Most famous actors weren’t instant successes. Before becoming well-known, many of them worked as extras in movies, often without getting any credit. These early jobs gave them valuable experience and a behind-the-scenes look at how the film industry works. From Oscar winners to action stars, a lot of famous faces started their careers quietly, observing the leads.

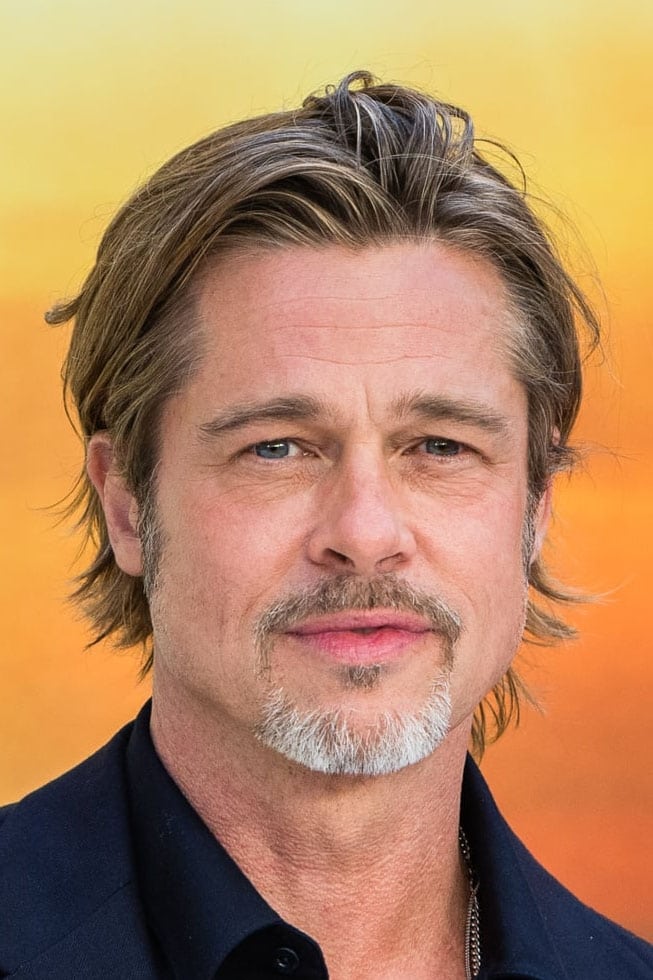

Brad Pitt

Before becoming a star, Brad Pitt made a few uncredited appearances in movies during the late 1980s. For example, he wore a tuxedo in ‘No Way Out’ (1987) and was a background extra at a party in ‘Less Than Zero’ that same year. These small roles helped him gain valuable experience on film sets before his big break in ‘Thelma & Louise’.

George Clooney

Before becoming a famous actor, George Clooney worked for about fifteen years in small, uncredited roles. He started as an extra in the 1978 miniseries ‘Centennial’ and continued taking similar background parts in TV shows throughout the early 1980s. His big break finally came with the series ‘ER’.

Renée Zellweger

Renée Zellweger made a very brief, uncredited appearance in the popular 1993 film ‘Dazed and Confused’. She was an extra, playing a girl in a blue pickup truck during a group scene, and didn’t have any lines. Even without speaking, she was part of a cast that included several other actors who would later become famous. She quickly moved into leading roles with the film ‘Texas Chainsaw Massacre: The Next Generation’ soon after.

Ben Affleck

Before becoming a famous actor and screenwriter, Ben Affleck had a small role in the 1989 movie ‘Field of Dreams’. He and his longtime friend, Matt Damon, were extras in a crowd scene filmed at Fenway Park. Affleck has mentioned they spent a whole day at the stadium, but only appeared on screen for a few seconds. This was one of his first experiences with a large-scale film production.

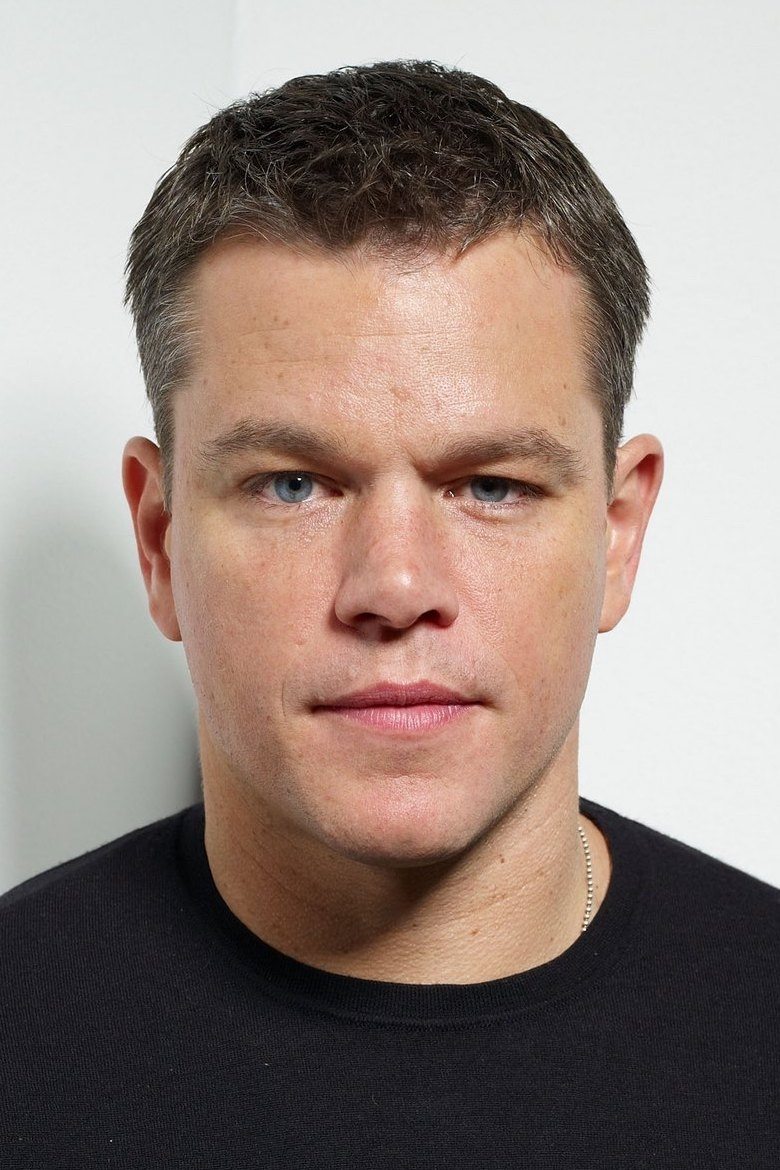

Matt Damon

Before becoming a famous actor, Matt Damon made a very brief, uncredited appearance in the movie ‘Field of Dreams’. While still a teenager, he was part of the crowd scene filmed at Fenway Park in Boston, eager to get any experience he could in the film industry. This small role is one of the first professional credits from what would become a hugely successful career starting in the 1990s.

Megan Fox

Megan Fox began her acting career with a small, uncredited role in the 2003 film ‘Bad Boys II’. At just 15 years old, she appeared as a background dancer in a club scene. Director Michael Bay included her in the scene alongside Will Smith and Martin Lawrence. This early appearance came before she became a leading actress in Bay’s ‘Transformers’ movies.

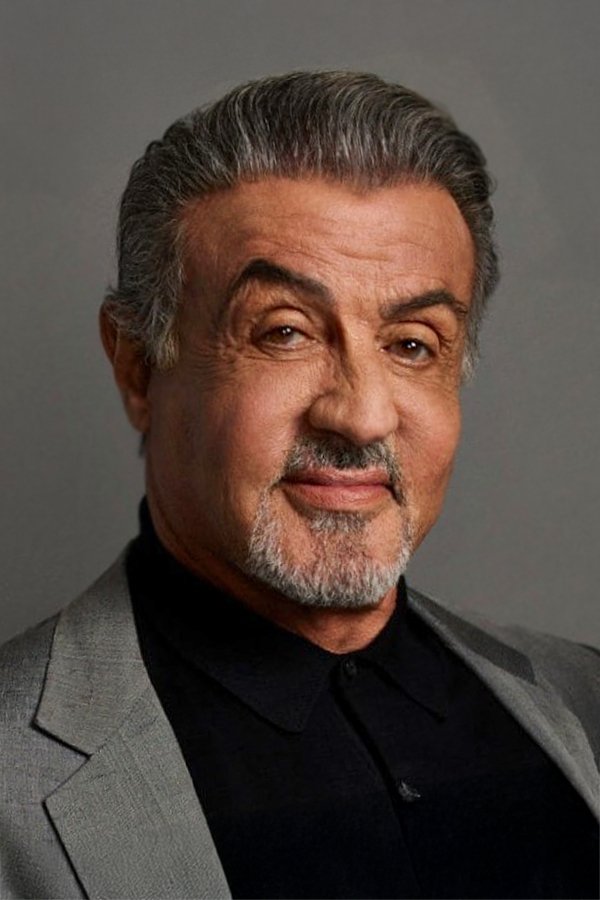

Sylvester Stallone

Before becoming a major star, Sylvester Stallone had a small, uncredited role in Woody Allen’s 1971 comedy, ‘Bananas.’ He played a thug on the subway who bothered the main character. Throughout the early 1970s, Stallone took on similar small parts while trying to launch his acting career. Just five years later, these experiences helped inspire him to create and star in the iconic film ‘Rocky’.

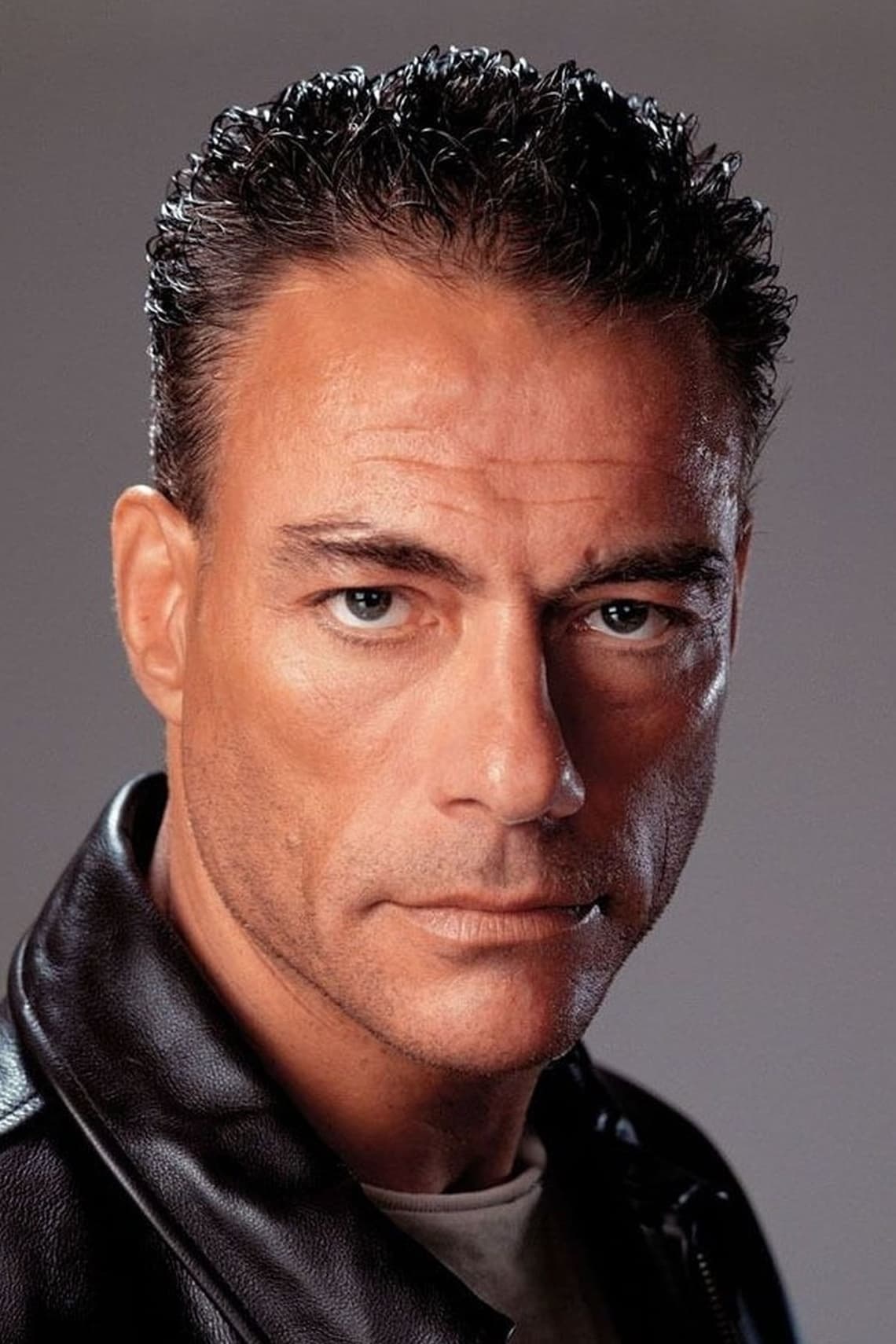

Jean-Claude Van Damme

Before becoming a martial arts star, Jean-Claude Van Damme made a brief, memorable appearance in the 1984 film ‘Breakin”. He can be spotted in the background, wearing a black tank top and dancing during one of the street performances. This happened soon after he moved to the United States to become an actor, and it’s a fun fact many fans of his later films, like ‘Bloodsport’, enjoy learning.

Channing Tatum

Before becoming a famous actor, Channing Tatum had a small, uncredited role in Steven Spielberg’s 2005 film, ‘War of the Worlds.’ He appeared briefly as a boy in a church scene during the movie’s alien invasion sequences. Prior to this, he’d mostly worked as a model and dancer, appearing in music videos. Soon after, he landed more prominent acting roles, including the film ‘Step Up’.

Jackie Chan

As a lifelong cinema fan, I always find it fascinating to learn about the early careers of stars. It’s incredible to think that Jackie Chan actually worked as a stuntman and extra on ‘Enter the Dragon’ back in 1973! He was one of the guards Bruce Lee fights in the underground base – a small role, but he was in a Bruce Lee movie! Apparently, Bruce Lee accidentally hit him during filming and actually apologized – a brief but memorable encounter, I’m sure. It’s amazing to think Jackie got to learn from a legend like Bruce Lee before becoming the global star we all know and love.

Jennifer Lawrence

Jennifer Lawrence actually appeared on TV before she became famous. One of her very first roles was a small, uncredited part on the show ‘Monk’ in a 2006 episode called ‘Mr. Monk and the Big Game.’ She played a high school basketball mascot, dressed in a lion costume, which meant most people didn’t even recognize her. This was four years before she really gained attention with her role in ‘Winter’s Bone’.

Tell us which of these celebrity origins surprised you the most in the comments.

Read More

- Gold Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- Securing the Agent Ecosystem: Detecting Malicious Workflow Patterns

- Silver Rate Forecast

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- NEAR PREDICTION. NEAR cryptocurrency

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Top 15 Insanely Popular Android Games

- USD COP PREDICTION

2026-02-22 18:16