The labor market, one might observe, is a field much like any other. It yields a harvest when tended with diligence, yet lies fallow when neglect or misfortune prevails. When hands are busy and spirits are high, a subtle abundance permeates all things, encouraging a willingness to spend, to acquire, to live. But when those hands are stilled, a cautiousness descends, a drawing inward, as if bracing for a season of scarcity.

We find ourselves now in a middle ground, a peculiar autumn of the economic year. The figures suggest a workforce still employed, yet the growth is…hesitant. The unemployment rate, while below the threshold of full alarm, creeps upward with the stealth of a late frost. It is a condition not of outright distress, but of a lingering unease.

Investors, naturally, are ever vigilant, scanning the horizon for portents. They seek not so much to predict the future, as to discern the subtle shifts in the present, the whispers carried on the wind.

The Sahm Indicator: A Measure of Disquiet

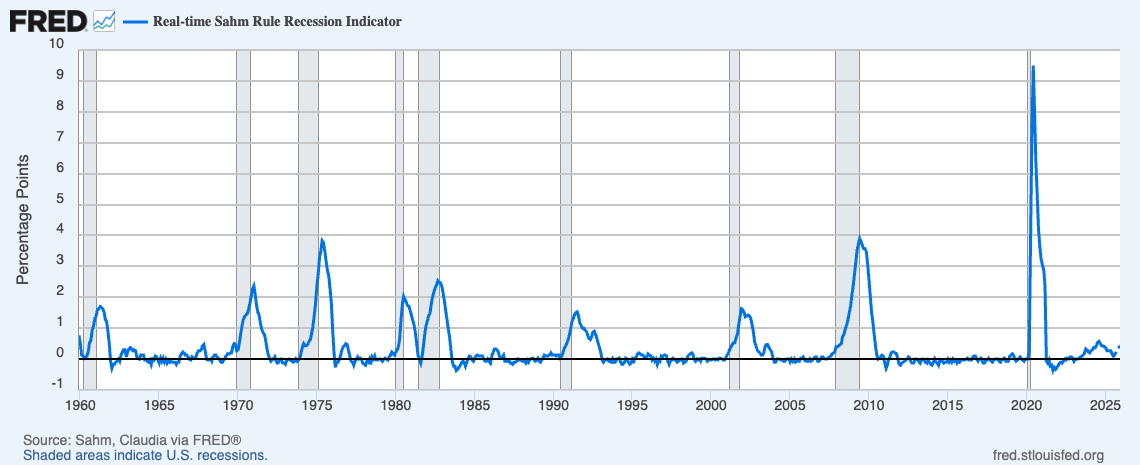

The Sahm indicator, devised by the astute Claudia Sahm, is a curious instrument. It is intended not to shout a warning from the rooftops, but to offer a quiet signal, a nudge to those who are paying attention. It is a simple rule, really: a rising tide of unemployment, measured with a certain precision, suggests a storm approaching.

The logic is straightforward. A swift and sustained increase in joblessness rarely occurs in a vacuum. It is a symptom, a consequence of deeper currents at play. And history, as we are so often reminded, has a habit of repeating itself.

Examining the past sixty-five years, one observes a remarkable consistency. The Sahm indicator, more often than not, has sounded its warning just as the first shadows of recession began to lengthen. It is a rule that, while not infallible, has proven remarkably reliable.

A Signal Raised, Yet No Tempest

In July of this year, the indicator was triggered once more. The unemployment rate, it was noted, had risen by 0.54% over the preceding twelve months. A clear signal, one might assume, of impending hardship. Yet, the hardship has not materialized. Not yet.

It is a curious situation, to say the least. Should this indicator prove false, it would be a first in six decades. But what we have witnessed of late is not a sudden collapse, but a slow, almost imperceptible erosion of the job market. The figures for 2025 reveal a modest increase of 181,000 jobs – a trickle, rather than a flood. And the unemployment rate, while still relatively low, has been steadily inching upwards.

There is no denying that the labor market is slowing. It is merely doing so at a pace that feels…unfamiliar. A gradual waning, rather than a dramatic fall.

The Question of the Storm

Perhaps the storm is gathering, but moving at a glacial pace. Perhaps it will bypass us altogether. GDP growth remains reasonably strong, and inflation appears to be easing. These are encouraging signs, certainly. But we would be foolish to ignore the warnings carried on the wind, the subtle shifts in the landscape.

The fact that the Sahm indicator has already been triggered should serve as a caution. We are likely not through the storm season yet, even if the tempest itself remains distant. It is a reminder that the market, like life itself, is a complex and unpredictable affair. And that even the most reliable indicators can only offer a glimpse of what may lie ahead. One must remain vigilant, observe carefully, and prepare for whatever may come.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Gold Rate Forecast

- Wuchang Fallen Feathers Save File Location on PC

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- MicroStrategy’s $1.44B Cash Wall: Panic Room or Party Fund? 🎉💰

- Exit Strategy: A Biotech Farce

- QuantumScape: A Speculative Venture

2026-02-21 19:02