The year 2023, ah, a fever dream of ascending valuations! Portfolios, swollen with the promise of growth – particularly those fixated on the digital behemoths and the nascent god of Artificial Intelligence – strutted and preened, leaving the venerable S&P 500 trailing in their wake like a forgotten peasant. But 2026… 2026 is a different beast entirely. A creature of shadows and unsettling realities.

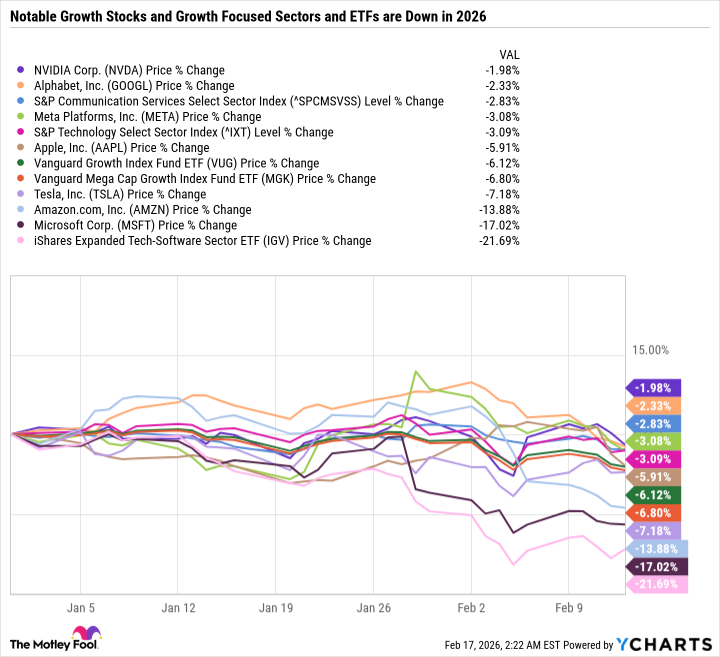

The sectors once gilded with the sheen of progress – technology, communications – now exhibit a peculiar pallor. A decline, one might say. Each of the so-called “Magnificent Seven” – those self-appointed arbiters of market destiny – has begun to list, to falter. Nvidia, once a radiant sun, now casts a strangely elongated shadow. Alphabet, Apple, Microsoft, Amazon, Meta Platforms, and even the audacious Tesla… all afflicted with a similar melancholic downturn. It is as if a mischievous imp has loosened the screws on their carefully constructed empires.

Thus, it is hardly surprising that those exchange-traded funds – those convenient bundles of hope and speculation – are feeling the pinch. The air, once thick with optimism, now carries a faint scent of…disappointment. One might even say, the scent of slightly stale pierogies.

Let us, then, examine three of these financial contraptions, not with the breathless enthusiasm of a market tout, but with the detached curiosity of a pathologist examining a particularly intriguing specimen.

1. Vanguard Growth ETF

The Vanguard Growth ETF. A name that suggests stability, a bedrock upon which to build one’s financial future. It possesses, one might say, a certain…foundational quality. And its expense ratio – a mere 0.04%! – is a dream come true for the passive investor. A veritable paradise for those who prefer to relinquish control and trust in the whims of the market.

Historically, this fund has mirrored the performance of the Nasdaq-100, but with subtle, yet significant, differences. The Nasdaq-100, you see, is a creature of habit, confined to the largest non-financial companies listed on the Nasdaq exchange. It refuses to venture beyond its prescribed boundaries. This means it will overlook perfectly respectable growth stocks, like Oracle, merely because they happen to reside on the New York Stock Exchange. A peculiar prejudice, wouldn’t you agree?

Furthermore, the Nasdaq-100 is prone to including companies that are, shall we say, merely large, rather than truly growing. Walmart, Costco, PepsiCo… these are consumer staples, content to plod along at a predictable pace. Not the high-octane, AI-fueled rockets that one might desire. Vanguard, in its infinite wisdom, attempts to rectify this imbalance, assigning these lumbering giants to its Value ETF, while reserving the Growth ETF for the more…ambitious specimens. Though even its wisdom has its limits, as Costco still finds itself within the Growth camp. A minor inconsistency, perhaps, but a telling one.

Currently down 6.1% year to date, the Vanguard Growth ETF remains a solid, if unremarkable, choice for those seeking low-cost exposure to a basket of 151 stocks. Though one suspects that even the stocks themselves are beginning to question their purpose.

2. Vanguard Mega Cap Growth ETF

The Vanguard Mega Cap Growth ETF. A more…concentrated version of its sibling. With a mere 60 holdings, it bestows a disproportionate weight upon the largest growth stocks. A bit like a portly nobleman attempting to balance a stack of pancakes. It seems impressive at first, but one senses an impending collapse.

A staggering 59.4% of this fund is allocated to the Magnificent Seven. Add Broadcom, Eli Lilly, and Visa, and that figure swells to 68.4%. A precarious concentration, wouldn’t you say? A single tremor in the market could send the whole edifice tumbling down. It is like building a castle upon the backs of ten particularly temperamental dragons.

Predictably, given the recent misfortunes of its favored constituents, the Vanguard Mega Cap Growth ETF has fared slightly worse than its broader counterpart. A cautionary tale, perhaps, about the perils of putting all one’s eggs in a single, gilded basket.

Like its sibling, the Mega Cap Growth ETF boasts a remarkably low expense ratio of 0.05%. A tempting proposition for those who are specifically targeting the largest growth stocks by market capitalization. Though one wonders if these stocks themselves are beginning to feel the weight of expectation.

3. iShares Expanded Tech Software Sector ETF

It is a curious phenomenon, isn’t it? To witness broader indexes hovering near all-time highs while a significant portion of the market languishes in a steep downturn. A bit like a lavish banquet being held in the shadow of a crumbling monastery. But that, precisely, is what is happening with software, a core industry within the largest sector of the market – technology.

The iShares Expanded Tech Software Sector ETF is down a staggering 21.7% year to date, as investors question the disruptive potential of Artificial Intelligence on the software-as-a-service business model. A bit of a panic, really. As if a single algorithm could unravel decades of carefully constructed code.

Some of these fears are, admittedly, justified. The industry’s traditionally high margins are dependent on growing user bases and justifying price increases. But if AI tools can replace entire software workflows, and fewer subscriptions are needed… well, that is a threat. A bit like a blacksmith being rendered obsolete by the invention of the automobile.

Still, to assume that the entire industry should falter is a mistake. The sell-off in the iShares Expanded Tech Software Sector ETF presents an impeccable buying opportunity for those seeking exposure to names like Microsoft, Palantir Technologies, Oracle, and Salesforce. It is easier to hold a basket of stocks through a turbulent period than to rely on one or two names. Stocks can rise and fall to levels beyond imagination. The fund is a good buy for investors who prefer to bet on a broader industrywide recovery. However, one drawback is that it features a 0.39% expense ratio, which is significantly higher than the previously discussed Vanguard funds. A minor extravagance, perhaps, but one that should not be ignored.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Gold Rate Forecast

- Wuchang Fallen Feathers Save File Location on PC

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- MicroStrategy’s $1.44B Cash Wall: Panic Room or Party Fund? 🎉💰

- Exit Strategy: A Biotech Farce

- QuantumScape: A Speculative Venture

2026-02-21 19:24