Throughout TV history, many popular actors have left hit shows hoping to become big movie stars or pursue different kinds of work. Fans often wonder if taking that risk was worth it. While some go on to achieve movie stardom, others realize how valuable the stability of a long-running TV show really was. This article looks at several male actors who left secure TV jobs to chase bigger opportunities.

David Caruso

The actor left the TV show ‘NYPD Blue’ after its second season, hoping to launch a film career. He believed his success on television would open doors to leading roles in movies, and he soon appeared in films like ‘Kiss of Death’ and ‘Jade’. Although those movies weren’t big hits, he later found success returning to television with the long-running series ‘CSI: Miami’, where he played Lieutenant Horatio Caine for many years.

McLean Stevenson

The actor, known for his comedic roles, left the popular show ‘MASH’ after three seasons to pursue other opportunities. He believed his character, Henry Blake, wasn’t featured enough compared to the other main actors. He then signed a long-term contract with NBC, hoping to star in his own variety and comedy shows. However, most of these new projects didn’t last long and weren’t as successful as his work on ‘MASH’. He’s still remembered for the touching way his character left the show.

George Clooney

This actor spent five seasons on the TV show ‘ER’ before deciding to concentrate on his film career. He’d begun landing roles in big movies like ‘Batman & Robin’ and ‘Out of Sight’ even while still on the show. Leaving ‘ER’ allowed him to become a major movie star, appearing in hits like ‘Ocean’s Eleven’ and ‘Syriana’. Since then, he’s also found success directing and producing. His career move is frequently pointed to as a prime example of someone successfully transitioning from television to film.

Dan Stevens

The actor decided to leave the hit show ‘Downton Abbey’ after three seasons to pursue opportunities in theater and film. His character, Matthew Crawley, was a key part of the story, so his departure surprised many viewers. Since then, he’s worked on a variety of projects, including the films ‘The Guest’ and the live-action ‘Beauty and the Beast,’ as well as the TV series ‘Legion,’ which highlighted his acting skills. He continues to work steadily in both independent and large-scale Hollywood films.

Steve Carell

The star of the comedy series ‘The Office’ left the show after seven seasons to focus on his family and pursue different types of roles in movies. He went on to appear in highly praised films such as ‘Foxcatcher’ and ‘The Big Short’. His exit noticeably altered the show’s direction during its final two seasons. He’s now known for being both a talented comedic actor and a respected dramatic performer.

Christopher Meloni

Christopher Meloni famously played Detective Elliot Stabler on ‘Law & Order: Special Victims Unit’ for twelve seasons. He left the show after disagreements during contract talks, wanting to explore other acting roles in series like ‘True Blood’ and movies like ‘Man of Steel’. His character’s abrupt departure surprised many viewers, as it happened without a formal goodbye. After a decade, he returned to the ‘Law & Order’ universe, starring in and leading the spinoff series ‘Law & Order: Organized Crime’. His comeback was a highly publicized event and a significant moment for the franchise.

Topher Grace

Topher Grace, known for his role in ‘That ’70s Show,’ left the series after seven seasons to focus on a film career. He quickly found success, landing the part of Eddie Brock in ‘Spider-Man 3.’ He continued to build his film career with roles in movies like ‘Predators’ and ‘Interstellar.’ His character, Eric Forman, was written off the show with a storyline about moving to Africa to teach. He made a brief appearance in the show’s final episode to give fans a proper ending to his character’s story.

David Duchovny

After eight seasons on the popular sci-fi show ‘The X-Files,’ this actor decided to leave the main cast to explore different roles and ease his demanding schedule. He went on to work on other films and later starred in the series ‘Californication.’ He did return to finish out the original series and participate in its later revivals with Gillian Anderson. His performance as Fox Mulder is still considered one of the most memorable in television history.

Rob Lowe

The actor departed ‘The West Wing’ during its fourth season because his character, Sam Seaborn, had a smaller role. He also disagreed with the show over his salary and decided to look for other work. Following his exit, he appeared in shows like ‘Brothers & Sisters’ and ‘Parks and Recreation,’ before achieving long-term success on the series ‘9-1-1: Lone Star.’ Throughout his career, he’s consistently worked in both comedic and dramatic roles.

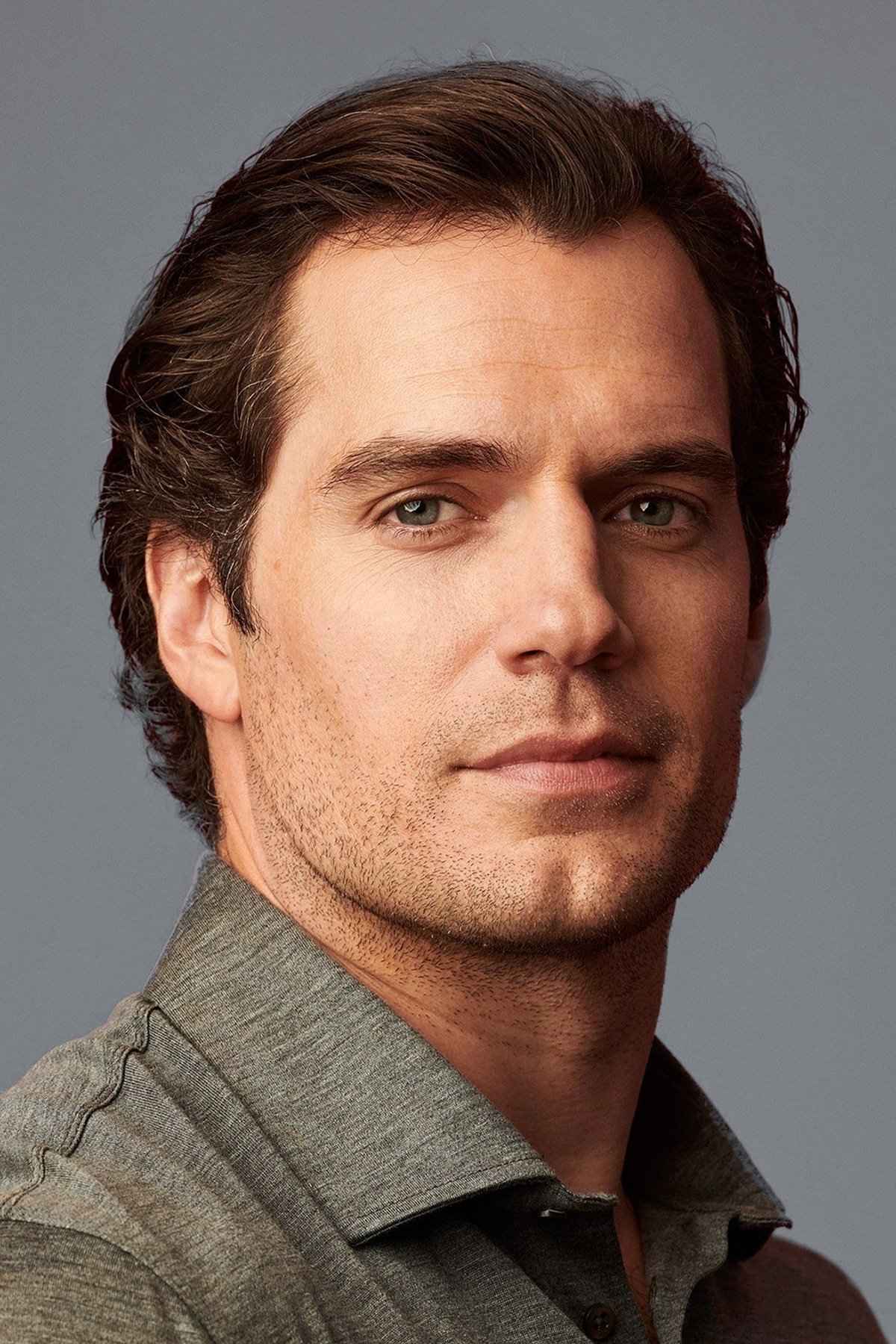

Henry Cavill

The actor known for his role in the fantasy series ‘The Witcher’ announced he would be departing after three seasons. Reports suggest he left to work on other major film projects and explore new creative opportunities. He was quickly connected to several upcoming movies and potential franchises. Another actor took over the role of Geralt of Rivia for the rest of the series, which led to a lot of debate among fans about what the future holds for the show.

Regé-Jean Page

After appearing in the first season of the popular historical drama ‘Bridgerton’, he quickly became a worldwide star. However, he decided not to return for the second season, opting instead to pursue leading roles in big-budget films like ‘The Gray Man’ and ‘Dungeons & Dragons: Honor Among Thieves’. This surprised many viewers who thought his character would continue to be a key part of the show. He remains a highly in-demand actor in Hollywood.

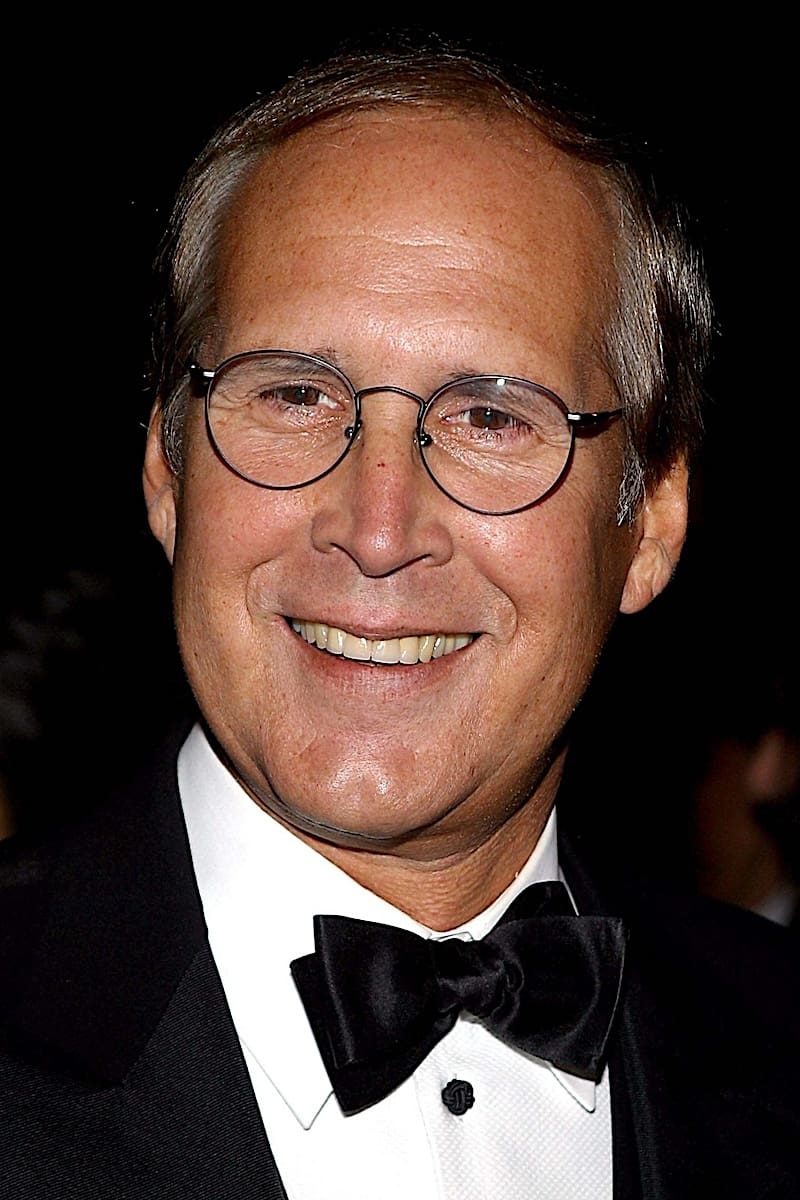

Chevy Chase

This comedian quickly became famous as a new cast member on the first season of ‘Saturday Night Live’. However, he chose to leave after just one year to focus on a successful movie career. This decision led to memorable roles in hit comedies like ‘Caddyshack’ and ‘National Lampoon’s Vacation’. Though he found a lot of success in the 1980s, leaving ‘SNL’ was considered a bold move at the time. Years later, he enjoyed another long-running role on the television sitcom ‘Community’.

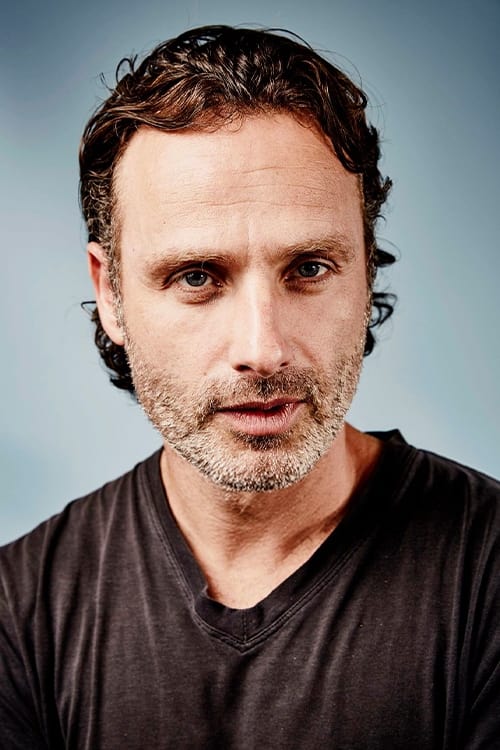

Andrew Lincoln

Andrew Lincoln, the star of ‘The Walking Dead’, left the show during season nine to focus on his family. His character, Rick Grimes, had been a central figure since the very beginning. Although his exit was a significant moment for the series, producers had plans to continue his story in a series of films. Eventually, he returned to the ‘Walking Dead’ universe in a new show called ‘The Walking Dead: The Ones Who Live’. His departure marked a major shift for the popular horror series.

Jim Parsons

Jim Parsons, best known for playing Sheldon Cooper on ‘The Big Bang Theory’ for twelve seasons, chose to leave the show. This ultimately led to its ending, as the creators believed the series couldn’t continue without him. Since then, he’s concentrated on stage work and producing, including the show ‘Young Sheldon,’ and has also appeared in projects like the film ‘The Boys in the Band’ and the series ‘Hollywood.’ He continues to be one of the most highly compensated actors in television history.

William Petersen

William Petersen, known for playing Gil Grissom on ‘CSI: Crime Scene Investigation’, left the show during its ninth season to focus on returning to theater and pursuing different acting opportunities. Though he stepped down from being a full-time cast member, he continued as an executive producer and made a few guest appearances. Years later, he brought the character back for the revival series, ‘CSI: Vegas’. Grissom is widely considered a key part of the original show’s success and its popularity around the world.

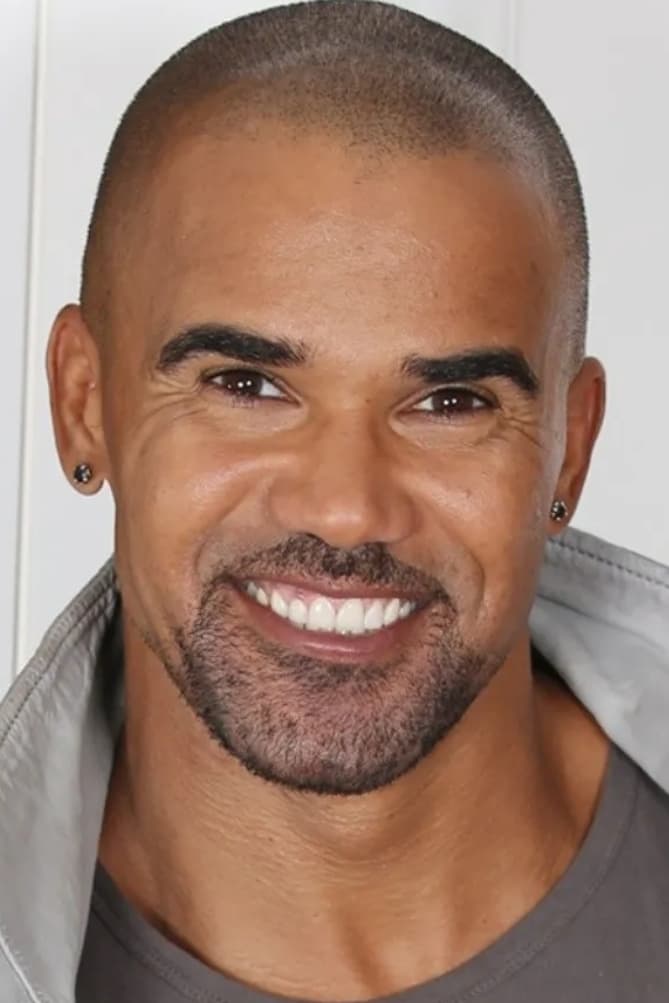

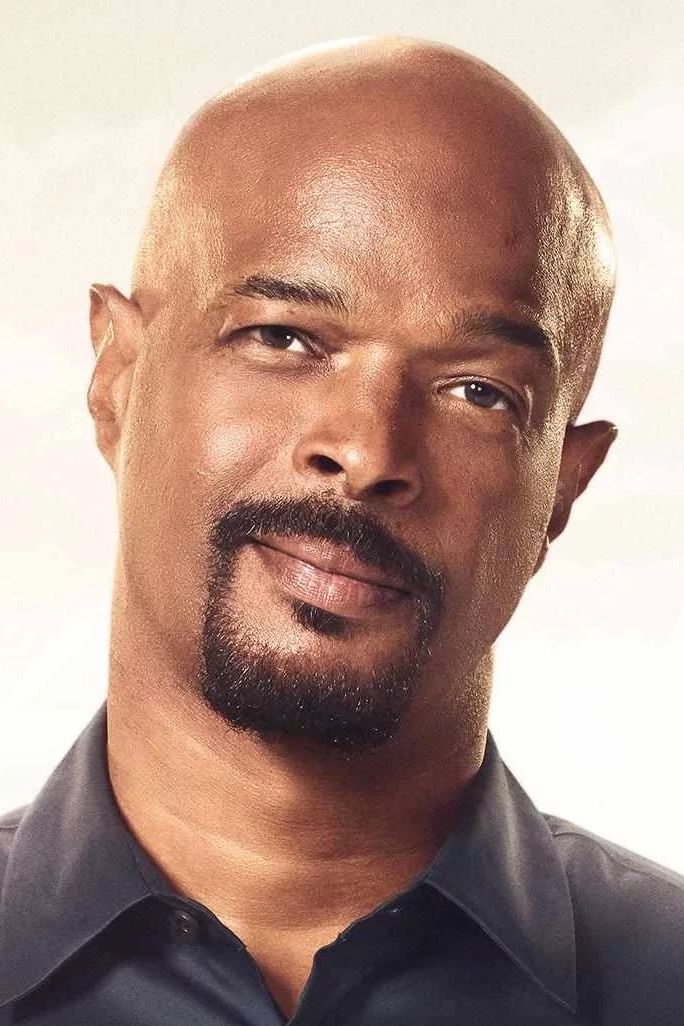

Shemar Moore

The actor is best known for his eleven seasons as Derek Morgan on ‘Criminal Minds’. He left the show wanting to grow personally and try new roles, and quickly became the star of the action series ‘S.W.A.T.’. He’s spoken fondly of his time on ‘Criminal Minds’ and has returned for occasional guest spots. His move from being part of a larger cast to leading his own show has been a major success.

Mandy Patinkin

He’s known for leaving hit TV shows, including ‘Chicago Hope’ and ‘Criminal Minds’. He famously quit ‘Criminal Minds’ after just two seasons because he found the subject matter too upsetting and wanted to focus on roles that better matched his beliefs and creative goals. He then achieved significant acclaim starring in ‘Homeland’ for eight seasons. He’s very particular about the projects he commits to long-term.

Josh Charles

I was really surprised when this actor decided to leave ‘The Good Wife’ back in season five! He felt like he’d done everything he wanted to with his character, Will Gardner, and was eager to explore other creative opportunities. The way they wrote him off the show was a total shock, though! Since then, I’ve seen him in a bunch of different things, like ‘Masters of Sex,’ and I even found out he’s been directing for TV shows too. It’s great to see him branching out!

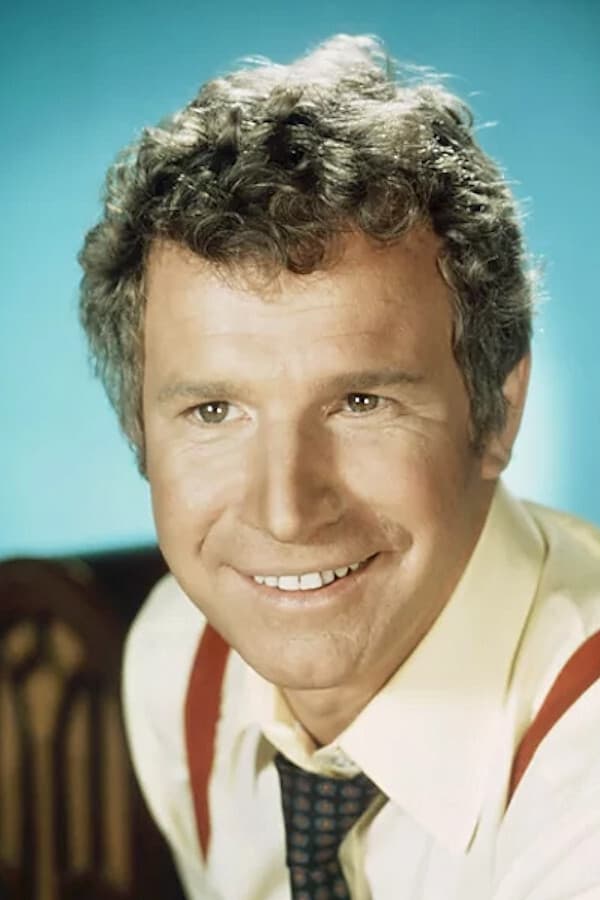

Wayne Rogers

Wayne Rogers was best known for playing Trapper John McIntyre on the popular TV series MASH for three seasons. He decided to leave the show because he believed the character Hawkeye Pierce was becoming the central focus of the storylines. After MASH, Rogers enjoyed a successful career as a businessman and often appeared as a financial analyst on news programs. He also continued to act in made-for-TV movies and hosted several shows of his own. He’s still remembered as a key part of the early seasons of the beloved comedy.

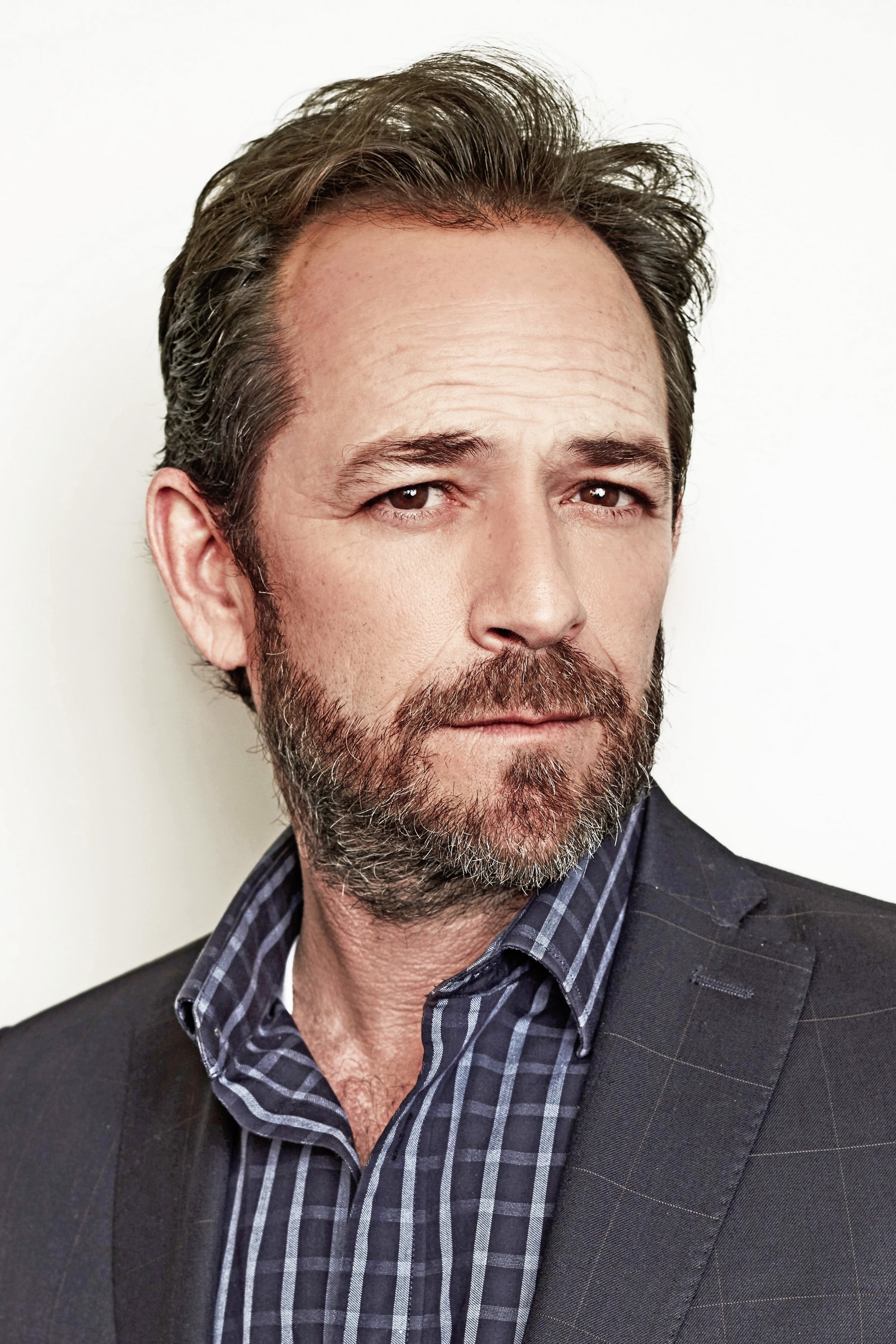

Luke Perry

The actor departed ‘Beverly Hills, 90210’ during its sixth season, seeking more adult roles in films such as ‘The Fifth Element’ and ‘8 Seconds’. He later rejoined the show for its ninth season and remained until it ended. More recently, he gained popularity with a new audience through his role in ‘Riverdale’. He’s widely considered a defining star of 1990s television.

Jason Priestley

The actor who played a lead role in ‘Beverly Hills, 90210’ left the show during its ninth season to pursue directing and producing. Although he stepped away from acting as a main cast member, he continued to work on the series as an executive producer and directed multiple episodes after his character’s departure. He went on to star in other shows like ‘Call Me Fitz’ and ‘Private Eyes,’ building a successful and varied career in the entertainment industry, working both on screen and behind the scenes.

Chad Michael Murray

Chad Michael Murray left ‘One Tree Hill’ after six seasons due to disagreements over his contract. He wanted to pursue more opportunities in film and television, appearing in movies like ‘House of Wax’ and later taking roles in shows such as ‘Agent Carter’ and ‘Riverdale’. His departure as Lucas Scott, a key character on ‘One Tree Hill’, significantly changed the show’s storyline, though he did return for a cameo in the final season.

Zach Braff

Zach Braff, best known for starring in the comedy ‘Scrubs’ for eight seasons, decided to leave the show to concentrate on directing and writing his own movies. He’d already gained recognition as a director with his film ‘Garden State’ while still on ‘Scrubs’. He made a few appearances in the ninth season to help with the show’s cast change. He continues to act and direct for both film and television.

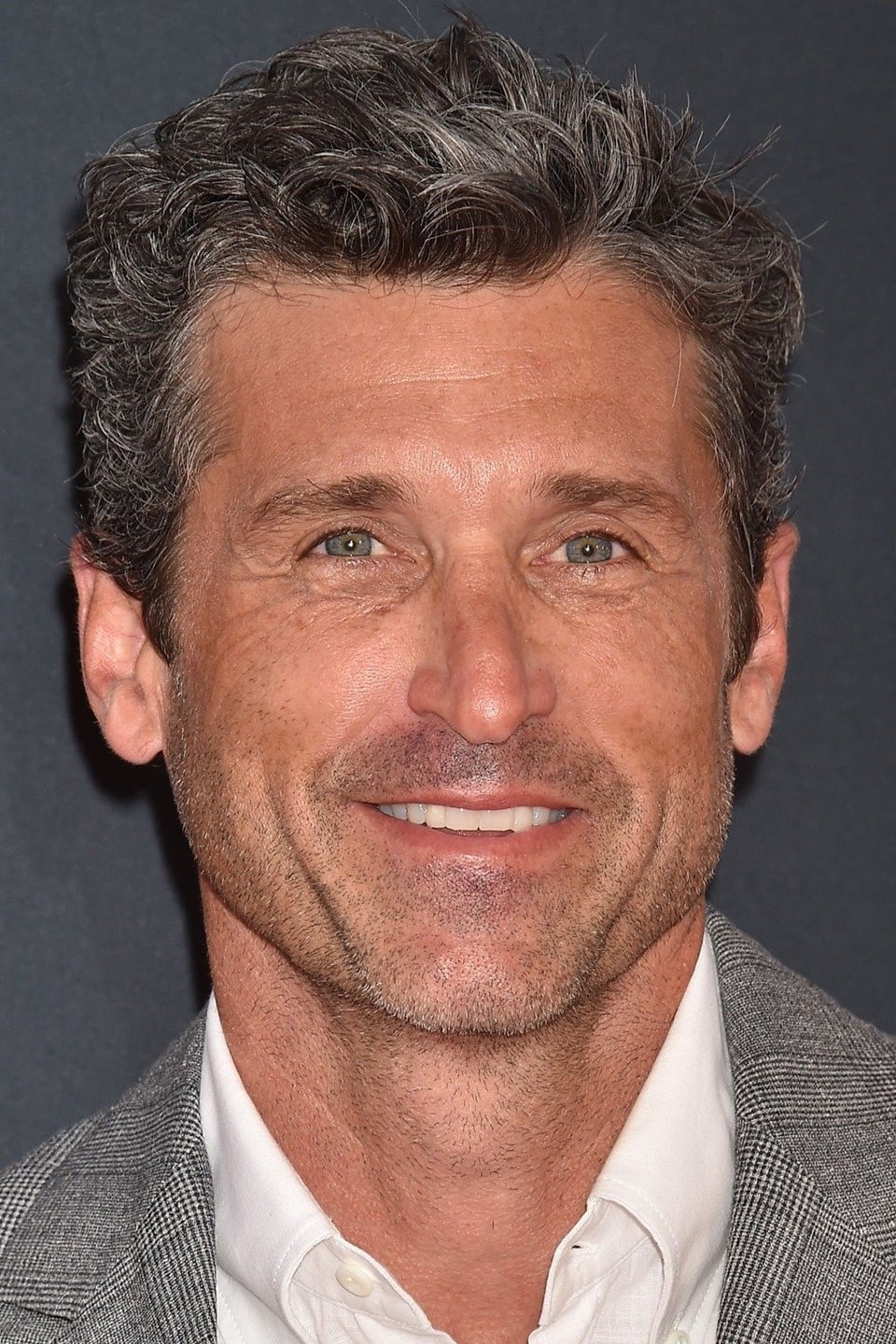

Patrick Dempsey

Patrick Dempsey, famous for playing Dr. Derek Shepherd on ‘Grey’s Anatomy’, left the show after eleven seasons to focus on his family and his love of auto racing. His exit was a significant moment for the series and involved a memorable storyline. Since then, he’s been in films like ‘Bridget Jones’s Baby’ and the TV series ‘Devils’, and even made a surprise return to ‘Grey’s Anatomy’ for a few episodes in its seventeenth season.

Justin Chambers

Justin Chambers was a core cast member on ‘Grey’s Anatomy’ for sixteen seasons, playing the character Alex Karev. He unexpectedly left the show to pursue different acting opportunities and have more family time. The show didn’t film his departure, which upset some loyal viewers. Since then, he’s appeared in projects like the limited series ‘The Offer’. He’s still remembered as one of the longest-running actors on the medical drama.

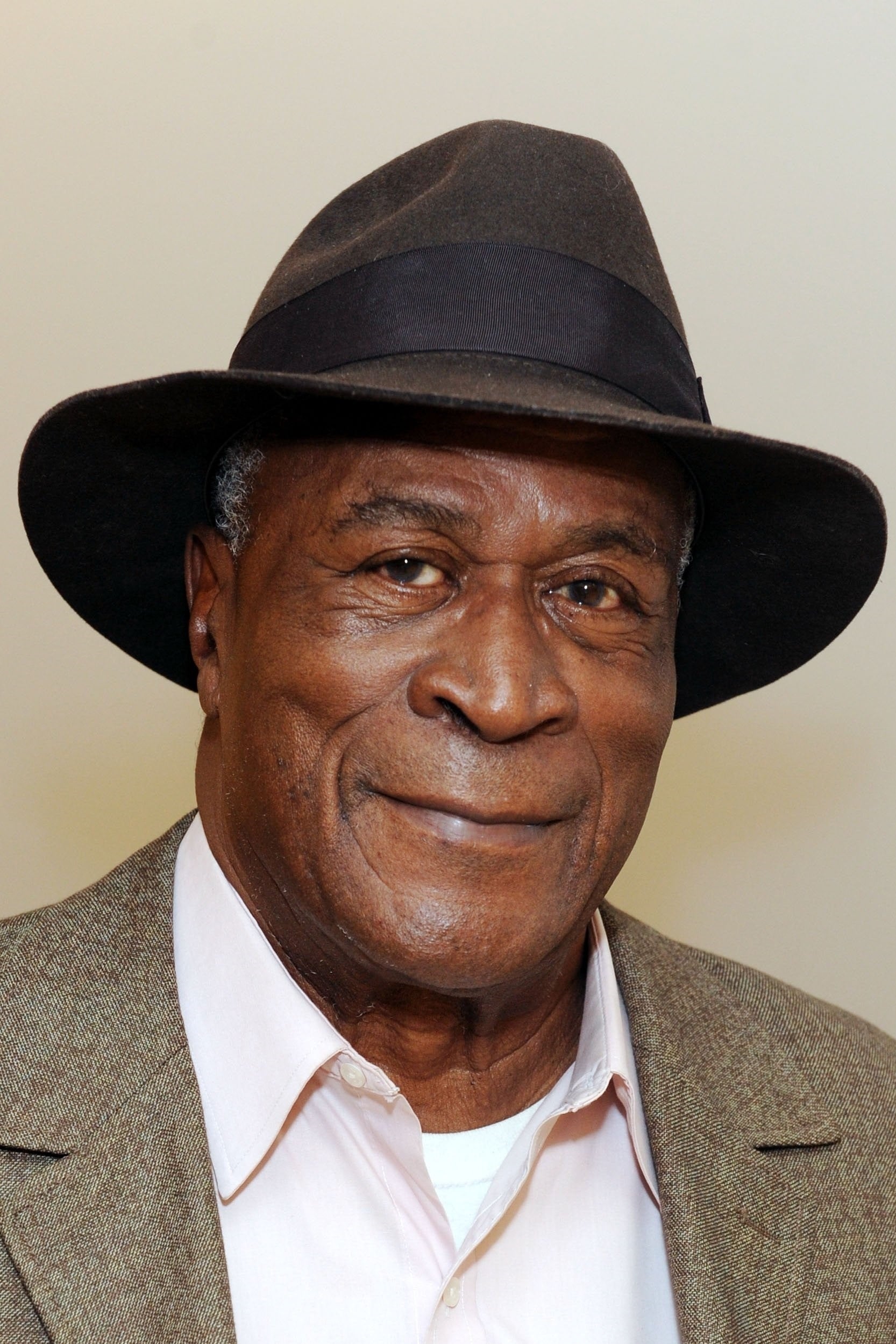

John Amos

John Amos is best known for playing James Evans, the father on the TV show ‘Good Times’. He left after three seasons because he disagreed with the show’s direction, believing it prioritized comedy over addressing important social problems. Following ‘Good Times’, he gained recognition for his role in the groundbreaking miniseries ‘Roots’ and appeared in films such as ‘Coming to America’. He went on to enjoy a successful and respected career in television and film for many years.

Dominic Monaghan

After finding fame in ‘The Lord of the Rings’, Dominic Monaghan became well-known for his role in the popular series ‘Lost’. He chose to leave the show during its third season to explore different opportunities. His character, Charlie Pace, had a particularly moving and heroic departure from the storyline. Since then, he’s hosted the nature documentary series ‘Wild Things with Dominic Monaghan’ and appeared in films like ‘X-Men Origins: Wolverine’ and ‘Star Wars: The Rise of Skywalker’.

Michael Weatherly

Michael Weatherly was a beloved part of ‘NCIS’ for thirteen seasons, playing Special Agent Tony DiNozzo. He decided to leave the popular show to take on the lead role in ‘Bull’, wanting a new challenge and the chance to play a different kind of character. His exit was a big moment for the show and its viewers. He then starred in ‘Bull’ for six seasons before it ended.

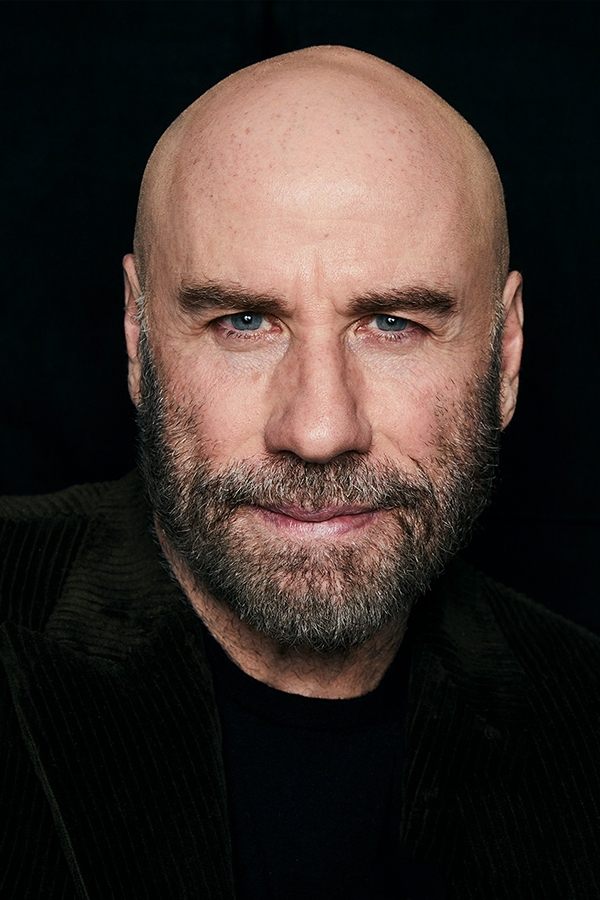

John Travolta

John Travolta first rose to fame in the 1970s on the TV show ‘Welcome Back, Kotter.’ He then left the series to pursue a movie career, which quickly took off with hits like ‘Saturday Night Fever’ and ‘Grease.’ His move from television to film is considered remarkably successful. Though his career had its ups and downs, he later returned to television with the highly praised series ‘The People v. O. J. Simpson: American Crime Story.’ Today, he’s remembered as a legendary figure in both movies and television.

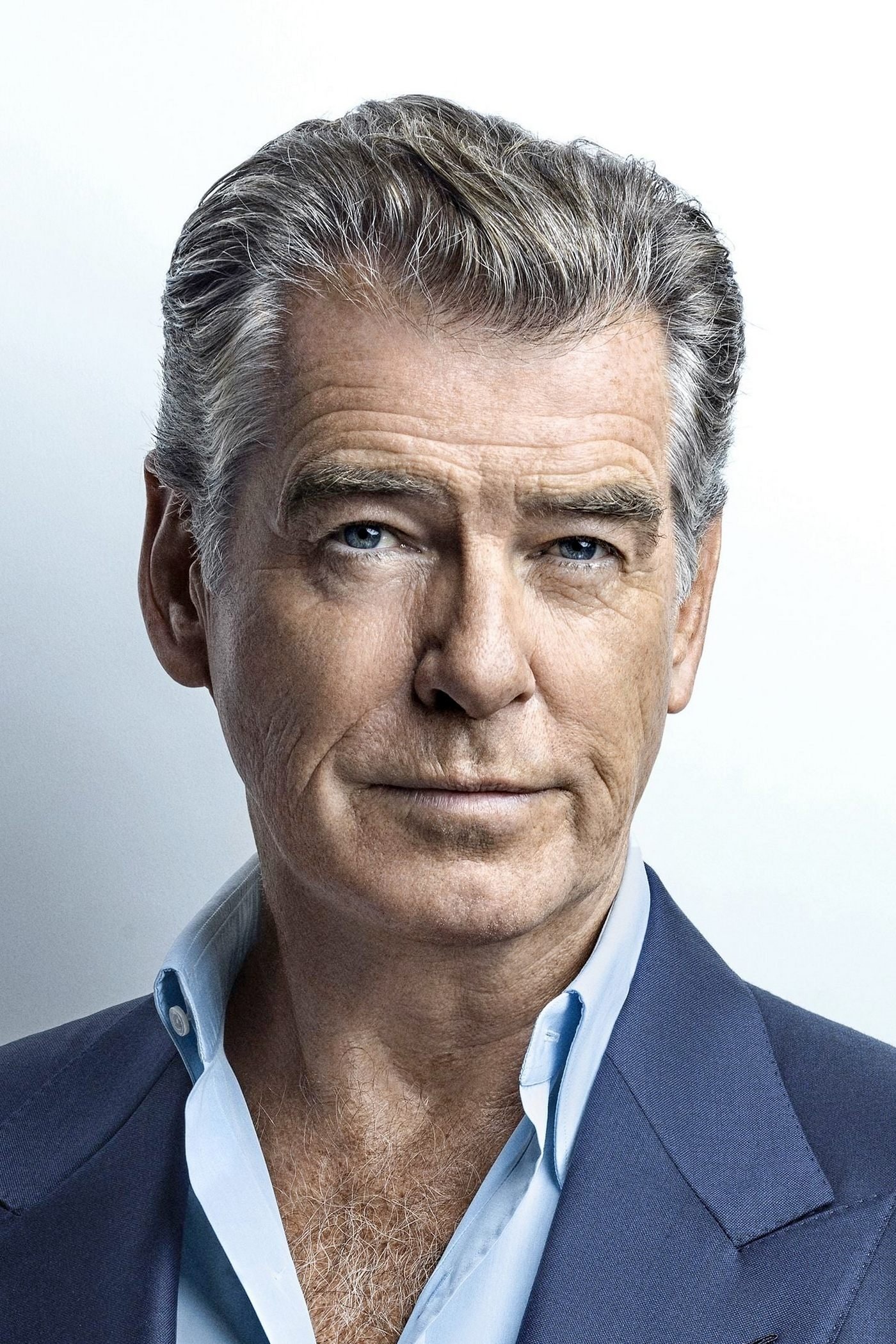

Pierce Brosnan

This actor initially landed the role of James Bond, but a prior commitment to the television series ‘Remington Steele’ kept him tied to that show. Once ‘Remington Steele’ concluded, he was free to become 007, and he went on to star in four Bond films that established him as a leading movie star. He also had roles in films like ‘The Thomas Crown Affair’ and ‘Mamma Mia!’. His career demonstrates how patience and waiting for the perfect opportunity can lead to worldwide success.

Rick Schroder

I’ve been a fan of this actor for years! I remember when he joined ‘NYPD Blue’ after Jimmy Smits left – he really kept the show strong and those ratings high. It was a surprise when he decided to leave, but he wanted to focus on his family and life on his ranch, which I totally understood. Since then, he’s been in a lot of TV movies and miniseries, and he’s even gotten behind the camera, directing and producing, including a documentary series called ‘The Fighting Season’. It’s amazing to think he started as a child star on ‘Silver Spoons’ – he’s had such a long and successful career!

Jimmy Smits

This actor is known for moving on to new roles after finding success on shows like ‘L.A. Law’ and ‘NYPD Blue’. He intentionally avoided staying with a single project for an extended period, always leaving on good terms and allowing the shows to evolve. This strategy helped him build a very successful career, including appearances in ‘Star Wars’ and ‘The West Wing’. He remains a prominent and respected leading man in television dramas today.

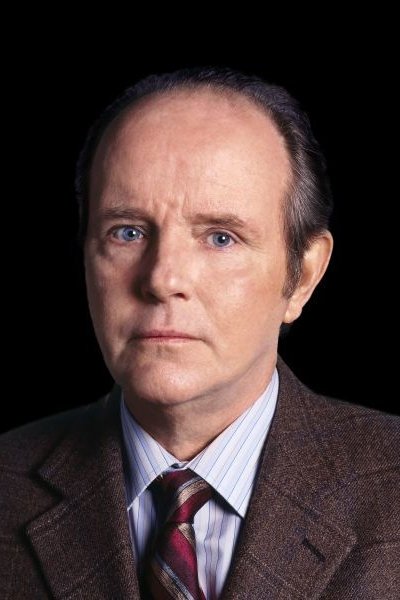

Michael Moriarty

He was the first lead prosecutor on the TV show ‘Law & Order,’ appearing in its first four seasons. He left after a public disagreement with the network about violence on television, and then moved to Canada, continuing his career in independent films and theater. Sam Waterston took over the role and became a well-known part of the show for many years. He’s best remembered for his powerful and thoughtful performance as Executive Assistant District Attorney Ben Stone.

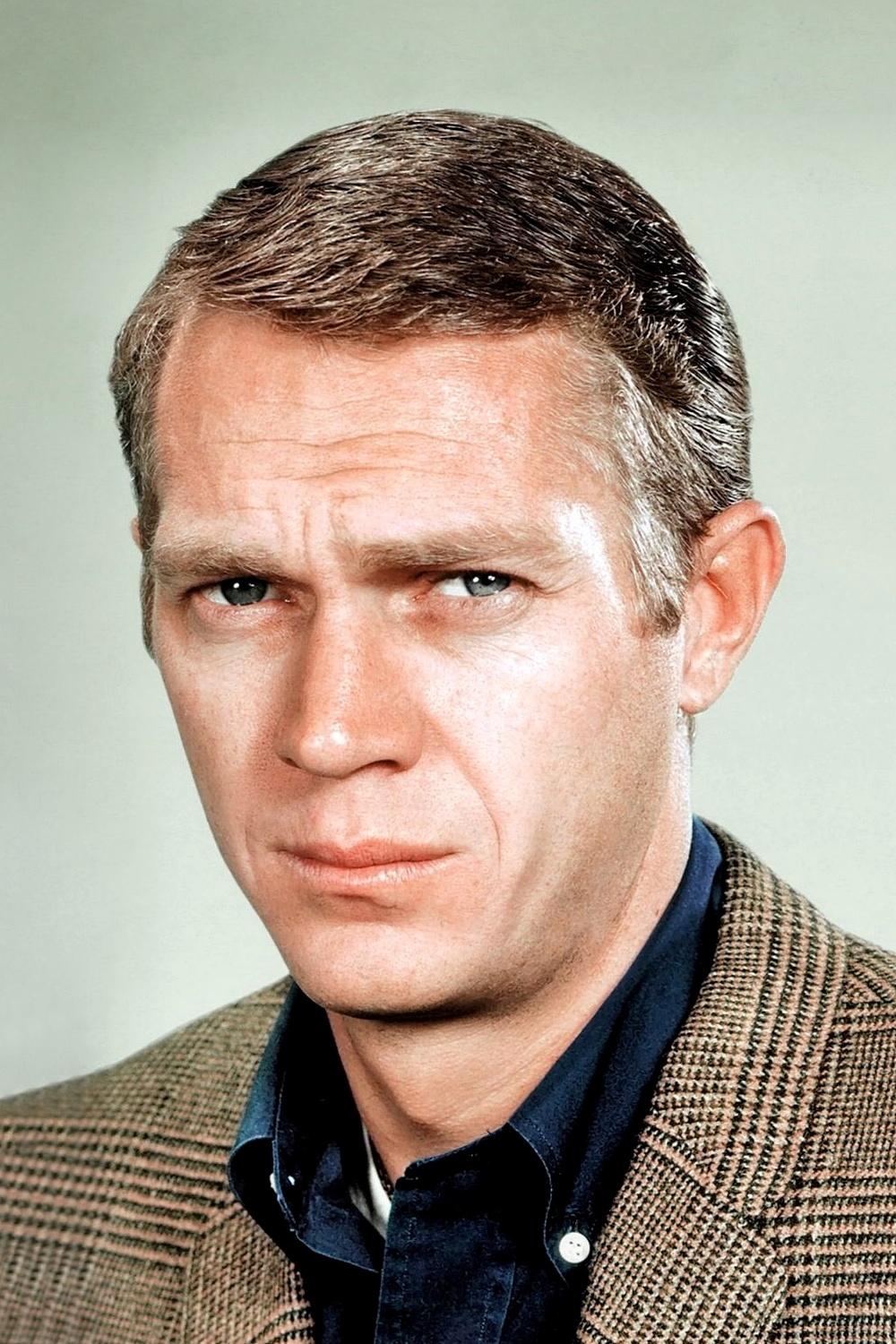

Steve McQueen

The actor first became famous in the late 1950s with his role in the western TV series ‘Wanted: Dead or Alive.’ After three seasons, he left the show to pursue a career in movies. He rapidly became a major star in the 1960s and 70s, appearing in popular films like ‘The Great Escape’ and ‘Bullitt.’ Known for his tough image and captivating presence, he earned the nickname ‘The King of Cool.’ He’s often considered the perfect example of an actor successfully moving from television westerns to become a big movie star.

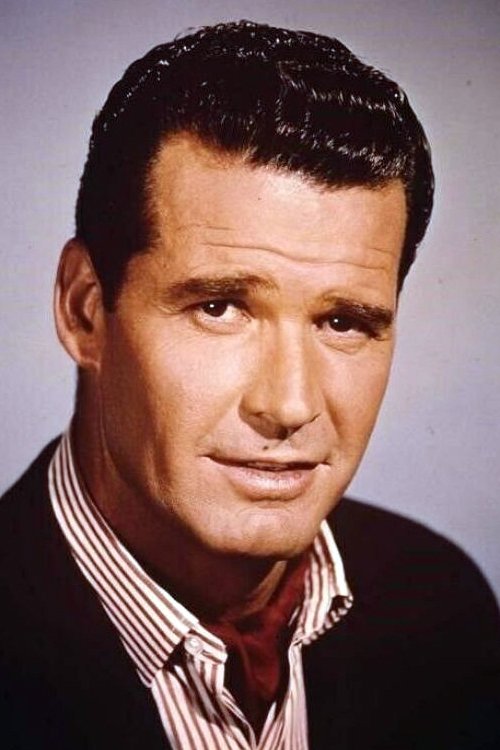

James Garner

He first gained fame as the star of the TV series ‘Maverick,’ but left after a disagreement over his contract. This opened the door for a highly successful movie career, including roles in classics like ‘The Great Escape’ and ‘The Americanization of Emily.’ Later, he returned to television with the popular show ‘The Rockford Files,’ which became another signature role. He’s one of the rare actors who achieved consistent success in both movies and television as a leading man.

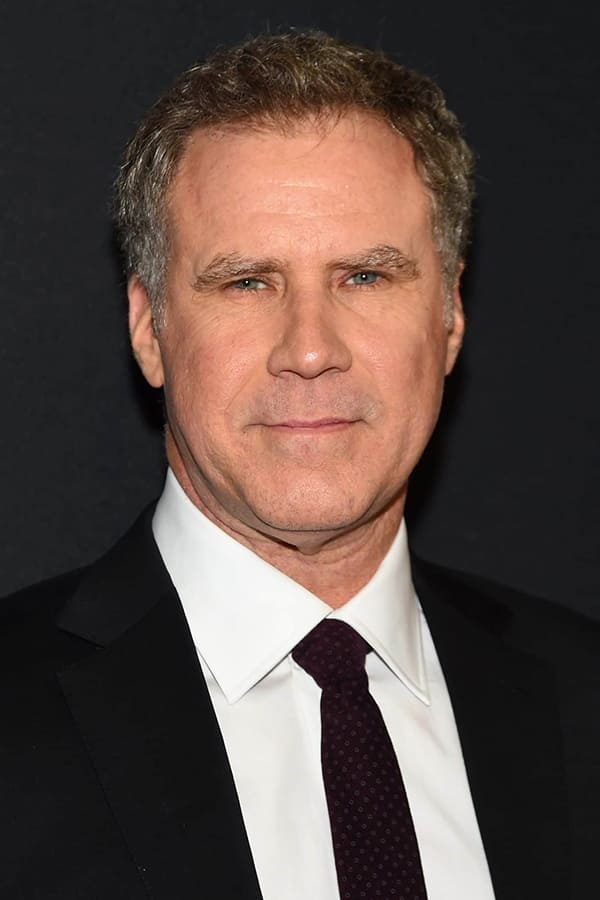

Will Ferrell

This comedian was a key performer on ‘Saturday Night Live’ for seven seasons. In 2002, he left the show to pursue a career in movies, which proved to be very successful. He starred in popular comedies like ‘Old School’ and ‘Anchorman: The Legend of Ron Burgundy’ and has become a leading comedic actor and producer in Hollywood. His exit from ‘SNL’ was a significant moment for the show.

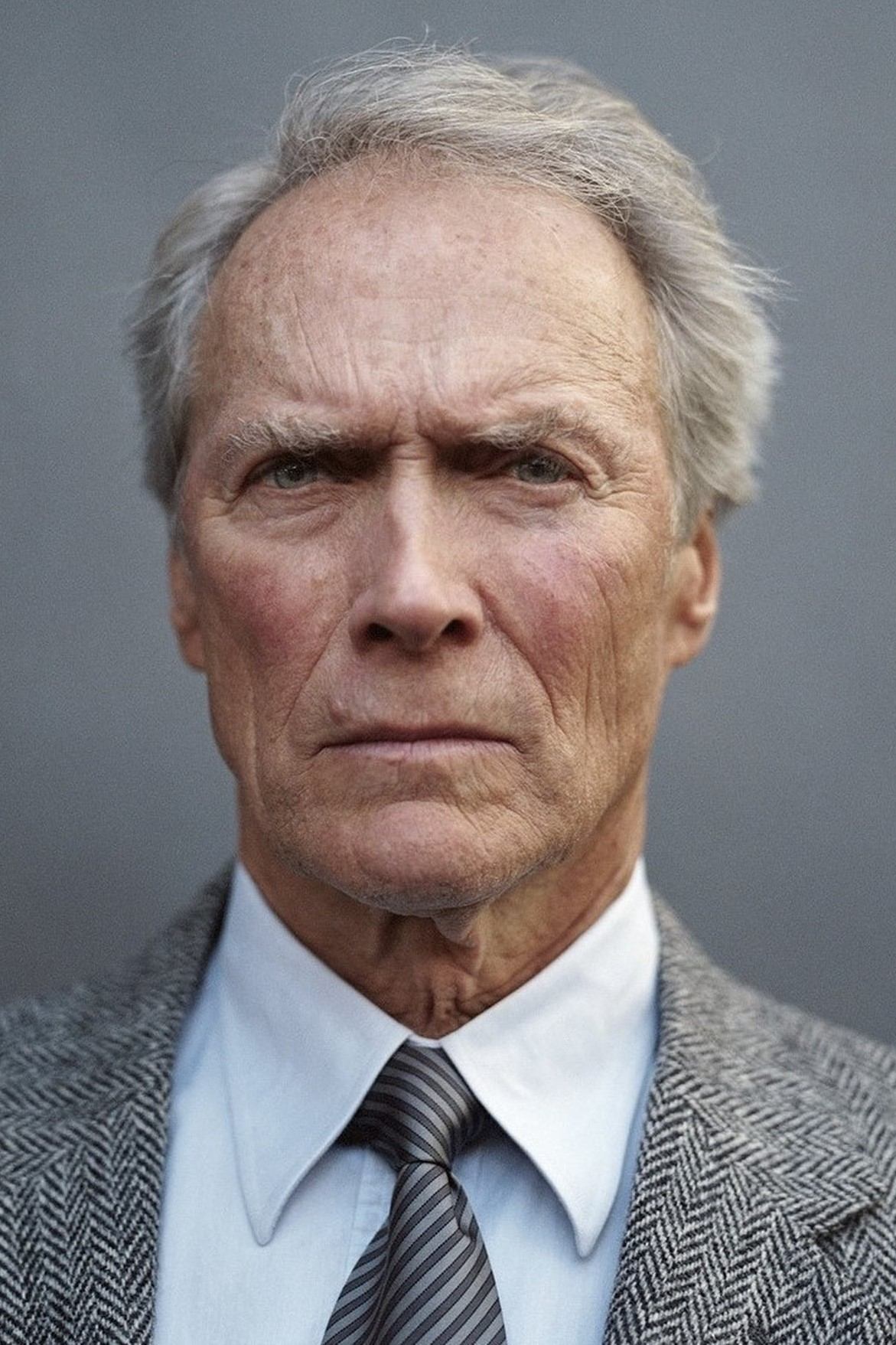

Clint Eastwood

Before becoming a famous director and actor, Clint Eastwood first gained recognition playing Rowdy Yates in the TV series ‘Rawhide’ for eight years. During breaks from the show, he collaborated with Sergio Leone on the highly successful Dollars Trilogy in Europe. These westerns were a hit, allowing him to move away from television and become a worldwide star. He’s since won numerous Academy Awards for directing and acting in acclaimed films like ‘Unforgiven’ and ‘Million Dollar Baby,’ solidifying his place as a hugely influential figure in cinema.

Burt Reynolds

This actor began his career with television appearances on shows like ‘Gunsmoke’ and ‘Hawk’. He then transitioned to film, becoming a major box office draw in the late 1970s with popular movies like ‘Smokey and the Bandit’ and ‘The Cannonball Run’. Later in his career, he returned to television, winning an Emmy for his work on the sitcom ‘Evening Shade’. Throughout his long career, he successfully played a variety of roles in different types of productions.

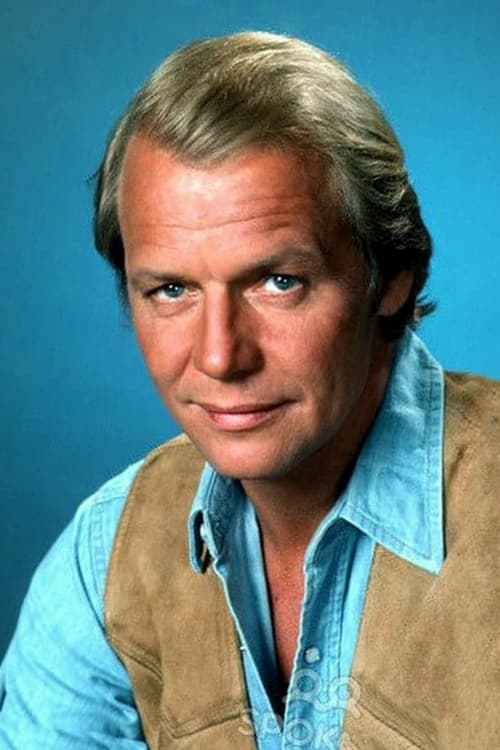

David Soul

Best known as Ken ‘Hutch’ Hutchinson from ‘Starsky & Hutch,’ this actor left the show after four seasons to pursue his passion for music and explore other acting roles in both the US and the UK. He had a hit song, ‘Don’t Give Up on Us,’ even while continuing to appear on television. Later, he moved to London and became a popular performer in West End theater. Fans still remember him fondly for his role in the classic police series.

James MacArthur

James MacArthur played Danny Williams on the original ‘Hawaii Five-O’ for eleven seasons. He chose to leave the show because he felt the role had become predictable and he wanted to explore other acting opportunities. The writers handled his exit by having his character retire from the police force. After ‘Hawaii Five-O,’ he continued acting in theater and made appearances on other TV shows. He’s still well-known for the memorable line his character often said throughout the series.

Adewale Akinnuoye-Agbaje

Adewale Akinnuoye-Agbaje is the actor known for playing the enigmatic Mr. Eko on ‘Lost’. He chose to leave the show during its second season to focus on film opportunities back in London. Since then, he’s appeared in popular movies like ‘Thor: The Dark World’ and ‘Suicide Squad’. Despite his relatively brief time on ‘Lost’, he’s become a favorite character among fans. He continues to work steadily in both large-scale blockbuster films and critically acclaimed TV series.

Damon Wayans

He first became famous as one of the original cast members and biggest stars of the comedy show ‘In Living Color’. After three seasons, he decided to pursue a career in movies and start his own production company, which led to leading roles in films like ‘The Last Boy Scout’ and ‘Major Payne’. Later, he returned to television with the popular sitcom ‘My Wife and Kids’. He continues to be a major inspiration in comedy and television production.

Adam Pally

After appearing as a main cast member on ‘The Mindy Project’ for three seasons, this actor decided to pursue other work. He wanted to create his own projects and star in movies. Since then, he’s had leading roles in the TV series ‘Making History’ and ‘Happy Endings,’ and appeared in films like ‘Iron Man 3’ and the ‘Sonic the Hedgehog’ movies. He continues to work regularly in comedy, both as a guest star and in leading roles.

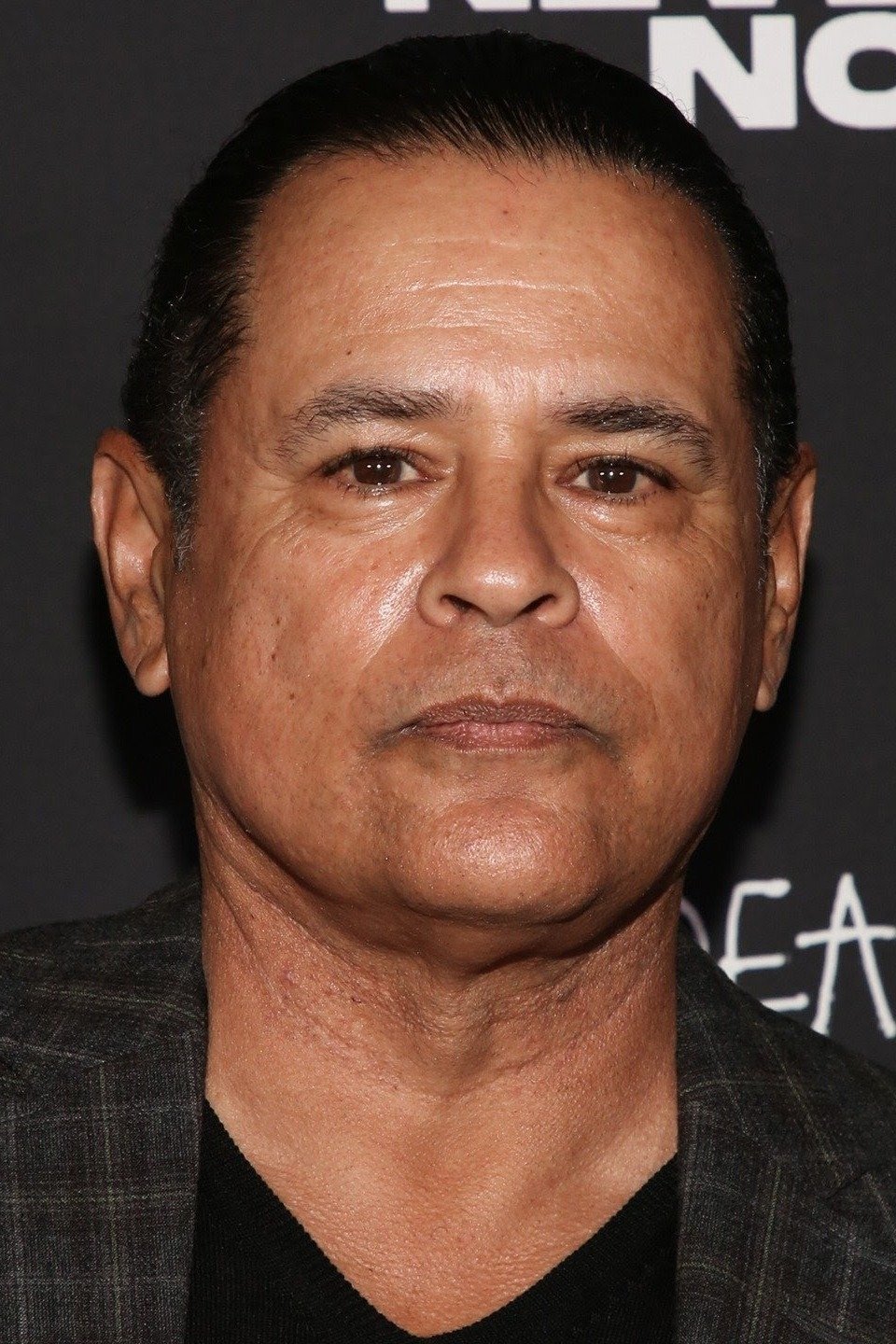

Raymond Cruz

Raymond Cruz is best known for his long-running roles as Detective Julio Sanchez in ‘The Closer’ and ‘Major Crimes,’ but he ultimately decided to pursue a wider variety of acting opportunities. He gained significant recognition for his powerful performance as Tuco Salamanca in ‘Breaking Bad’ and ‘Better Call Saul,’ and has proven his versatility by successfully playing both heroes and villains. He continues to be a highly regarded character actor in television.

Read More

- Building 3D Worlds from Words: Is Reinforcement Learning the Key?

- Gold Rate Forecast

- Securing the Agent Ecosystem: Detecting Malicious Workflow Patterns

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Wuthering Waves – Galbrena build and materials guide

- The Best Directors of 2025

- Games That Faced Bans in Countries Over Political Themes

- TV Shows Where Asian Representation Felt Like Stereotype Checklists

- 📢 New Prestige Skin – Hedonist Liberta

- SEGA Sonic and IDW Artist Gigi Dutreix Celebrates Charlie Kirk’s Death

2026-02-24 18:22