The chronicles of Wall Street offer a ceaseless parade of enthusiasms, and lately, the name of CoreWeave (CRWV 8.22%) has echoed with a particular fervor. A return of ninety-two percent in the preceding year – 2025 – is a figure that compels attention, a fleeting prosperity in a landscape often barren of genuine gain. The stock, having commenced the current year with a further advance of twenty-two percent, presents itself as a beacon. But a careful observer, one accustomed to the long winters of the market, must inquire: is this light truly a guide, or merely a phosphorescence, illuminating a path to inevitable dissipation?

CoreWeave, in essence, constructs and maintains the very cathedrals of the new digital age – data centers dedicated to the insatiable hunger of artificial intelligence. One might term them, with a certain grim irony, ‘armament foundries’ for the algorithmic wars. Hyperscalers, those behemoths of the cloud, find expediency in procuring GPU compute from CoreWeave, accelerating their expansion with a purchased velocity. It is a transaction devoid of the slow, organic growth that once defined enduring enterprise.

The torrent of capital flowing into data centers in 2025 was considerable, yet the forecasts for the coming year suggest a deluge. One is compelled to ask, however, whether this expansion is driven by genuine need or by a speculative frenzy, a collective delusion fueled by the promise of boundless algorithmic power. The question of whether CoreWeave stock remains a viable investment in 2026 demands a scrutiny beyond the simple arithmetic of growth.

The Illusion of Limitless Expansion

The stakes in this technological race, it appears, are ever escalating. Artificial intelligence is transitioning from a phase of intensive training – a costly and energy-intensive process – to one of inference, where models are deployed in real-world applications. This shift presents opportunities for monetization, a reaping of the rewards for years of investment in infrastructure. Yet, it also introduces new vulnerabilities, new points of potential failure. Reasoning models, autonomous agents, AI-powered robotics – these are the promised fruits, but their attainment is far from assured.

The influx of investment has manifested in CoreWeave’s burgeoning backlog, reaching $55.6 billion by the third quarter of 2025, a threefold increase from the previous year. One anticipates, with a degree of weary resignation, that the forthcoming earnings report will reveal a further escalation. But the accumulation of orders, while superficially impressive, does not necessarily translate to enduring prosperity. It is a measure of demand, yes, but also of dependence, a precarious reliance on a limited number of providers.

Analysts project a surge in revenue, from just over $5 billion in 2025 to $12 billion this year and $19.5 billion next year. Such growth, if realized, would indeed be remarkable. Yet, it is precisely this velocity that warrants caution. Rapid expansion often obscures underlying weaknesses, masking structural flaws that will inevitably surface when the pace inevitably slows.

The Razor’s Edge of Dependence

To characterize CoreWeave as a ‘pure play’ in AI data centers is to state a simple truth with profound implications. All this growth is predicated on a singular focus, a complete reliance on the fortunes of a nascent and volatile industry. This concentration of risk is not merely substantial; it is existential. The company derives eighty-six percent of its revenue from just four customers. The loss of any one of these entities would be catastrophic, a severing of a vital artery. It is not simply a matter of competition, but of systemic vulnerability. A retraction of spending by these hyperscalers – a recalibration of their strategic priorities – would have a devastating impact.

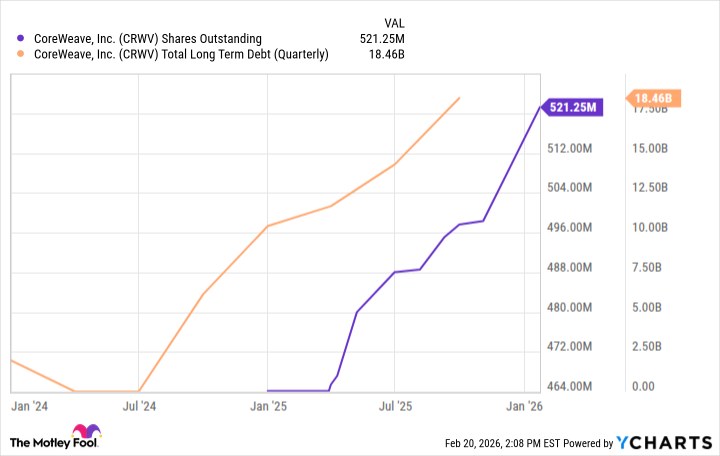

Furthermore, the construction of these data centers requires a substantial upfront investment, a constant drain on capital. CoreWeave has consumed $8 billion in the past four quarters alone. Management is aggressively pursuing debt and equity financing, accumulating nearly $18.5 billion in long-term debt. This relentless pursuit of capital is not a sign of strength, but of desperation. It is a testament to the insatiable appetite of this expansion, a hunger that threatens to consume the company itself.

The issuance of new shares dilutes the ownership of existing shareholders, spreading revenue and profits across a larger base, steadily depressing the stock price. The accumulation of debt creates a mounting burden, a constant pressure on the company’s finances. The loss of a key customer, coupled with a slowdown in spending by hyperscalers, would be a confluence of disasters, particularly in light of this substantial debt and ongoing losses.

A Prudent Assessment for 2026

It is a fallacy to believe that revenue growth is the sole determinant of a stock’s value. While CoreWeave undoubtedly exhibits impressive growth, it is accompanied by a multitude of caveats that demand careful consideration. The allure of rapid expansion often blinds investors to the underlying risks, obscuring the structural flaws that will inevitably surface.

At present, it is difficult to recommend this stock as a viable investment. CoreWeave trades at a price-to-sales ratio of 8 to 9, comparable to Microsoft and Meta Platforms, two of its customers. While these companies may not be growing at the same rate, they possess established, profitable core businesses and are not facing the same existential threats. They are not dependent on the continued expansion of a single, volatile industry.

The market is currently infatuated with AI stocks, but CoreWeave presents unique risks compared to most other companies in this sector. Prudent investors may wish to avoid this stock until its valuation comes down and the business can fund its expansion without relying so heavily on debt. A long winter may be coming, and those who have built their foundations on sand will be the first to fall.

Read More

- Gold Rate Forecast

- Securing the Agent Ecosystem: Detecting Malicious Workflow Patterns

- NEAR PREDICTION. NEAR cryptocurrency

- DOT PREDICTION. DOT cryptocurrency

- Wuthering Waves – Galbrena build and materials guide

- Silver Rate Forecast

- USD COP PREDICTION

- EUR UAH PREDICTION

- USD KRW PREDICTION

- Games That Faced Bans in Countries Over Political Themes

2026-02-23 16:53