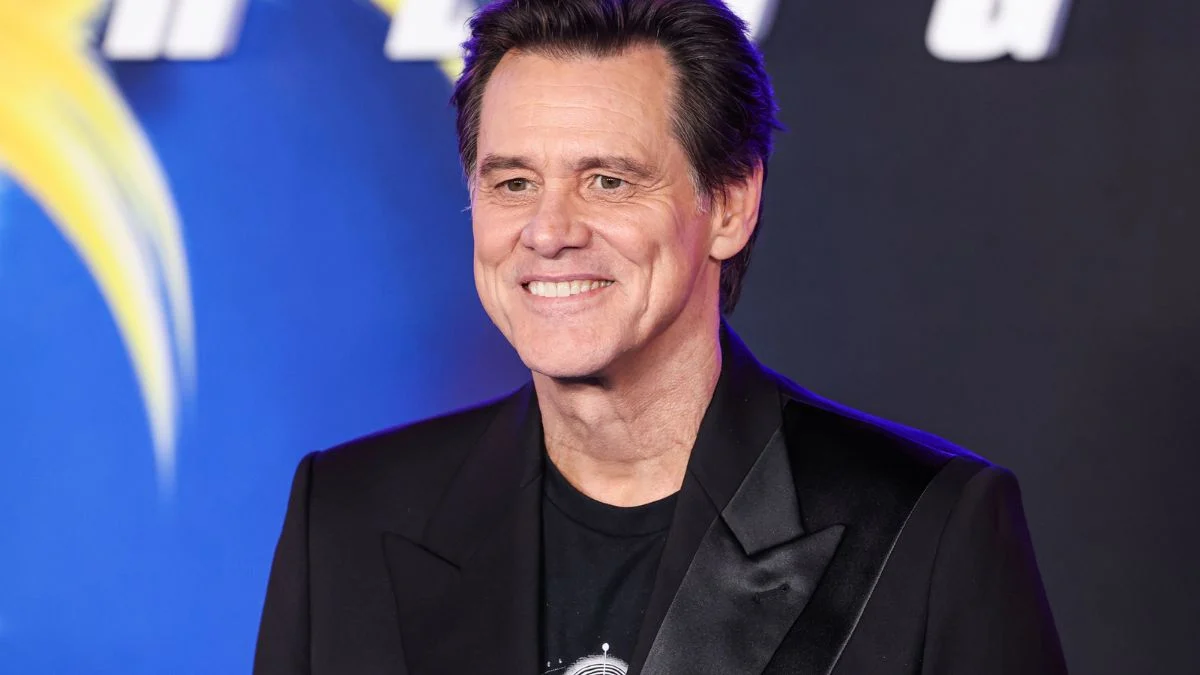

Throughout the 1990s, Jim Carrey was best known for his energetic physical comedy, using exaggerated movements and facial expressions to drive his performances – even in films like Batman Forever, where his physicality often spoke louder than his lines. However, as the 2000s began, he received a career-changing opportunity with the film Eternal Sunshine of the Spotless Mind.

The film feels surreal and dreamlike, with Jim Carrey portraying a character constantly fluctuating between love and despair, sometimes within just a few seconds. While Carrey was ready for the film’s emotional challenges, director Michel Gondry’s unconventional methods were unlike anything he’d experienced before.

Gondry didn’t use traditional cues like “action” or “cut,” leaving Carrey constantly uncertain and striving for perfection in every take. Producer Anthony Bergman revealed that the entire crew intentionally tried to push Carrey outside of his comfort zone.

Knowing Carrey’s dedication to perfection, they asked themselves, “How do we disrupt his process so he can’t over-prepare and rely on his usual performance style?” Their solution involved deliberately creating a chaotic set with unpredictable camera angles and lighting, designed to make him feel off-balance and unable to control the environment.

Bergman acknowledged that while the confusing and unsettling work environment influenced the actor’s performance, it was incredibly difficult for Jim Carrey. Carrey apparently disliked it intensely, frequently leaving the set and yelling at the crew. He reportedly told Bergman it was the worst experience he’d ever had on a film, due to the lack of clarity, but the crew believed they were creating something remarkable.

Making the film was incredibly difficult for Jim Carrey, but that struggle actually made the final product even better. He was going through a tough time personally, and that vulnerability perfectly suited the character, making him seem truly desperate throughout the movie.

Although he initially doubted his performance, Carrey later considered the film one of his best works. He could have easily chosen safer, more mainstream roles, but his commitment to this project changed how the public saw him.

He demonstrated that he could convincingly play broken and fragile characters, proving he wasn’t limited to just over-the-top comedy. Today, that performance remains a peak achievement in his dramatic career, revealing a depth and nuance audiences hadn’t seen before.

Jim Carrey has experienced a major comeback recently, putting his short-lived 2022 retirement plans aside to reprise his famous role as Dr. Robotnik. He was a huge box office draw in late 2024 and early 2025 with Sonic the Hedgehog 3, even playing both Dr. Robotnik and Gerald Robotnik in the film.

This month, the 64-year-old actor will receive an Honorary César Award in Paris on February 26. Excitingly, reports suggest Carrey is in discussions to star as George Jetson in a live-action version of The Jetsons at Warner Bros. There’s also talk of him revisiting some of his classic roles, possibly in a sequel to The Mask or The Grinch. Beyond acting, Carrey has been actively pursuing his passions for painting and writing, demonstrating his incredible versatility and talent.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- Wuchang Fallen Feathers Save File Location on PC

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- QuantumScape: A Speculative Venture

- ETH PREDICTION. ETH cryptocurrency

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- 9 Video Games That Reshaped Our Moral Lens

2026-02-23 13:44