Right. American Express. Lovely company, really. Up 160.4% in five years. Which, let’s be honest, is showing off a bit. The S&P 500 managed a perfectly respectable 73.7%. But here’s the thing…I’m looking at both of them, and I’m thinking, Visa. It’s just…less likely to end in tears.

Don’t get me wrong, AXP is solid. It’s…flirty. It knows how to attract a crowd. But Visa? Visa is the quiet one in the corner, efficiently processing transactions while everyone else is busy peacocking. And honestly, in this market, I’ll take efficient over flashy any day.

Visa’s High-Margin Business Model (Or, How They Get Away With It)

Here’s the thing about Visa: they don’t actually take the risk. They just connect the people who do. Think of it like being a really good matchmaker. You bring the right parties together, take your cut, and then subtly step back before anyone starts throwing things. JPMorgan Chase, for example, issues those fancy Sapphire cards and deals with all the messy credit stuff. Visa just…facilitates. It’s beautifully cynical, isn’t it?

American Express, bless them, does it all. They’re the host, the caterer, the security guard, and the one who has to deal with Uncle Barry after three glasses of champagne. More risk, more drama. And let’s face it, I’ve had enough drama lately. Visa keeps it clean. They charge a fee, everyone’s happy. It’s almost…elegant.

Which means they can focus on, you know, actually making money. No massive rewards programs to fund (because they don’t issue the cards), no constant fire-fighting over bad debt. Just pure, unadulterated margin. It’s not glamorous, but it’s reliable. And in this economy, reliability feels like a superpower.

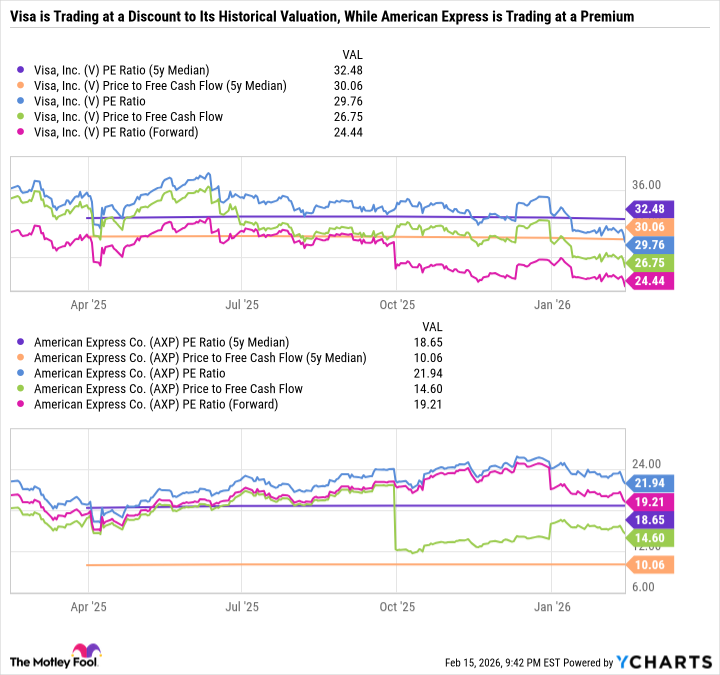

Historically, that’s meant a higher valuation. But AXP has been outperforming the S&P 500 for five years. Visa? Down 11.2% over the last year. Which, frankly, feels like an opportunity. A little bruised, a little undervalued. Like a perfectly good cashmere sweater on sale.

Caps on Credit Card Interest Rates (Or, Why Everyone’s Panicking)

So, Visa, Mastercard, American Express are all down year-to-date – between 8.8% and 10.4%. The S&P 500 is…fine. Just muddling through. And everyone’s flapping about this proposed 10% cap on credit card interest rates. Honestly? I think it’s overblown. It’s like worrying about a paper cut during a hurricane.

If they actually capped rates at 10%, lenders would just stop lending to anyone with a credit score below…well, let’s just say “functioning adult.” Which would push everyone towards payday loans and other delightful financial instruments. Not exactly a win for anyone. And Visa doesn’t really care, because they’re not the ones issuing the credit.

The cap would hurt the issuers – JPMorgan Chase, American Express – because it would squeeze their margins. Visa would see a slight dip in transaction volume, sure. But they’re diversified enough to weather the storm. They’re the cockroach of the financial world. Unpleasant, but remarkably resilient.

Visa is One of the Best Stocks to Buy Now (Don’t Tell Anyone I Said That)

Look, American Express is a good company. It really is. It’s just…a bit more involved. Visa is the cool aunt who sends a check for birthdays and then disappears before anyone asks her to babysit. It’s a smart strategy.

AXP has a slightly higher dividend yield, 1% versus Visa’s 0.9%. But both are buying back stock like it’s going out of style. Which is good. It keeps things interesting. But Visa is a cash cow. A glorious, international, rock-solid cash cow. The most accepted card brand worldwide. They have more cards in circulation than anyone. It’s…a bit intimidating, actually.

Companies like that rarely go on sale. But right now? They are. A multi-year low valuation. It’s like finding a vintage Chanel bag at a flea market. You grab it. You don’t ask questions. You just…buy it.

Visa appeals to dividend investors, value investors, growth investors. It’s a foundational holding. A portfolio staple. Something you can build around. And honestly, in 2026? We’re all going to need something solid to hold onto. Trust me.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Gold Rate Forecast

- Wuchang Fallen Feathers Save File Location on PC

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- QuantumScape: A Speculative Venture

- 9 Video Games That Reshaped Our Moral Lens

- Here Are the Best TV Shows to Stream this Weekend on Hulu, Including ‘Fire Force’

2026-02-22 01:23