It’s not uncommon for actors to become screenwriters, and many famous stars secretly contribute to big movie scripts. Some actors receive credit for writing, while others work anonymously as “script doctors” – fixing and improving existing scripts – or under pen names so their work can be evaluated fairly. They might polish dialogue, rework the plot, or completely change characters, especially in popular franchises. Looking at which celebrities contribute to writing reveals how much collaboration and behind-the-scenes work goes into making movies in Hollywood.

Carrie Fisher

She was a highly sought-after script doctor in Hollywood, secretly rewriting parts of many popular movies. She helped improve the dialogue and characters in films like ‘Hook’, ‘Sister Act’, and ‘The Wedding Singer’. Studios often brought her in to add humor and cleverness to scripts that weren’t quite working. Though she rarely got official credit, her contributions significantly shaped some of the biggest hits of the 1990s.

Wentworth Miller

Wentworth Miller, known for his role in ‘Prison Break,’ shocked many by writing the psychological thriller ‘Stoker.’ He used the pen name Ted Foulke so producers would judge the script based on its merits, without knowing he was an actor. The script made it onto the 2010 Black List, a prestigious collection of top unproduced screenplays. Miller has explained that writing gave him a chance to express his creativity in a new way within the film industry.

Justin Theroux

Justin Theroux is known as an actor in shows like ‘The Leftovers’ and ‘Mulholland Drive,’ but he’s also a successful screenwriter. He helped write the comedy ‘Tropic Thunder’ with Ben Stiller and Ethan Cohen, and he was the sole writer for the Marvel film ‘Iron Man 2.’ He’s also contributed to movies like ‘Rock of Ages’ and ‘Zoolander 2’.

Paul Rudd

Paul Rudd often helps write the movies he’s in, especially those in the Marvel Cinematic Universe. He officially received writing credit for ‘Ant-Man’ after significantly revising the first version of the script with Adam McKay, and he also contributed to the writing of ‘Ant-Man and the Wasp,’ working with a team to keep the movies funny. He generally focuses on making his superhero characters more down-to-earth and relatable.

Rashida Jones

Rashida Jones is well-known for her acting role in ‘Parks and Recreation’, but she’s also a successful screenwriter. She co-wrote and starred in the movie ‘Celeste and Jesse Forever’ with Andy Samberg, and contributed to the story of the hit Pixar film ‘Toy Story 4’. Her writing credits also include episodes of ‘Black Mirror’, and she was an executive producer and writer for the show ‘Angie Tribeca’.

Phoebe Waller-Bridge

Phoebe Waller-Bridge, the writer behind ‘Fleabag’, was brought in to refine the script for the latest James Bond film, ‘No Time to Die’. Daniel Craig specifically asked her to update the dialogue and create more well-developed female characters. This was an unusual opportunity, as very few women have contributed to writing the 007 movies. Waller-Bridge’s unique writing style helped blend the classic action of Bond with more modern and relatable characters.

Edward Norton

I always thought Edward Norton brought something special to ‘The Incredible Hulk,’ and I recently learned it was because he basically rewrote the whole script, even though he didn’t get official credit for it! Apparently, he really wanted to make Bruce Banner a more complex, tragic figure, and everyone on set was talking about how much he improved the story. It’s cool to see that’s something he consistently does – he really cares about making a good, well-structured narrative in all his films.

Patton Oswalt

Beyond performing stand-up and acting, he’s a highly requested script consultant for big Hollywood comedies and animated movies. He secretly rewrites jokes to make them funnier in many expensive films. His talent for writing fast-paced, witty dialogue is incredibly helpful to studios as they finish their scripts. Oswalt’s writing often goes unnoticed, but it’s a key ingredient in the success of several popular comedies today.

Donald Glover

Before becoming a well-known actor and musician as Childish Gambino, Donald Glover started his career as a writer on the NBC show ’30 Rock’. He was hired by Tina Fey at just 23 years old because she was impressed with his comedy sketches from his time with the Derrick Comedy group. He wrote for the show for several seasons, then moved into a recurring acting role on ‘Community’. Glover eventually used his writing and creative experience to create, write, and direct the critically acclaimed series ‘Atlanta’.

Owen Wilson

Owen Wilson began his career as a key writing collaborator with director Wes Anderson. Together, they wrote Anderson’s first three films: ‘Bottle Rocket’, ‘Rushmore’, and ‘The Royal Tenenbaums’. Their screenplay for ‘The Royal Tenenbaums’ earned them an Academy Award nomination. While Wilson is now known mostly as an actor, his early writing was instrumental in shaping the unique and distinctive style of Anderson’s movies.

Jason Segel

Jason Segel didn’t wait for opportunities – he created them. He wrote the popular comedy ‘Forgetting Sarah Marshall’ and spent years convincing studios to bring back ‘The Muppets,’ eventually co-writing and executive producing the 2011 film with Nicholas Stoller. Segel’s work is known for mixing edgy humor with genuine heart, often including musical numbers.

Jonah Hill

Over ten years, Jonah Hill successfully moved from being known as a funny actor to a well-regarded writer and director. He helped write the screenplays for the popular movies ’21 Jump Street’ and ’22 Jump Street,’ and was key in changing them from a realistic cop show into a humorous, self-aware action comedy. More recently, he wrote and directed ‘Mid90s,’ a coming-of-age drama that received a lot of positive reviews.

Tina Fey

As a movie fan, I’m always impressed by writers who really leave a mark, and Tina Fey is definitely one of them. She wrote ‘Mean Girls,’ which basically became the 2000s – everyone was quoting that movie! It’s amazing to think she turned a parenting book, ‘Queen Bees and Wannabes,’ into that iconic film. But her talent doesn’t stop there. She also ran the show at ‘Saturday Night Live’ and created ’30 Rock,’ which is hilarious. What I love about her writing is how smartly she skewers society, and the jokes just come at you non-stop – it’s brilliantly paced comedy.

Seth Rogen

Seth Rogen and his frequent collaborator, Evan Goldberg, started writing the movie ‘Superbad’ when they were still in high school. They went on to create other popular comedies together, like ‘Pineapple Express’, ‘The Interview’, and ‘This Is the End’. Rogen often writes his own movies, which lets him craft jokes perfectly suited to his comedic style. He’s had a major influence on how R-rated comedies with large casts are made today.

Kristen Wiig

Kristen Wiig co-wrote the hit movie ‘Bridesmaids’ with Annie Mumolo in 2011. The film was a huge success with both critics and audiences, and Wiig even received an Academy Award nomination for the screenplay. ‘Bridesmaids’ was especially important because it showed that comedies starring women and featuring mature content could be very popular and profitable. Since then, Wiig has continued to create and develop her own projects for film and TV.

Bill Hader

Bill Hader is famous for his work on ‘Saturday Night Live’, but he’s also been a writer and creative consultant for ‘South Park’ since 2008, often contributing to their story ideas. He’s also the co-creator, writer, and director of the dark comedy series ‘Barry’. His writing style is known for blending realistic, dramatic moments with unexpected, surreal humor.

Steve Carell

I’ve always been fascinated by Steve Carell’s creative process. It’s amazing to me that ‘The 40-Year-Old Virgin,’ the movie that really put him on the map, started with a character he developed while doing improv at Second City, and he co-wrote the script with Judd Apatow! Beyond that, he’s a seriously talented comedy writer for TV too – he penned some of the most memorable episodes of ‘The Office’ like ‘Casino Night’ and ‘Survivor Man.’ What I really appreciate about his work is how he finds humor in the little awkward moments and vulnerabilities that everyone experiences – it feels so relatable.

George Clooney

George Clooney has become a highly respected screenwriter, known for tackling political and historical subjects. He received an Academy Award nomination for co-writing ‘Good Night, and Good Luck,’ and also co-wrote the historical film ‘The Monuments Men’ and the screenplay for ‘Suburbicon.’ His work often delves into the intricacies of American history and the responsibilities of the media.

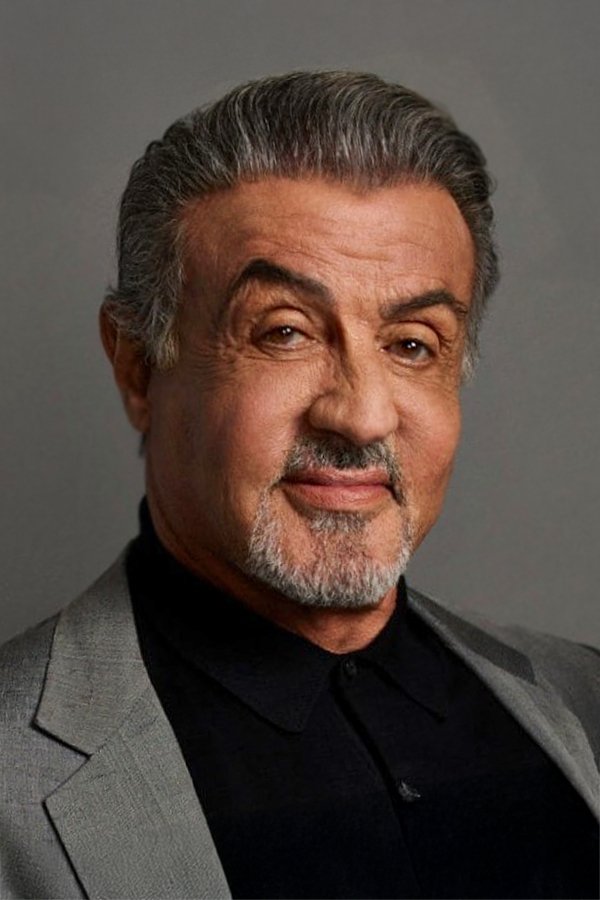

Sylvester Stallone

Sylvester Stallone famously wrote the screenplay for ‘Rocky’ in just three days while struggling financially. He made a bold move by insisting on starring in the film himself, a risk that ultimately paid off with an Academy Award for Best Picture. Since then, Stallone has written or helped write most of the movies in both the ‘Rocky’ and ‘Rambo’ series, making him one of the rare actors who’s penned the scripts for multiple blockbuster franchises earning billions of dollars.

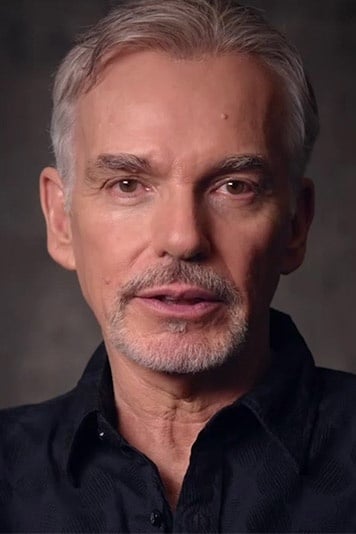

Billy Bob Thornton

Billy Bob Thornton wrote the screenplay for the acclaimed 1996 film Sling Blade, winning an Academy Award for his work. The film was based on a play he originally wrote himself, and he spent years developing the character of Karl Childers. He also co-wrote the thrillers One False Move and the drama The Gift. Thornton’s writing is recognized for its authentic Southern flavor and the deeply developed, often heartbreaking, characters he creates.

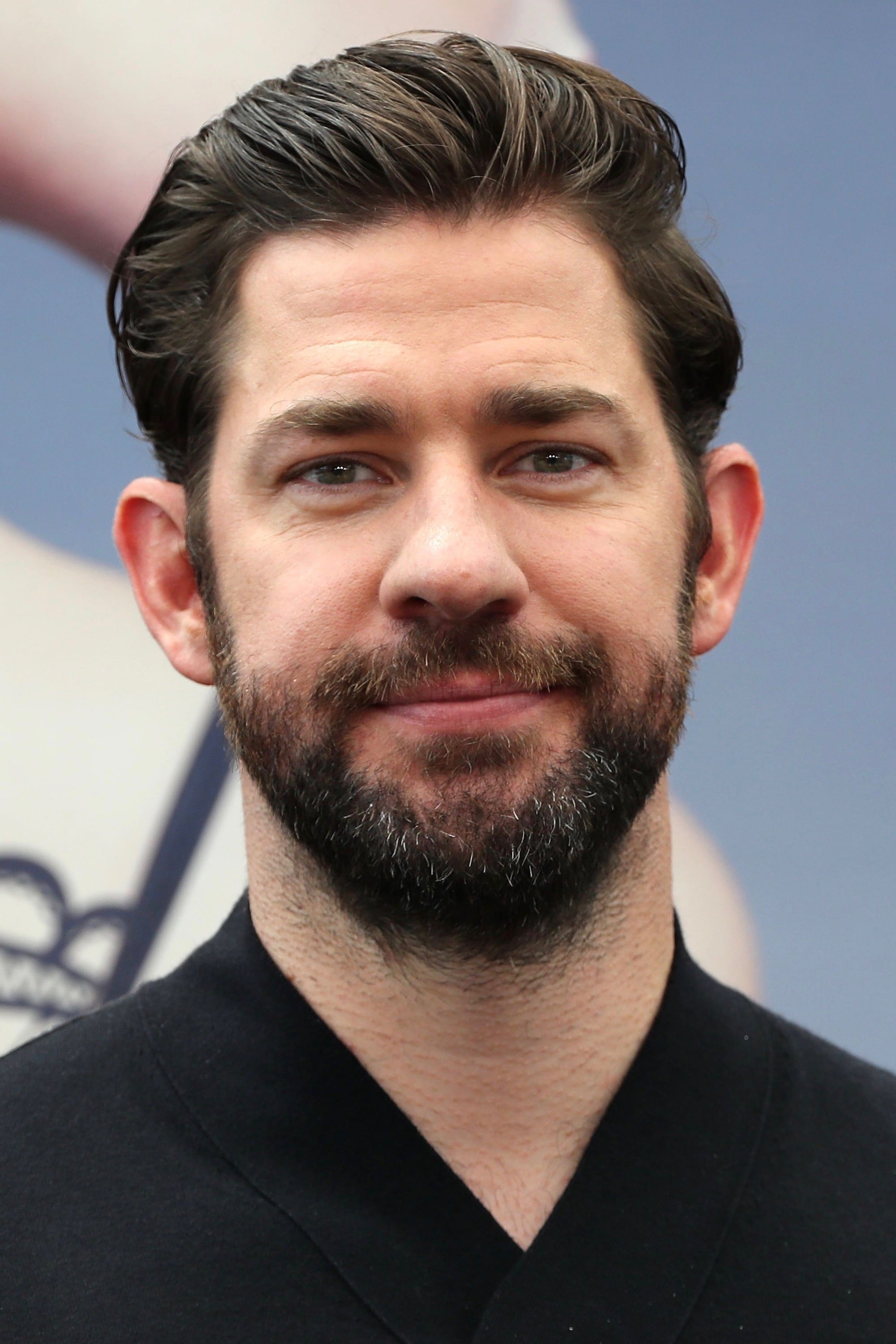

John Krasinski

John Krasinski heavily revised the original script for ‘A Quiet Place’ after becoming the director and lead actor. He changed the story’s emphasis to focus more on the family’s relationships and emotions, rather than simply creating scares. He shared the screenplay credit for the first movie and then wrote the entire script for ‘A Quiet Place Part II’ himself. Critics have consistently praised his writing for its masterful use of silence and visual cues to create suspense.

Bradley Cooper

Bradley Cooper spent several years writing the screenplay for the 2018 film ‘A Star Is Born’ with Eric Roth and Will Fetters. He wanted to modernize the story by portraying the music industry and battles with addiction in a genuine way. His scriptwriting earned him an Oscar nomination for Best Adapted Screenplay, and he even learned to play instruments and sing to make the film’s musical aspects believable.

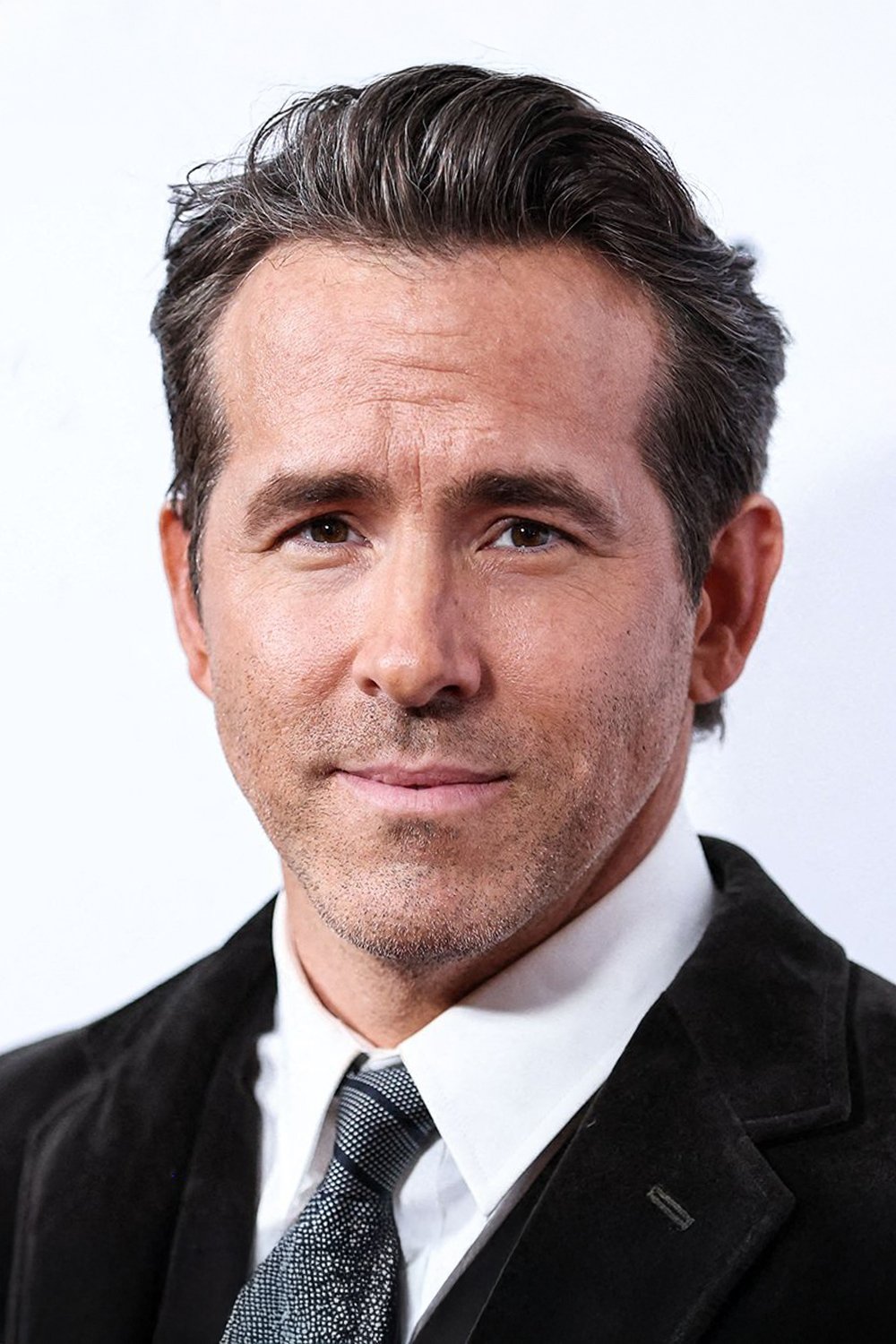

Ryan Reynolds

Ryan Reynolds is a key creative force behind the ‘Deadpool’ movies. He officially received writing credit on ‘Deadpool 2’ after collaborating with writers Rhett Reese and Paul Wernick. He’s particularly known for crafting Deadpool’s witty, self-aware humor and the character’s tendency to break the fourth wall. Reynolds’s contributions are essential to maintaining the unique, playful style that defines the films.

Joel Edgerton

I’ve been really impressed with Joel Edgerton’s work. He’s become a major writer and director, and his scripts are consistently praised. I especially enjoyed that he not only wrote ‘The Gift’ and ‘The King,’ but also acted in both of them! He also wrote the screenplay for ‘Boy Erased,’ which was based on a really powerful memoir. What I find most compelling about his writing is that he doesn’t shy away from complicated moral issues and really delves into the complexities of what makes people tick.

Zoe Kazan

Zoe Kazan wrote the screenplay for the popular independent film ‘Ruby Sparks’, which cleverly examines how we try to control our creations and project our ideal partners onto others. The film was praised for its fresh perspective on a common movie storyline – the ‘magical girlfriend’. She later collaborated with director Paul Dano to adapt ‘Wildlife’. With a family history of writers, Kazan has established herself as a perceptive and insightful voice in modern filmmaking.

Lake Bell

Lake Bell is a writer and director known for her witty and insightful comedies. She gained recognition for ‘In a World…’, a film about the unusual world of movie trailer voice-over artists, which won a screenwriting award at Sundance. She followed that up with ‘I Do… Until I Don’t’, a comedy exploring relationships. Bell’s work often delves into the details of how people connect and focuses on interesting, lesser-known communities.

Brit Marling

Brit Marling is a writer known for her work on thought-provoking science fiction films like ‘Another Earth’ and ‘Sound of My Voice’, which she co-wrote. She frequently teams up with director Zal Batmanglij, and together they create ambitious stories without relying on huge budgets. Marling also co-created and wrote the Netflix series ‘The OA’, a complex show that ran for two seasons. Her writing often combines philosophical ideas with elements of science fiction.

Mindy Kaling

Mindy Kaling began her career at 24, writing and performing on the American version of ‘The Office’. She contributed to some of the show’s most memorable episodes, like ‘The Injury’ and ‘Niagara’. Later, she created and wrote ‘The Mindy Project’ and wrote the movie ‘Late Night’. Her work often uses humor to explore career goals and the ups and downs of relationships.

Chris Rock

Chris Rock is a writer and director known for projects like the 2014 film ‘Top Five,’ which tells the story of a comedian trying to be taken seriously as an actor. He also wrote the documentary ‘Good Hair,’ examining the importance of hair in African American culture and its effect on the community. Throughout his career, Rock has consistently written his own material for television shows like ‘The Chris Rock Show’ and ‘Everybody Hates Chris.’ His work is celebrated for its clever observations and insightful commentary on society.

Ben Stiller

Throughout his career, Ben Stiller has consistently worked as a writer, helping create the screenplays for popular comedies like ‘Zoolander’ and ‘Tropic Thunder’. He often teams up with other writers to build the funny, often exaggerated worlds seen in his movies. He also co-wrote ‘The Cable Guy’ and played a key role in creating ‘The Ben Stiller Show’. A common theme in his writing is poking fun at the silliness and self-importance often found in Hollywood.

Angelina Jolie

Angelina Jolie began her career as a screenwriter in 2011 with the film ‘In the Land of Blood and Honey’. She secretly developed the script to thoughtfully examine the impact of the Bosnian War on people’s lives. Later, she adapted Loung Ung’s memoir into the screenplay for ‘First They Killed My Father’. Throughout her writing, Jolie frequently explores difficult humanitarian issues and the strength people demonstrate in the face of adversity.

Greta Gerwig

Greta Gerwig began her career co-writing independent films like ‘Hannah Takes the Stairs’ and later collaborated with Noah Baumbach on ‘Frances Ha’ and ‘Mistress America’. She then wrote the critically acclaimed screenplay for ‘Lady Bird’, a semi-autobiographical story about her own life. Gerwig’s writing is known for realistic conversations and insightful portrayals of women’s relationships with each other and their families.

Julie Delpy

Julie Delpy co-wrote the screenplays for the popular romantic films ‘Before Sunset’ and ‘Before Midnight’ alongside Ethan Hawke and Richard Linklater. They worked together in a way that let the actors bring their own lives and real feelings about relationships to the dialogue. Delpy has also written and directed her own films, including the ‘2 Days in Paris’ series and the historical drama ‘The Countess’. Her work often realistically portrays both the funny and challenging sides of long-term relationships.

Ethan Hawke

Ethan Hawke is known for his work as a writer, notably co-writing the screenplays for the ‘Before’ trilogy and crafting its thoughtful conversations. Beyond that, he’s penned two novels and adapted the film ‘Blaze’. He also wrote and directed the independent film ‘Chelsea Walls’. His writing style is often considered literary and deeply focused on the inner worlds of his characters.

Daniel Craig

When the writers went on strike in 2007-2008, Daniel Craig and director Marc Forster had to finish the script for ‘Quantum of Solace’. Production started before the script was fully done, so Craig ended up helping to rewrite scenes during filming. He admitted it was a really tough experience, and emphasized he wasn’t a trained writer. Even so, his work was crucial to getting the movie finished.

Emma Thompson

Emma Thompson spent five years writing the screenplay for the film adaptation of Jane Austen’s ‘Sense and Sensibility,’ and her work was highly praised. She won an Academy Award for Best Adapted Screenplay in 1996 for it. She also wrote the screenplays for the ‘Nanny McPhee’ films. Thompson is rare among artists, having won Oscars for both her acting and her writing.

Vin Diesel

Vin Diesel began his career making short films, including ‘Multi-Facial’, which he wrote, directed, and acted in. He then directed and wrote the feature film ‘Strays’. This early work impressed Steven Spielberg, leading to Diesel’s role in ‘Saving Private Ryan’. Today, Diesel continues to help shape the stories for the ‘Fast & Furious’ and ‘Riddick’ film series.

Dan Aykroyd

Dan Aykroyd was the main writer behind the first ‘Ghostbusters’ movie, originally envisioning it as a much scarier story. He teamed up with Harold Ramis to transform it into the hilarious supernatural comedy that became a worldwide hit. He also co-wrote beloved films like ‘The Blues Brothers’ and ‘Spies Like Us.’ Aykroyd’s writing style frequently blends imaginative science fiction or fantasy elements with dry, understated humor.

Harold Ramis

Harold Ramis was a hugely successful comedy writer who helped create some of the most memorable films of the late 1900s, including ‘National Lampoon’s Animal House,’ ‘Caddyshack,’ ‘Stripes,’ and ‘Ghostbusters.’ He also co-wrote and directed ‘Groundhog Day,’ a movie often praised for its brilliant script. His films frequently touched on ideas about people finding themselves and the humor in challenging those in power.

Share your thoughts on these surprising celebrity writing credits in the comments.

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2026-02-26 23:50