Hollywood often struggles with strict ideas about race and what feels ‘real.’ Black male actors, in particular, find it hard to get roles because people have limited ideas of what Blackness looks like. This has sparked public conversations about things like colorism and where someone comes from. Some actors have even been criticized for not fitting a certain image. Despite these challenges, the fifty actors featured here have built thriving careers in the industry.

Daniel Kaluuya

When Daniel Kaluuya was cast in ‘Get Out’, some American critics and industry professionals wondered if a British actor could convincingly portray the unique racial issues faced in the United States. The debate centered on whether his experiences growing up outside of America would prevent him from fully understanding the Black American experience needed for the role. Kaluuya countered by pointing out that systemic racism exists everywhere and sharing his own personal experiences with prejudice. He has continued to choose important roles that challenge limited ideas about who can portray certain identities.

David Oyelowo

When David Oyelowo was cast as Martin Luther King Jr. in the movie ‘Selma,’ some people questioned the decision, arguing that a British actor shouldn’t portray such a significant American figure. The main concern was whether his background would prevent him from fully understanding the civil rights movement. Oyelowo responded by emphasizing the profound emotional and spiritual demands of the role. Ultimately, his performance was widely praised and showed his dedication to accurately representing the historical events.

Will Smith

When Will Smith was chosen to play Richard Williams in ‘King Richard’, many people criticized the casting, arguing he wasn’t dark enough to realistically portray the father of Venus and Serena Williams. This led to a broader discussion about colorism in Hollywood and how lighter-skinned actors are often favored for roles based on real people. Despite the controversy, Smith concentrated on embodying Williams’ spirit and drive, and ultimately won an Academy Award for his performance as the dedicated coach and father.

Giancarlo Esposito

Giancarlo Esposito has often discussed the difficulties he encountered early in his acting career as a biracial man. He was frequently told he didn’t fit neatly into roles meant for Black actors – sometimes considered too light-skinned, and other times too dark. This made him develop a flexible acting approach that moved beyond racial stereotypes. He ultimately achieved success by focusing on characters known for their strength and intelligence, rather than just how they looked. His performance in ‘Breaking Bad’ proves his ability to captivate audiences despite these initial challenges in the industry.

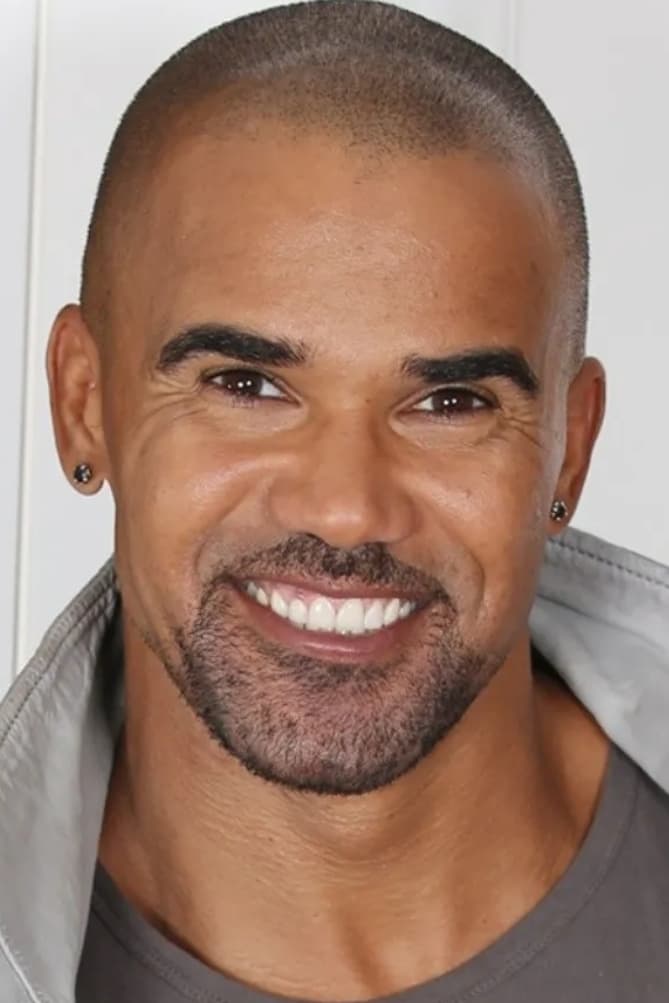

Shemar Moore

Shemar Moore has frequently spoken about the challenges of being biracial in Hollywood, where people tend to expect actors to fit neatly into one racial category. Early in his career, he often felt pressured to prove his identity to casting directors who didn’t see him as Black enough for certain roles. They often thought he looked better suited for romantic or comedic parts. Moore has described the internal conflict of feeling caught between two worlds as he tried to establish his career. He ultimately found success playing complex characters in long-running shows like ‘Criminal Minds’ and ‘S.W.A.T.’.

Michael Ealy

Michael Ealy has experienced how colorism affects actors, particularly because of his appearance. His blue eyes and lighter skin often led to him being cast as the attractive love interest, which sometimes limited the types of roles he was offered early in his career. Some people saw his looks as a distraction from more complex or culturally relevant stories. Ealy has intentionally sought out diverse roles, like in ‘For Colored Girls,’ to demonstrate his acting ability beyond just his physical appearance.

Jesse Williams

Jesse Williams often speaks about the unique challenges of being a biracial, light-skinned actor in Hollywood. He recognizes that his appearance gives him advantages, but also leads to doubts about how genuinely connected he is to the Black community. Despite actively participating in social justice work, some have questioned his place within the Black experience. Williams openly addresses these criticisms in interviews and speeches, continuing to use his career to support and advocate for the Black community.

Anthony Mackie

Anthony Mackie has often discussed the pressure for Black actors to fit a specific image, and how this affects who gets cast in films. He’s frustrated that the film industry often limits the portrayal of Black life to stories of hardship or inner-city experiences. Mackie himself has been criticized for playing characters who don’t conform to typical stereotypes of Black men. He believes we need more varied and realistic depictions of Black men, showcasing their diverse backgrounds and interests. His work in the Marvel Cinematic Universe has been important in bringing Black heroes to a wider, global audience.

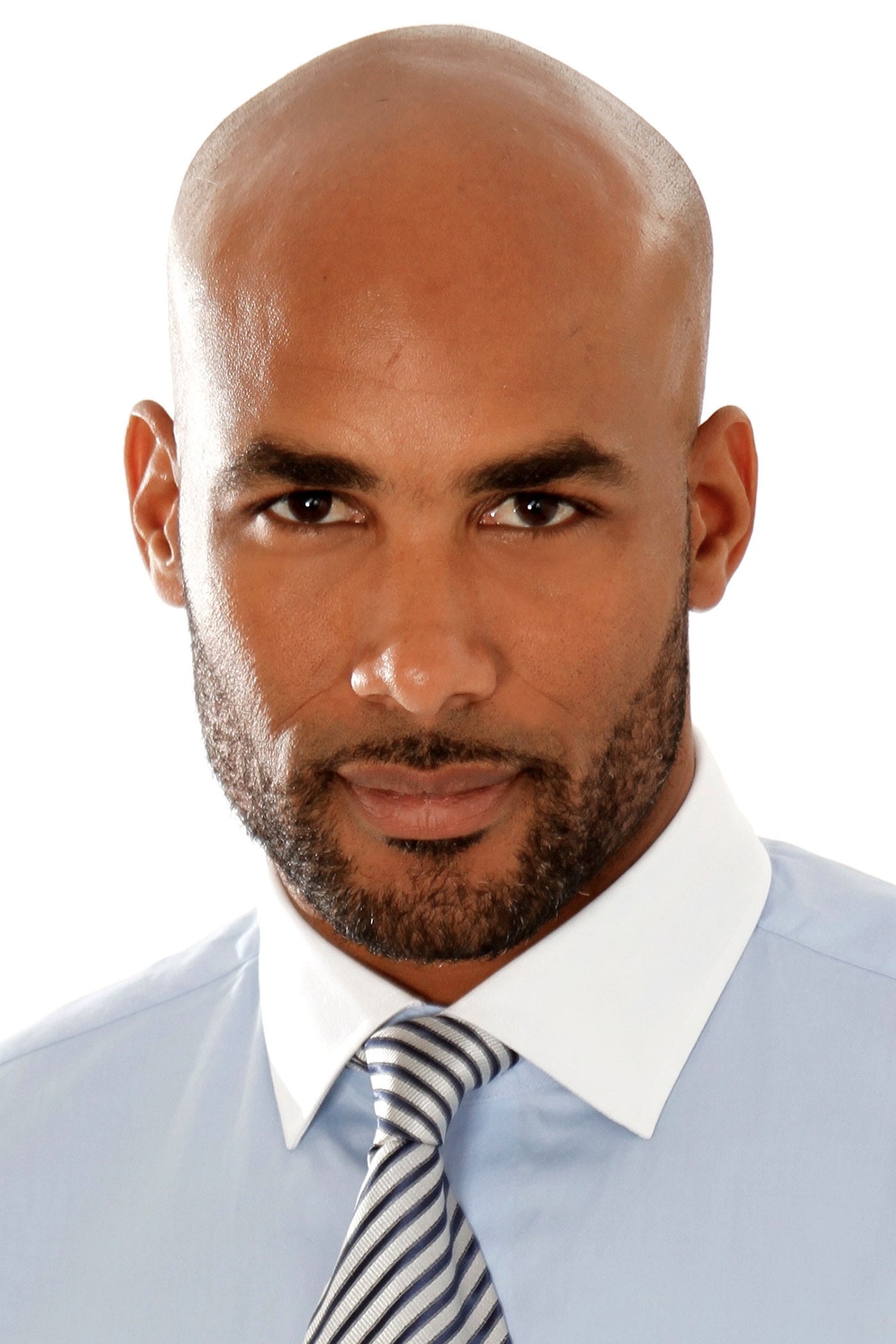

Boris Kodjoe

Boris Kodjoe’s background – born in Germany to parents from Ghana and Germany – has presented some obstacles in his acting career. Early on, he noticed that casting directors had difficulty fitting him into typical African American roles, likely due to his accent and diverse heritage. He was sometimes considered too different or ‘exotic’ for those parts. Kodjoe has overcome this by choosing roles, such as in ‘Station 19’, that allow him to embrace and showcase his international background.

Wentworth Miller

As a longtime movie and TV fan, I was really struck when Wentworth Miller started talking about his biracial identity. For years, especially when he first became famous in ‘Prison Break,’ he was often seen as simply white, and that led to a certain kind of expectation. But once people learned about his full heritage, it sparked a conversation about what roles he could—or should—take on, specifically regarding Black characters. He’s been incredibly open about how confusing and challenging it was growing up not fitting neatly into one racial category. And honestly, it’s inspiring to see him now using his experiences to push for more complex and thoughtful stories about identity in general. It’s something I really appreciate as a viewer.

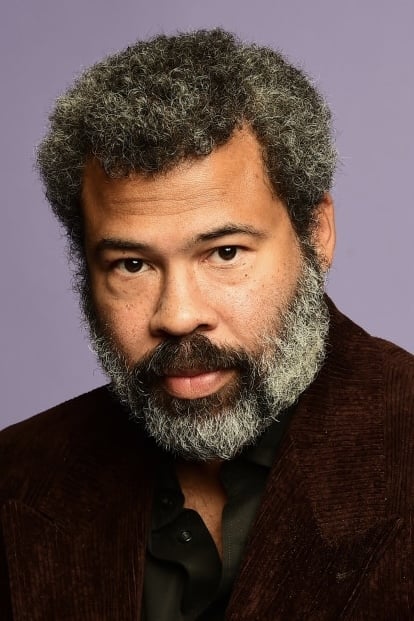

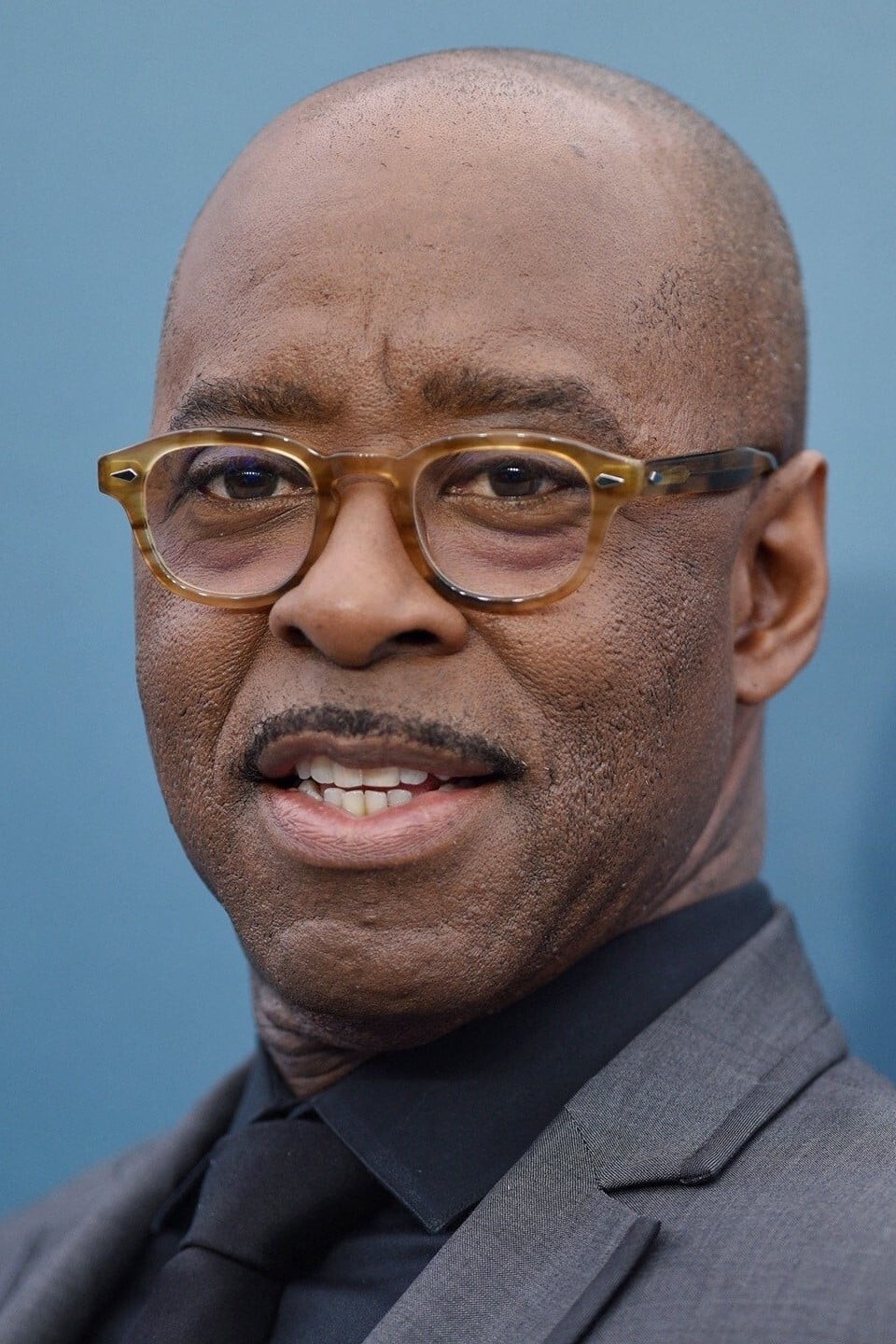

Jeffrey Wright

Jeffrey Wright has frequently faced criticism for not fitting stereotypical expectations of Black actors, often being told his articulate speech and thoughtful approach aren’t ‘Black enough’ for certain roles. He’s noted that the film industry tends to favor performances that conform to familiar tropes. Wright consistently challenges these limitations through his nuanced and diverse work, such as in ‘American Fiction,’ and highlights how the richness and variety within the Black community are often ignored. Throughout his career, he’s powerfully demonstrated that there isn’t a single, definitive way to express Black identity.

Kingsley Ben-Adir

When Kingsley Ben-Adir was chosen to play Bob Marley in the movie ‘One Love’, he received a lot of criticism online, particularly from people in the Caribbean. Many felt a British actor wasn’t the right choice to portray the Jamaican music legend, arguing he lacked the cultural connection to Marley’s background and Rastafarian beliefs. Ben-Adir responded by immersing himself in Jamaican culture, spending considerable time there and learning the local way of speaking, to ensure an authentic and respectful performance. He’s stated he sees the role as a chance to honor Marley as a worldwide icon whose message reached beyond national boundaries.

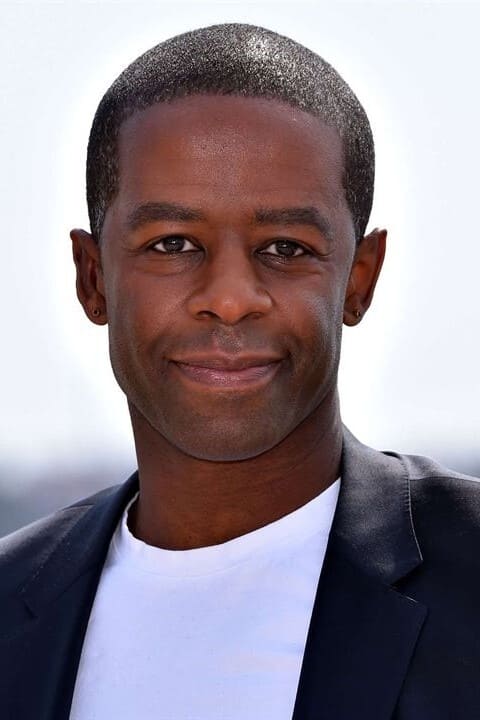

Regé-Jean Page

Regé-Jean Page was allegedly passed over for a role in the show ‘Krypton’ because producers didn’t believe he resembled Superman’s grandfather. This decision sparked criticism online, with many pointing to a lack of creativity and potential bias based on skin color within science fiction and fantasy casting. Page later achieved widespread recognition for his performance in ‘Bridgerton’ and remains a strong candidate for leading roles in big franchises, often challenging typical casting expectations.

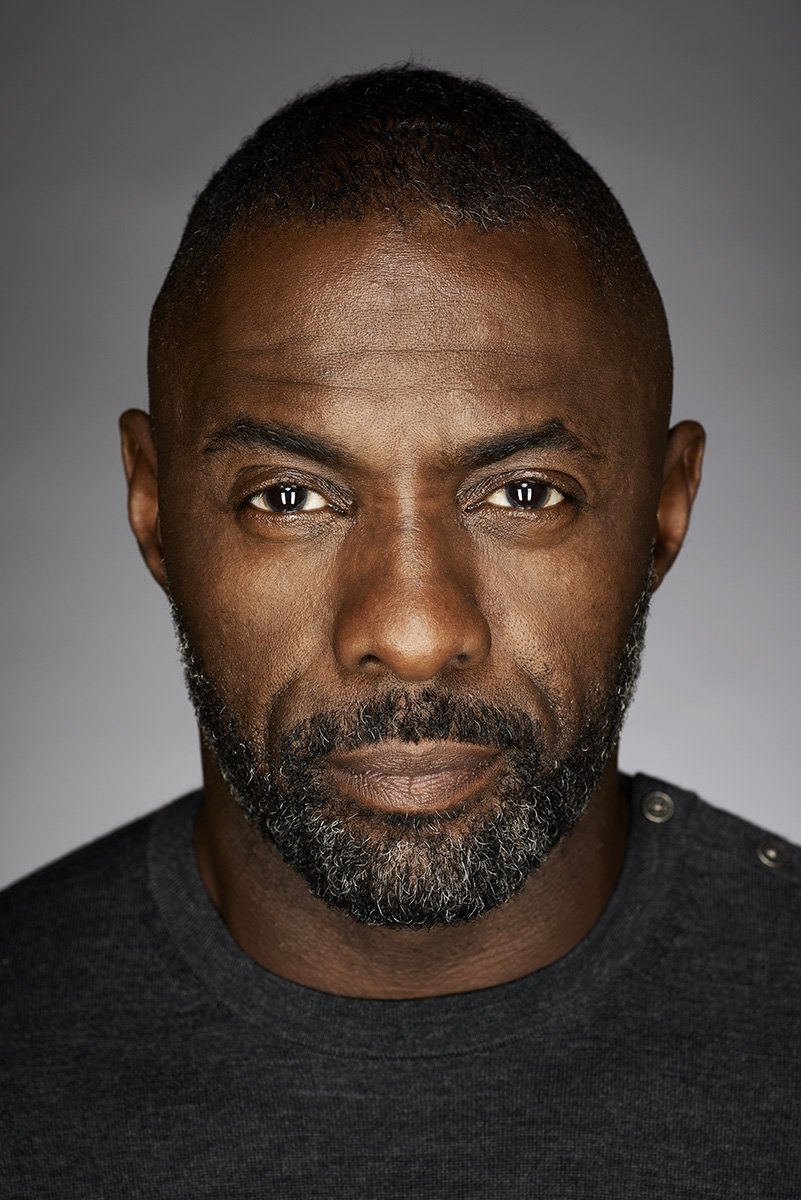

Idris Elba

Idris Elba has often faced discussions about whether he’s right for famous roles, like James Bond. Some people have argued he doesn’t seem suited for parts calling for a tough, specifically American Black background, while others have questioned his ability to play traditionally British characters because of his race. Elba has mostly stayed above these conversations, concentrating on his acting work around the world. He often chooses roles that reflect the diverse experiences of Black people globally.

John Boyega

John Boyega has openly discussed the challenges Black actors face in big film franchises. Following his time in ‘Star Wars,’ he explained how his character received less attention than his white colleagues. He’s also received backlash from some people who thought his public activism was too political or interfered with his work. Despite this, Boyega has remained firm, emphasizing the need for genuine diversity and support for Black actors and stories. He continues to work on projects that showcase Black experiences and perspectives.

Keegan-Michael Key

Keegan-Michael Key often uses his comedy and acting to examine what it means to be Black. As a biracial man, he’s discussed ‘code-switching’ – changing how you act depending on the situation – and how it connects to feeling accepted as Black in different groups. His work with Jordan Peele often poked fun at the entertainment industry’s focus on race. Key has said he often felt pressured to change how he presented himself to meet what casting directors expected. He’s now successfully moved between serious and funny roles, proving his skills as an actor.

Jordan Peele

Before becoming a director, Jordan Peele experienced similar struggles as an actor. He’s talked about how growing up as biracial often made him feel like he didn’t fully belong in either Black or white communities. Early in his career, he was sometimes told he didn’t have the right appearance or energy for certain Black roles. This feeling of being an outsider actually influenced the ideas behind his successful horror movies. Now, as a filmmaker, he’s working to break down the same stereotypes he faced as an actor.

Laz Alonso

Laz Alonso often speaks about being Afro-Latino and the challenges that come with it in Hollywood. He’s found that people often expect him to choose between identifying as Black or Latino when he’s up for roles. He’s been told he doesn’t fit the typical look for either African American or Spanish-speaking characters. Alonso actively works to get more recognition for Afro-Latino people in the entertainment industry.

Damson Idris

Damson Idris, the British actor starring in ‘Snowfall,’ has discussed the challenges of portraying an American character. He’s been asked if he can authentically represent the experiences of the Black community affected by the American drug war. Idris worked extensively on his accent and understanding of American culture to connect with viewers. He’s also been caught in discussions about British actors being cast in American roles, but believes his commitment to acting allows him to overcome those cultural boundaries.

Chiwetel Ejiofor

Chiwetel Ejiofor, a celebrated British actor, also experienced criticism questioning whether his nationality would affect his ability to convincingly play a role. When he was cast in ’12 Years a Slave,’ some people wondered if his British upbringing would prevent him from accurately portraying an enslaved American man, arguing that the pain and history were uniquely tied to the American South. Ejiofor proved them wrong with a powerful and moving performance that earned him an Oscar nomination. He remains a prominent actor, frequently working on projects that explore diverse cultures.

Terrence Howard

Throughout his career, Terrence Howard has experienced how skin tone affects opportunities in Hollywood. Shows like ‘Empire’ often emphasized his lighter complexion and eyes to portray his characters as sophisticated or high-class. He’s discussed how the entertainment industry treats actors with lighter skin differently than those with darker skin. His casting and the way he’s perceived have sometimes sparked public discussion. Despite these challenges and changing industry standards, Terrence Howard has consistently remained a successful and recognizable actor.

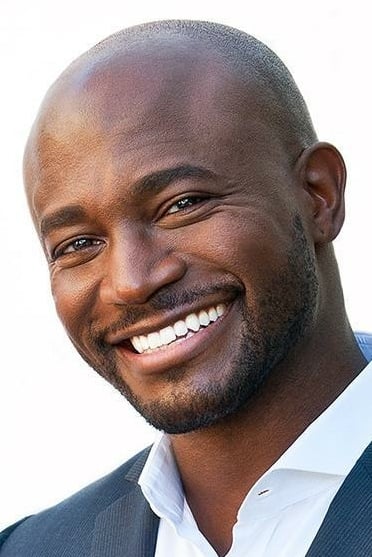

Taye Diggs

Taye Diggs has sometimes faced public criticism about his personal life and how it connects to his identity as a Black man. Some people have unfairly judged his choices and how he presents himself, leading to questions about his authenticity. He’s spoken out against the idea that there’s a single way to be “truly” Black. Throughout his acting career, he’s often played roles like professionals or romantic leads, which some saw as different from roles depicting more traditional Black experiences. Diggs has consistently challenged these limited expectations both in his work and through what he says publicly.

Jussie Smollett

While starring on ‘Empire,’ Jussie Smollett frequently sparked discussions about identity and his background as a biracial actor. His prominent role brought up questions about representation and colorism in the entertainment industry, with some viewers believing he embodied a version of Black identity that was favored by Hollywood. These conversations were complicated by opinions about his acting and personal life. More recently, Smollett’s career has been largely defined by legal troubles, shifting the public focus away from these earlier discussions.

Alfred Enoch

Alfred Enoch became well-known for his role in ‘How to Get Away with Murder,’ and people were immediately curious about his heritage. Being British-born with a Brazilian mother and English father, his casting reflected a growing trend of Black actors from around the world appearing on American TV. Some questioned whether he could authentically portray the experiences of Black Americans in a legal setting. Enoch ultimately won over viewers with his performance and his ability to seamlessly fit into the American context. He’s continued to work on prominent projects that highlight his broad appeal.

Sterling K. Brown

Sterling K. Brown is a successful actor who has spoken openly about the challenges of being typecast in Hollywood. Early in his career, he often found himself limited to roles demanding a narrow portrayal of Black masculinity. Even with his breakthrough role in ‘This Is Us,’ he noticed a pattern of the industry restricting Black actors. He tackled this issue head-on in the film ‘American Fiction,’ playing a character who satirizes these expectations. Brown remains committed to supporting stories that showcase the full spectrum of human feeling.

Mahershala Ali

Mahershala Ali has often been asked to define himself in terms of his faith and background. As a Black Muslim, he’s encountered common stereotypes associated with both identities. He’s discussed how difficult it has been to find acting roles that aren’t simplistic or that don’t limit him to being seen as just a symbol of a particular group. His acclaimed performances in films like ‘Moonlight’ and ‘Green Book’ have allowed him to move beyond those early constraints. By consistently choosing challenging and nuanced roles, Ali has established himself as a highly respected actor of his generation.

Courtney B. Vance

Courtney B. Vance has worked in the entertainment industry for many years and has observed how views on Black representation have changed. Early in his career, he often found himself offered only “safe” or “respectable” roles, intended to appeal to a broad audience. This sometimes meant he wasn’t considered for more complex or challenging characters. Throughout his career, from stage to television and film—like his portrayal of Johnnie Cochran in ‘The People v. O. J. Simpson’—Vance has consistently showcased his talent and proven that intelligence and dignity are integral to the Black experience.

Derek Luke

Derek Luke gained recognition with his role in ‘Antwone Fisher’ and quickly felt the pressure of being seen as a leading actor for Black audiences. He’s talked about how Hollywood often tries to promote only one type of Black actor at a time. Luke felt pressured to take on roles portraying a very specific, often limited, image of a Black man facing hardship. He’s intentionally chosen diverse projects to avoid being typecast, and his career demonstrates his commitment to breaking free from the industry’s narrow expectations.

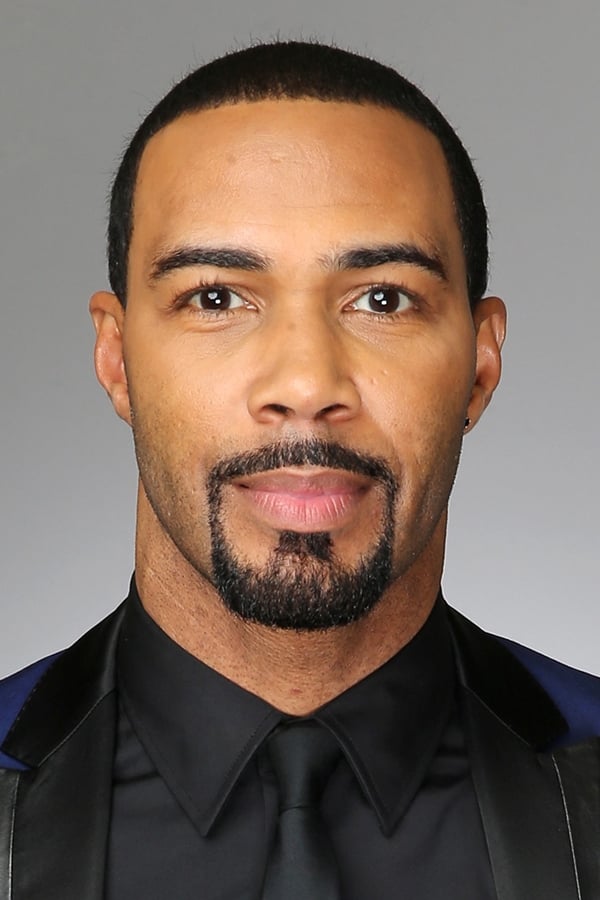

Omari Hardwick

Omari Hardwick has discussed experiencing colorism while starring in the show ‘Power,’ acknowledging that despite his success, the entertainment industry often favors certain appearances. He also responded to criticism that his depiction of a drug dealer wasn’t realistic enough, arguing that he focused on showing the character’s depth and humanity. Hardwick continues to advocate for more diverse and complex stories about Black men.

Blair Underwood

I’ve always admired Blair Underwood, and it’s frustrating to hear how he’s been typecast throughout his career. People kept wanting to see him as the ‘perfect professional,’ and it apparently made it hard for him to get roles that were a little rougher around the edges. He’s talked about how being a Black actor, and being seen as ‘too polished,’ limited the parts he was offered. But he’s really proven everyone wrong by taking on such a wide range of characters – from doctors to bad guys! He’s a truly versatile actor, and I think he’s opened doors for a lot of other performers who want to show they’re capable of more than just one type of role.

Robert Ri’chard

Robert Ri’chard, as a biracial actor with light skin, has experienced the difficulties of finding consistent work in the entertainment industry. He often found himself caught in between, not fitting neatly into the expectations of casting directors – sometimes considered not Black enough for certain roles, and at other times, typecast for younger characters. Through dedication to his physical fitness and a willingness to take on diverse roles, Ri’chard has built a steady career. He continues to seek out opportunities that allow him to showcase his individual style and look.

Charles Michael Davis

Charles Michael Davis is known for his good looks and biracial background, which often play a role in the characters he’s offered. He’s talked about how his appearance can sometimes limit the roles he gets, even when he’s proven his talent, like when he played a strong leader in ‘The Originals’ – a role that broke from typical expectations. Despite this, he continues to work as both an actor and model, and is actively seeking out diverse roles to showcase his full range.

Gary Dourdan

Gary Dourdan gained widespread recognition from his role on ‘CSI’, and people often commented on his striking green eyes and light complexion. This led to conversations about his background and how it impacted the roles he was offered. He’s discussed the challenges of finding acceptance while fitting into limited expectations. Some critics suggested he was presented as a non-threatening portrayal of Black masculinity on the show. Since then, Dourdan has focused on independent projects that allow him to take on a wider range of roles and stories.

Harold Perrineau

Harold Perrineau has frequently spoken about the challenges Black actors face in Hollywood. While working on ‘Lost,’ he was disappointed that his character wasn’t developed with the same complexity and relatability as the white characters. He’s noticed a pattern in the industry where Black characters often lack depth. Perrineau has been typecast as a ‘character actor’ but is actively working to break free from that label, consistently delivering strong performances in shows like ‘From’ to prove his range.

Adrian Lester

Adrian Lester is a British actor successful in both the UK and the US. He’s observed that America and Britain often have different understandings of what it means to be Black. Because of his formal training and British accent, he’s sometimes been questioned about whether he fits certain American roles. Lester emphasizes that Hollywood needs to understand that there isn’t one single ‘Black experience.’ He’s gained international recognition for his range as an actor, demonstrated in shows like ‘Hustle’ and his work on stage.

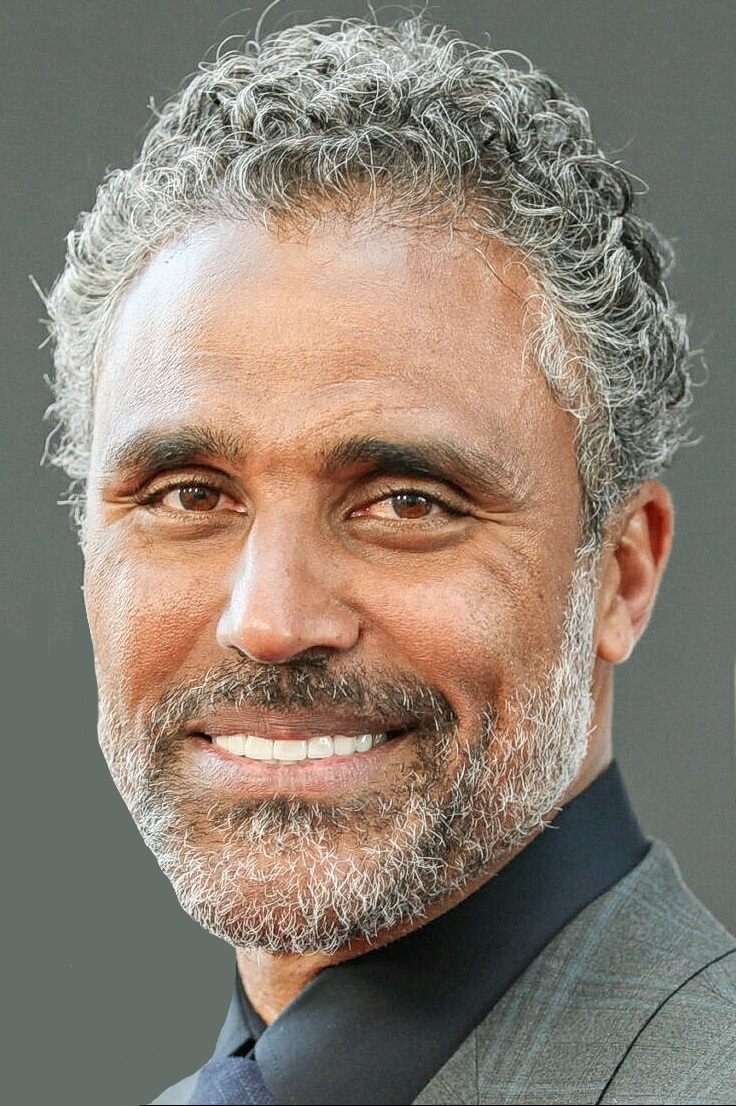

Rick Fox

Rick Fox faced challenges when he switched from being a professional basketball player to an actor. As a biracial man in the public eye, people often made assumptions about who he was. Some questioned whether he was ‘Black enough’ for certain acting roles, likely due to his background as an athlete and his appearance. Fox has been working hard to establish himself as a serious actor, taking on different kinds of roles in shows like ‘Oz’ and ‘Greenleaf’. He’s also been open about the difficulties of navigating identity in both the sports and entertainment worlds.

Columbus Short

Throughout his career, Columbus Short has navigated how the entertainment industry views him and whether it sees him as genuine. He’s observed that Hollywood often expects Black actors to conform to limited roles – either as strong and resilient or highly intellectual. This has made it difficult for Short to explore a wide range of characters and acting styles. He’s also felt pressure to uphold a specific public image to remain successful in Hollywood. Even through personal difficulties, he’s continued to work steadily in film and television.

Nate Parker

Nate Parker’s film, ‘The Birth of a Nation,’ sparked significant debate when it was released. Critics questioned whether his portrayal of a historical slave rebellion was genuine and what drove him to tell that story. The discussion became even more complex due to past issues in his personal life and how he addressed them publicly. Parker has consistently stated that his work comes from a sincere desire to explore Black history and experiences. Despite this, his career has remained controversial, with the entertainment industry continuing to grapple with his place in the cultural conversation.

Corey Hawkins

Corey Hawkins is a successful actor who has played prominent real-life individuals, such as Dr. Dre in ‘Straight Outta Compton’. He’s often discussed how important it is to embody the essence of a character, not just look like them, especially considering conversations around representation and casting choices in film – including the debate between British and American actors. Hawkins remains a highly sought-after performer, known for his powerful and engaging roles in both theater and film.

Aldis Hodge

As a fan, it’s amazing to see Aldis Hodge’s career unfold. He’s been working for a long time and has really witnessed how things have changed for Black actors. He’s talked about how frustrating it can be when people only want to see Black actors play characters where race is the main focus. He’s even faced comments about not being ‘the right fit’ or being ‘too intense’ when going for roles that weren’t those typical stereotypes. But he’s broken through that by taking on such diverse characters in shows like ‘Leverage’ and movies like ‘Hidden Figures’. It’s clear he’s passionate about seeing Black men portrayed as complex, intelligent individuals on screen, and I really admire him for that.

Winston Duke

Winston Duke became well-known for his role in ‘Black Panther’ and has quickly become a significant actor in Hollywood. Born in Tobago, he brings a unique viewpoint to discussions about Black identity, differing from many American actors. He’s been vocal about the need to include Caribbean perspectives in broader conversations about Blackness and has also contributed to discussions about how Black masculinity is portrayed in film, particularly regarding body image. Duke consistently seeks out roles that showcase the wide range and diversity within the African diaspora.

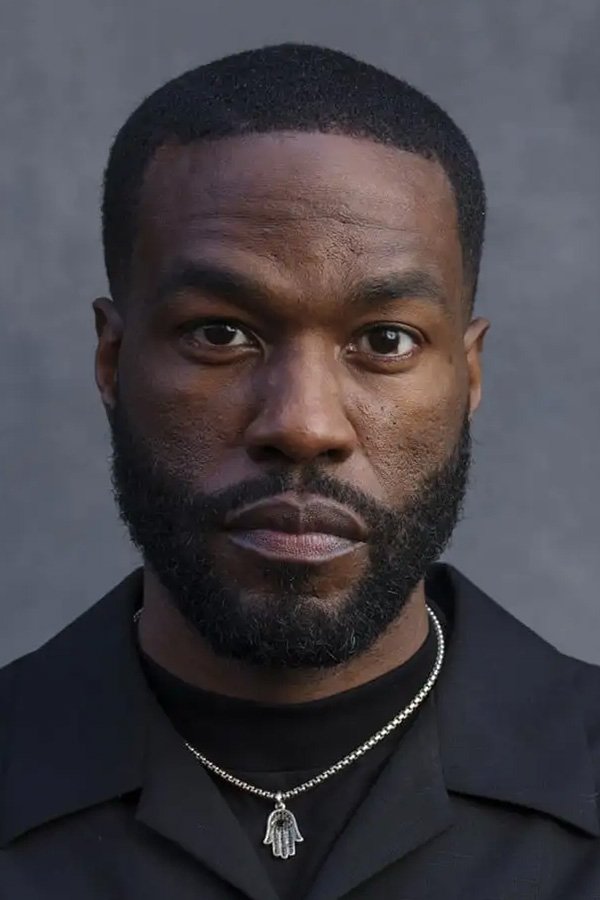

Yahya Abdul-Mateen II

Yahya Abdul-Mateen II is rapidly becoming known as one of Hollywood’s most adaptable actors. He’s often challenged expectations, with some questioning if he’s right for roles ranging from superheroes to figures from history, and even if he physically fits certain well-known characters who’ve been portrayed differently in the past. However, he consistently answers these doubts with powerful performances centered on the character’s inner life. His work in projects like ‘Watchmen’ and ‘Candyman’ has firmly established him as a leading actor capable of tackling complex stories.

Lakeith Stanfield

Lakeith Stanfield is celebrated for choosing unusual and captivating roles that break away from typical portrayals of Black characters. He’s openly discussed wanting to expand the possibilities for Black actors in Hollywood. Because of his unique choices and personality, some have questioned how genuine he is, but Stanfield embraces this by playing characters that are both strange and relatable. He’s a key figure in independent films and is also appearing in big-budget movies.

Jonathan Majors

Jonathan Majors quickly became a prominent actor, often seen as a symbol of strong Black masculinity. He’s talked about the responsibility he felt portraying Black characters and how those roles connected to Black history and contemporary life. Majors has also argued for more complex and emotionally open portrayals of Black men, moving beyond simple stereotypes. However, his career has recently been derailed by personal and legal issues.

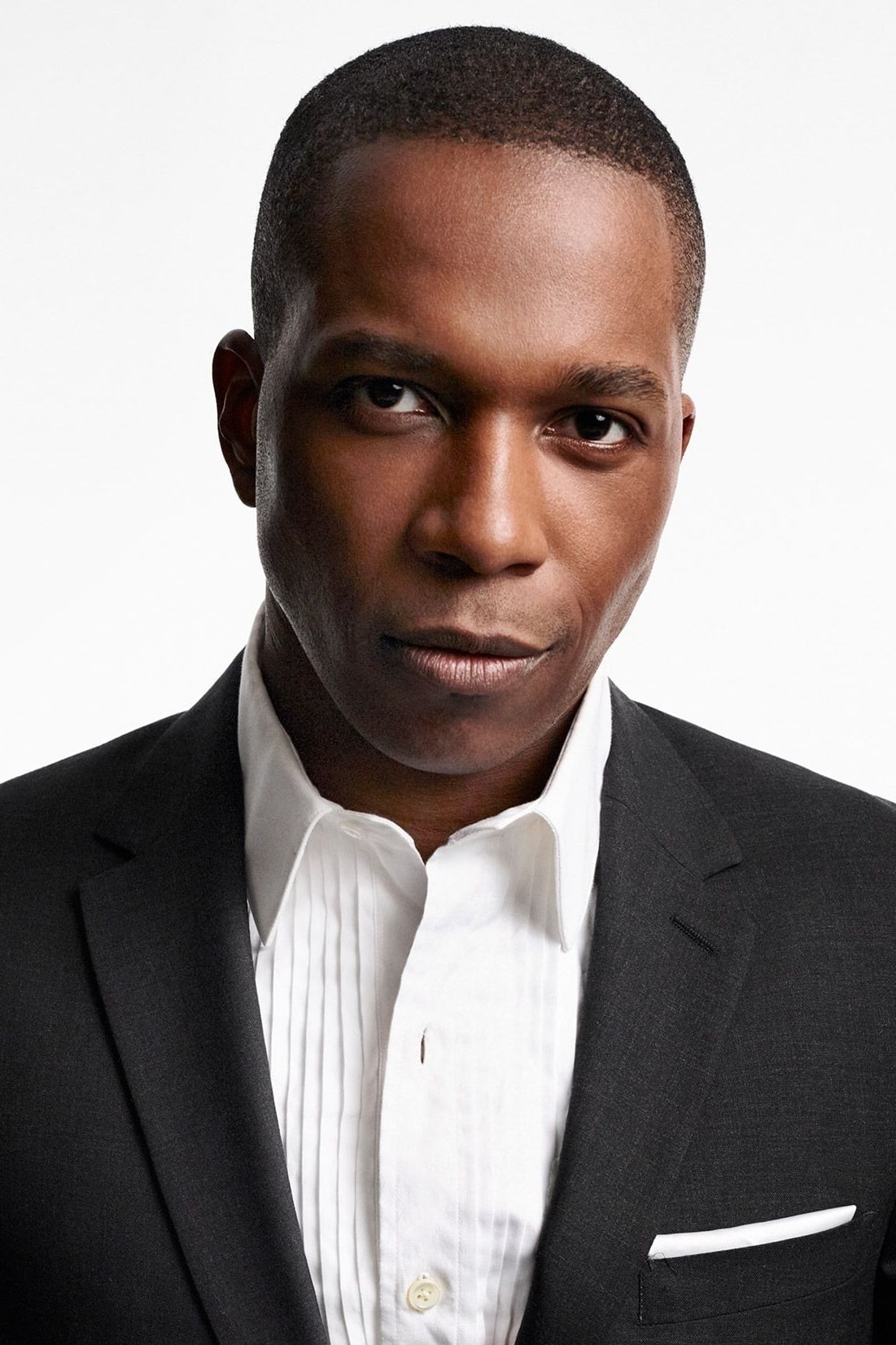

Leslie Odom Jr.

Leslie Odom Jr. became a household name with his role in ‘Hamilton’ and has been steadily working in film and television ever since. He’s spoken openly about the difficulties faced by Black actors in theater and on screen. Some have wondered if his training in musical theater would limit his ability to play realistic characters in movies, but he’s demonstrated his versatility in films like ‘One Night in Miami,’ where he portrayed Sam Cooke. Odom continues to look for roles that let him showcase both his singing and acting skills.

Terrence J

Terrence J started his career as a well-known TV host and then moved into acting and producing. He’s talked about how challenging it was to be seen as a serious dramatic actor after being known for hosting. Some people in the industry thought he was too mainstream or didn’t fit the mold for certain roles written for Black actors. He’s worked to change those perceptions by taking on different kinds of roles, like in the movie ‘Think Like a Man’. He continues to thrive in the entertainment world by using his established personal brand and his own production company.

Brandon T. Jackson

Brandon T. Jackson frequently uses humor to point out Hollywood’s focus on race. In the movie ‘Tropic Thunder,’ he played a character who made fun of the idea that some Black people aren’t ‘Black enough.’ He’s talked about how Black actors feel pressured to conform to certain stereotypes to get roles. Jackson has achieved success in both stand-up and movies by exposing these ridiculous expectations, and he continues to speak out against the industry’s attempts to stifle Black performers’ creativity.

Stephan James

Stephan James is known for portraying important Black figures like Jesse Owens and John Lewis. Because he’s Canadian, some have questioned whether he can authentically portray the experiences of American heroes, particularly regarding the American civil rights movement. James addresses this by focusing on the universal themes of fighting for justice in his performances. He’s now a highly-regarded actor, bringing a subtle but powerful energy to both historical and contemporary roles.

We’d love to hear your opinions on the recent discussions about casting choices and how Black identity has been portrayed in movies. Please share your thoughts in the comments below.

Read More

- Gold Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- Silver Rate Forecast

- EUR UAH PREDICTION

- Top 15 Insanely Popular Android Games

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2026-02-22 07:23