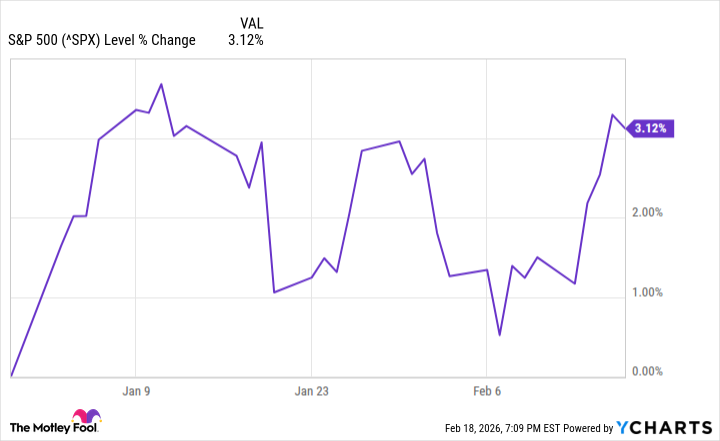

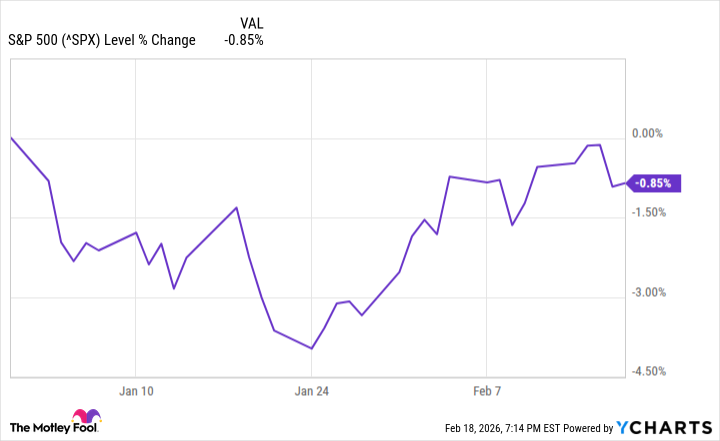

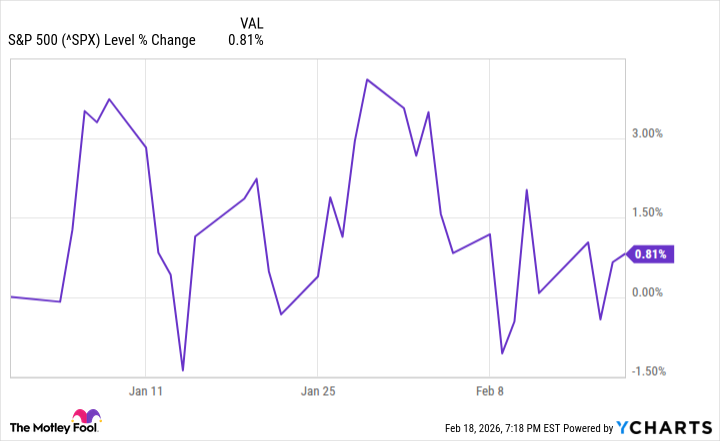

One does rather wish the market would make up its mind. It’s all terribly indecisive, isn’t it? The S&P 500, that rather ubiquitous index, seems to be having a bit of a sit-down, a moment of quiet contemplation. Not exactly crashing, heavens no, just…stuck. A most tiresome state of affairs, really. The exuberance of the last few seasons appears to have taken a holiday.

It’s not as though it’s plummeting into the abyss, mind you. It simply lacks the vim and vigour one expects. It’s oscillating, as the analysts so charmingly put it, between points that are remarkably similar. A bit like a rather dull party where everyone is politely avoiding each other.

So, the S&P 500 is, shall we say, paused. One wonders, what does history suggest? And frankly, history is often a more reliable companion than most fund managers.

Lessons from Previous Pauses

These little hesitations aren’t entirely unprecedented, you know. They do occur from time to time, though one wishes they wouldn’t disrupt one’s afternoon tea. 2006, for instance, offers a rather instructive parallel. The index spent the first few weeks of the year dithering about, unable to commit to a direction. A bit like choosing between caviar and foie gras – both perfectly acceptable, but one must decide.

Then, quite unexpectedly, it took off. A solid gain of nearly 14% by year-end. One hopes for a repeat performance, naturally. Though, one shouldn’t rely on hope; it’s a rather unreliable investment strategy. 2005, however, was less obliging. Similar hesitation, a rather meagre 3% gain. A distinct lack of panache, wouldn’t you agree?

And then there was 1999. A sluggish start, followed by a rather boisterous rally. Almost 20% by year-end. One suspects a great deal of irrational exuberance was involved, but who’s counting? The market, it seems, has a fondness for drama.

I shan’t bore you with a comprehensive review of the last fifty years. Suffice it to say, the index has, more often than not, managed to salvage something positive from these hesitant starts. Catastrophic declines have been, thankfully, rather rare. Though, one shouldn’t mistake a lack of disaster for a guarantee of success.

What Lies Beneath the Surface

The most instructive observation, however, is that not all stocks behave with the same lack of conviction. The index may be pausing, but opportunities remain for those with a discerning eye. Take, for example, the State Street Energy Select Sector SPDR ETF. It’s soared over 20% this year. Geopolitical anxieties and a surge in demand, particularly from those power-hungry data centres, are providing a rather pleasant tailwind.

The State Street Materials Select Sector SPDR ETF isn’t far behind. The AI boom, increased infrastructure spending, and a fondness for precious metals are all contributing to its success. One suspects a great deal of speculation is involved, but who’s to say that’s a bad thing?

And then there’s Sandisk. A rather remarkable performance, wouldn’t you agree? Over 150% gain, despite the volatility of the tech sector. A testament to the power of flash memory, or perhaps just a temporary bubble. One never knows.

Opportunities for the Discerning Investor

History suggests the S&P 500 will likely finish the year on a positive note. But frankly, the present is far more interesting. This year offers opportunities for those who are willing to look beyond the index and select individual stocks with genuine potential. Energy and materials stocks, at this juncture, appear particularly promising. Though, one should always remember the cardinal rule: never put all your eggs in one basket, no matter how tempting.

Read More

- Gold Rate Forecast

- Securing the Agent Ecosystem: Detecting Malicious Workflow Patterns

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- NEAR PREDICTION. NEAR cryptocurrency

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- USD COP PREDICTION

2026-02-22 12:52