The actress, known for ‘Stranger Things,’ experienced a major setback in her career in 2001 when she was arrested for shoplifting at Saks Fifth Avenue. She was convicted and forced to take several years off from acting. Companies that had previously hired her for advertising campaigns quickly ended their partnerships. Though she later regained her position as a prominent Hollywood star, she initially lost a substantial amount of money due to cancelled endorsement deals. Years later, she eventually repaired her professional relationship with Marc Jacobs, but only after facing considerable public criticism.

Sharon Stone

In 2008, actress Sharon Stone received strong criticism after suggesting the devastating Sichuan earthquake in China was linked to the country’s treatment of Tibet. As a result, Christian Dior, the fashion house she represented globally, immediately pulled her from all advertising campaigns in China and publicly disassociated itself from her comments. This led to the end of their professional relationship and is a clear example of how expressing political opinions can quickly lead to the loss of lucrative contracts.

Lori Loughlin

As a longtime fan of hers, it was really sad to watch Lori Loughlin’s career fall apart after the college admissions scandal back in 2019. It happened so quickly – Hallmark dropped her almost immediately, even halting projects they were already filming. Then Netflix cut her from the final season of ‘Fuller House,’ and she lost a bunch of other deals she had with brands. For years, she’d been known as America’s sweetheart, so the scandal completely changed how people saw her. Beyond the public fallout, I imagine the legal bills and lost income from those endorsements really hurt her financially.

Felicity Huffman

Like Lori Loughlin, the ‘Desperate Housewives’ actress was caught up in the college admissions scandal and suffered professionally as a result. Although she didn’t have many major endorsement deals, she lost upcoming TV appearances and promotional opportunities. Networks and production companies stopped working with her to avoid bad publicity related to her legal troubles. While a quick plea deal helped her return to work sooner, she immediately lost income. The scandal ultimately stopped her from being a go-to actress for television commercials.

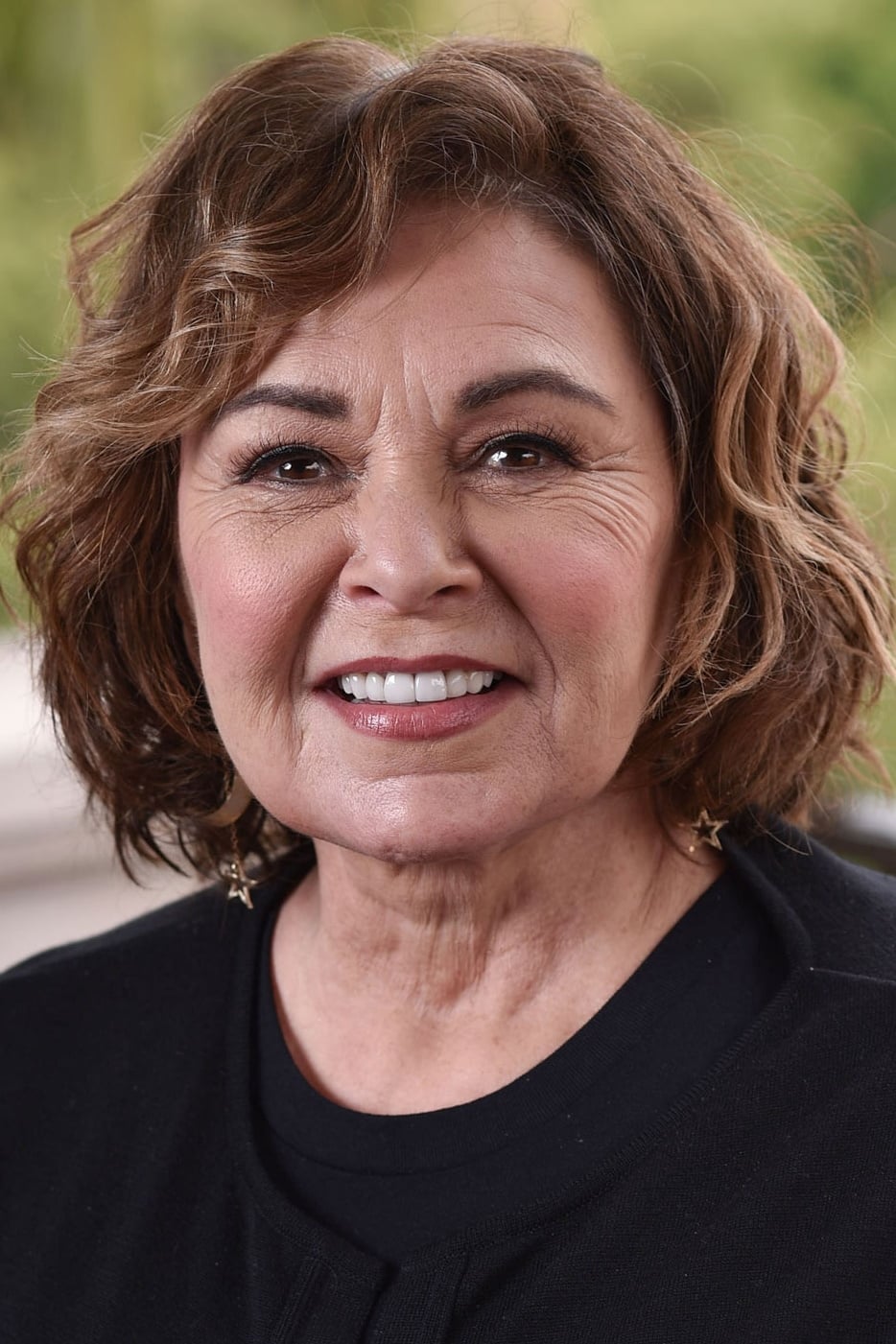

Roseanne Barr

In 2018, ABC cancelled Roseanne Barr’s revived sitcom ‘Roseanne’ after she posted a controversial message on social media. The post, which criticized a former government advisor, was widely considered racist by both the network and the public. As a result, Barr not only lost her popular show but also various financial opportunities that had come with her recent career comeback. The network and sponsors quickly distanced themselves from her—within hours of the post—demonstrating how quickly companies now react to public backlash. The cancellation was projected to cost Barr millions of dollars, considering how successful future seasons of the show were expected to be.

Gina Carano

In 2021, the actress and former MMA fighter was fired from ‘The Mandalorian’ because of controversial posts she made on social media. Lucasfilm stated they wouldn’t work with her again, calling her posts unacceptable. As a result, a planned spin-off show was canceled, and she lost deals with Hasbro, the toy company that made action figures of her character, ending a source of income. Ultimately, her departure from the ‘Star Wars’ franchise meant she lost several potentially lucrative future contracts.

Lea Michele

In 2020, the actress known for ‘Glee’ faced criticism after former colleagues publicly accused her of fostering a negative and harmful work environment. Almost immediately, HelloFresh, a meal kit company she worked with, ended their business relationship, stating they strongly oppose racism and discrimination. Other sponsorships and promotional work also disappeared as public opinion turned against her. This situation demonstrated how past accusations of misconduct can quickly damage current business partnerships.

Chrissy Teigen

Chrissy Teigen is well-known as a TV personality and model, and she’s also acted in movies like ‘Hotel Transylvania 3.’ However, in 2021, old, hurtful tweets she made resurfaced, causing many companies to stop working with her. Stores like Target and Macy’s removed her cooking products from their shelves and online, and she lost a voice acting role on the Netflix show ‘Never Have I Ever.’ This quickly led to a significant loss of income and potential earnings for Teigen.

Rihanna

Rihanna, the famous actress and singer, was a spokesperson for Nivea in the early 2010s. However, in 2012, Nivea’s new CEO decided she didn’t fit the brand’s family-friendly image, finding her public image too revealing. This led to the quick cancellation of her lucrative endorsement contract. While Rihanna had a huge fan base worldwide, Nivea opted for a more traditional approach. She later created her own successful beauty line, but the Nivea situation clearly showed a difference in brand values.

Fan Bingbing

A top Chinese actress, famous for her work in ‘X-Men: Days of Future Past,’ vanished from public view in 2018 following accusations of tax evasion. As a result, major luxury brands like Louis Vuitton, Guerlain, and De Beers cancelled or paused their partnerships with her. The Chinese government issued a fine of almost $130 million, effectively ending her career as a global brand ambassador. While she’s slowly reappeared in international films, losing these endorsements was devastating. Her situation is considered one of the biggest financial downfalls ever seen in the Asian entertainment world.

Zheng Shuang

As a movie critic, I’ve seen a lot of careers rise and fall, but this one was shockingly swift. Back in January 2021, this Chinese actress was tapped as a Prada ambassador – a huge deal! But just eight days later, everything imploded. A major scandal broke involving accusations of surrogacy and abandoning a child – incredibly sensitive issues in China. Prada acted fast, posting a statement online ending their partnership. Other brands, like Lola Rose and Chando, quickly followed suit, cutting ties immediately. It’s often talked about as one of the quickest celebrity endorsement collapses in luxury fashion history – a real cautionary tale.

Seo Yea-ji

I was a big fan of the lead actress from ‘It’s Okay to Not Be Okay,’ so I was really shocked when accusations came out in 2021 about her allegedly manipulating an ex-boyfriend and bullying someone in school. It happened so fast – almost immediately, brands started dropping her. New Origin, the health food company, and Luna, the cosmetics brand, both pulled her from all their ads and wiped her photos from their websites and social media. I read that she might even have to pay damages to those companies because of clauses in her contracts. It was a huge hit to her career, and she basically disappeared from TV and commercials for over a year. It was really sad to see.

Lindsay Lohan

In the mid-2000s, Lindsay Lohan was a favorite face for fashion and beauty companies. However, as she faced increasing legal and personal difficulties, brands began to distance themselves from her. Companies like Fornarina and Miu Miu stopped using her in their campaigns due to reports of her being unreliable during filming. Her repeated arrests and public mishaps made her a risk for companies seeking a dependable spokesperson. Losing these lucrative fashion deals effectively ended her time as a major advertising star. While Lohan’s career has recently experienced a comeback with Netflix, she went over a decade without significant endorsement deals.

Whoopi Goldberg

Whoopi Goldberg lost a lucrative endorsement deal with SlimFast in 2004 after making a joke about President George W. Bush at a fundraising event. SlimFast considered the comment offensive and decided to stop using her in their advertisements, stating it didn’t align with their brand’s values. This happened while Goldberg was a popular face for the company. Since then, she’s primarily concentrated on her work as a host on ‘The View’ and hasn’t pursued many large commercial sponsorships.

Paula Deen

The actress known for her appearances on television and in the film ‘Elizabethtown’ faced a major downfall in 2013 after publicly admitting to using a racial slur. Major retailers like Walmart, Target, and Sears quickly stopped selling her products and ended their business relationships with her. Her show on the Food Network was cancelled, and she lost valuable sponsorship deals, including one with Smithfield Foods. These losses were estimated to total tens of millions of dollars. Even though she tried to rebuild her career, the sudden and massive financial impact remains one of the biggest in the lifestyle industry.

Scarlett Johansson

In 2014, actress Scarlett Johansson, known for her role as Black Widow, found herself in a difficult situation with Oxfam, the charity she represented as a global ambassador. She agreed to a sponsorship deal with SodaStream, a company that had a factory in a West Bank settlement – an area Oxfam opposed trading with. This disagreement led to a public conflict, and Johansson ultimately decided to end her eight-year relationship with Oxfam to fulfill her contract with SodaStream. While she received payment from the endorsement, she lost the positive public image and charitable connection she’d built with the organization.

Kim Sae-ron

In 2022, a well-known South Korean actress caused a car accident while driving under the influence. The accident resulted in a local power outage and damage to public property. As a direct consequence, several brands dropped her from their advertising campaigns and removed her from social media. She was also removed from the drama ‘Trolley’ and faced limitations on future work. The incident led to substantial financial penalties, as she had to compensate the affected brands and businesses. This single event effectively paused her career as a rising star.

Mischa Barton

Rachel Bilson, known for her role in ‘The O.C.’, was once a popular face in advertising, partnering with brands like Keds, Bebe, and Neutrogena. But after her arrest in 2007 and the personal difficulties that followed, companies started to move away from her as a spokesperson. The media’s focus shifted from her acting to her legal troubles, and she lost out on potentially lucrative long-term endorsement deals. By the time she tried to rebuild her career, her value to advertisers had decreased considerably.

Lizzo

In 2023, the Grammy-winning singer and actress from ‘Hustlers’ was sued by former backup dancers who claimed they experienced a negative and harassing work environment. Although she disputed these claims, the resulting public backlash quickly impacted her career. She was reportedly passed over for major opportunities, like performing at the Super Bowl Halftime Show. Several brands she worked with stopped promoting her, and upcoming projects were re-evaluated. This legal issue put at risk the positive image she’d worked hard to create over the years.

Kate Moss

The famous model, known for her role in ‘Absolutely Fabulous: The Movie’, went through a difficult time in 2005. After photos surfaced suggesting she was using drugs, several major companies ended their business relationships with her. H&M, Chanel, and Burberry all cancelled planned campaigns with her almost immediately. This caused her to lose an estimated millions of dollars in earnings. Remarkably, she managed to revive her career and secure new contracts within a year, a rare feat for someone facing such a public scandal and brand abandonment.

Katherine Heigl

Katherine Heigl was once a hugely popular actress, known for romantic comedies and her role on ‘Grey’s Anatomy.’ However, a reputation for being challenging to work with led to fewer opportunities. After publicly voicing her dissatisfaction with her own projects, companies became reluctant to partner with her, worried about potential bad press. This shift from a sought-after star to someone avoided by the industry resulted in a significant loss of income from both acting roles and sponsorships. She largely disappeared from major advertising for several years, until she returned to television through streaming services.

Vanessa Hudgens

In 2007, at the peak of her fame from ‘High School Musical,’ the actress experienced a major public relations problem when private photos were released online without her permission. This put her career with Disney Channel at risk, though the network ultimately let her continue. However, several companies cancelled planned sponsorships, fearing the negative publicity. These brands, focused on young audiences, didn’t want to be linked to the scandal. The incident highlighted how quickly online leaks could damage a young performer’s ability to land commercial opportunities.

Amber Heard

After the very public and intense legal fight with Johnny Depp, Amber Heard faced a lot of negative attention regarding her career. During the 2022 trial, a petition asking for her to be removed from the movie ‘Aquaman and the Lost Kingdom’ quickly gained millions of supporters. Although she remained in the film, companies like L’Oreal, where she was a global spokesperson, reportedly started to move away from working with her. As the trial’s outcome became clear, she appeared in fewer and fewer advertisements, and she received far fewer offers for new endorsements. The whole situation made her a controversial figure, impacting her ability to secure new work.

Shailene Woodley

Shailene Woodley is well-known for speaking out about environmental issues, and her activism led to an arrest during protests against the Dakota Access Pipeline in 2016. While many fans applauded her actions, some of the brands she worked with, particularly those with conservative viewpoints, became hesitant to continue their partnerships. It’s been reported that she lost interest from some mainstream brands who prefer to work with celebrities who don’t publicly take sides on political issues. Despite a thriving acting career, her dedication to activism has sometimes clashed with what companies expect from their sponsored celebrities, which has meant fewer opportunities for major endorsement deals compared to other actors.

Tell us what you think about these high-stakes celebrity brand deals in the comments.

Read More

- Building 3D Worlds from Words: Is Reinforcement Learning the Key?

- Gold Rate Forecast

- Securing the Agent Ecosystem: Detecting Malicious Workflow Patterns

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Wuthering Waves – Galbrena build and materials guide

- The Best Directors of 2025

- TV Shows Where Asian Representation Felt Like Stereotype Checklists

- Games That Faced Bans in Countries Over Political Themes

- 📢 New Prestige Skin – Hedonist Liberta

- SEGA Sonic and IDW Artist Gigi Dutreix Celebrates Charlie Kirk’s Death

2026-02-26 03:47