Science fiction fans have a lot to look forward to this week, with new movies hitting theaters and major updates coming to streaming services. There’s something for everyone, including the next installments in popular series, thought-provoking films by well-known directors, and exciting new independent sci-fi releases. Whether you like to watch movies in a theater or at home, late February 2026 has plenty of options. Here’s a look at the sci-fi titles coming out this week in theaters and on streaming platforms.

‘Arco’ (2026)

Launching digitally on February 24th, ‘Arco’ is already receiving rave reviews, with a 93% fresh rating and high praise from audiences. The game takes place in a fascinating world where magic and technology collide, and players will face tough choices that determine how the story unfolds. Reviewers have highlighted its beautiful art style and the clever, strategic way the story is told. Available to stream this Tuesday, ‘Arco’ is a standout choice for anyone who enjoys unique and imaginative fiction.

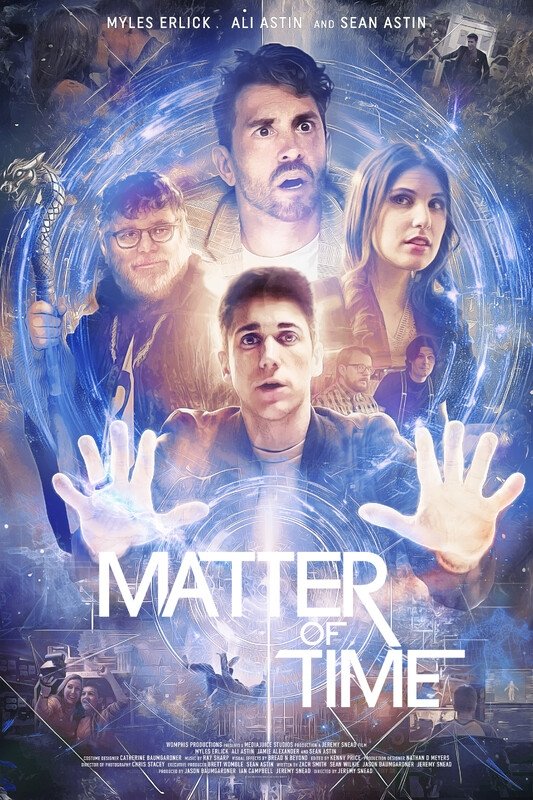

‘Matter of Time’ (2026)

I’m really excited for this new sci-fi movie coming out! It hits theaters this Friday, February 27th, and has a great cast – Sean Astin, Myles Erlick, Ali Astin, and Jaimie Alexander are all in it. It’s not a super long movie, about an hour and 44 minutes, which is perfect if you want something engaging without a huge time commitment. They’re keeping the story details pretty secret, but with actors like these, I’m expecting a really character-focused story in a cool, futuristic setting. It’s going to be exclusive to cinemas, so I’m already planning my trip!

‘Monarch: Legacy of Monsters’ (2023–)

The epic MonsterVerse story returns for a second season, launching February 27th on Apple TV+. Picking up after the dramatic events of Season 1, the show explores the hidden past of the Monarch organization and its links to the giant Titans. The new episodes will reveal more about the world of Godzilla and other colossal creatures, all while continuing the compelling human stories that span years. Get ready for bigger challenges and stunning effects as the secrets of the Titans are uncovered on the streaming service.

‘Agents of Mystery’ (2024–)

The second season of this fact-based mystery show arrives on Netflix February 27th, with the team returning to investigate more strange occurrences. The show combines real people with fictional puzzles and takes place on impressively built sets that look like scenes from sci-fi or paranormal stories. Expect a visually stunning experience that challenges the investigators’ teamwork and problem-solving abilities. Unlike typical science fiction shows, this unscripted series offers a more relaxed but still thrilling viewing experience.

‘In the Blink of an Eye’ (2026)

Andrew Stanton’s thought-provoking sci-fi film arrives on streaming services February 27th. The movie tells three interconnected stories across millennia, delving into the history of our world and what it means to be alive. Stanton, a celebrated director known for his imaginative science fiction, tackles big ideas about connection and existence in this eagerly awaited release. It’s already sparking discussion with its Rotten Tomatoes score and is set to be a major event for fans of smart, epic science fiction.

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Securing the Agent Ecosystem: Detecting Malicious Workflow Patterns

- DOT PREDICTION. DOT cryptocurrency

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- NEAR PREDICTION. NEAR cryptocurrency

- EUR UAH PREDICTION

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Top 15 Insanely Popular Android Games

- USD COP PREDICTION

2026-02-25 17:44