In Hollywood, an actress’s relationship with her agent or manager is often key to her success. Some of these partnerships last a long time, but others fall apart quickly – sometimes due to one big error, or a pattern of bad decisions that erodes trust. Whether it’s missing out on major roles or dealing with unsuccessful films, these actresses realized they needed new representation to get their careers back on track. This list looks at stars who made the tough decision to switch teams and take control of their futures.

Taraji P. Henson

After the huge success of ‘Empire,’ Taraji P. Henson let go of her entire team because they weren’t bringing in enough opportunities. Despite being incredibly popular, she wasn’t getting major film roles or valuable endorsement deals. She felt her team wasn’t doing enough to support her, especially considering her acclaimed role as Cookie Lyon, and decided she needed completely new representation to get the career she deserved.

Rose McGowan

As a lifelong movie fan, I was really struck by Rose McGowan’s story about being sent a truly awful audition request. She got a script with a wardrobe note – can you believe it asked her to wear a tight tank top and a push-up bra to show off her cleavage? She bravely shared it online, and it perfectly illustrated how deeply ingrained sexism is in Hollywood, even from the people who are supposed to be on your side. Honestly, it made me so angry that her own agency didn’t have her back and protect her professional boundaries, which is why she immediately fired them. It just showed a complete lack of respect.

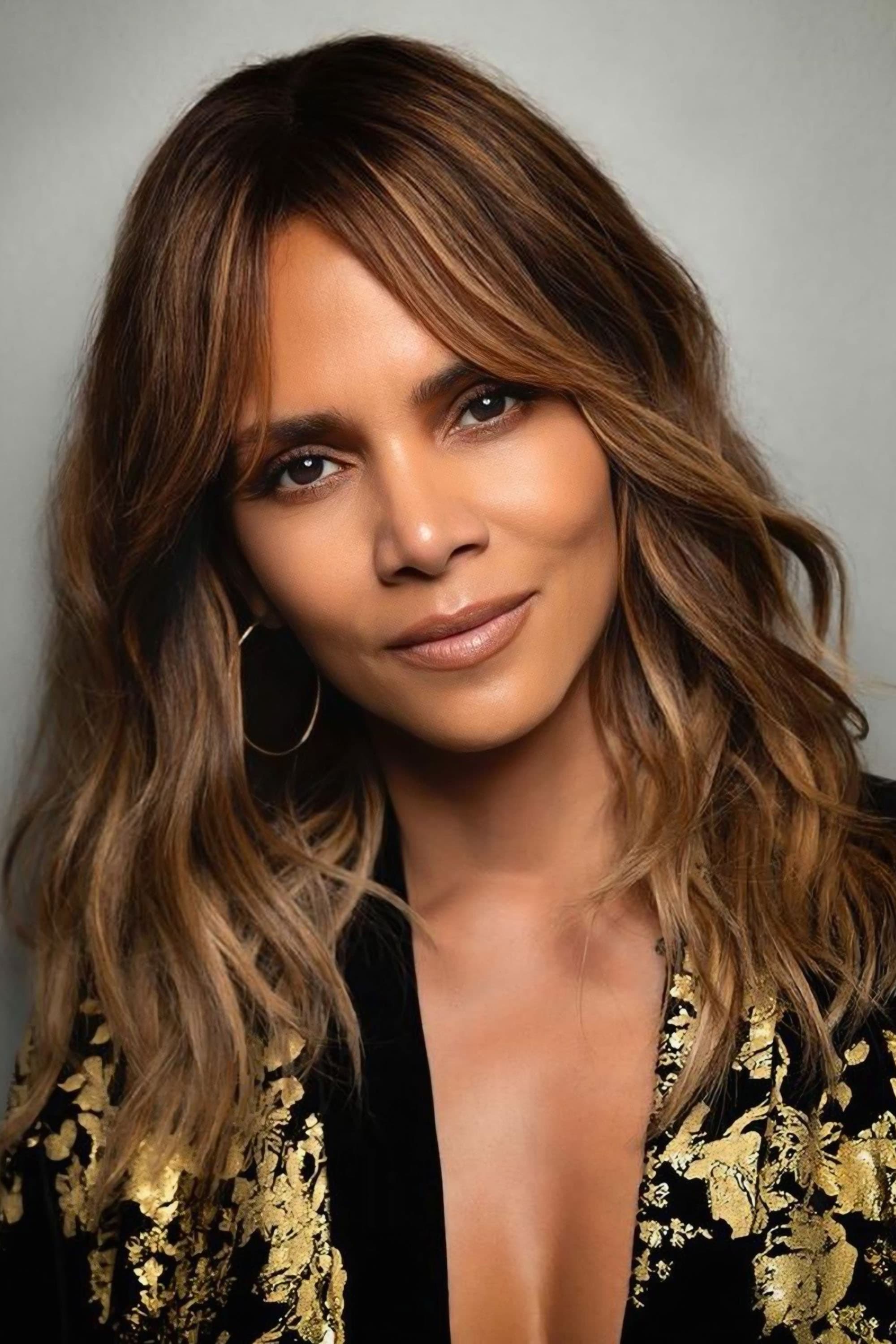

Halle Berry

After the film ‘Catwoman’ flopped both with critics and audiences, Halle Berry let go of her manager, Vincent Cirrincione. The movie, which was meant to launch a successful franchise, instead damaged her career. Berry believed the film was a bad decision and that her manager hadn’t carefully reviewed the project’s creative choices. This led her to make changes to her team and work on restoring her reputation in Hollywood.

Charlize Theron

Following the poor reception of the movie ‘Aeon Flux’, Charlize Theron ended her working relationship with her manager of many years, J.J. Harris. The film’s critical and commercial failure felt like a major disappointment after she’d won an Oscar for ‘Monster’. Theron felt her management wasn’t guiding her towards roles that aligned with her vision for a successful, lasting career. This decision proved to be a pivotal moment, as she started taking a more active role in choosing her projects.

Rachel McAdams

Rachel McAdams apparently let go of her management team after they talked her out of roles that later became huge successes. At the height of her career, she turned down leading parts in films like ‘The Devil Wears Prada’, ‘Casino Royale’, and ‘Iron Man’. Seeing how well those movies did with other actors, she realized her team’s advice wasn’t helping her reach her full potential. She then found new representation to make sure she wouldn’t miss out on big opportunities in the future.

Jennifer Lopez

In 2003, at a difficult time in her career, Jennifer Lopez made the tough decision to let go of her longtime manager, Benny Medina. After the disappointing performance of the movie ‘Gigli’ and a lot of negative press, she felt she needed a fresh start and a new approach to managing her public image. Medina had been key to her early achievements, but Lopez believed a change was necessary to get her career back on track. While they later worked together again, the initial split was a bold step to protect her career.

Katherine Heigl

Katherine Heigl made a tough choice and let her mother, Nancy, go as her manager, hoping to improve how the public saw her. For years, people in the entertainment industry had labeled her as difficult, and she believed a professional management company could better guide her career. She realized their personal and professional lives had become too intertwined, which was hurting her reputation in Hollywood. By working with a standard agency, she hoped to move past past issues and concentrate on her work as an actress.

Mo’Nique

Mo’Nique ended her relationship with her agents after a very public disagreement about how her Oscar campaign for ‘Precious’ was handled and the job offers she received afterward. She believed she was deliberately excluded from opportunities because she wouldn’t work for free to promote projects. Mo’Nique felt her team didn’t adequately support her financially or protect her reputation. This ultimately led to a long period where major Hollywood agencies wouldn’t work with her.

Mischa Barton

Mischa Barton and her mother, Nuala Barton, had a falling out that led to both a firing and a lawsuit. The actress accused her mother of secretly taking out a loan against her house and holding back money she’d earned. This happened after a difficult period in Barton’s career following her departure from the TV show ‘The O.C.’ Barton took these steps to regain control over her finances and professional life.

Leighton Meester

Leighton Meester ended her working relationship with her mother following a dispute over money. Meester had been giving her mother a substantial monthly allowance meant to cover medical bills for her brother, but discovered the money was instead used for cosmetic surgery. This betrayal of trust led Meester to cut off all professional ties and take legal action to clarify her financial rights. She then brought in a professional team to manage her career and finances.

Sharon Stone

After ‘Basic Instinct 2’ didn’t revive her career, Sharon Stone let go of her agents at CAA. Despite a lot of promotion, the sequel wasn’t well-received by audiences or critics, and Stone felt her agents hadn’t delivered on their promise of a major comeback. She’s now with a new agency, hoping to find more meaningful and challenging roles.

Hilary Swank

After winning her second Oscar for ‘Million Dollar Baby’, Hilary Swank changed agents. While critically acclaimed, she was unhappy that her agent couldn’t negotiate higher salaries for her new roles. Swank realized she was being offered less money than her male counterparts and other actors who had won Oscars. Determined to be fairly compensated, she quickly found a new agency that would better advocate for her worth.

Winona Ryder

After her 2001 shoplifting arrest and the intense media attention that followed, Winona Ryder changed talent agencies. She felt her previous team hadn’t adequately supported her during a very difficult time and lacked effective crisis management. The incident caused a break in her acting career, and she decided a new team would be better to help her rebuild it. Eventually, she found success again, notably with her role in ‘Stranger Things’.

Alicia Silverstone

After ‘Batman & Robin’ wasn’t well-received and she faced harsh media attention, Alicia Silverstone found her career stalling. She felt her agents weren’t working hard enough to help her move beyond the typecast she’d become known for in films like ‘Clueless’ and wanted roles that would show her range. This led her to let go of her existing representation and find a new team to help her pursue more challenging and independent projects.

Selena Gomez

In 2014, Selena Gomez made the difficult decision to end her professional relationship with her parents, Mandy and Brian Teefey, who had managed her career since her days on ‘Wizards of Waverly Place.’ She felt she needed the expertise of a professional management company to help her grow as an adult performer. Gomez then signed with WME and Brillstein Entertainment Partners to oversee her expanding work in both music and film, a move widely considered essential for establishing her as a major global star.

Ariel Winter

Ariel Winter, the actress from ‘Modern Family’, officially cut ties with her mother after a difficult and public disagreement about her career and personal life. Winter claimed her mother was emotionally abusive and hadn’t managed her career well. Once legally independent, she took complete control of her finances and hired new representatives, allowing her to finish ‘Modern Family’ and plan her future as she chose.

Julianna Margulies

Julianna Margulies changed agents because she was unhappy with how much she was being paid for ‘The Good Wife’. She felt her previous representation didn’t strongly advocate for her value to the show during negotiations. Margulies has always been confident about her worth and unwilling to accept less than she deserves. She found a new agency that successfully negotiated better contracts and production opportunities for her.

Jennifer Hudson

After winning an Oscar for ‘Dreamgirls’, Jennifer Hudson felt her agent wasn’t getting her the significant dramatic acting roles she deserved. She was worried they were prioritizing her music over her film career. Following her role in the ‘Sex and the City’ movie, she decided to find new representation that would focus on securing her major film roles and awards consideration. Essentially, she wanted a team that would treat her as a serious actress.

Megan Fox

After leaving the ‘Transformers’ films due to controversial comments about director Michael Bay – comments that led to her being removed from the third movie and significantly impacted her career – Megan Fox decided to start fresh with a new team of agents. She felt her previous representation hadn’t adequately defended her or helped manage the resulting negative reaction, so she switched agencies hoping to repair her public image and pursue different kinds of acting opportunities.

Tiffani-Amber Thiessen

Early in her career, Tiffani Thiessen decided to switch agents because she wasn’t getting the kinds of roles she wanted. After becoming known for shows like ‘Saved by the Bell’ and ‘Beverly Hills, 90210,’ she aimed for more mature, dramatic parts, but felt her agent was limiting her to teen roles. She took charge and found new representation who helped her land roles in shows like ‘White Collar,’ ultimately allowing her to have a long and successful career.

Elizabeth Taylor

Elizabeth Taylor was famous for being a tough negotiator, and she didn’t hesitate to fire her agents if they didn’t get her what she wanted. She demanded – and received – incredibly high salaries, like the million dollars she earned for the film ‘Cleopatra’. If an agent wasn’t aggressive enough in asking for better pay or benefits, Taylor would quickly find someone else. Her career was full of intense negotiations that changed how stars were valued in Hollywood.

Jennifer Aniston

After ‘Friends’ ended, Jennifer Aniston temporarily switched agents because she was frustrated with how slowly her movie career was developing. Despite being a huge TV star, she had trouble finding the right film roles to become a leading actress. She hoped a new agent could help her make the leap from television to movies. Although she later went back to her original agency, this change showed she had ambitious goals for her career.

Courtney Love

Courtney Love is known for switching agents and managers when she feels they’re trying to dictate how she presents herself to the public. She often disagrees with her representatives about her movie choices and her willingness to speak her mind online. Love prioritizes her creative freedom and consistently seeks teams who understand and support her vision. This pattern of change has made her a somewhat unpredictable client for Hollywood agencies.

Lindsay Lohan

In the mid-2000s, Lindsay Lohan repeatedly changed agents and managers while dealing with legal and personal difficulties. She often felt her representatives weren’t adequately helping her find work or manage negative publicity. While each new agent offered hope for a career revival, her personal struggles consistently made that difficult. Despite this constant turnover, Lohan remained a popular, though often problematic, actress.

Joan Crawford

Joan Crawford was known for being difficult to work with and quickly fired agents who didn’t prioritize her career. She expected her agents to secure her the best roles possible and wouldn’t hesitate to find new representation if she felt another actress was getting preferential treatment. This uncompromising attitude allowed her to enjoy a long and successful career in Hollywood’s competitive studio environment.

Demi Moore

After the movie ‘G.I. Jane’ didn’t do as well as expected in theaters, Demi Moore let go of her entire team of agents. She was a top-earning actress at the time, and the film’s failure significantly impacted her career. Moore believed her representatives hadn’t accurately gauged what audiences wanted or the film’s potential. As a result, she took a break from acting and spent a few years rebuilding her career.

Maggie Gyllenhaal

Maggie Gyllenhaal decided to find new agents after one told her she was considered “too old” to play a romantic partner for a man who was 55 – she was only 37 at the time. This experience showed her how much ageism exists in Hollywood. She felt her previous agents weren’t pushing back against this bias and weren’t finding roles that valued her talent. She hoped a new team would help her find projects that broke away from typical Hollywood expectations.

Chloë Grace Moretz

Chloë Grace Moretz changed her team of agents and managers because she wanted to focus on different kinds of films. She felt she was doing too many big, mainstream projects and wanted to return to her love of independent cinema. She briefly stepped back from acting to figure out what she wanted and find a team that understood her goals. This led to her taking on more interesting and varied roles, such as in the film ‘The Miseducation of Cameron Post’.

Anne Hathaway

Early in her career, Anne Hathaway made a deliberate change in who managed her, wanting to shed the “Disney princess” image she’d gained from ‘The Princess Diaries.’ She felt her original team was only offering her similar, wholesome roles, which could have restricted her as an actress. She looked for new representation to help her land more challenging and complex roles, as she did in films like ‘Havoc’ and ‘Brokeback Mountain.’ This decision proved crucial to her later success, ultimately contributing to her Academy Award win.

Shailene Woodley

Shailene Woodley changed agents because she wasn’t happy with the roles she was being offered while working on the ‘Divergent’ movies. She wanted to focus on meaningful, character-focused stories, but felt Hollywood was pushing her towards big-budget action films. She even thought about stopping acting altogether until she found new representation who understood her vision. This change in direction eventually led to her success with well-received projects like the series ‘Big Little Lies’.

Frances Fisher

Frances Fisher ended her professional relationship with her manager following disagreements about money and the future of her career. She believed the manager was taking too much control and making choices without her approval. As a result, the actress decided to handle her career more directly to safeguard her own interests. This allowed her to continue thriving in Hollywood, landing memorable roles in films like ‘Titanic’ and ‘Watchmen’.

Bette Davis

Bette Davis was well-known for her tough dealings with movie studios and the people who represented her. She often dismissed her agents if they didn’t aggressively negotiate with Warner Bros. Davis preferred representatives who were as determined as she was to get better roles and more say in her projects. Throughout her career, she constantly fought for respect and wouldn’t tolerate anyone who wasn’t willing to fight with her.

Geena Davis

After the costly flop of ‘Cutthroat Island’, Geena Davis’s career slowed down. The film’s poor reception meant fewer leading movie roles came her way, despite having previously won an Oscar. She believed her agents weren’t actively seeking new opportunities for her in television or other areas. Eventually, she changed representation and found a new team who helped her land the starring role in the series ‘Commander in Chief’.

Kim Basinger

After facing negative press and a difficult legal dispute related to the movie ‘Boxing Helena’, Kim Basinger decided to overhaul her entire team of agents and publicists. Labelled a risky hire by some in the industry, she believed a fresh start was crucial for her career. She found a new agency that guided her towards roles that showcased her acting range and maturity. This strategic shift eventually led to her critically acclaimed and Oscar-winning performance in ‘L.A. Confidential’.

Faye Dunaway

Throughout her career, Faye Dunaway often changed agents when she was unhappy with the films she was offered. A dedicated actress, she expected her representatives to work just as hard as she did to find excellent roles. When her career slowed down in the 1980s, she felt her team hadn’t found her projects as strong as those she’d had in the 1970s. She was known for being a demanding client, and this extended to how she dealt with her professional relationships.

Toni Collette

Toni Collette switched talent agencies because she felt her previous representation wasn’t showcasing her full acting abilities. Even with an Oscar nomination, she often missed out on leading roles, with Hollywood typically favoring more conventional stars. Her new agency promised to emphasize her versatility and help her land starring roles in movies and TV shows. This change proved beneficial, leading to successful projects like ‘United States of Tara’ and ‘Hereditary’.

Fairuza Balk

After achieving success with ‘The Craft’, Fairuza Balk felt limited by the types of roles her agents were offering. They seemed to only want her for “dark” or “gothic” characters, and she worried this would prevent her from showing her range as an actress. She decided to find new agents who would help her pursue a wider variety of projects and ultimately shifted her career towards more independent and artistic films.

Nicollette Sheridan

After being let go from ‘Desperate Housewives,’ Nicollette Sheridan dismissed her agents and lawyers and launched a long legal fight against the show’s creator. She was dissatisfied with her previous team, believing they hadn’t done enough to keep her on the show or help her deal with the aftermath. Sheridan felt the situation harmed her career and looked for new representation to help her get back on television. She eventually secured a significant role in the reboot of ‘Dynasty’.

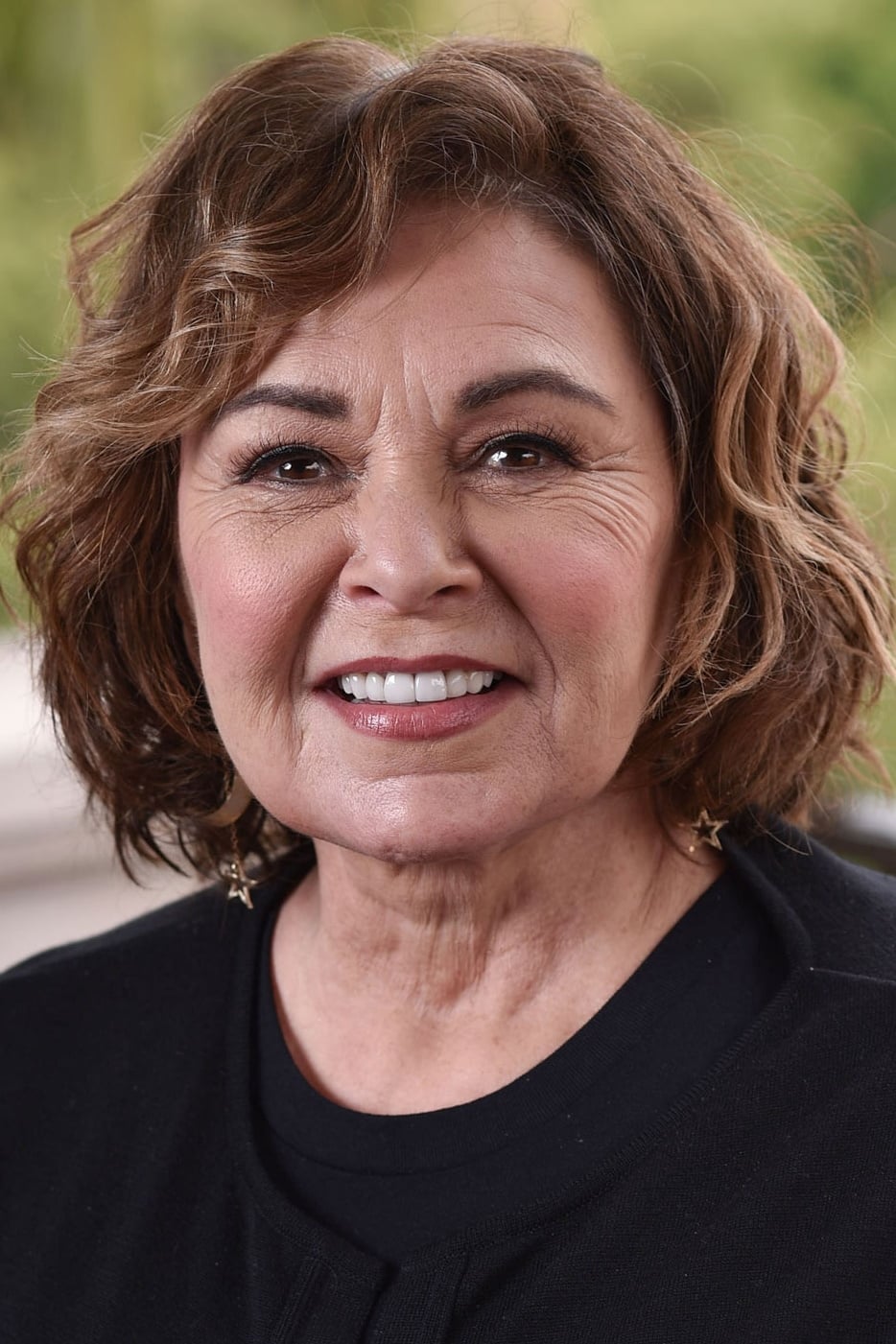

Roseanne Barr

After her show ‘Roseanne’ was canceled in 2018 due to a controversial tweet, Roseanne Barr dismissed her longtime managers. She felt they hadn’t given her enough support or guidance during the fallout, and that they failed to protect her reputation during a major career crisis. Following this, she changed how she handled public appearances and business matters.

Whoopi Goldberg

In the late 1990s, Whoopi Goldberg decided to find new representation because she felt typecast and wasn’t being offered a wide enough variety of roles, despite her EGOT status. She wanted to expand into hosting and producing, so she built a new team to help her make that shift. This ultimately led to her successful and long-lasting role on ‘The View’ and allowed her to stay a major presence in entertainment for many years.

Share your thoughts on these career-defining moves in the comments.

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- EUR UAH PREDICTION

- DOT PREDICTION. DOT cryptocurrency

- Silver Rate Forecast

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2026-02-26 10:19