It’s a truth universally acknowledged that investors, single investors especially, must be in possession of a healthy desire for outsized returns. This, naturally, creates a rather inviting climate for Wall Street, which has obligingly concocted a range of exchange-traded funds designed to deliver just that – double, even triple, the market’s gains. Sounds splendid, doesn’t it? A shortcut to prosperity. But as anyone who’s ever attempted a shortcut will tell you, they often lead to surprisingly complicated places.

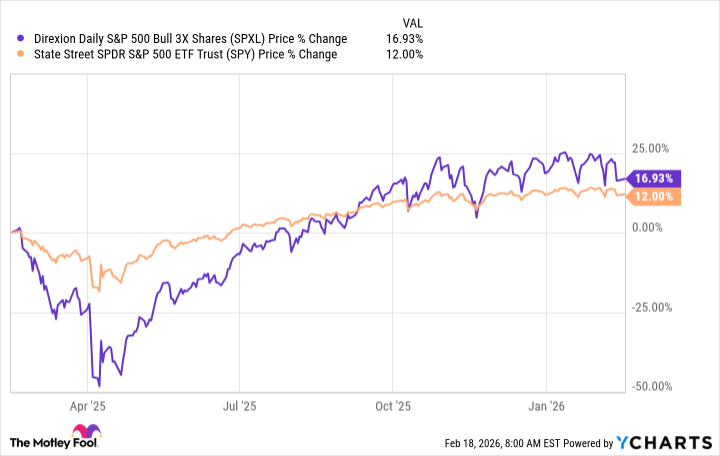

These are leveraged ETFs, and they operate on a principle that, while not exactly arcane, is best approached with a degree of cautious skepticism. You can find them offered by firms like Leverage Shares, Direxion, and ProShares. Historically, they’ve tended to latch onto broad market indices, like the S&P 500, offering products like the Direxion Daily S&P 500 Bull 3X Shares (SPXL +2.06%). Though, in a display of typical financial ingenuity, they’ve expanded to encompass sectors – ProShares Ultra Financials (UYG +1.41%) being a prime example – and, rather astonishingly, even individual stocks. There’s a 2X Long OPEN Daily ETF (OPEG +14.52%) tracking Opendoor Technologies, for goodness sake! They’ve even managed to create ETFs based on volatility itself – the 2x Long VIX Futures ETF (UVIX 4.53%) – which feels a bit like trying to bottle smoke.

The basic idea is that these funds employ complex investment strategies to amplify returns. It’s a bit like using a magnifying glass to focus the sun’s rays – effective when things are going well, but potentially disastrous if you’re not careful. And, as with most things involving financial markets, the potential for disaster is always lurking. It’s a bit like the history of the spork – a noble idea, but rarely a resounding success.

Don’t Forget Gravity

The crucial point, and one often overlooked in the enthusiasm for quick gains, is that leverage works both ways. If the S&P 500 enjoys a 10% rally, a 3X leveraged ETF might soar by 30%. Wonderful! But if the market dips 10%, that same ETF could plummet by 30%. It’s a simple mathematical reality, and one that seems to catch a surprising number of people off guard. Think of it like a seesaw – what goes up must eventually come down, and sometimes with considerable force.

These ETFs generally reset their performance daily, which means the sustained outperformance you might expect doesn’t always materialize. It’s a bit like trying to build a sandcastle during a particularly vigorous tide. And let’s not forget the power of compounding – or, in this case, negative compounding. If an investment loses 50% of its value, it requires a 100% gain just to break even. A rather sobering thought, isn’t it?

This raises two rather important questions. First, are you beginning to view investing as a form of gambling rather than a strategy for long-term wealth creation? If you’re attempting to time the market with a leveraged ETF, you’ve likely strayed into dangerous territory. And if you then start switching between leveraged and inverse ETFs (which move in the opposite direction of the index), well, you’re essentially placing a series of high-stakes bets. It’s a bit like trying to predict the outcome of a particularly chaotic game of pinball.

Second, assuming you are committed to a long-term investment horizon, can you realistically hold onto a leveraged ETF through the inevitable ups and downs of the market? Most investors, I suspect, would find the resulting price swings rather unsettling. If you can’t stomach the volatility, you won’t be around to reap the rewards when the market eventually recovers. It’s a bit like attempting to climb Mount Everest – you need to be prepared for a long, arduous journey with plenty of setbacks along the way.

Given the inherent risks, most investors would be better off avoiding leveraged ETFs altogether. There are far more sensible ways to build wealth, involving less speculation and more patience. It’s a bit like choosing a sturdy oak tree over a fragile dandelion – one is likely to weather the storm far better than the other.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- Wuchang Fallen Feathers Save File Location on PC

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- QuantumScape: A Speculative Venture

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

2026-02-22 21:32