The Schwab U.S. Dividend Equity ETF (SCHD), a construct lauded for its steady yield, has exhibited a curious surge in these early months of 2026. Fifteen percent, they proclaim. A substantial figure, certainly. But to attribute this ascent to inherent strength, to a blossoming of underlying value, is to succumb to a comforting delusion. It is a story written not in the balance sheets of thriving enterprise, but in the volatile script of geopolitical contingency and the crude, literal price of oil.

Last year, this same fund languished, a mere 0.4% return a testament to the market’s indifference. The broader S&P 500, though scarcely vibrant, managed a marginal gain. Now, SCHD outpaces it, a sudden blossoming amidst the prevailing economic winter. But let us not mistake the warmth of a temporary flare for the sustaining heat of genuine prosperity.

A Hidden Dependency

The index upon which SCHD is built – the Dow Jones U.S. Dividend 100 – is a mechanism of selection, favoring those companies that consistently distribute a portion of their earnings. A noble aim, perhaps, but one that can inadvertently concentrate risk. The fund’s holdings, while numerous, are not evenly distributed. A disproportionate weight is given to the energy sector – nearly twenty percent at year’s end. This concentration, previously a drag on performance when the price of crude faltered, has now become the engine of its ascent. A precarious dependence, indeed.

The recent surge in crude prices – Brent oil breaching the seventy-dollar mark – is not a natural phenomenon, a simple consequence of supply and demand. It is a symptom of a world riddled with instability. The detention of a former Venezuelan president, accused of unsavory dealings, and the escalating tensions with Iran – these are not background noises, but active forces shaping the market’s currents. SCHD, unwittingly or not, has become a vessel for these anxieties, its fortunes buoyed by the prospect of disruption and scarcity.

The Weight of Black Gold

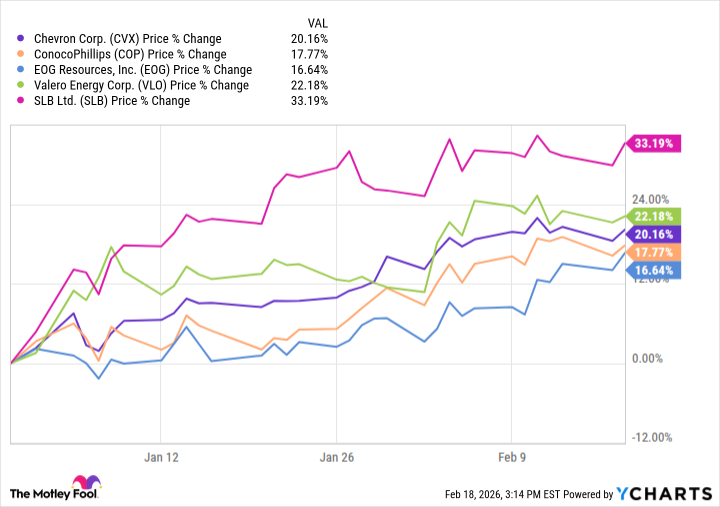

Chevron, ConocoPhillips, SLB, EOG Resources, Valero Energy – these are the names that now dominate SCHD’s gains. They are not necessarily paragons of innovation or sustainable growth, but rather beneficiaries of a system that rewards extraction and distribution. Their stock prices have risen, not because of inherent virtue, but because of a temporary reprieve from the pressures that have long plagued the energy sector. To celebrate this ascent as a triumph of investment acumen is to ignore the underlying fragility of the arrangement.

The rationale for including these companies in SCHD is not based on a long-term vision of energy independence or environmental responsibility. It is, simply put, a matter of dividend yield. Chevron’s thirty-nine-year streak of dividend growth, ConocoPhillips’ commitment to ranking among the top twenty-five S&P 500 companies in dividend growth – these are metrics of consistency, not necessarily of strength. They are indicators of a system that prioritizes the distribution of wealth over the creation of it.

Chevron anticipates robust free cash flow growth through 2030, predicated on oil averaging seventy dollars a barrel. ConocoPhillips projects a doubling of annual free cash flow by 2029, also contingent on the seventy-dollar benchmark. These are not projections of resilience, but rather calculations of dependence. They are affirmations of a system that remains tethered to the fluctuations of a finite resource.

The Illusion of Return

The energy sector, by its very nature, is prone to cycles of boom and bust. To build a portfolio heavily weighted towards it is to accept a degree of inherent risk. SCHD’s recent gains are not a sign of enduring prosperity, but rather a temporary respite from the forces that have long plagued the energy sector. The fund’s oil stock investments have been a boon this year, but this boon is fragile, contingent on geopolitical stability and the continued demand for fossil fuels.

To celebrate this ascent as a triumph of investment acumen is to ignore the underlying fragility of the arrangement. The oil patch may indeed be home to a plethora of top dividend stocks, but these dividends are, ultimately, derived from a diminishing resource. The illusion of return, sustained by the price of crude, may prove to be just that – an illusion, destined to dissipate when the currents shift.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Gold Rate Forecast

- Wuchang Fallen Feathers Save File Location on PC

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- MicroStrategy’s $1.44B Cash Wall: Panic Room or Party Fund? 🎉💰

- Exit Strategy: A Biotech Farce

- QuantumScape: A Speculative Venture

2026-02-21 20:12