Now, listen closely. Back in late 2024, a rather clever bunch at Alphabet concocted a quantum computing chip. A truly peculiar device, capable of calculations that left ordinary supercomputers looking like snails in treacle. This, naturally, sent a fizz of excitement through the markets, a sort of giddy rush for anything labelled ‘quantum.’

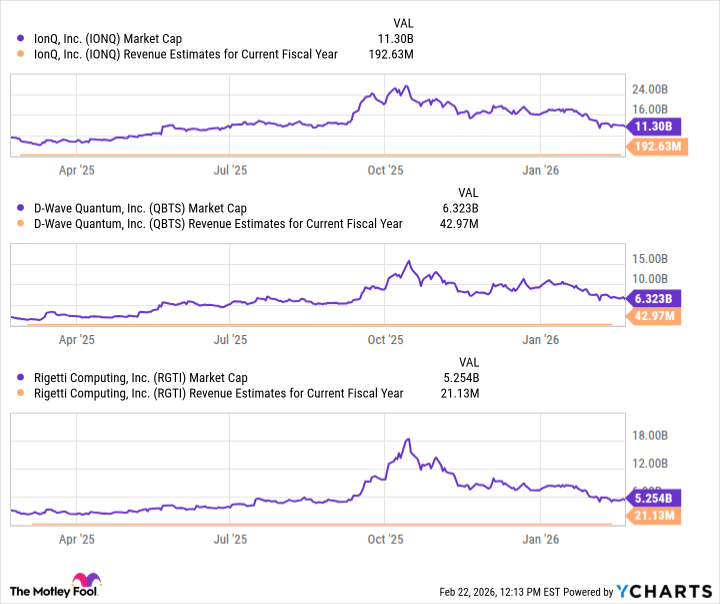

A handful of companies – IonQ (IONQ +7.12%), D-Wave Quantum (QBTS +5.52%), and Rigetti Computing (RGTI +7.04%) – saw their shares balloon like overfilled sausages throughout 2025. They wobbled a bit towards autumn, mind you, but still managed a rather impressive year, climbing as high as 211%. It was a bit like watching a flock of pigeons suddenly sprout wings of gold.

These quantum contraptions, you see, could unlock wonders. Imagine, if you will, a world where artificial intelligence isn’t dim-witted, drugs actually work, and secrets remain, well, secret. New industries might sprout like particularly stubborn weeds. But I, having watched markets for a good long while, suspect this quantum enthusiasm is about to deflate. A slow leak, perhaps, but a leak nonetheless. And here’s why.

The Sticky Bits and Bumpy Roads

The trick with these quantum computers, you see, lies in something called ‘qubits.’ Ordinary computers use ‘bits’ – simple little things that are either a 1 or a 0. Dull as dishwater, really. Qubits, however, are far more mischievous. They can be both 1 and 0 at the same time, a sort of wobbly, undecided state. This allows them to tackle problems that would make a normal computer’s circuits sizzle and pop.

But here’s the rub. These qubits are frightfully delicate. They require conditions colder than a penguin’s pedicure, and even then, they’re prone to making errors. Lots of them. It’s like trying to build a house of cards during an earthquake. Beyond that, nobody’s quite figured out what to tell these things to do. Software, you see, is rather important. It’s like having a magnificent racing car with no steering wheel.

And let’s not forget the price. Cutting-edge technology is always costly, like commissioning a portrait of yourself made entirely of sausages. It will take a very long time, and a great deal of money, before quantum computing becomes practical. For now, these machines are mostly used for research, which is a polite way of saying ‘expensive tinkering.’

The Price of Air

With so little actual doing happening, investors are starting to take a closer look at the price tags on these quantum companies. IonQ, D-Wave Quantum, and Rigetti Computing are generating very little revenue compared to how much they’re worth. It’s like paying a king’s ransom for a bag of air.

There’s precious little to justify these valuations. Even if revenue grows, it’s difficult to say when these companies might actually turn a profit, or what that profit might look like. It’s a long list of unknowns, and unknowns, my friend, tend to weigh on things. Like a particularly heavy toad.

And if that weren’t bad enough, these companies are about to face some serious competition. Several large, rather greedy tech giants – International Business Machines, Amazon, Alphabet, and Microsoft – are all poking around in the quantum world, eager to grab a piece of the pie.

Lastly, investors aren’t quite as giddy as they were last summer. They’re starting to reconsider some of these speculative stocks. And when the music stops, quantum computing seems likely to be left holding the bag. A rather expensive bag, at that.

Read More

- Gold Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- Silver Rate Forecast

- Securing the Agent Ecosystem: Detecting Malicious Workflow Patterns

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- NEAR PREDICTION. NEAR cryptocurrency

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- USD COP PREDICTION

2026-02-25 23:24