The market, my dears, is a most capricious mistress. As of late, the so-called “Magnificent Seven” – Nvidia, Alphabet, Apple, Microsoft, Amazon, Meta Platforms, and Tesla – have begun to resemble less a portfolio of prosperity and more a collection of fading portraits. They’ve underperformed the S&P 500, a circumstance that proves, yet again, that even the most celebrated beauties eventually lose their luster. To believe otherwise is to mistake momentum for permanence, a folly common to both investors and optimists.

One seeks, naturally, a return on investment, a gentle trickle of income to soothe the anxieties of existence. And amongst these titans, one finds a glimmer of genuine value, a prospect worthy of consideration. While the herd chases the latest bauble, the discerning eye rests upon Meta Platforms. It is a company that understands, with a pragmatism sadly lacking elsewhere, that true wealth lies not in innovation alone, but in its profitable application.

Meta Platforms: A Conviction, Not a Craving

The cloud, you see, is merely a new vessel for an old desire: the accumulation of data. Amazon and Microsoft build the infrastructure, certainly, but it is Meta that understands how to use it, to translate fleeting attention into enduring revenue. They are not merely selling space on a server; they are selling access to the very habits and desires of humanity. A far more lucrative proposition, wouldn’t you agree?

These other cloud behemoths, preoccupied with capital expenditure, remind one of a man building a grand ballroom, only to discover he has no guests. Oracle, burdened by debt, is a particularly tragic figure, a cautionary tale of ambition exceeding resources. The market, ever unforgiving, will not reward extravagance without commensurate returns.

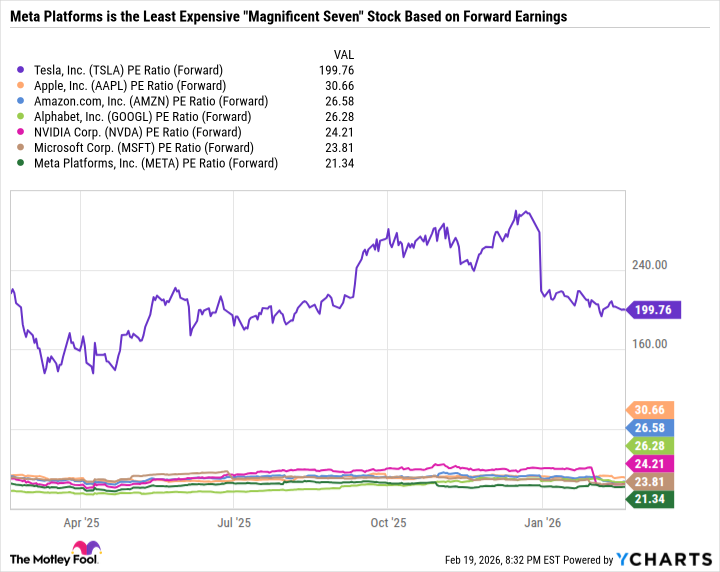

Meta’s approach to artificial intelligence is refreshingly direct. They aren’t chasing the fantastical; they are improving the existing, refining the profitable. Their LLaMA model, freely available, is a stroke of genius – a calculated generosity that fosters dependence. It is a lesson in power: give a little to gain much. And at a forward earnings multiple that doesn’t induce palpitations, Meta offers a rare combination of growth and value – a siren song to the sensible investor.

Tesla: A Promise Deferred, a Dividend Denied

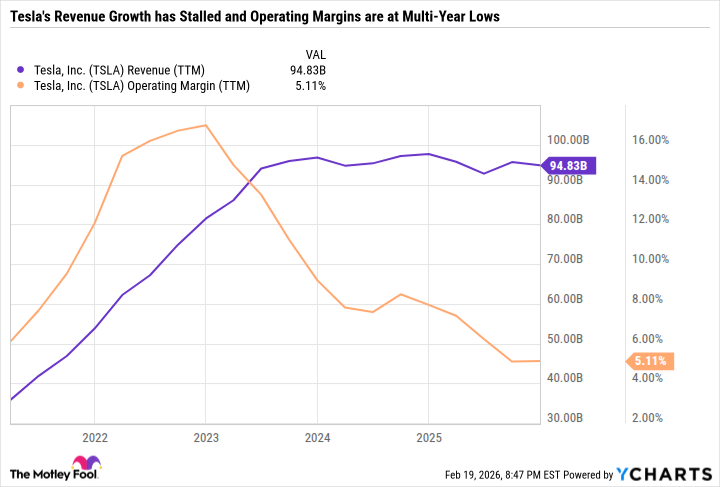

Tesla, alas, is a different story. It is a company built on aspiration, on the promise of a future that remains stubbornly out of reach. Its electric vehicle business, once a cash cow, is now showing signs of fatigue. The energy and services segments are promising, but hardly sufficient to justify the current valuation. To mistake hype for substance is a common, and often costly, error.

The talk of robotaxis and Optimus robots is, frankly, diverting. It is the sort of grand vision that appeals to dreamers, but rarely translates into dividends. To rely on the potential of a technology is to gamble on a ghost. One might as well invest in the pursuit of perpetual motion.

Tesla’s market capitalization, comparable to Meta’s, is a testament to the power of narrative, not necessarily financial performance. Meta generates billions in net income; Tesla, a mere trickle. The disparity is… striking. It proves, once again, that the market is driven by hope, not always by reason.

Tesla possesses potential, undoubtedly. But so much must go right, so many promises must be fulfilled, just to justify the existing valuation. Until then, there are far more sensible investments to be made. One seeks not merely growth, but a return on investment, a tangible reward for one’s patience. And in that regard, Tesla, for the moment, remains a tantalizing, but ultimately unrewarding, prospect.

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Silver Rate Forecast

- EUR UAH PREDICTION

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2026-02-26 22:02