As a movie buff, I’ve always been fascinated by the stories behind the stars, and it turns out, Hollywood glamour doesn’t always stay on set. We usually hear about rock stars trashing hotel rooms, but believe it or not, some incredibly famous actresses have gotten into similar trouble. From the classic stars of old Hollywood to today’s tabloid fixtures, a surprising number have been banned from hotels, faced legal issues, or become public spectacles simply because of the mess they left behind. It’s been everything from accidental fires and damage caused by their pets to deliberate acts of rebellion against hotel staff – it’s wild!

Amanda Bynes

In 2013, Amanda Bynes was asked to leave the W Hotel in New York City after a public incident. Hotel staff said she had been smoking in her room, and her suite was found very messy and damaged. This was one of several unusual behaviors that led to her being temporarily held for psychiatric evaluation. The room reportedly needed significant cleaning and professional repairs before anyone else could stay there.

Bai Ling

The actress, famous for her part in ‘The Crow’, has a reputation for unpredictable behavior, especially in public and at hotels. Several small hotels in Los Angeles have reported that her rooms were often very messy during her stays. Staff described unusual decorations and a significant lack of order, sometimes to the point of causing damage. These issues often happened around the time she attended film festivals, and her behavior frequently became gossip in the tabloids.

Bette Davis

Bette Davis, the famous actress from ‘All About Eve,’ was known for being strong-willed and wasn’t afraid to challenge authority, even when staying in hotels. Stories say she would deliberately burn cigarette holes in hotel sheets to show her displeasure with the service she received. This caused problems with several luxury hotels, who had to replace their expensive bedding after she checked out. Though she always appeared professional on camera, Davis had a reputation for being one of Hollywood’s most challenging stars, and her hotel antics were part of that image.

Britney Spears

I remember hearing about what happened with Britney at the Chateau Marmont back in 2007. Apparently, she was no longer allowed to stay there after some really disruptive behavior. People who worked there said she was making a mess, even smearing food on the walls and furniture in her bungalow. It all happened when she was going through a very tough time, and the media was following everything closely. Ultimately, the hotel decided it was best to ask her not to return, both to protect the hotel and make sure other guests felt comfortable.

Courtney Love

As a film buff, I’ve always been fascinated by celebrity stories, and this actress definitely has a few! It seems she’s had a really rough time with hotels over the years. The most famous incident, as I understand it, happened at the Ritz-Carlton in New York back in 2004 – apparently, she was kicked out after causing a lot of trouble and damaging her suite. Then, a few years later, in 2010, the Inn on Irving Place actually sued her, claiming she left her room in an unbelievably messy and filthy condition, and that she’d seriously damaged the floors and furniture while she was staying there. It’s wild stuff!

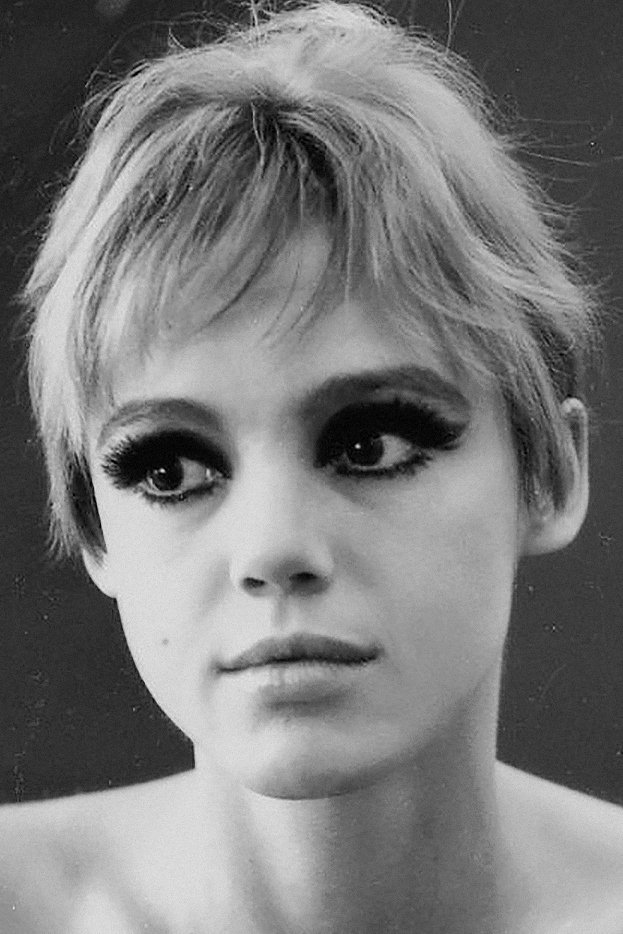

Edie Sedgwick

Edie Sedgwick was a prominent figure in the 1960s New York art world, known as an actress and inspiration to Andy Warhol. She lived at the famous Chelsea Hotel and became known for her wild behavior, including a notorious incident where she accidentally started a fire in her room. The fire caused significant damage to the hotel and contributed to her image as a troubled and unpredictable personality.

Elizabeth Taylor

Elizabeth Taylor, famous for her role as Cleopatra, lived a very glamorous life and often traveled with a large group of people and many pets. While filming in London and staying at The Dorchester hotel, her animals often damaged the expensive carpets and furniture. Taylor and her husband, Richard Burton, were also known for throwing wild, destructive parties that left hotel suites needing complete makeovers. The hotel apparently had to replace custom furnishings to repair the damage after each of her visits.

Fairuza Balk

I recently stumbled across an old story about the actress best known for ‘The Craft,’ and it’s a bit of a wild one. Apparently, early in her career, she had a really rough patch and, after staying in a hotel, her room was left…well, let’s just say it needed a lot of work beyond a simple cleaning. Reports from the ’90s paint a picture of significant damage. It really seemed to solidify her reputation as someone with a fiery, rebellious spirit. While she’s largely stepped away from the public eye now, this incident still pops up when people talk about her early days.

Faye Dunaway

In 1994, Faye Dunaway, known for her role in ‘Network,’ was sued by the Sunset Tower Hotel in West Hollywood. The hotel claimed she hadn’t paid her bill and had damaged her room. They specifically stated she hadn’t taken proper care of the furniture and fixtures in the historic Art Deco building. The legal battle brought attention to reports of Dunaway being difficult and not respecting hotel property.

Heather Locklear

The actress from ‘Melrose Place’ has a history of difficult situations that have sometimes required police involvement. Over the years, authorities have been called to her home and to hotels while she was traveling for work. Hotel staff have reported significant damage to rooms after these incidents, often requiring professional repairs. These property-related issues have frequently become public as part of her ongoing personal and legal difficulties.

Juliette Lewis

Early in her career, actress Juliette Lewis was known for a rebellious lifestyle, and stories circulated about the condition of her hotel rooms after parties or visits. While she didn’t often take legal action over damage, reports described a pattern of significant mess and a carefree attitude toward hotel property. Though Lewis has since settled into a more stable phase of her career, these tales remain a part of her early Hollywood reputation.

Lily Allen

Lily Allen, known for her acting role in ‘How to Build a Girl’, caused a stir in 2008 when her hotel room at Claridge’s was left extremely messy after an awards ceremony. British newspapers reported on the significant damage, highlighting the cleanup needed by hotel staff. Allen later spoke about the incident, which reinforced her image as a bit of a rebel in the entertainment world.

Lindsay Lohan

In 2012, Lindsay Lohan was reportedly asked to leave the Shutters on the Beach hotel in Santa Monica after allegedly causing significant damage to her room during a three-night stay. Hotel management claimed the room was left in terrible condition, costing thousands of dollars to repair. This happened while the actress was dealing with legal issues and personal struggles. Following this, the W Hotel also reportedly asked her to leave due to the poor state of her suite.

Marilyn Monroe

Marilyn Monroe, the famous star of ‘Some Like It Hot,’ was asked to leave the Beverly Hills Hotel in the early 1950s. Although she was a popular guest, her messy habits caused problems with hotel management. She often ate meals in bed and left food and makeup scattered around her suite, which permanently stained the furniture. Despite her fame, the hotel decided she needed to move out because she wasn’t taking care of the room.

Mischa Barton

In 2009, actress Mischa Barton, known for her role in ‘The O.C.’, was sued by her landlord in New York over unpaid rent and damage to a luxury apartment she’d been renting. The landlord claimed she’d left the apartment in very poor condition, similar to reports of destructive behavior. This legal issue occurred during a difficult time for Barton, impacting both her career and finances. Court documents revealed the apartment had suffered considerable wear and tear and hadn’t been well-maintained.

Naomi Campbell

Naomi Campbell is best known as a supermodel, but she’s also appeared in shows like ‘Empire’ and ‘American Horror Story’. She’s gained notoriety for several public incidents, including being banned from British Airways. There have also been reports of disruptive behavior during hotel stays, such as an alleged chaotic mess left in her room after an emotional episode in Rome. Despite efforts to improve her public image in recent years, these past controversies continue to be remembered.

Pamela Anderson

In 2005, the actress known for ‘Baywatch’ caused a stir during a hotel stay when her room was left significantly damaged. After she checked out, hotel staff reported needing professional cleaning and repairs due to the condition of the furniture and the overall mess. This wasn’t the first time her lively personality led to issues with the expectations of upscale hotels.

Paz de la Huerta

In 2011, actress Kelly Macdonald, known for ‘Boardwalk Empire,’ was involved in an incident at The Standard Hotel in New York City that resulted in her being asked to leave. According to reports, she had been partying heavily for several nights, and her hotel room was found in considerable mess. This added to a growing perception of her as someone who could be challenging for luxury hotels to accommodate.

Sienna Miller

While filming in Shanghai in 2014, actress Sienna Miller was involved in a dispute at the Peace Hotel. According to reports, her hotel suite was left significantly damaged after she and her guests checked out, with broken items and a messy room. International tabloids widely publicized the incident, which seemed out of character for Miller and suggested the stress of filming abroad may have contributed.

Tara Reid

Alyson Hannigan, famous for her work in the ‘American Pie’ movies, has reportedly had problems with hotels throughout her career. There was an incident in Las Vegas where she was asked to leave after complaints about her room and noise levels. Hotel staff said her suite needed extensive cleaning and upholstery repairs after she stayed there. These kinds of events helped create a public perception of her as a demanding and sometimes difficult guest when she was at the peak of her popularity.

Vivien Leigh

Vivien Leigh, famous for her role in ‘Gone with the Wind,’ lived with bipolar disorder, and her symptoms often appeared when she was traveling for work and staying in high-end hotels. When experiencing mania, she would sometimes become destructive, breaking things in her hotel room. Her husband, Laurence Olivier, frequently had to step in, dealing with hotel staff and paying for the damage. These incidents were mostly kept private to protect her career and reputation.

Whitney Houston

Before Whitney Houston died in 2012, her room at the Beverly Hilton was found in a very messy condition. Hotel staff reported finding trash, spilled drinks, and personal belongings scattered everywhere. Though the investigation mainly focused on her health, witnesses said the state of the room showed how troubled she was in her final days. The cleanup was said to be a major undertaking for the hotel staff.

Please share your thoughts on these notorious hotel incidents in the comments.

Read More

- Gold Rate Forecast

- Securing the Agent Ecosystem: Detecting Malicious Workflow Patterns

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- NEAR PREDICTION. NEAR cryptocurrency

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Top 15 Insanely Popular Android Games

- USD COP PREDICTION

2026-02-26 04:47