Meta Platforms, a concern formerly known by a rather more innocent appellation, appears determined to spend with the profligacy of a minor principality. The declared intention to deploy some $115 to $135 billion by 2026—a sum sufficient to rebuild several respectable European nations—is, of course, presented as ‘capital investment’. One suspects a degree of competitive one-upmanship with other digital leviathans is also at play.

The object of this largesse, naturally, is ‘artificial intelligence’. A phrase which, when uttered with sufficient gravity, seems to absolve all financial imprudence. Meta’s ‘Superintelligence Labs’—a name redolent of both ambition and potential disaster—will, we are assured, benefit. But it is Nvidia, that purveyor of silicon and exorbitant valuations, which stands to gain most handsomely.

An agreement has been reached, a ‘multiyear, multigenerational strategic partnership’ as the press releases have it. One pictures the signatures affixed with a degree of mutual self-satisfaction. Meta will acquire ‘millions’ of Nvidia’s Grace CPUs, Blackwell and Rubin GPUs, and Ethernet switches. A veritable army of processors, destined to inhabit the cavernous, air-conditioned cathedrals of the data centre. The scale of it all is, frankly, rather vulgar.

Mr. Zuckerberg, that most assiduous of proprietors, has further indicated that Nvidia’s Vera Rubin chips will power his ‘personal superintelligence platform’. One trusts adequate safeguards are in place. The claim that this technology will reduce the cost of AI inference tenfold and the number of GPUs needed by fourfold is, of course, presented as justification for the expense. Such promises are rarely met, but one assumes the shareholders will remain, for the moment, unperturbed.

The selection of Arm-based Grace CPUs for a large-scale deployment is, one gathers, a matter of efficiency. Efficiency, naturally, is the last refuge of the spendthrift. Nvidia, meanwhile, enters the year with a ‘solid order backlog’. A polite way of saying that it is already struggling to meet demand. Taiwan Semiconductor Manufacturing, Nvidia’s foundry partner, is ramping up capacity, but one suspects that even that will prove insufficient. The whole affair smacks of a supply-constrained boom, which, as history teaches us, rarely ends well.

A Most Generous Forecast

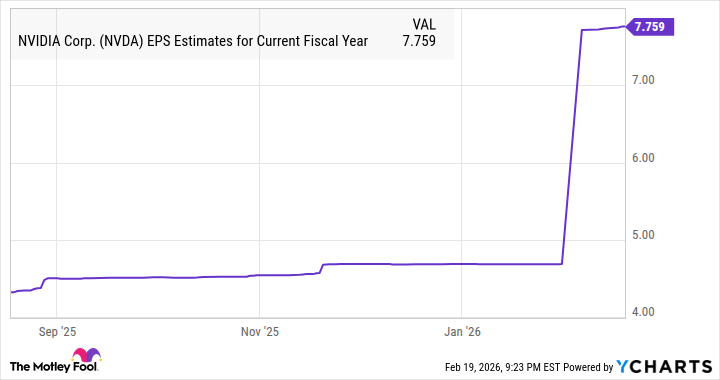

Analysts, those tireless peddlers of optimism, are forecasting a 53% increase in Nvidia’s revenue to $327 billion. Earnings are expected to jump by 65% to $7.75 per share. These figures, naturally, are subject to revision. The recent increase in earnings estimates following Meta’s announcement suggests a degree of momentum. One should, however, treat such projections with a healthy dose of skepticism.

Assuming Nvidia achieves a bottom line of $7.80 per share and trades at 32 times earnings—in line with the Nasdaq-100’s current valuation—the stock price could reach $247. A 32% gain. Not inconsiderable. Purchasing the stock at 24 times forward earnings appears, therefore, to be a reasonable, if not entirely reckless, course of action. One should, however, remember that the market has a habit of punishing exuberance. And this, one suspects, is a particularly exuberant moment.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Gold Rate Forecast

- Wuchang Fallen Feathers Save File Location on PC

- Banks & Shadows: A 2026 Outlook

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- QuantumScape: A Speculative Venture

- ETH PREDICTION. ETH cryptocurrency

2026-02-22 16:52