In the movie business, actors are usually expected to memorize their entire script to keep filming on schedule. But some of Hollywood’s biggest male stars have done things differently, preferring to use notes or make things up as they go. They believed that trying to remember all their lines actually made their performances feel less natural and genuine. From classic actors to today’s leading men, these performers changed how movies were made with their individual approaches.

Marlon Brando

I’ve always been fascinated by Marlon Brando, and I learned he famously used cue cards throughout his entire career! He felt that rigidly memorizing lines actually hurt a performance, making it feel stiff instead of natural and alive. Apparently, while filming ‘The Godfather,’ he’d have his lines hidden all over the set – on objects, and even stuck to the chests of the other actors! It was his way of staying completely present in the moment, maintaining eye contact, and delivering those incredible lines with a real, believable energy.

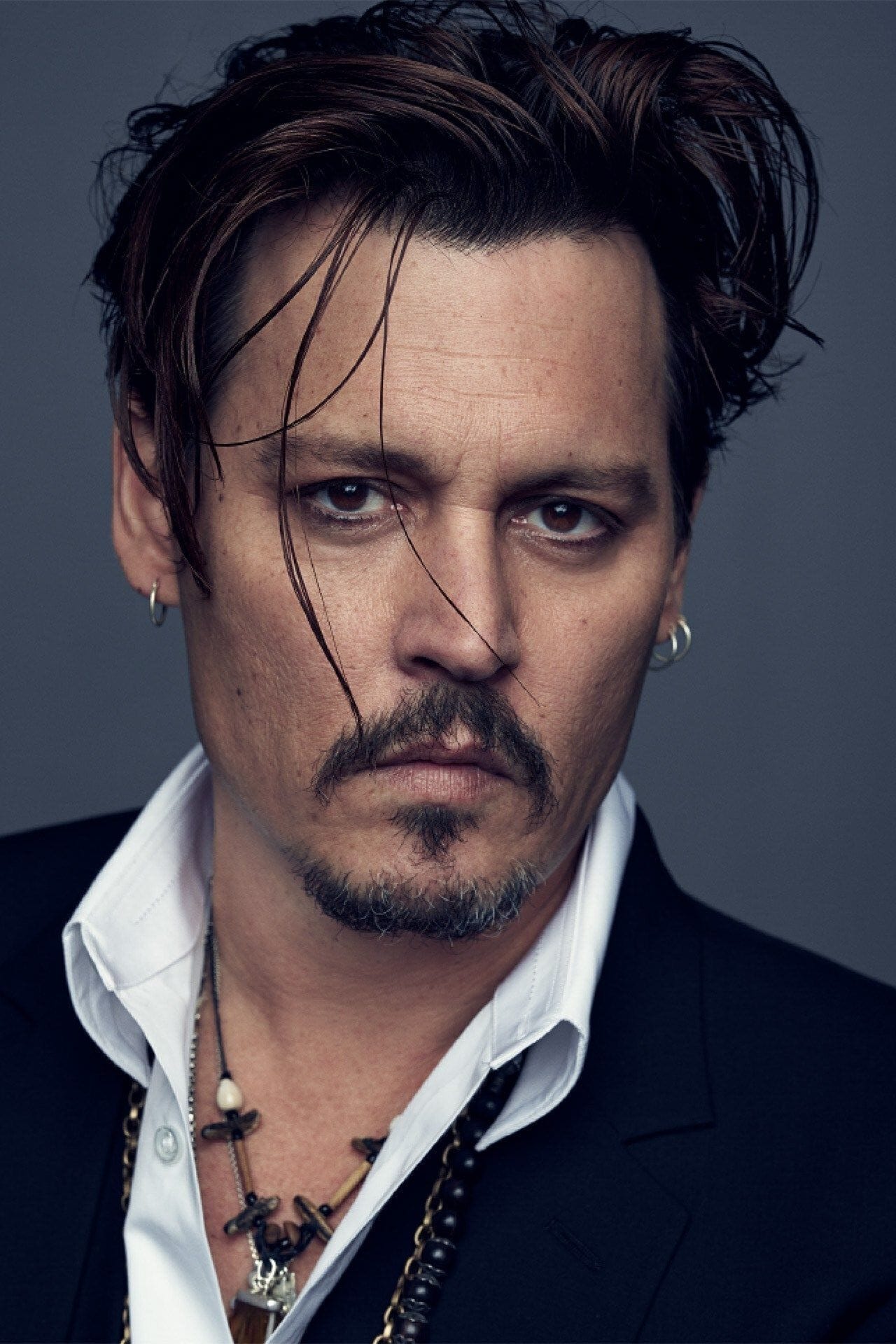

Johnny Depp

Johnny Depp often uses an earpiece while filming to have his lines read to him by someone off-camera. He says this helps him focus on truly becoming the character, rather than simply memorizing lines. During the filming of ‘Pirates of the Caribbean,’ he even asked for specific sounds and music to be played through the earpiece to enhance the atmosphere. This practice has become a recognized part of his acting approach, especially on large-scale movies.

Bruce Willis

Towards the end of his career, Bruce Willis started using earpieces to help him remember his lines while filming. Director M. Night Shyamalan revealed that Willis used this technology during the movie ‘Glass’. This allowed him to keep working on projects even as memorizing lines became more difficult. He frequently used this method while filming independent action movies in recent years.

Al Pacino

Like many experienced actors, Al Pacino sometimes uses an earpiece to help him remember lines during long and demanding filming schedules. While working on Martin Scorsese’s ‘The Irishman,’ he used a small device to keep up with the complex script. Pacino has talked about how challenging his roles can be, and how these tools allow him to fully immerse himself in a scene without getting bogged down in memorization. This technology helps him focus on the emotional impact of his performance instead of worrying about forgetting a line.

Robert De Niro

Robert De Niro sometimes uses cue cards while filming, especially in his recent movies. This helps the acclaimed actor concentrate on his physical performance and expressions without losing track of his lines. For example, during ‘The Intern,’ he employed different techniques to keep his acting feeling natural and smooth. Directors generally support this practice because of his incredible talent and captivating presence on screen.

Jack Nicholson

While filming ‘The Departed’, Jack Nicholson used cue cards to help him with his complicated scenes as a mob boss. He liked having the lines visible so he could try out different ways of saying them on the spot. Director Martin Scorsese let him do this because it allowed Nicholson to bring his signature unpredictable energy to the role. This approach ultimately helped create the character’s chaotic and intimidating presence in the film.

John Wayne

In the later years of his career, John Wayne often used cue cards because he found it harder to remember lines for his westerns. While filming ‘The Shootist,’ large boards were positioned behind the camera to help him deliver his performance. This allowed the legendary actor to maintain his strong on-screen persona without the pressure of memorizing everything perfectly.

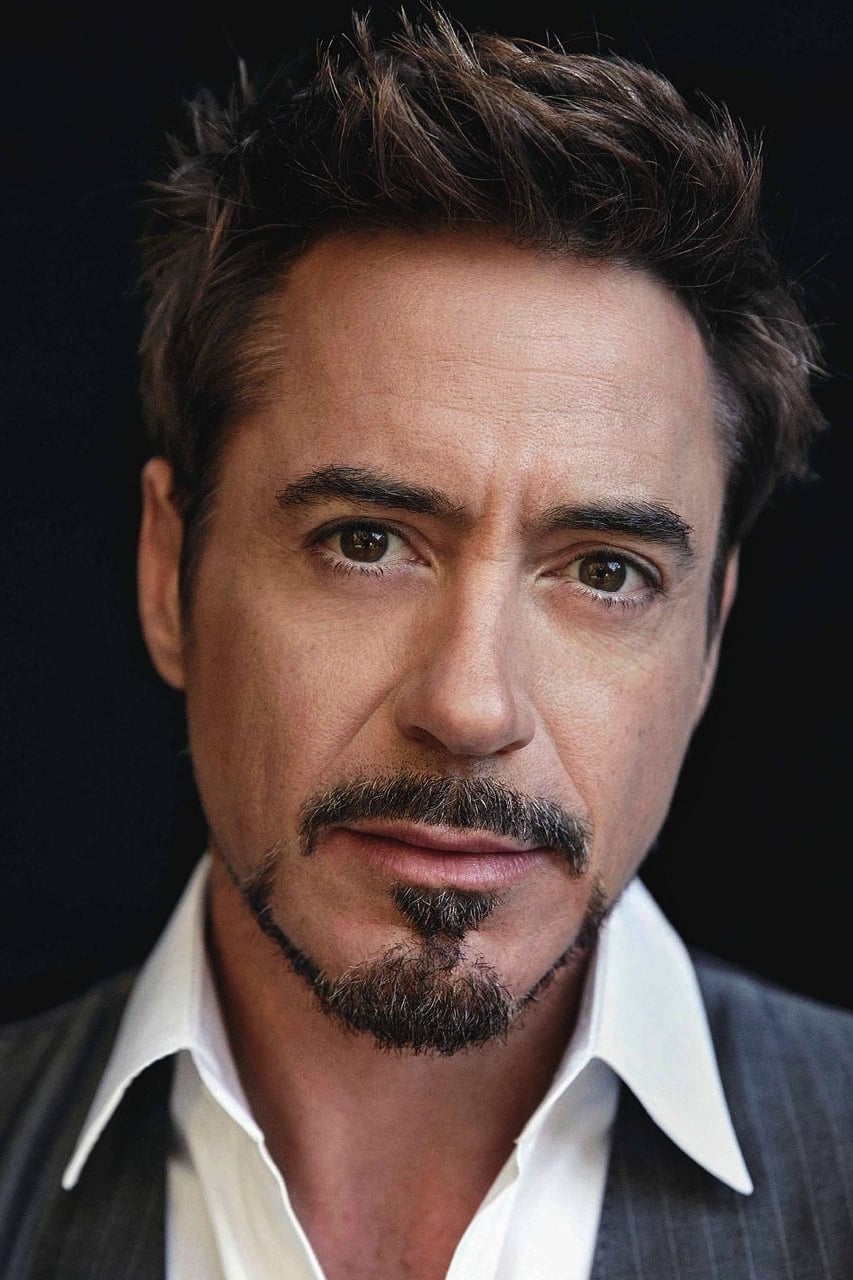

Robert Downey Jr.

During the filming of the first ‘Iron Man’ movie, Robert Downey Jr. cleverly used sticky notes and hidden cue cards all over the set. The script was constantly changing, so he found it easier to have the updated lines visible around him. This technique allowed him to consistently deliver Tony Stark’s quick, clever dialogue and helped shape the character’s personality for all the subsequent movies.

Frank Sinatra

Frank Sinatra was famous for not rehearsing or memorizing lines for his movies. He liked doing scenes just once, believing the first attempt was the most genuine. While filming ‘From Here to Eternity,’ he preferred to do as few takes as possible and relied on quick cues to get through his scenes. He was so naturally charming and talented that he could pull it off, even without a lot of preparation.

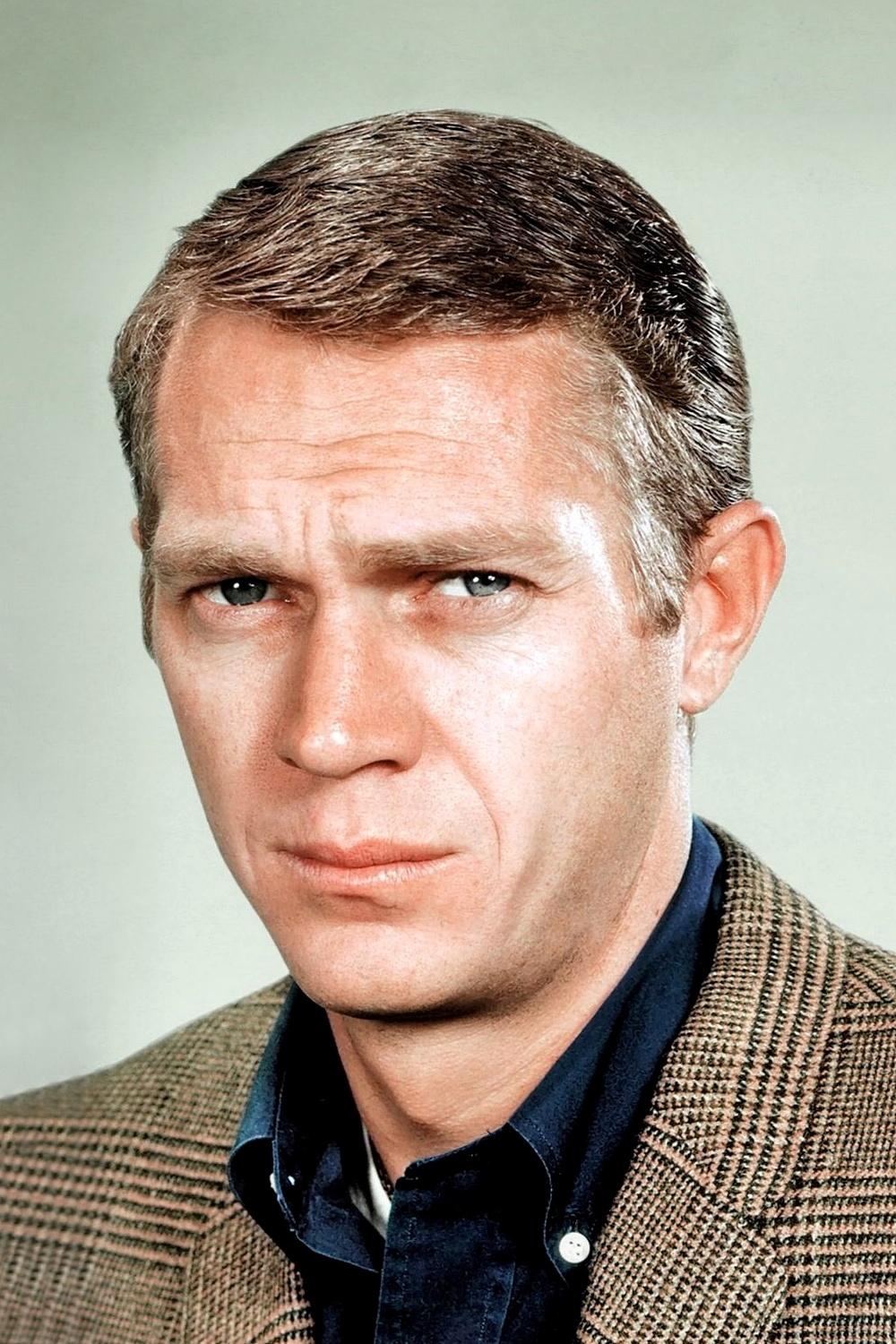

Steve McQueen

Steve McQueen famously relied on cue cards while filming his movies, especially action and dramatic roles. He focused more on his physical performance and the overall visual impact of a scene than memorizing lines. For example, during ‘The Magnificent Seven,’ he often had his dialogue placed in visible spots, which helped him maintain his calm and reserved on-screen persona while still delivering his lines effectively.

John Barrymore

John Barrymore was among the first big movie stars to use cue cards. He struggled with memorizing lines when he moved from acting on stage to making films, finding the repeated takes difficult. He’d have his lines written on large boards positioned just outside the camera’s view, and he quickly became known for always having these helpful prompts nearby on set.

Orson Welles

In his later career, Orson Welles frequently used cue cards while acting and directing. He believed that the visual and technical side of filmmaking was more crucial than simply memorizing lines. When working on films in Europe, he’d often have his dialogue written on tape and attached to cameras, or held up by people assisting him. This helped him concentrate on how the film looked and the overall feeling he wanted to create.

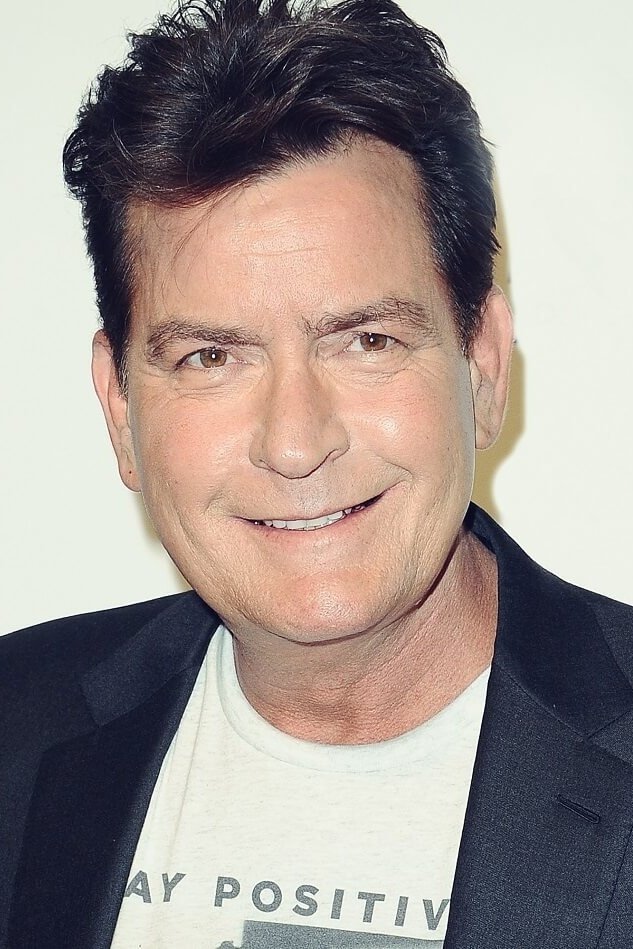

Charlie Sheen

For many years, while working on his TV show and in movies, Charlie Sheen had someone feed him his lines through an earpiece. He liked this because it kept filming moving at a fast pace. This was especially useful on his sitcom, where scripts were often changed daily, allowing him to deliver his comedic lines well without needing to memorize everything beforehand.

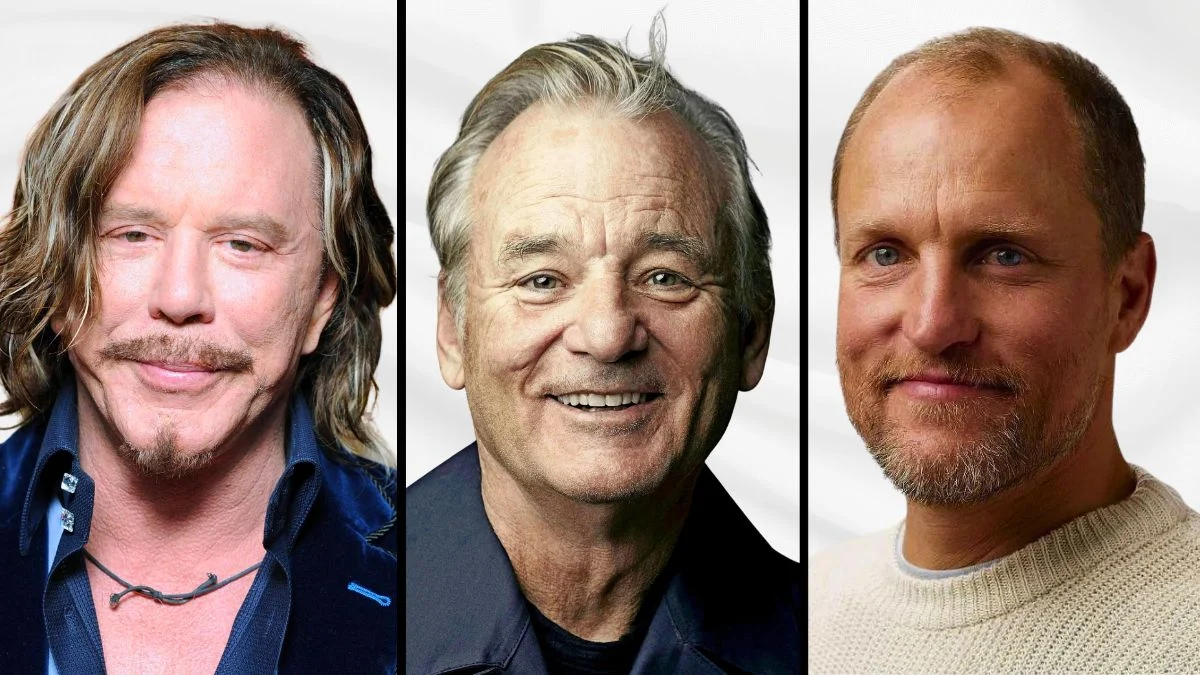

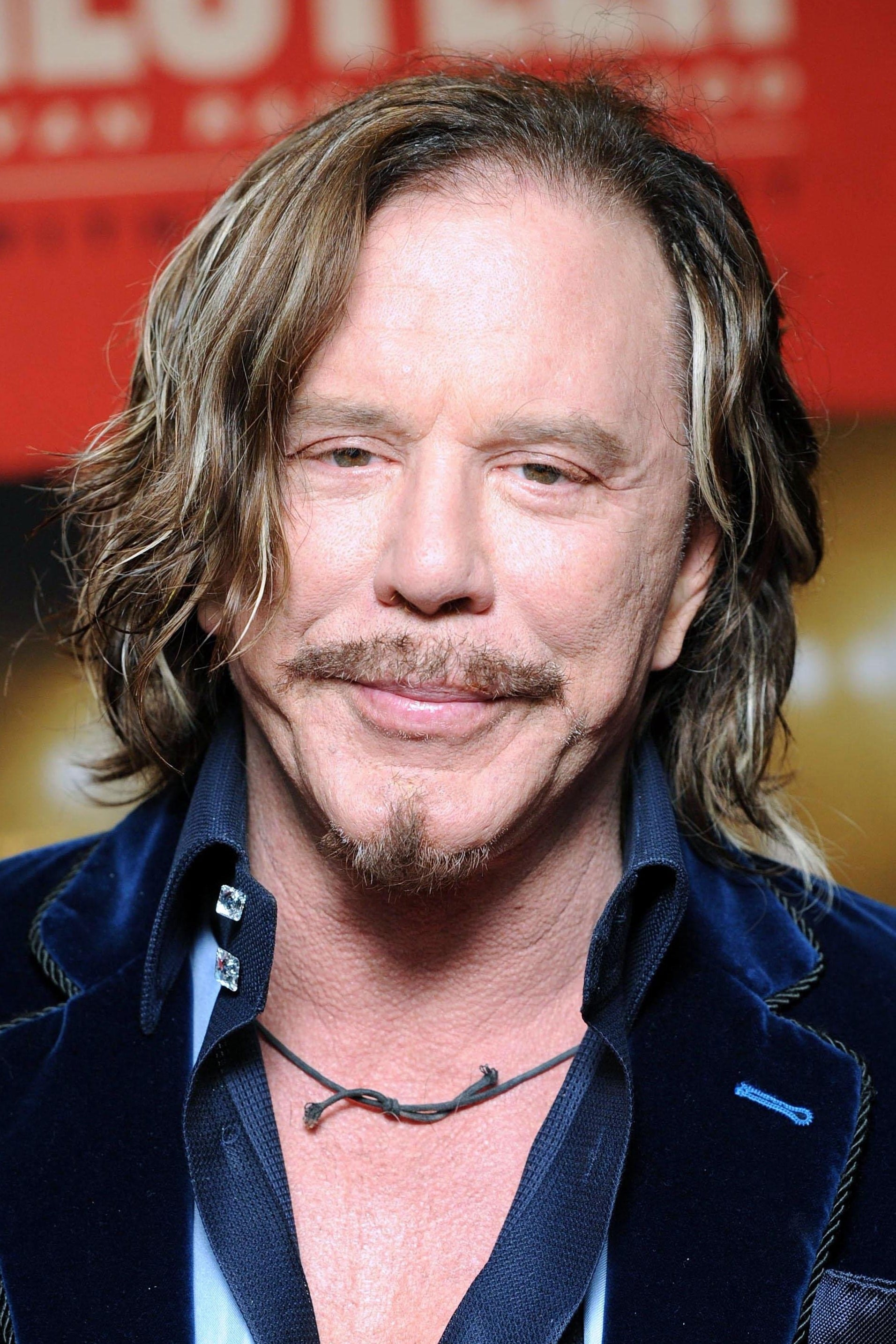

Mickey Rourke

Mickey Rourke often uses small earpieces during filming to help him fully connect with his characters. He found them particularly helpful during ‘The Wrestler,’ where the role was both physically and emotionally challenging. Rourke believes the earpieces allow him to stay focused and immersed in the performance. Directors have consistently praised his talent for using these prompts to create compelling and impactful scenes.

Gary Busey

Gary Busey is a distinctive actor known for his unusual methods. He likes to use cue cards while filming, allowing him to concentrate on the feeling and energy he brings to a role. This practice has been a consistent part of his work, helping him deliver his famously intense and unpredictable performances, and colleagues have noted how well he incorporates them into his scenes.

Burt Reynolds

Throughout his career, Burt Reynolds liked to keep his performances lively by using cue cards and making things up as he went along. He didn’t see scripts as rules, but as starting points for creating his characters. While filming ‘Smokey and the Bandit,’ he often went off-script to inject his own unique humor and charm. This willingness to stray from the written word was a key part of what made him such a huge star.

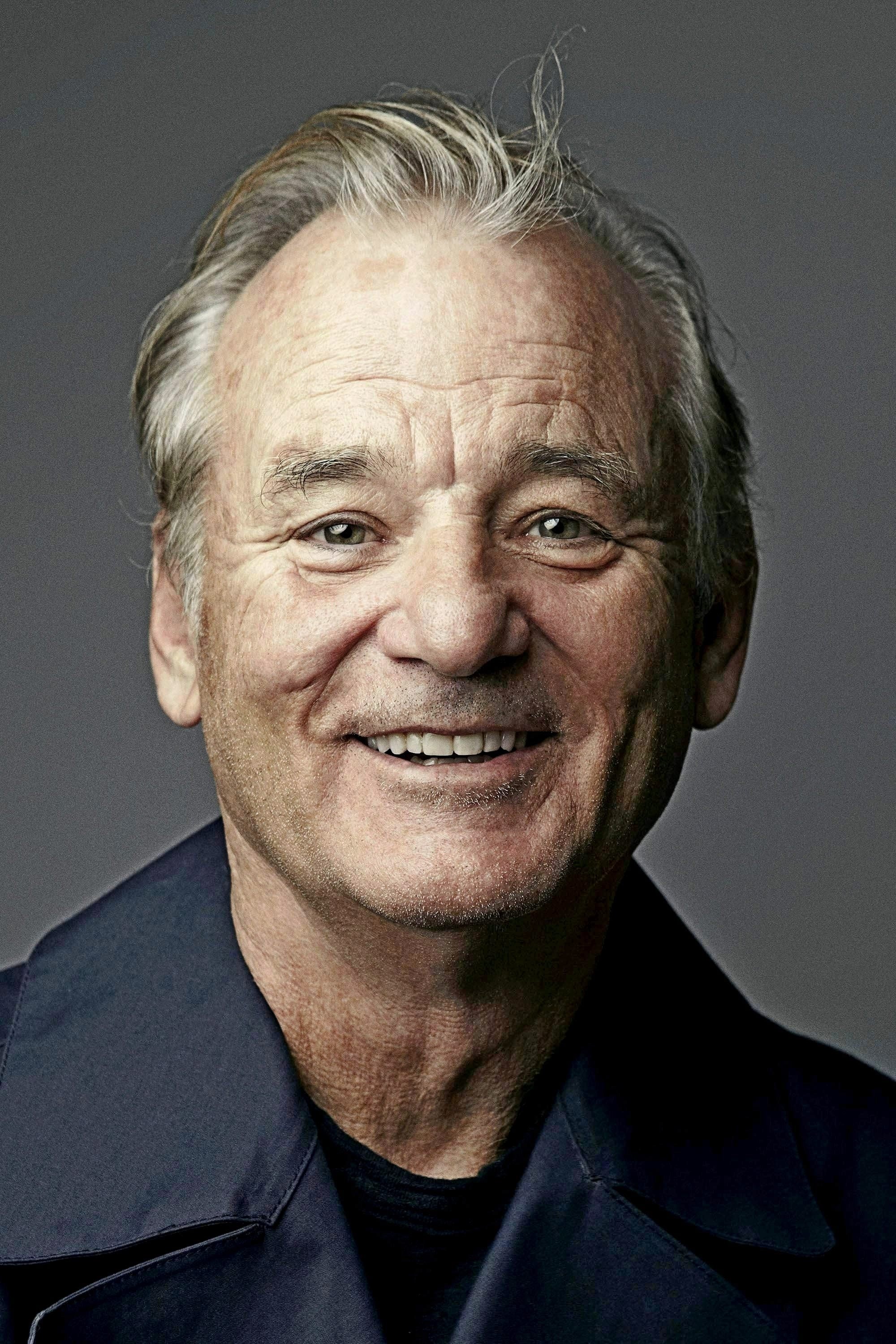

Bill Murray

Bill Murray is well-known for rarely sticking to the script, preferring to make up his own lines while filming. He often joins a movie project planning to redefine his character through improvised dialogue. For example, many of his most memorable lines in ‘Ghostbusters’ weren’t planned – he created them on the spot. This means his co-stars have to be prepared for anything when the cameras are rolling.

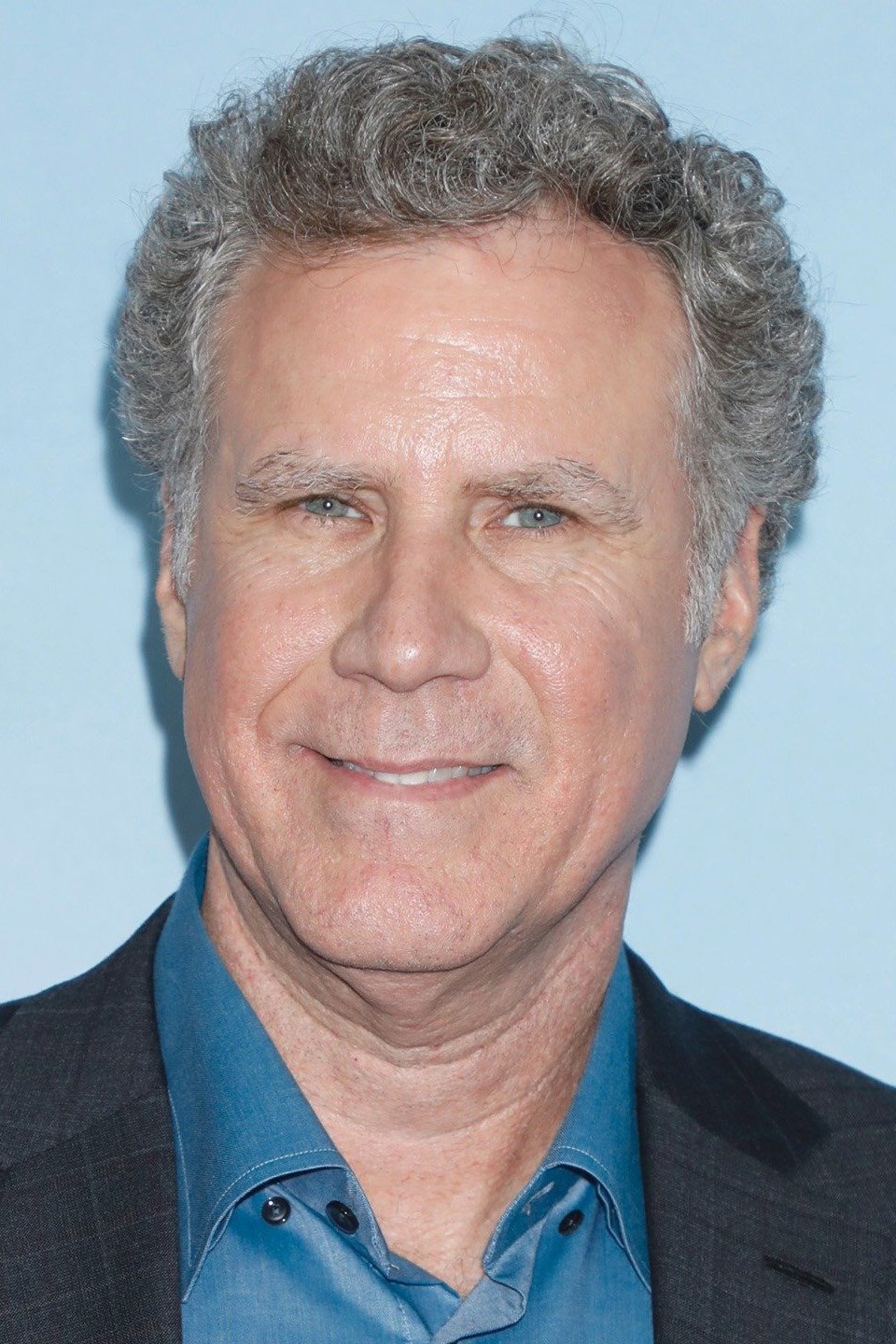

Will Ferrell

Will Ferrell is known for making up lines and scenes instead of strictly following the script. He collaborates with directors like Adam McKay to allow for this kind of creative freedom. For example, while filming ‘Anchorman,’ he’d often shoot the same scene several times, each time with completely different jokes and dialogue. He focuses on finding what’s funniest in the moment, rather than sticking exactly to what’s written.

Sacha Baron Cohen

Sacha Baron Cohen doesn’t typically memorize scripts. Instead, he creates his comedy through improvisation and fully embodying his characters. Since he often films in real-life settings, he needs to respond to the people he’s interacting with. For example, with ‘Borat,’ he had a basic storyline but made up the actual dialogue as he filmed. This approach, avoiding a traditional script, is key to the documentary feel of his humor.

Robert Mitchum

Robert Mitchum was famous for his laid-back approach to acting and often relied on cue cards. He playfully claimed he only had two ways of acting: with a cigar or without one. While filming ‘The Night of the Hunter,’ he used hidden prompts to remember his lines, but delivered them so naturally that audiences never suspected he was reading from a board.

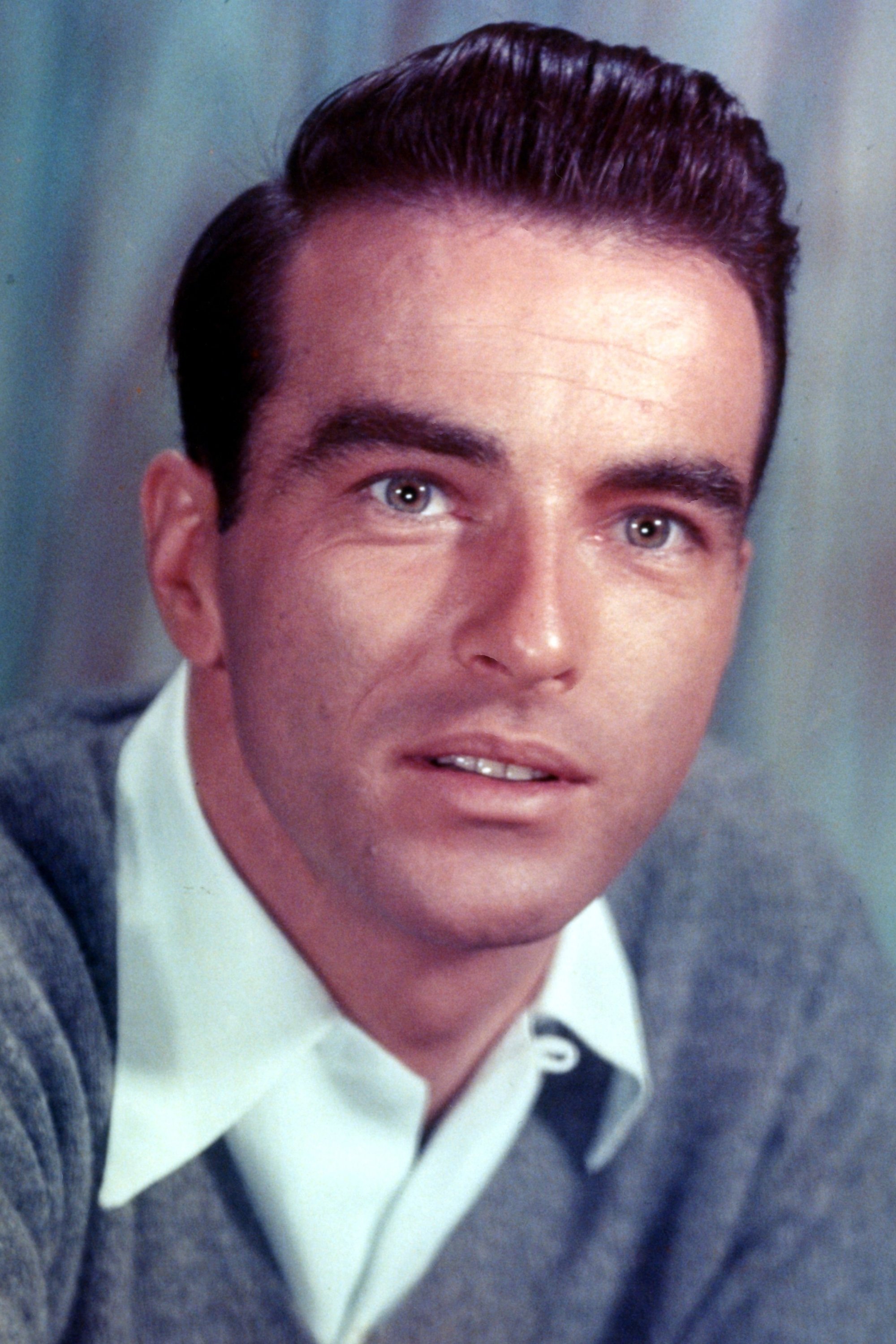

Montgomery Clift

After a severe car accident, Montgomery Clift started using cue cards to help him with his lines. The accident made it hard for him to concentrate and remember lengthy scripts. While filming ‘Judgment at Nuremberg,’ he needed prompts to deliver his powerful and emotional courtroom scenes. Even with these difficulties, he continued to give some of his most celebrated performances.

Richard Burton

Richard Burton was originally a highly skilled stage actor, but as he moved into film, he started using cue cards. The quick turnaround of movie-making didn’t always fit his usual careful preparation. During the filming of ‘Cleopatra,’ he used these aids to handle the very long script and the busy, unpredictable set. Even while relying on cue cards, he still maintained his strong voice and commanding presence.

Peter O’Toole

As a film buff, I always admired Peter O’Toole. It’s well known he had an amazing memory, able to learn whole plays, but apparently film scripts became a bit of a struggle as he got older. I read that during filming for ‘Troy’, he actually used cue cards to help him with his lines – he was playing the king, after all! It’s a testament to his professionalism that he embraced these tools to keep things moving and ensure the movie stayed on track. He clearly prioritized the production, even if it meant adjusting his usual methods.

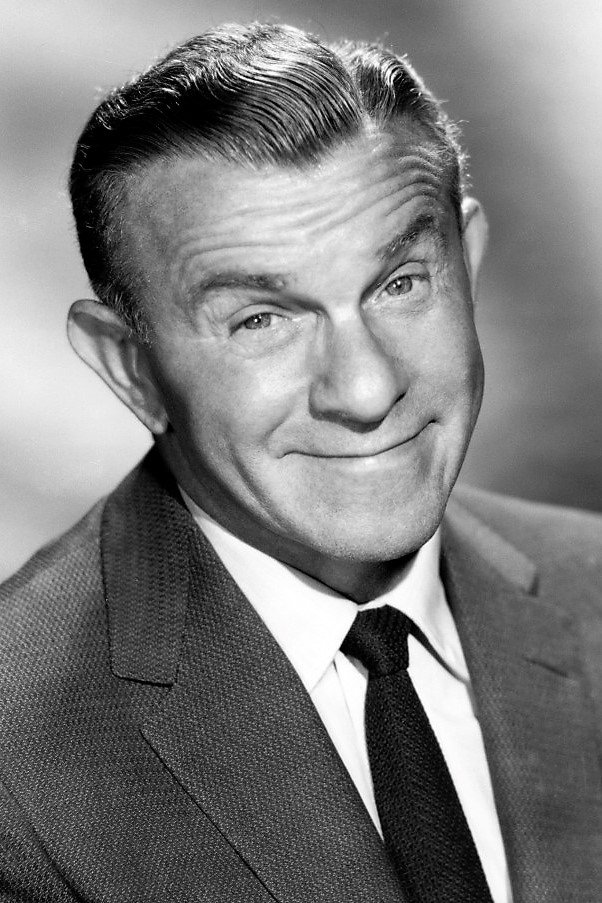

George Burns

In his later career, George Burns almost always used teleprompters or cue cards when acting in movies and on television. He readily admitted to using them, and even made jokes about it during his performances. For example, in the film ‘The Sunshine Boys,’ he relied on these prompts to deliver perfect comedic timing alongside his fellow actors. His skill at reading lines while seeming completely natural demonstrated his many years of experience as a performer.

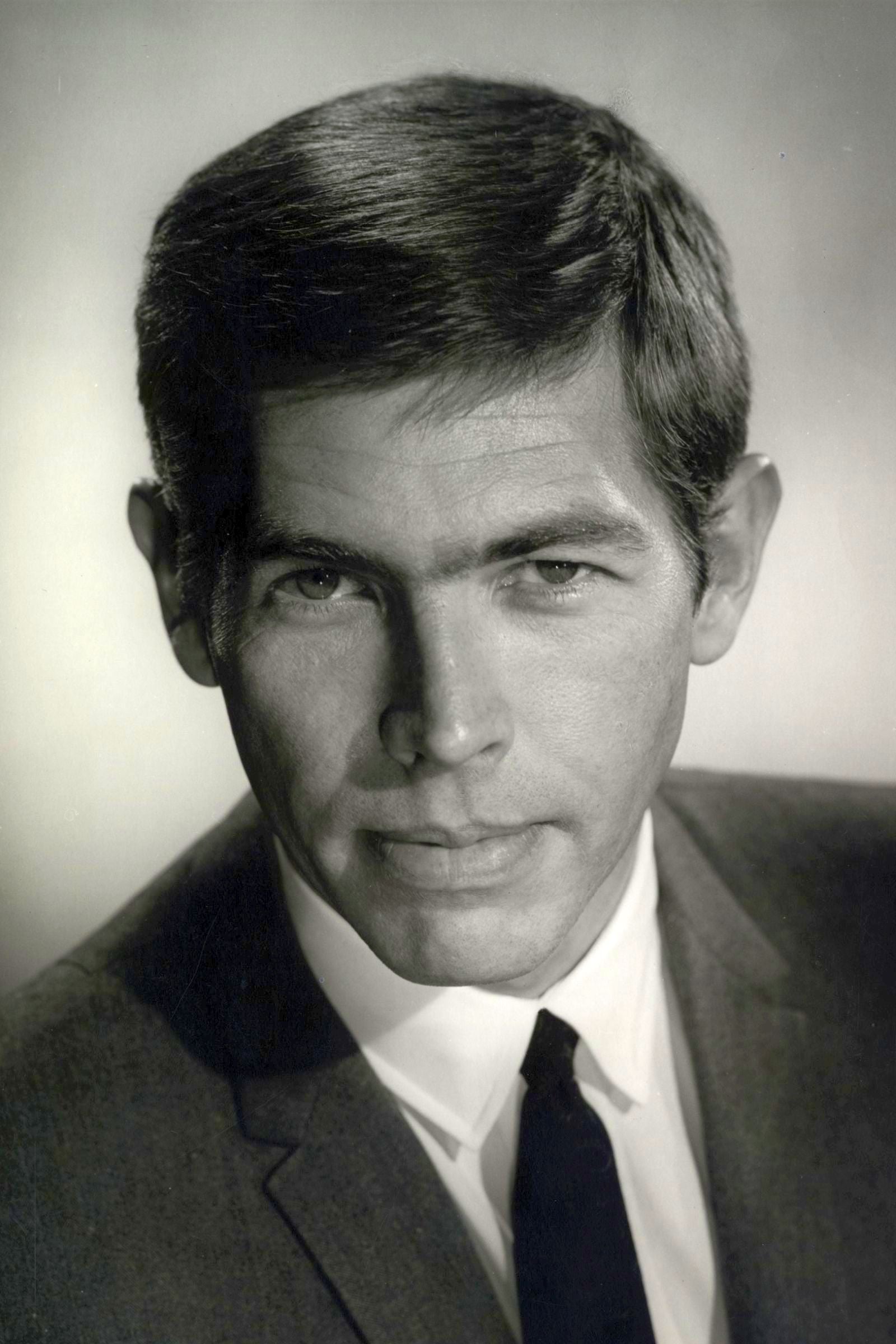

James Coburn

James Coburn won an Academy Award for his performance in ‘Affliction,’ and he used cue cards during filming to help him get into character. He found that having the lines readily available allowed him to fully concentrate on portraying the character’s raw emotion and intensity. Coburn was a dedicated professional, known for his collaborative spirit with directors, and the cue cards didn’t detract from his powerful and unforgettable performance.

Bela Lugosi

You know, as much as I love Bela Lugosi, it’s fascinating to learn about the challenges he faced early on. He wasn’t a native English speaker, and it really impacted how he worked. When he was filming ‘Dracula,’ he basically had to learn his lines by sound, using cue cards with the words phonetically written out. They’d put boards up with the pronunciation so he could nail it. It’s amazing when you think about it – that struggle actually created his incredibly distinctive, slow, deliberate way of speaking, which is such a huge part of what makes his Dracula so iconic. It wasn’t a stylistic choice, it was how he had to work!

Woody Harrelson

Woody Harrelson is famous for not just reading lines, but for creating his performances. He likes to collaborate with directors to understand his characters, then uses action and interaction to find the right dialogue. He’s often encouraged to add his own personality to roles, instead of simply memorizing the script. This approach gives his movies a realistic quality that viewers connect with.

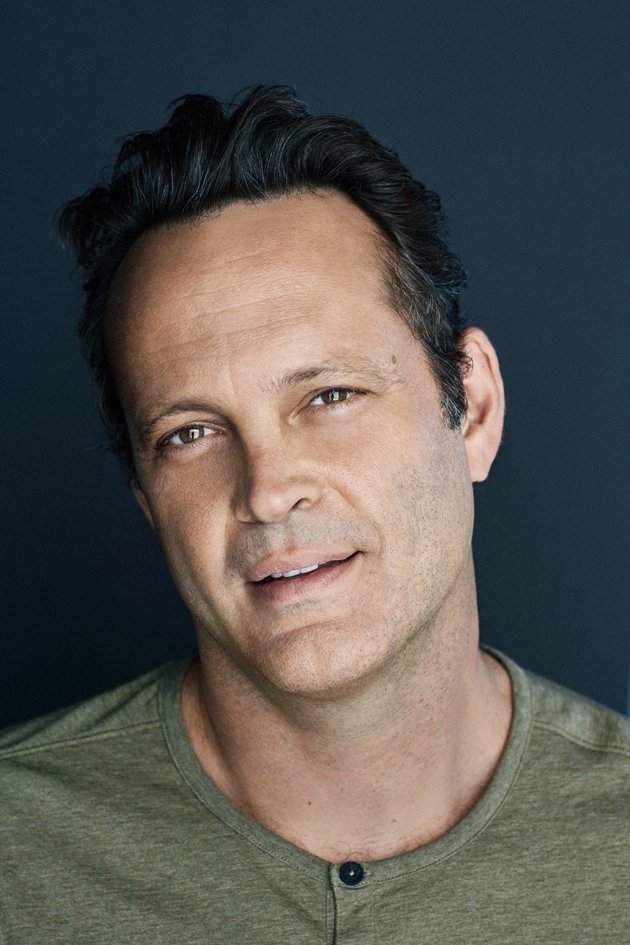

Vince Vaughn

Vince Vaughn is known for his quick, improvisational acting style, meaning he doesn’t always need to memorize lines beforehand. Instead, he focuses on understanding what a scene needs and then creates the dialogue naturally through conversation. This was especially noticeable in the movie ‘Old School,’ where a lot of his funny lines were made up on the spot during filming. Directors generally give him a lot of freedom to develop his characters without being tied down by a strict script.

Adam Sandler

Adam Sandler often relies on teleprompters and big cue cards while making his comedies. This lets him concentrate on the funny physical bits and connecting with his fellow actors. He usually works with the same crew who are experts at positioning these prompts to keep filming smooth and quick. This approach helps him make a lot of movies while also keeping the set relaxed and enjoyable.

Alec Baldwin

Alec Baldwin often uses teleprompters while filming to help with lengthy speeches and complicated lines. This is a typical practice in television, where scripts are frequently revised right up until shooting begins. The teleprompter allows him to deliver the writers’ precise wording accurately, reducing the need for repeated takes. Because he’s a skilled actor, he can use these tools without affecting the quality of his performance.

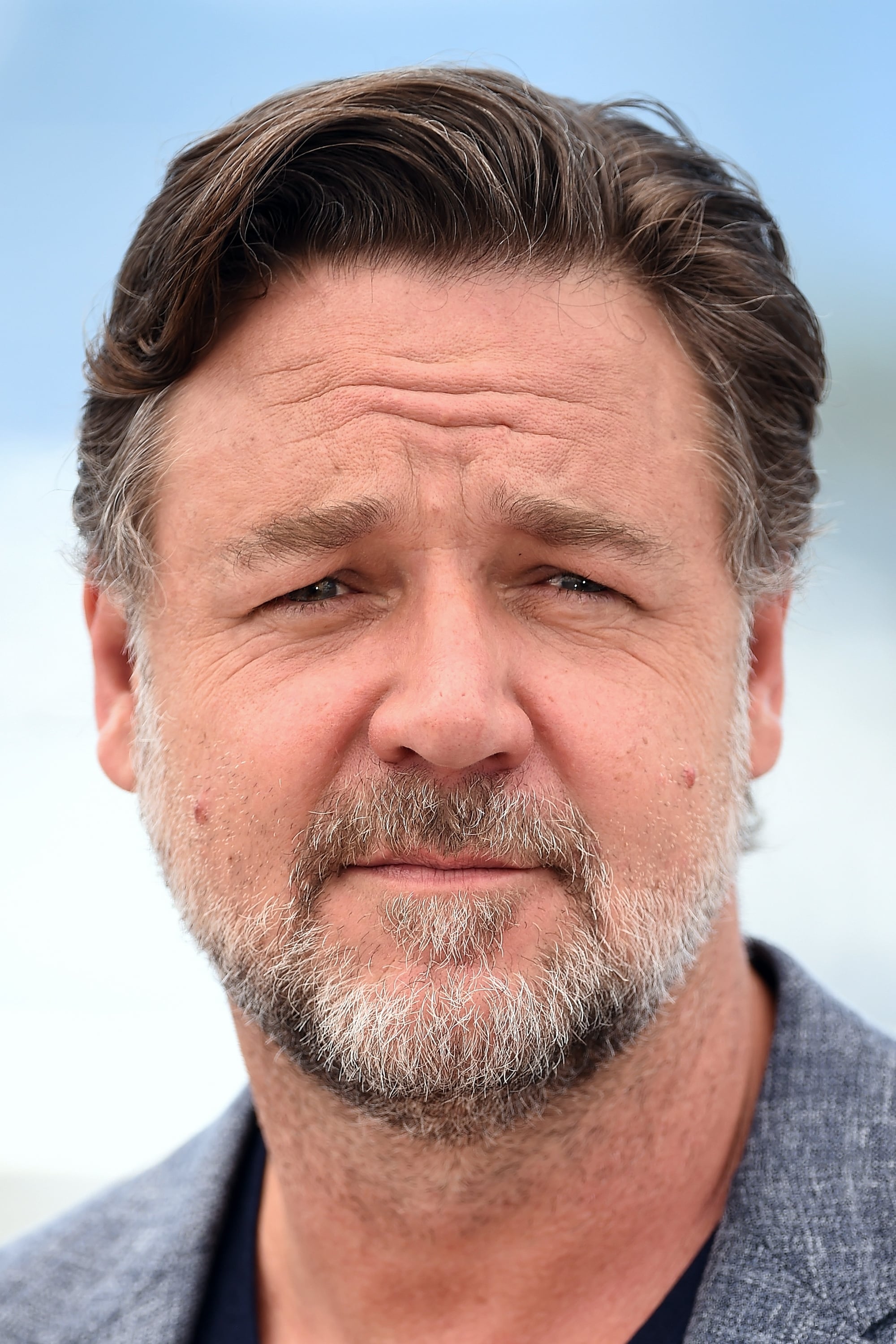

Russell Crowe

During filming of ‘Gladiator’, Russell Crowe sometimes wore an earpiece so the director could give him directions. This helped him stay completely focused during the big action sequences and emotionally charged scenes. Although he’s usually very self-directed, he’s happy to use these tools when a scene is technically complex. It ensures his acting matches up perfectly with the camera work and any visual effects.

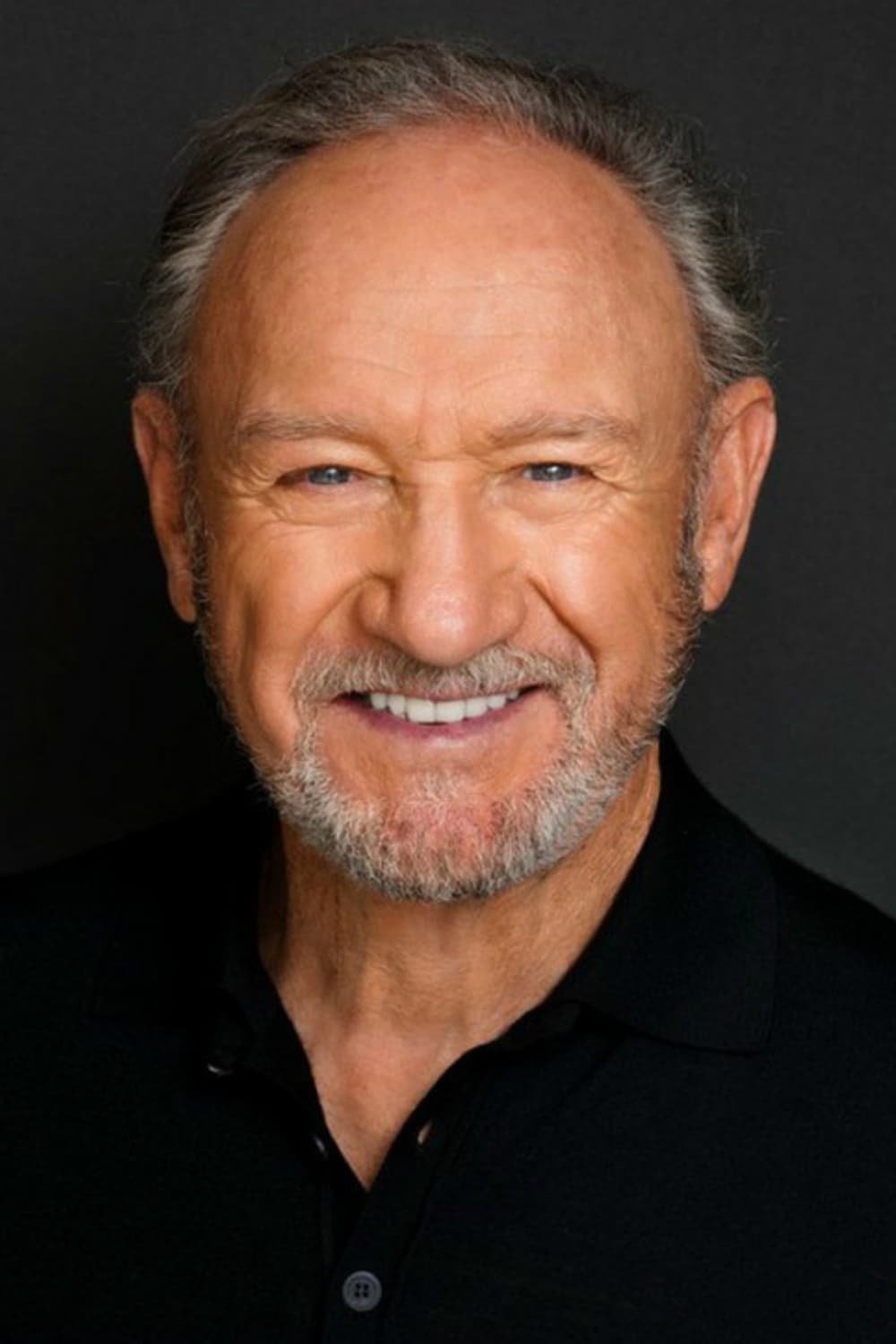

Gene Hackman

Gene Hackman was famous for thoroughly preparing for his roles, but he wasn’t afraid to deviate from the script if he thought it would improve his performance. While filming ‘The Royal Tenenbaums,’ he often challenged the formal language of the dialogue, striving to make his character sound more realistic. He’d sometimes use notes to guide him through scenes he’d adjusted. For Hackman, creating a truthful character was more important than sticking to the script word-for-word.

Liam Neeson

There have been reports that Liam Neeson uses a small earpiece during filming for his action movies. This helps him keep up with the quick pace and focus on the complex stunts and fight choreography. It’s a common practice for experienced action stars who often work on several films each year. Despite this, Neeson’s performances are still praised for being tough and believable.

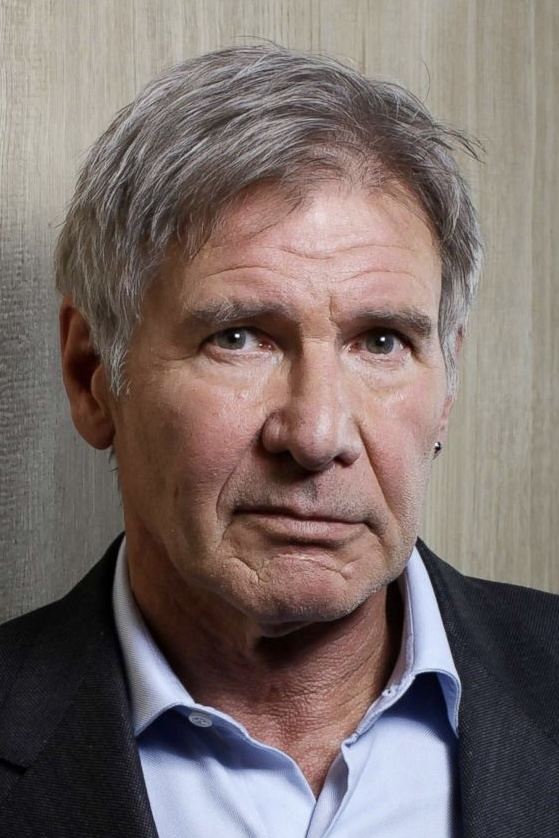

Harrison Ford

Harrison Ford sometimes uses cue cards to help him remember complicated lines in movies like ‘Star Wars’ and ‘Indiana Jones’. He’s known for getting frustrated with dense scientific or historical dialogue, and the cue cards allow him to deliver those lines convincingly. This lets him concentrate on the action and energetic performance his audience loves.

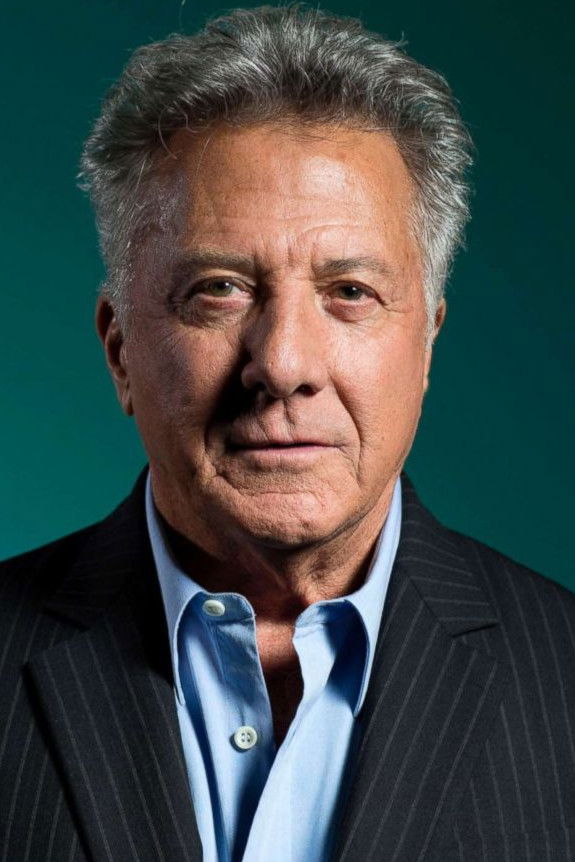

Dustin Hoffman

Dustin Hoffman often relies on notes and reminders while filming to help him fully embody his characters, especially during long shooting days. Although he’s a committed method actor, he’s found these tools can help him connect with the role. For example, while making ‘Rain Man,’ he used specific techniques to consistently recreate his character’s unique way of speaking, ensuring a believable performance throughout the entire film.

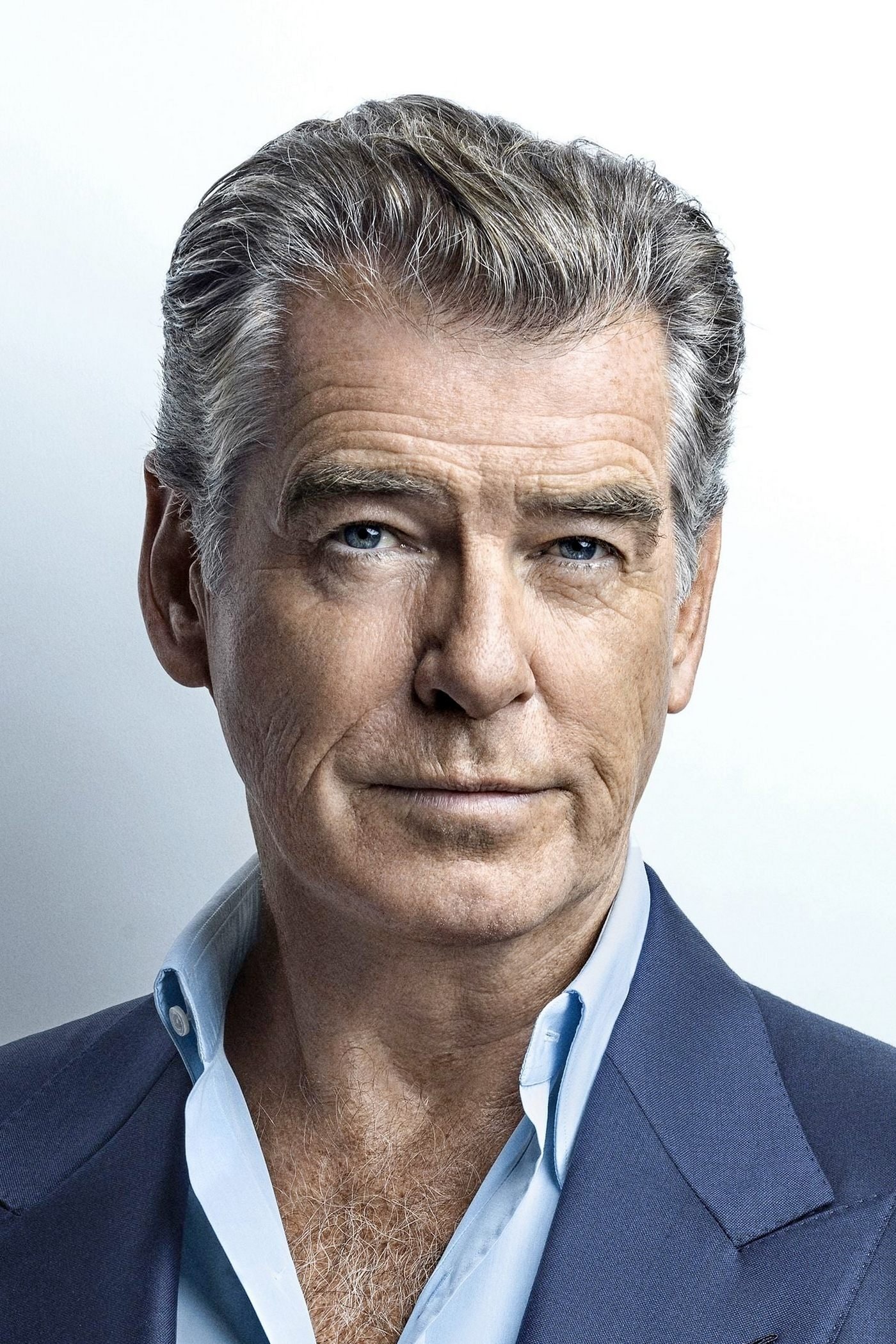

Pierce Brosnan

While filming the series ‘The Son’, Pierce Brosnan used an earpiece to help him remember all of his lines. The show had a lot of dialogue, and the earpiece allowed him to concentrate on his character and the story, rather than struggling to recall the words. The production team appreciated this, as it helped keep the filming process on track and efficient.

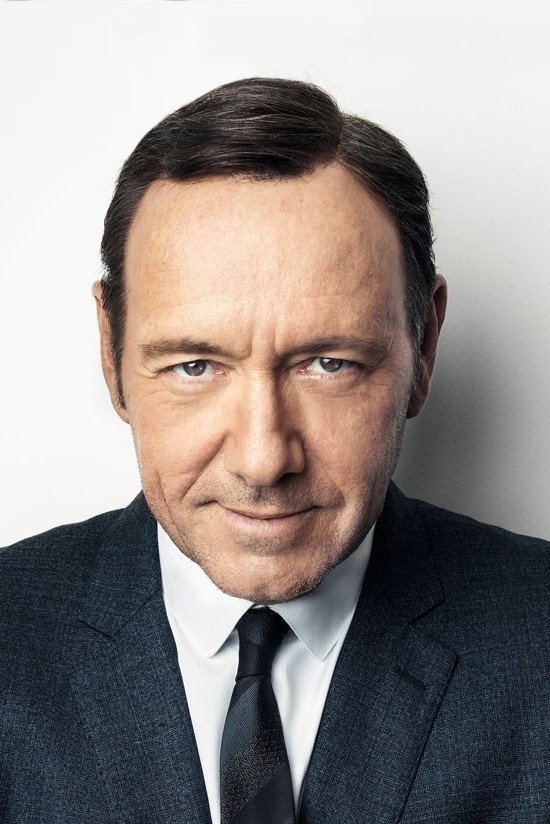

Kevin Spacey

Kevin Spacey frequently used hidden earpieces while filming to help him with difficult lines. This allowed him to keep a consistent rhythm, especially during lengthy or emotionally charged scenes. He believed these tools were essential for actors facing demanding work conditions. Surprisingly, many of his fellow actors didn’t even realize he was using them, as his performances still appeared completely natural.

Anthony Quinn

In the later years of his celebrated film career, Anthony Quinn began using cue cards to help him remember his lines. This allowed him to continue playing strong, impactful characters even into his eighties. He was a dedicated professional and used the cards to keep filming on schedule. Despite needing a little help, his on-screen presence remained as impressive and powerful as always.

Kirk Douglas

As Kirk Douglas got older, he started using cue cards on film sets to help him remember his lines. He was committed to continuing his acting career, and these cards became crucial for him to perform well. Despite needing a little help, he still delivered incredibly powerful and passionate performances. He’s remembered as one of Hollywood’s most admired actors, known for his determination and skill.

Paul Newman

As Paul Newman got older, he sometimes used cue cards to help him remember lines for certain scenes. Despite being known for thoroughly preparing for his roles, he wasn’t hesitant to use these aids if he thought they would make his performance better. This allowed him to concentrate on the subtle details of his character and how he interacted with other actors. Even later in his career, his work continued to be praised by critics and earned him award nominations.

Laurence Olivier

As Laurence Olivier’s health declined late in his career, he started using prompts and cue cards to help him remember lines. Even though he was widely considered one of the best actors ever, he wasn’t afraid to use practical tools to assist his performances. He relied on these aids during challenging roles, such as in ‘The Boys from Brazil’, and still convincingly portrayed characters even without memorizing everything perfectly.

Gregory Peck

In his later roles, Gregory Peck quietly used cue cards to help him remember his lines, maintaining the polished performance he was known for. Despite his age, he still possessed a strong and dignified voice. He was a consummate professional, always dedicated to delivering his best work and willing to use any technique to achieve that, and his preparation on set was legendary.

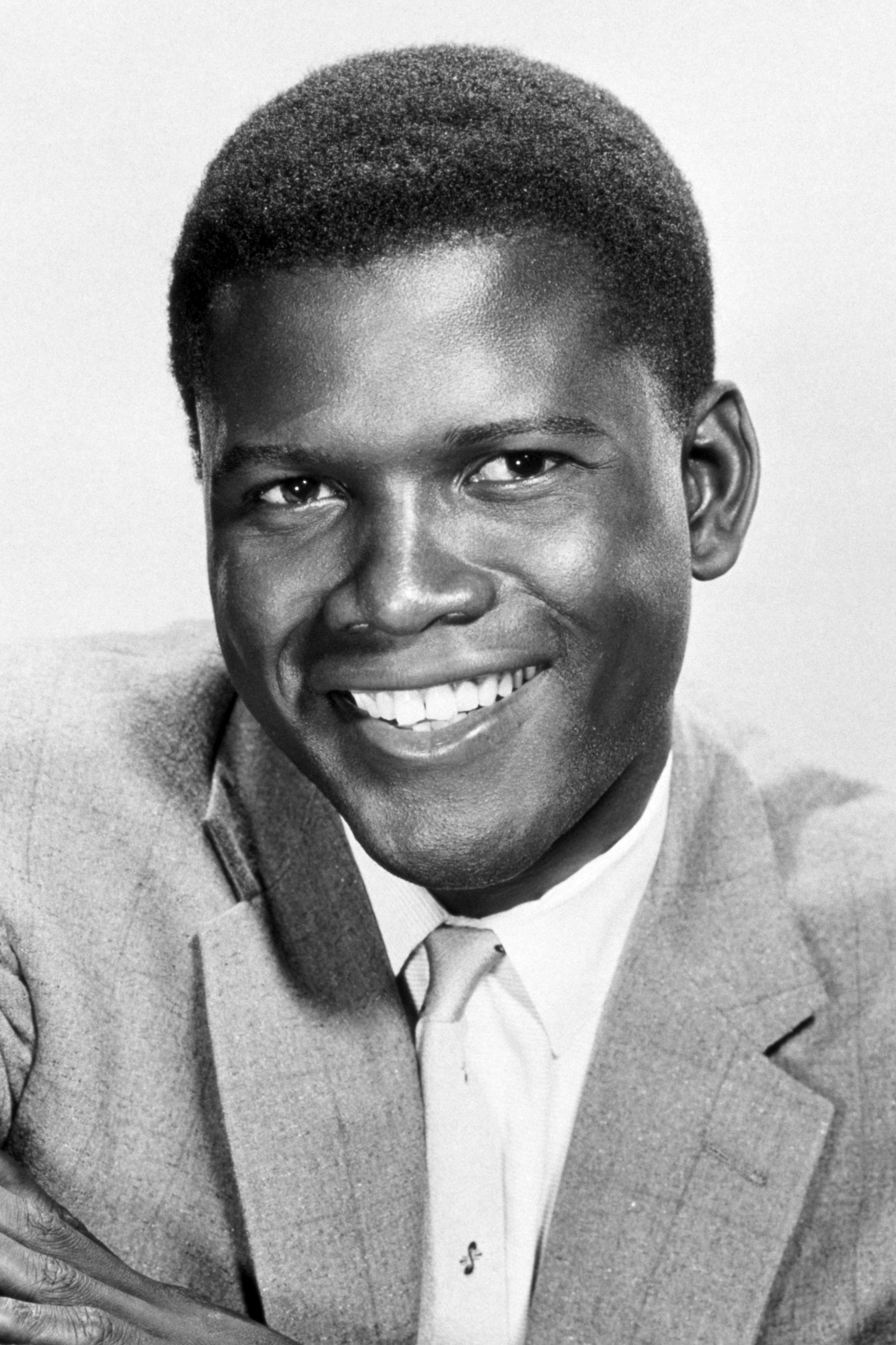

Sidney Poitier

As Sidney Poitier appeared in more television movies and films later in his career, he began using tools to help him remember his lines. Despite this, he remained a powerful and captivating actor, committed to delivering perfect performances. He was deeply admired by fellow actors and consistently found ways to adjust to the evolving film industry. These aids never overshadowed his remarkable talent or his pioneering achievements.

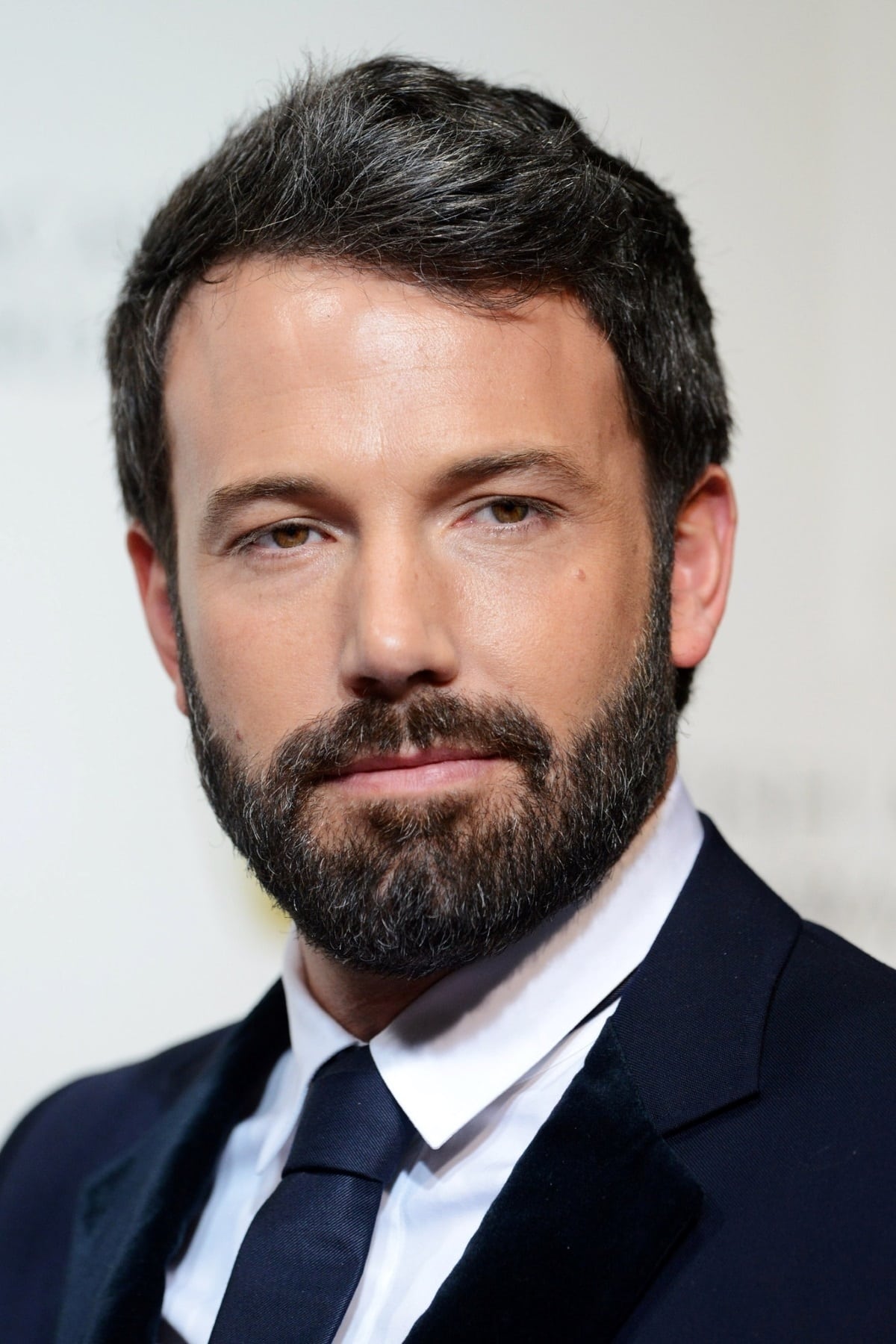

Ben Affleck

Ben Affleck sometimes uses hidden cue cards during scenes with lots of fast or complicated dialogue. This helps him stay focused and maintain the flow of the scene, especially when he’s also directing. These cards give him more freedom to adapt to changes made on set at the last minute, making it easier to handle all his different roles during filming.

Tom Hardy

Tom Hardy sometimes uses small earpieces while acting to help him get into character, especially when a role requires a distinct voice or speaking style. He’s explained that hearing prompts or even his own pre-recorded lines in his ear helps him stay focused. For example, while filming ‘Venom,’ he used technology to convincingly portray the connection between his character and the symbiote’s voice. This innovative technique allows him to deliver the detailed and nuanced performances he’s become known for.

Joaquin Phoenix

Joaquin Phoenix is famous for his unique acting approach, often prioritizing genuine emotion over sticking to the script. He prefers to collaborate with directors who give him creative freedom, allowing him to develop scenes organically. During filming of ‘Joker,’ he frequently made up lines and changed the dialogue to more accurately portray the character’s inner turmoil. This willingness to deviate from the written words is central to his deeply committed and realistic performances.

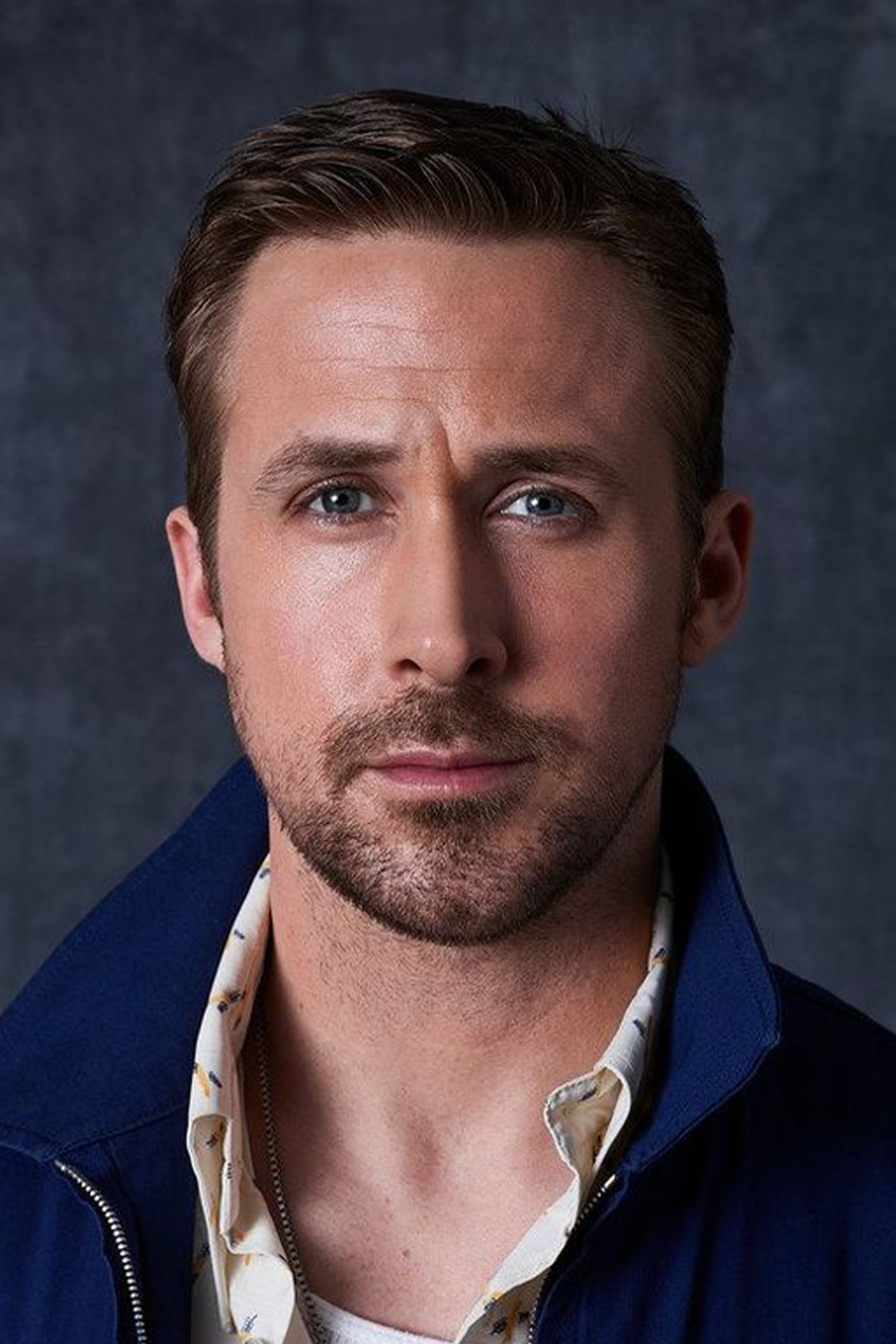

Ryan Gosling

Ryan Gosling frequently likes to add his own lines and ideas to scenes, making his performances feel more realistic and personal. He often views scripts as a starting point rather than something to follow exactly. For example, in ‘The Place Beyond the Pines,’ he improvised to create genuine chemistry with his fellow actors. This allows him to bring his own individual style and energy to each character he portrays.

Peter Sellers

Peter Sellers was a brilliantly spontaneous comedian who often felt limited by written scripts. He frequently changed scenes on set, performing them in his own unique way. While filming ‘Dr. Strangelove,’ he largely created his lines and character on the spot. This willingness to deviate from the script led to some of the most memorable scenes in movie history.

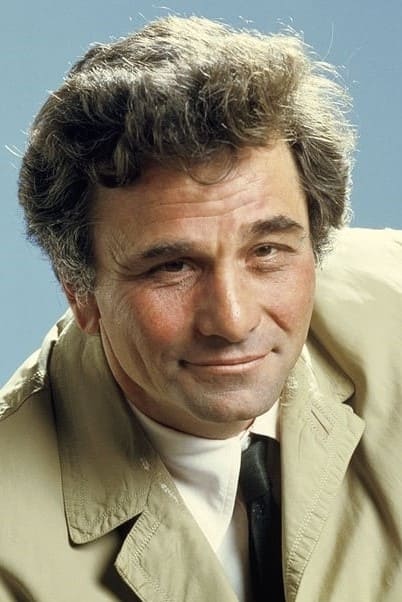

Peter Falk

Throughout his career, Peter Falk relied heavily on cue cards while filming both his TV series and movies. He cleverly concealed these lines within his character’s famous raincoat or amongst objects on set. This allowed him to convincingly portray the forgetful and confused Lieutenant Columbo, even while reading his lines. He was so good at hiding his use of prompts that it became a natural part of his acting.

Christopher Walken

Christopher Walken has a distinctive approach to acting. Instead of memorizing lines as they’re written, he focuses on each word individually to find his own natural rhythm when speaking. This often means he doesn’t follow the script exactly, resulting in the unique and recognizable way he delivers dialogue. Most directors understand this and allow him the freedom to interpret his lines in his own style.

Tell us which of these actors surprised you most in the comments.

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2026-02-27 03:22