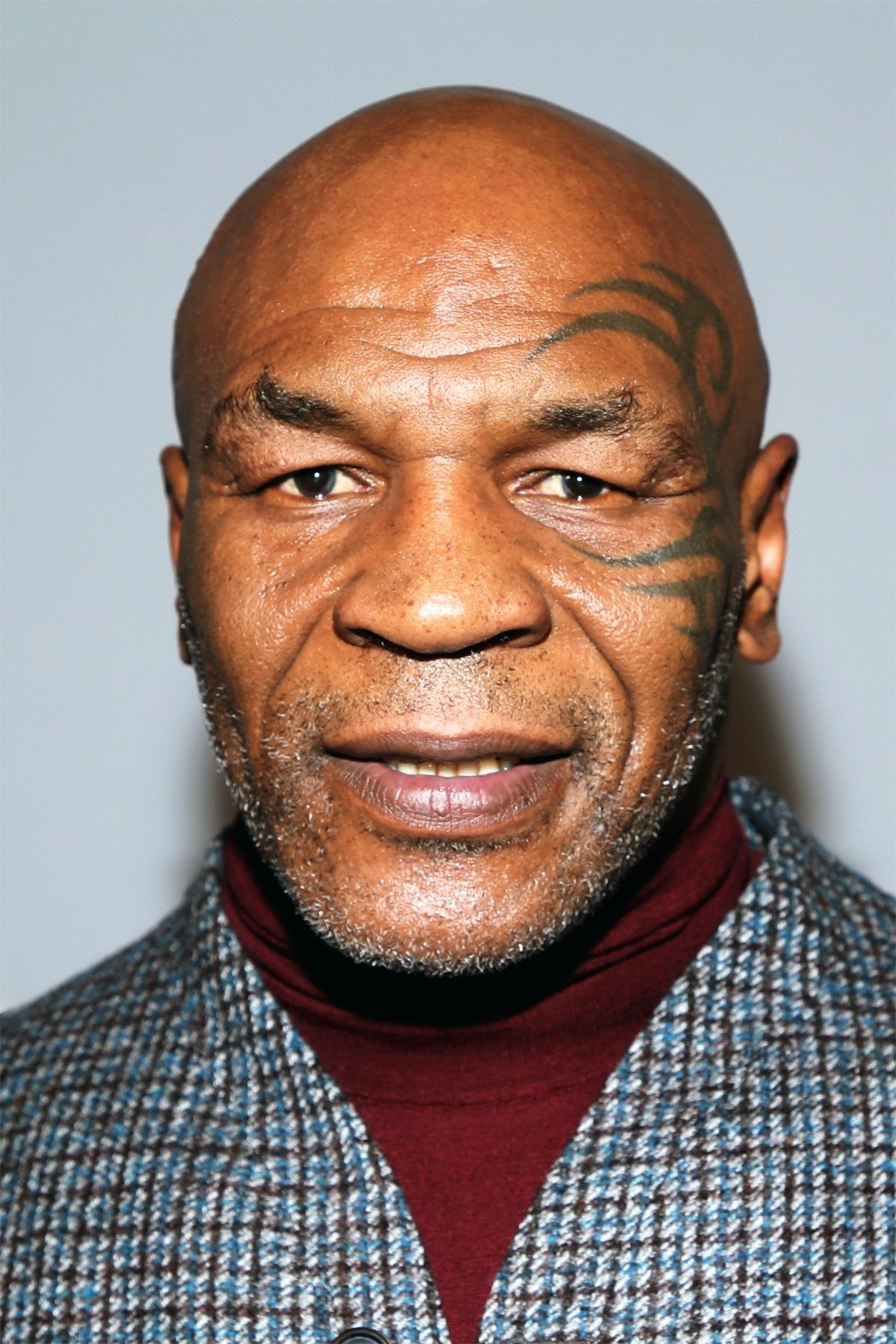

Mike Tyson

During his boxing career, Mike Tyson repeatedly damaged luxury hotel suites in Las Vegas when he lost his temper. Because of his incredible strength, the damage wasn’t just cosmetic – it often involved significant structural repairs. This led to hefty bills and legal issues for Tyson with the hotels. These incidents were frequently attributed to the intense stress of being a professional boxer.

Chris Brown

Chris Brown reportedly caused significant damage to a hotel suite at the Trump Soho in New York City. After he and his group checked out, hotel staff found the room completely wrecked, with broken furniture and trash scattered around. Walls were also damaged. This wasn’t the first time Brown has been accused of damaging hotel property, and he’s previously paid large amounts of money to resolve similar issues with luxury hotels.

James Gandolfini

Look, as someone who’s followed James Gandolfini’s career for years, it’s sadly not surprising to hear stories like this. Apparently, after a stay at The Carlyle hotel in New York, his room was found pretty trashed – we’re talking professional restoration needed. It seems the intense pressure of his work really got to him, and while he was generally a pro, these moments of struggle sometimes spilled into public view. He reportedly took care of the bill for the damage quietly, which, honestly, feels very much in character for him – a private man dealing with a lot.

Justin Bieber

During a tour of South America, Justin Bieber reportedly caused significant damage to a hotel suite in Rio de Janeiro, including spray-painting walls and breaking furniture. He was asked to leave and also faced legal trouble for graffiti on the outside of the building. This incident was one of several controversies as Bieber moved from being a teen star to a more mature artist. He later apologized and paid the fines for the damage.

Kid Rock

Kid Rock recently had an arrest after a fight at a Waffle House, and he’s known for causing trouble in hotels. After a concert in Memphis, he reportedly wrecked a hotel suite, often leaving rooms with broken glass and damaged carpets. Hotels frequently increased security when he stayed due to his reputation for rowdy behavior, something he’s often embraced as part of his public image.

Marilyn Manson

Marilyn Manson gained a reputation for causing significant damage in hotel rooms while touring. He’d often use things like makeup and other substances to mark up walls and furniture. Breaking mirrors and lights was a common pre-show habit for him and his band. This led to many major hotel chains banning him throughout the late 1990s. Manson saw this destruction as a continuation of his performance art and creative style.

Sebastian Bach

Sebastian Bach, the former lead singer of Skid Row, was arrested after an altercation at a bar and hotel in Ontario. Reports say he broke a wine bottle and damaged property during a disagreement. He was charged with assault and vandalism. Throughout his career in heavy metal, Bach has had several incidents involving property damage, often linked to his energetic and sometimes difficult personality, which frequently caused issues with hotel staff and security.

Amy Winehouse

During challenging times in her life, Amy Winehouse was infamous for leaving hotel rooms incredibly messy. She often broke furniture and left stubborn stains, requiring professional cleaning. A particularly bad incident at London’s Sanderson Hotel involved extensive damage during a personal struggle. Her battles with substance use frequently showed up in the condition of the hotels she stayed in – they were often neglected and things were broken. Paparazzi regularly photographed these scenes, and the stories were widely reported in the media.

Alice Cooper

Alice Cooper was known for trashing hotel rooms during his concerts, a common practice among rock stars at the time. He and his band would deliberately damage hotel suites, often using items from their stage show. Cooper once described throwing furniture and making big messes just to surprise and shock hotel employees. This wild behavior was typical of the shock rock style he became famous for in the 1970s. While he no longer acts this way, Cooper remains an important and iconic figure in rock history, representing a period of over-the-top performances and lifestyles.

Iggy Pop

Iggy Pop was notorious for his chaotic behavior during his time with The Stooges and as a solo artist. He frequently trashed hotel rooms, breaking windows and tearing furniture apart. This high-energy behavior, both during performances and in his personal life, often led to property damage. Hotels in Detroit and Los Angeles are full of stories about the messes he left behind. Iggy himself saw this destruction as a release of his intense creativity.

David Lee Roth

David Lee Roth and Van Halen were legendary for their wild and chaotic hotel parties. Roth frequently led the band in trashing hotel rooms, breaking furniture, and even causing water damage. They were notorious for having very specific demands in their contracts – if these weren’t met exactly, they’d often cause a scene. Roth loved the attention their destructive behavior brought and often talked about it in interviews. These incidents cemented Van Halen’s image as the biggest party band of the 1980s.

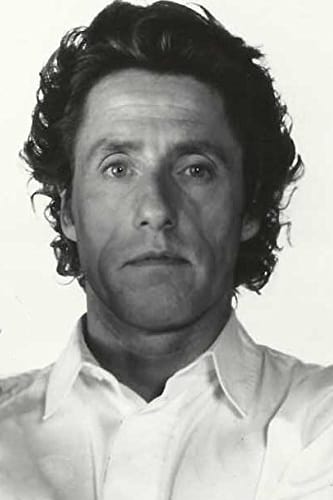

John Bonham

John Bonham, Led Zeppelin’s drummer, became notorious for the band’s wild hotel behavior. He was incredibly strong and could quickly destroy a hotel room. He famously even rode a motorcycle through the halls of the Continental Hyatt House multiple times. Bonham would often break furniture with heavy objects, leaving a trail of destruction on the band’s floor. Hotel staff who worked during rock’s peak years still talk about his antics.

Nikki Sixx

Nikki Sixx was largely responsible for the wild and destructive behavior Motley Crue became known for in the 1980s. He detailed numerous instances of hotel room damage in his autobiographies, often admitting to using drugs and alcohol to fuel the destruction. It was common for Sixx and his bandmates to be kicked out of hotels by the police due to the messes they left behind. This behavior frequently ate into the band’s earnings from touring.

Vince Neil

During Motley Crue’s tours, Vince Neil was notorious for trashing hotel rooms. He often lost his temper and damaged electronics and mirrors, and frequently joined his bandmates in throwing furniture and other heavy items from hotel balconies. This destructive behavior was unfortunately seen as a sign of being a true rock star in the heavy metal scene back then. As a result, Neil faced many lawsuits and had to pay for the damage he caused.

Duff McKagan

Duff McKagan, the bassist for Guns N’ Roses, was part of the band known for its wild behavior, especially damaging hotel rooms during their tours. He remembers a time of widespread destruction – broken furniture, messy walls, and general chaos – that often resulted in the band being kicked out of cities. While McKagan now lives a much calmer life, he looks back on that period as a time of complete and utter mayhem.

Slash

Slash famously fueled Guns N’ Roses’ wild reputation by trashing hotel rooms. He was notorious for leaving behind broken glass and damaged furniture, often smashing things with his guitar or other heavy objects when he was upset or simply bored. This behavior made it hard for the band to find nice places to stay, and Slash has since admitted that it was a part of the experience of becoming a huge rock star.

Roger Daltrey

Roger Daltrey played a role in the infamous hotel room destruction that became a hallmark of The Who’s career. Although Keith Moon usually started the chaos, Daltrey frequently joined in, contributing to the damage. He witnessed—and participated in—many of these wild incidents, which often resulted in wrecked bathrooms and ruined furniture. Daltrey also frequently had to manage the legal and financial consequences of the band’s behavior while touring. These events remain a key part of the band’s legendary status in rock and roll history.

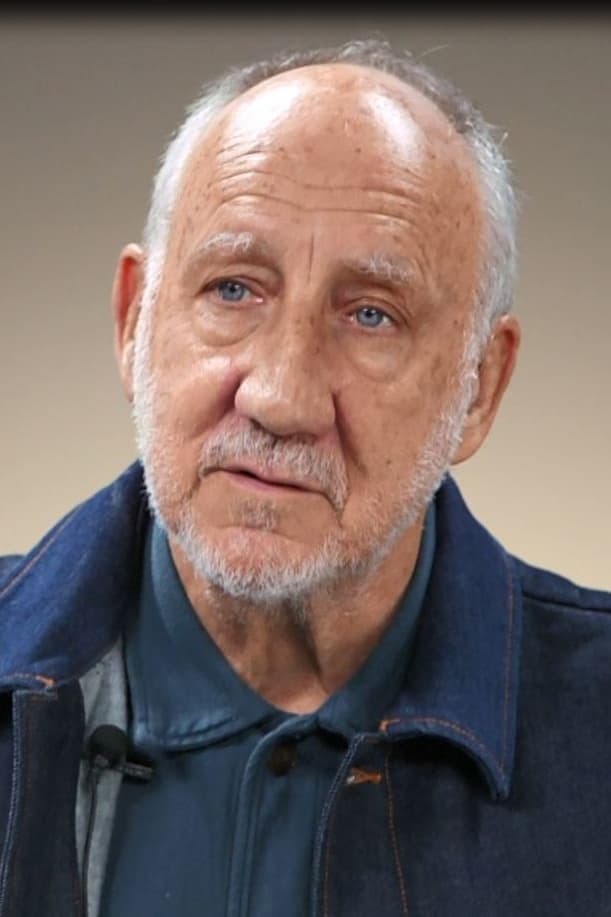

Pete Townshend

Pete Townshend, guitarist for The Who, was famous for smashing guitars, and this habit extended to hotel rooms during tours. He’d often break furniture and fixtures as a way to release creative energy. He was notorious for incidents at a Holiday Inn, which resulted in a lifetime ban for the band. Townshend saw this destruction as a meaningful expression of the band’s artistic ideas, and these events became part of the rock star image for years to come.

Scott Weiland

Throughout his career with Stone Temple Pilots and Velvet Revolver, Scott Weiland was frequently connected to reports of damage in hotel rooms. Following difficult personal battles and demanding tour schedules, he often left rooms very messy and with broken items, sometimes requiring professional cleaning. This behavior caused problems with bandmates and tour staff, who often had to pay for the resulting repairs. These incidents were a symptom of the challenges Weiland faced throughout his life and career.

Bobby Brown

Throughout his career and marriage, Bobby Brown was often connected to incidents where hotel rooms and other properties were damaged. Reports from hotel staff frequently described broken furniture and mirrors, allegedly caused by Brown during times of personal or domestic trouble. These incidents sometimes led to police involvement and costly settlements to prevent criminal charges. His unpredictable behavior became a common topic in tabloid media during the 1990s.

Whitney Houston

Whitney Houston and her husband, Bobby Brown, were notorious for causing significant damage to hotel rooms during their travels. Reports detailed broken furniture and stained carpets at numerous luxury hotels they stayed in, with repair costs often reaching tens of thousands of dollars per visit. These incidents were widely believed to be connected to the couple’s personal difficulties. While Houston later overcame this period, the stories of their hotel mishaps continued to follow her throughout her career.

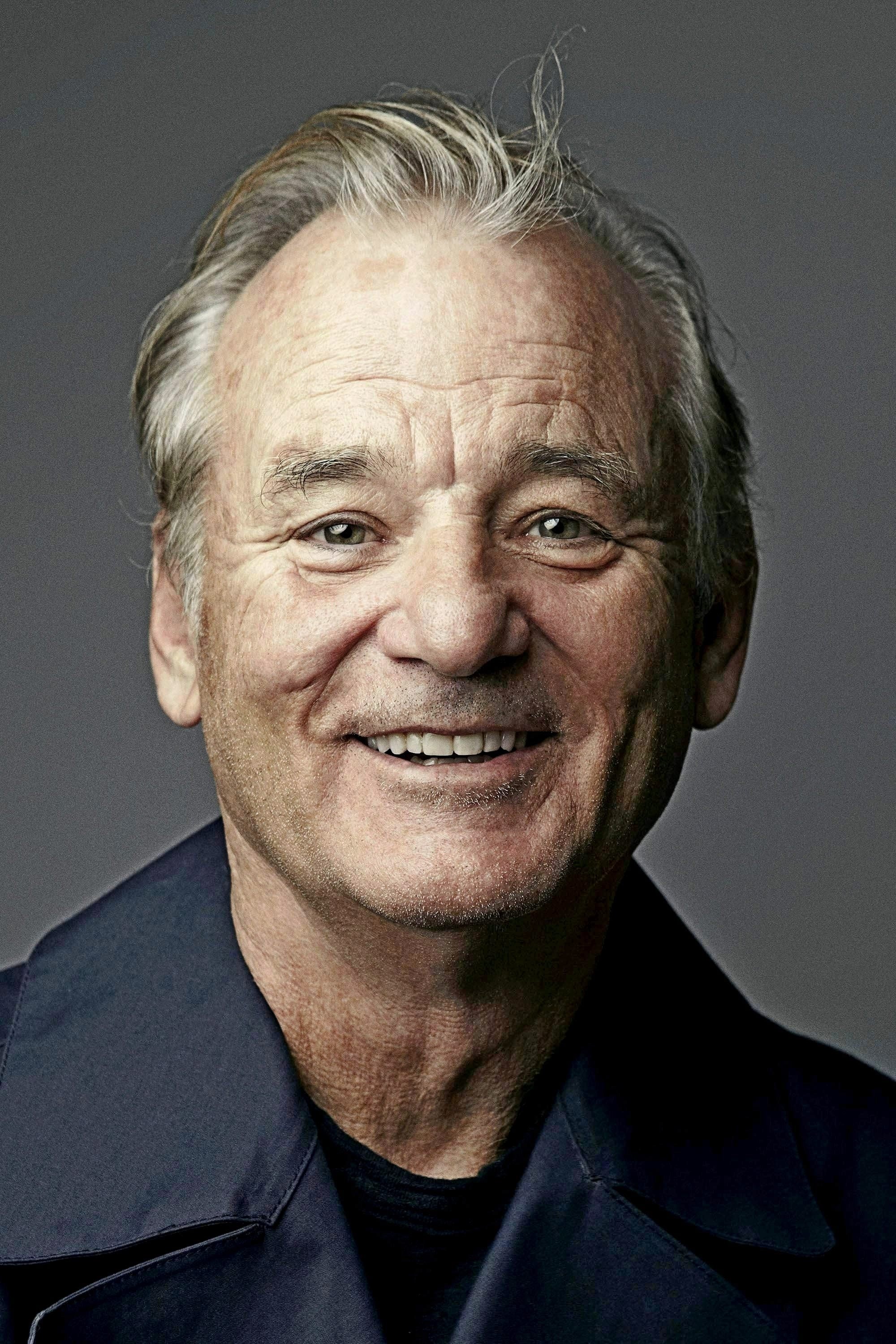

Bill Murray

Bill Murray was at The Mark Hotel in New York when Johnny Depp was involved in a notorious 1994 incident. Although Depp was mainly held responsible, reports indicate Murray was also present and participated in the rowdy party that caused damage to the hotel suite. Murray was known for his unusual behavior and late-night adventures during filming and vacations. Though he generally avoided legal trouble, his involvement in these kinds of events reinforced his image as unpredictable. He has consistently declined to discuss his part in the destruction of the luxury suite.

Amanda Bynes

Amanda Bynes was asked to leave the Ritz-Carlton in New York City after causing a disturbance in her room. Reports indicated smoke and damage to the property, raising safety concerns for other guests. Hotel staff found her suite messy and evidence she had broken hotel rules. This happened while Bynes was already facing personal difficulties and a lot of attention from the media. The incident led to further media coverage and her removal from the hotel.

Lily Allen

Lily Allen was reportedly kicked out of a hotel in Cannes after a wild night. She allegedly caused significant damage to her room, requiring a thorough cleaning and repairs. Allen later admitted things got out of control during the film festival and acknowledged her behavior. She’s been candid about her past and the results of living a fast-paced life. This incident is well-known as an example of a British pop star getting into trouble while traveling abroad.

Tell us which of these wild celebrity hotel stories surprised you the most in the comments.

Read More

- Building 3D Worlds from Words: Is Reinforcement Learning the Key?

- Gold Rate Forecast

- Securing the Agent Ecosystem: Detecting Malicious Workflow Patterns

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Wuthering Waves – Galbrena build and materials guide

- The Best Directors of 2025

- TV Shows Where Asian Representation Felt Like Stereotype Checklists

- Games That Faced Bans in Countries Over Political Themes

- 📢 New Prestige Skin – Hedonist Liberta

- SEGA Sonic and IDW Artist Gigi Dutreix Celebrates Charlie Kirk’s Death

2026-02-27 04:55