Ah, the crypto market. That glorious, unpredictable beast that makes the stock market look like a sedate game of bingo. Today, it decided to take a leisurely stroll off a cliff, with Bitcoin leading the charge like a lemming in a business suit. From its lofty heights of $67,684, it plummeted to a mere $64,290-a 4.6% drop that has investors clutching their digital wallets in terror. Ethereum, not wanting to be left out of the fun, followed suit, tumbling from $1,957 to $1,848. Because, you know, why have a stable financial system when you can have a rollercoaster?

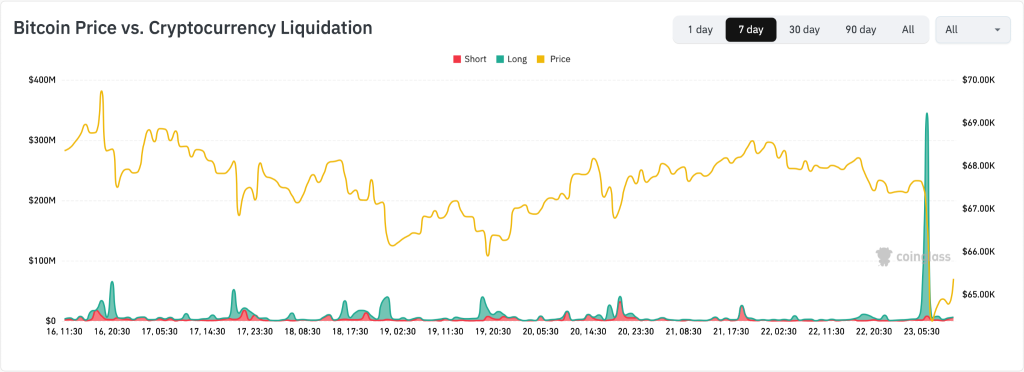

The market cap? Oh, it’s down too. A whopping 4.31% to $2.23 trillion. All thanks to a liquidation cascade in Bitcoin derivatives that makes Niagara Falls look like a dribbling tap. Bitcoin long liquidations surged 934% to $211 million in the past 24 hours. That’s right, $200 million in crypto longs were liquidated in just one hour as BTC flirted with $65,000. It’s like watching a game of financial Jenga, but instead of wooden blocks, it’s people’s life savings.

Altcoins: The Sidekicks in This Tragic Comedy

Of course, the altcoins couldn’t resist joining the party. Solana, once the darling of the crypto world, lost its grip on the $80 support level and nosedived to $77.43-a 9% pullback that has its fans questioning their life choices. XRP, Dogecoin, and Bitcoin Cash also took a beating, dropping over 5% each. It’s like a bad episode of Survivor, but with more math and fewer torches.

The altcoin market cap? Below $940 billion, flirting with lows around $910 billion. It’s been consolidating between $935 billion and $955 billion, but today’s drop broke the pattern like a bull in a china shop. LayerZero and pump.fun led the losers with drops of 10.21% and 8.72%, respectively. But fear not! Pippin is here to save the day with a 34.36% jump, because apparently, someone still believes in fairy tales. Kite, Memecore, and Toncoin also managed to rise, proving that even in chaos, there’s room for a little optimism.

USDT Liquidity: The Canary in the Crypto Coal Mine

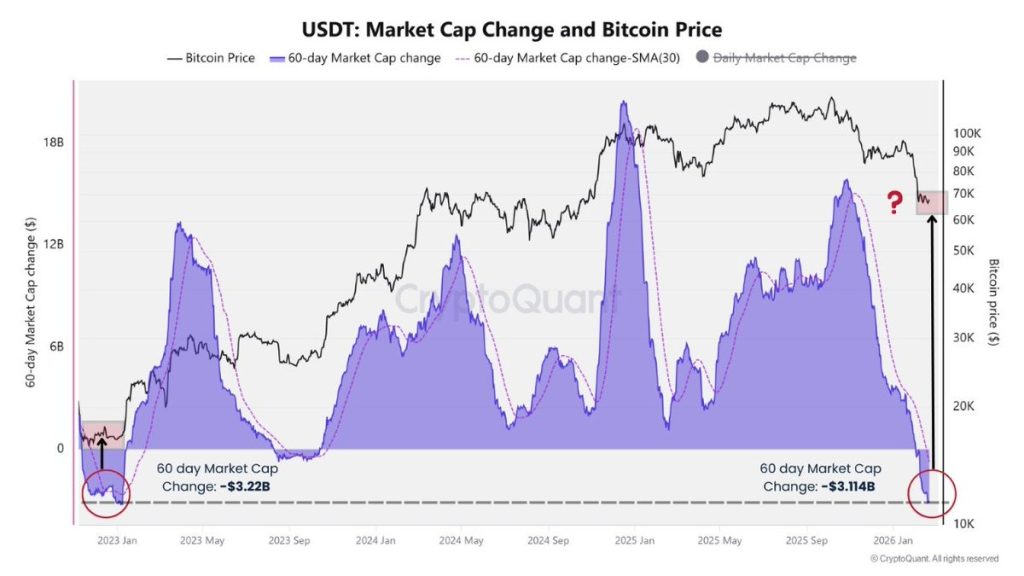

Now, let’s talk about USDT liquidity, because nothing says “fun” like a chart that tracks the 60-day change in stablecoin supply. Historically, when USDT supply expands (purple area rising), Bitcoin parties like it’s 2017. But when it contracts? Well, let’s just say Bitcoin starts looking for its security blanket. Right now, the 60-day USDT market cap change is down $3.1 billion-a level last seen near market bottoms in early 2023. Will this be another short-term dip, or the beginning of a deeper plunge? Only the crypto gods know, and they’re notoriously tight-lipped.

If stablecoin inflows don’t recover soon, Bitcoin might find itself in a spot of bother. But hey, who needs stability when you can have drama?

The Bottom Line: Buckle Up, Buttercup

The sell-off was sparked by a leveraged Bitcoin position unwind so violent it could rival a Michael Bay explosion. Ethereum’s ecosystem plunged nearly 20%, because why should Bitcoin have all the fun? The immediate future hinges on Bitcoin holding $65,000 and the total crypto market cap staying above $2.17 trillion. The next big catalyst? Daily ETF flow data, which will tell us just how interested institutions really are. Or, as I like to call it, “Will the big kids still play with us?”

So, the next few days are crucial. Will the market rebound, or will it continue its downward spiral into the abyss? Only time will tell. In the meantime, grab your popcorn, sit back, and enjoy the show. After all, in the world of crypto, the only certainty is uncertainty. And that, my friends, is why we’re all here.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- Wuchang Fallen Feathers Save File Location on PC

- ETH PREDICTION. ETH cryptocurrency

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- QuantumScape: A Speculative Venture

- Gay Actors Who Are Notoriously Private About Their Lives

2026-02-23 11:21