Microsoft. Yes, that Microsoft. The one that, for a decade or so, hasn’t managed to completely implode under the weight of its own ambition. A remarkable achievement, really. It’s gone up, oh, a bit. 680% they say. Which, when you think about it, is roughly the same increase you’d expect from a particularly successful goblin market stall specializing in slightly used prophecies. Outperforms the S&P 500 by a comfortable margin, too. Though, to be fair, outperforming the S&P 500 is a bit like winning a footrace against a particularly lethargic snail. Not exactly a cause for parades.

Recently, however, the stock has taken a bit of a tumble. About 26% down from its peak, which, in the grand scheme of things, is merely a polite correction. A gentle reminder that even empires, built on lines of code and quarterly earnings reports, are subject to the whims of… well, everything. Sell-offs of this magnitude are unusual for Microsoft, yes. But then, so is finding a genuinely honest accountant.1

And that brings us to the signal. The one clear sign that, if you’re the sort of person who still believes in signals (a foolish habit, if you ask me), suggests it might be time to… not exactly invest, mind you. Let’s call it a carefully considered allocation of resources. A strategic deployment of capital. A gamble, really, but one with marginally better odds than betting on the number of pigeons that will land on the statue of a minor deity in a given hour.

Microsoft Has Earned Its Premium (For Now)

A stock’s valuation is, essentially, a collective delusion. A shared belief that something is worth what someone else is willing to pay for it. Stocks trading at a discount usually have… issues. Shareholders start to suspect the Emperor has no code, and panic ensues. A premium valuation, on the other hand, implies confidence. A belief that this particular digital construct will generate more value than all the others. Microsoft recently lost that premium status, and now trades at a price roughly equivalent to… well, a reasonably priced digital construct. Which is, frankly, unsettling.

Valuing a company is an exercise in creative accounting. You can use sales, earnings, or any other metric that happens to be convenient. The price-to-earnings ratio (P/E) is a popular choice, but it’s about as reliable as a weather forecast made by a badger. Unrealized gains on investments, for example, can skew the results. And Microsoft, being the benevolent overlord it is, happens to have a rather large stake in OpenAI.2 OpenAI’s valuation is currently skyrocketing, which means Microsoft has to report those gains, even though they haven’t actually received any money yet. It’s a bit like claiming victory in a war that hasn’t started.

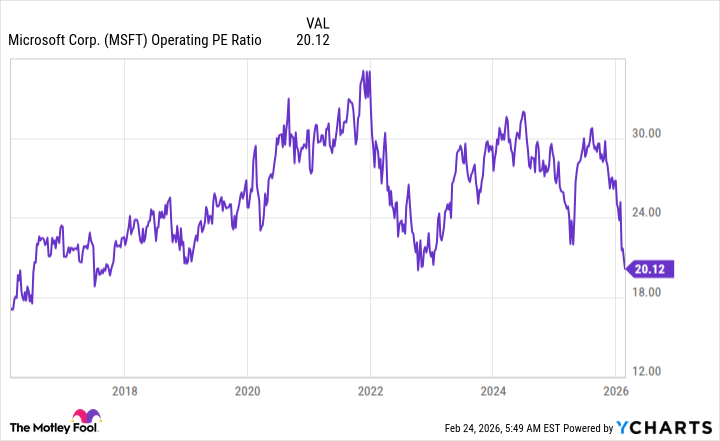

I prefer to value Microsoft based on its operating income. It’s a slightly less fanciful metric, unaffected by the whims of venture capitalists and the promise of artificial intelligence. And right now, Microsoft’s operating P/E ratio is at one of its lowest points in a decade. Which, in the cynical world I inhabit, is a good thing. Not because it means the company is undervalued, but because it means the inevitable reckoning hasn’t quite arrived.

A decade ago, Microsoft was desperately trying to reinvent itself as a cloud-first company. It succeeded, mostly by virtue of being large enough to crush any competition. Now, it’s positioning itself to dominate the generative AI race. Azure, its cloud computing segment, is growing at a ridiculous pace (39% year-over-year), and has a backlog of $625 billion. Which is, admittedly, a lot of backlog. A high-margin, recurring-revenue model business. Investors love that. Until they don’t.

The stock has sold off dramatically, and that, my friends, is an opportunity. Not a good opportunity, mind you. Just an opportunity. Like finding a slightly dented helmet in a battlefield. It might save your life. Or it might just give you a headache.

Sell-Offs Like This Rarely Occur (Unless You’re Paying Attention)

With Microsoft’s near-decade low valuations, some might call this a clear signal to buy. I wouldn’t go that far. Let’s just say it’s a marginally less foolish thing to do than many other things you could do with your money. Wall Street analysts are projecting 16% revenue growth this year and 15% next year. Which, statistically speaking, is probably optimistic. But who needs statistics when you have faith?

Microsoft is critical to the AI build-out, thanks to its vast cloud computing infrastructure. It’s not seeing any weaknesses in that area, which means the sell-off is… unwarranted. Or, perhaps, a perfectly rational response to the inherent instability of the market. I would be loading up on Microsoft stock at these prices, not because it’s a best-in-class business, but because it’s a large, established company with enough resources to weather most storms. And that, in this chaotic world, is a rare and valuable thing.

- Accountants, like alchemists, are often more skilled at illusion than substance.

- OpenAI, a company dedicated to creating artificial intelligence, is essentially building a digital genie. The only question is whether the genie will grant wishes or demand servitude.

Read More

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- Silver Rate Forecast

- Gold Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2026-02-27 03:52