As a lifelong movie fan, I’ve noticed something really poignant about actors coming out. It’s such a personal thing, and everyone’s timeline is different. I’ve seen a lot of male actors, especially, who waited many years, even decades, before sharing who they truly are. They’ve talked about finally finding inner peace and feeling like the world was ready to accept them. It’s incredibly brave, and their willingness to be visible, no matter how long it took, is really inspiring. It just shows you that it’s never too late to live authentically.

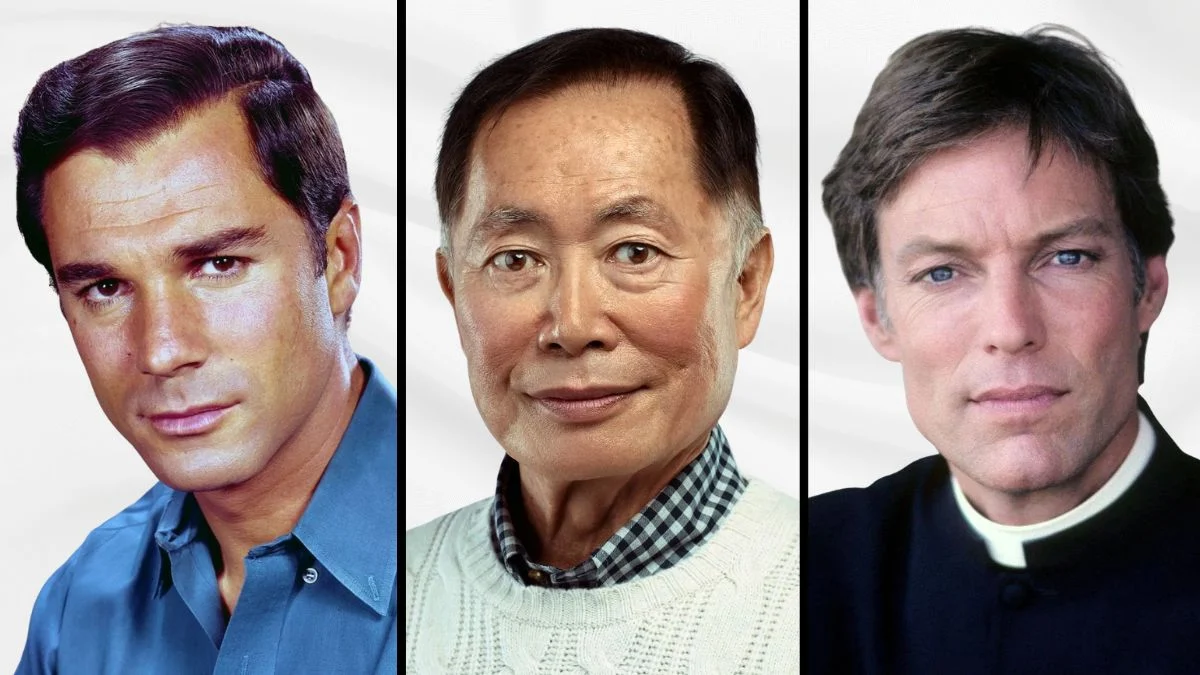

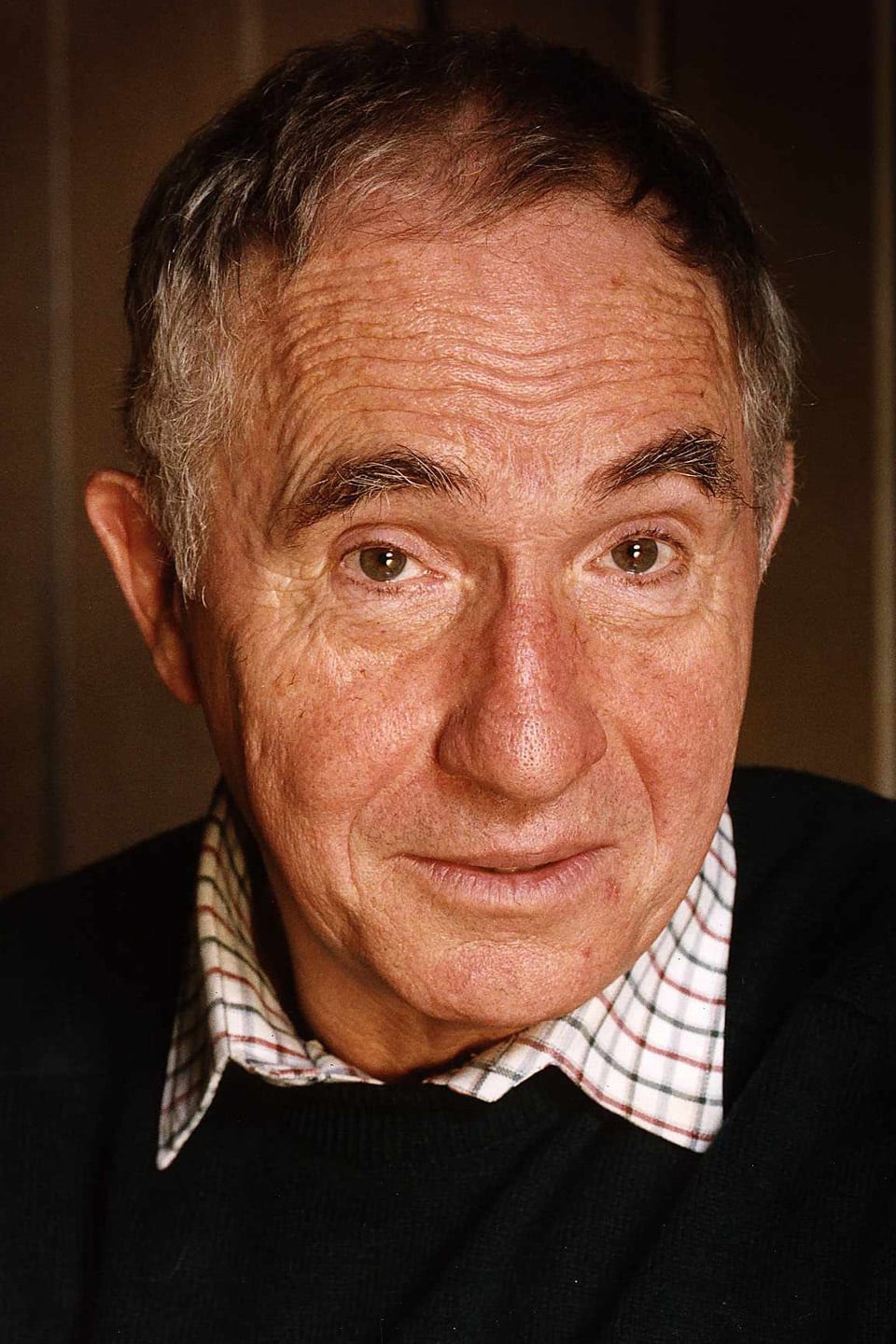

Joel Grey

Joel Grey is a celebrated actor, most famous for his role in the movie ‘Cabaret’. At the age of eighty-two, in 2015, he publicly shared that he is gay, something he had already discussed with close friends and family. He described coming out as a deeply freeing experience and a major personal achievement. Throughout his career, he’s made a lasting impact on both Broadway and the world of film, entertaining audiences for many years.

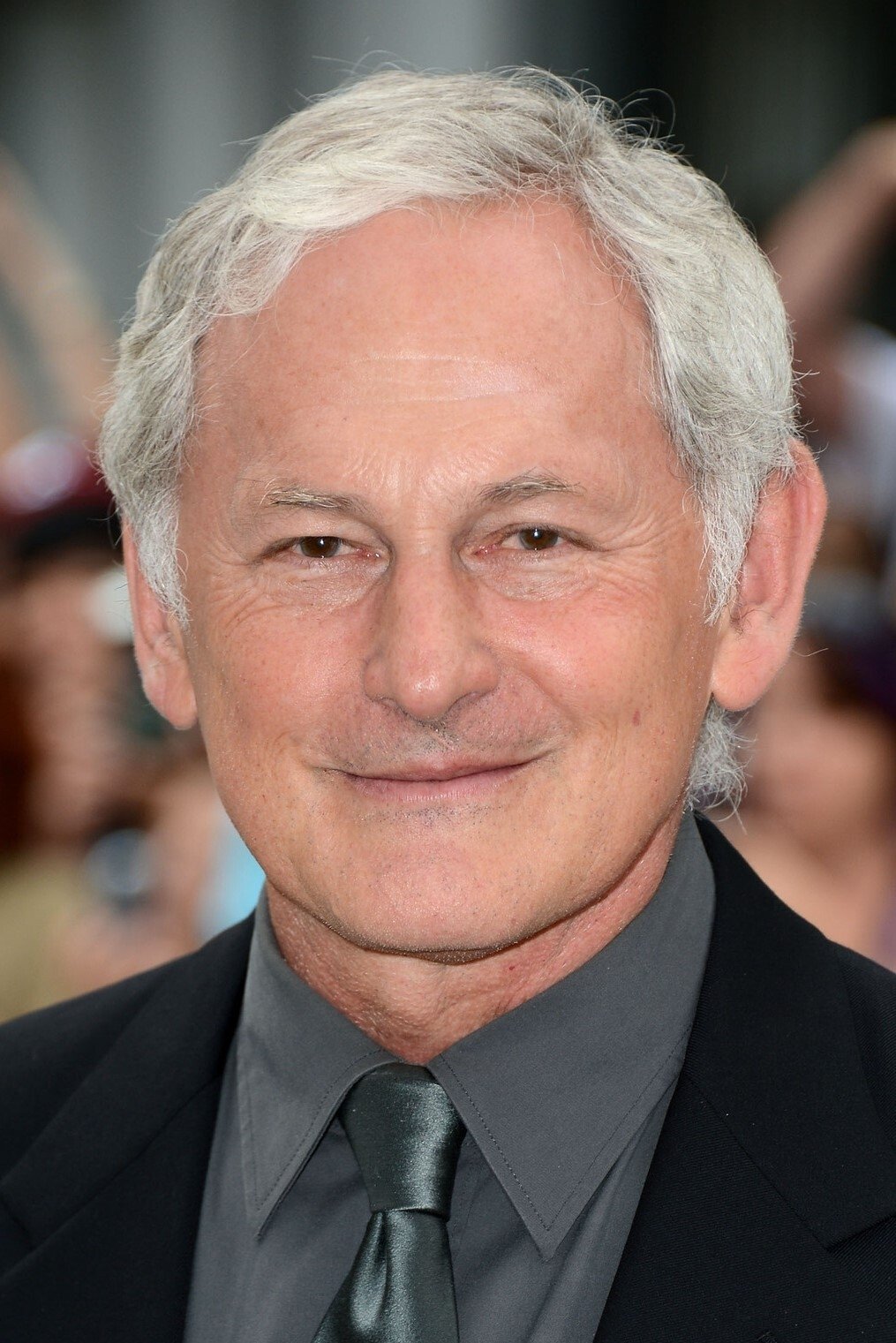

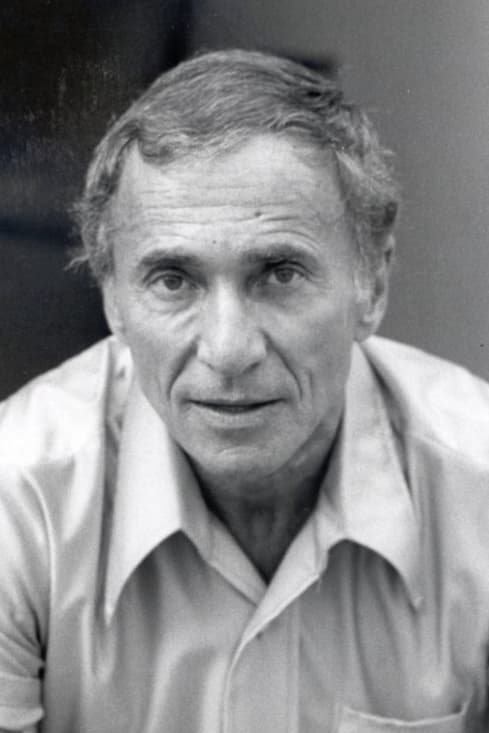

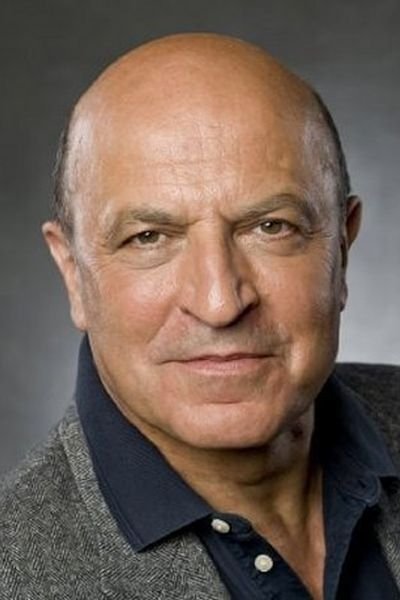

Victor Garber

Victor Garber, known for his roles in popular films and TV shows like ‘Titanic’ and ‘Alias’, publicly shared that he is gay in 2013, when he was 63 years old. He had been in a long-term relationship with his partner for many years before making the announcement. Garber chose to keep his personal life private, but felt it was important to be open and honest about who he is. He continues to be a well-respected and admired actor around the world.

Barry Manilow

Barry Manilow, the celebrated singer and actor known for hits like ‘Copacabana,’ publicly shared that he is gay in 2017 when he was seventy-three years old. He explained he’d kept his personal life private for many years, fearing it might affect his career and how fans viewed him. He was very happy with the supportive response from his longtime fans. Manilow has had a remarkable career in music and theater that has lasted for decades.

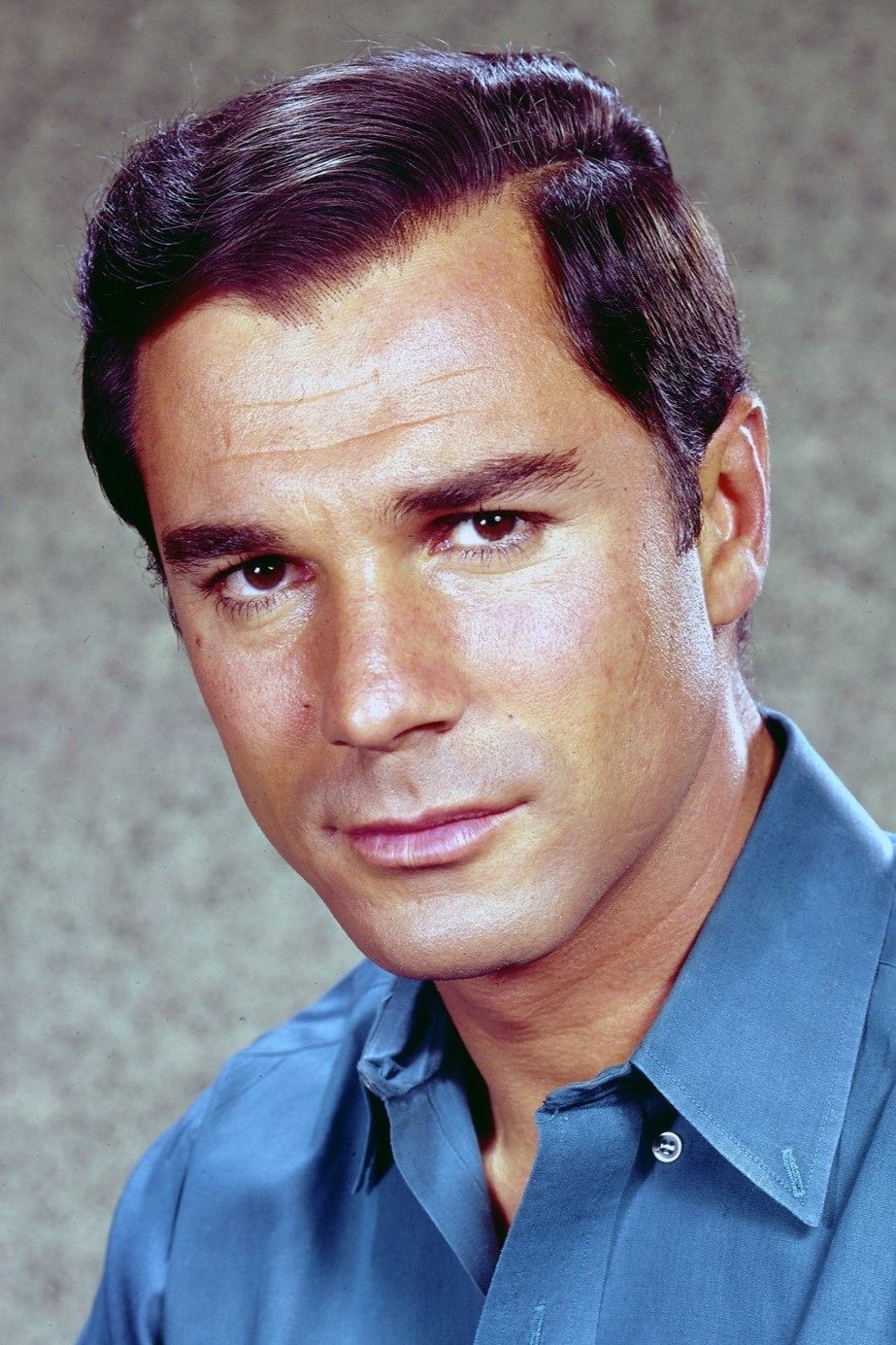

Richard Chamberlain

Richard Chamberlain rose to fame with his roles in ‘Dr. Kildare’ and ‘Shogun’. He publicly came out as gay in his 2003 memoir at the age of sixty-nine, having previously worried it would harm his career as a romantic lead. Now, he encourages others to live honestly, regardless of what the public or the entertainment industry thinks. His decision was considered a significant step for older actors on television.

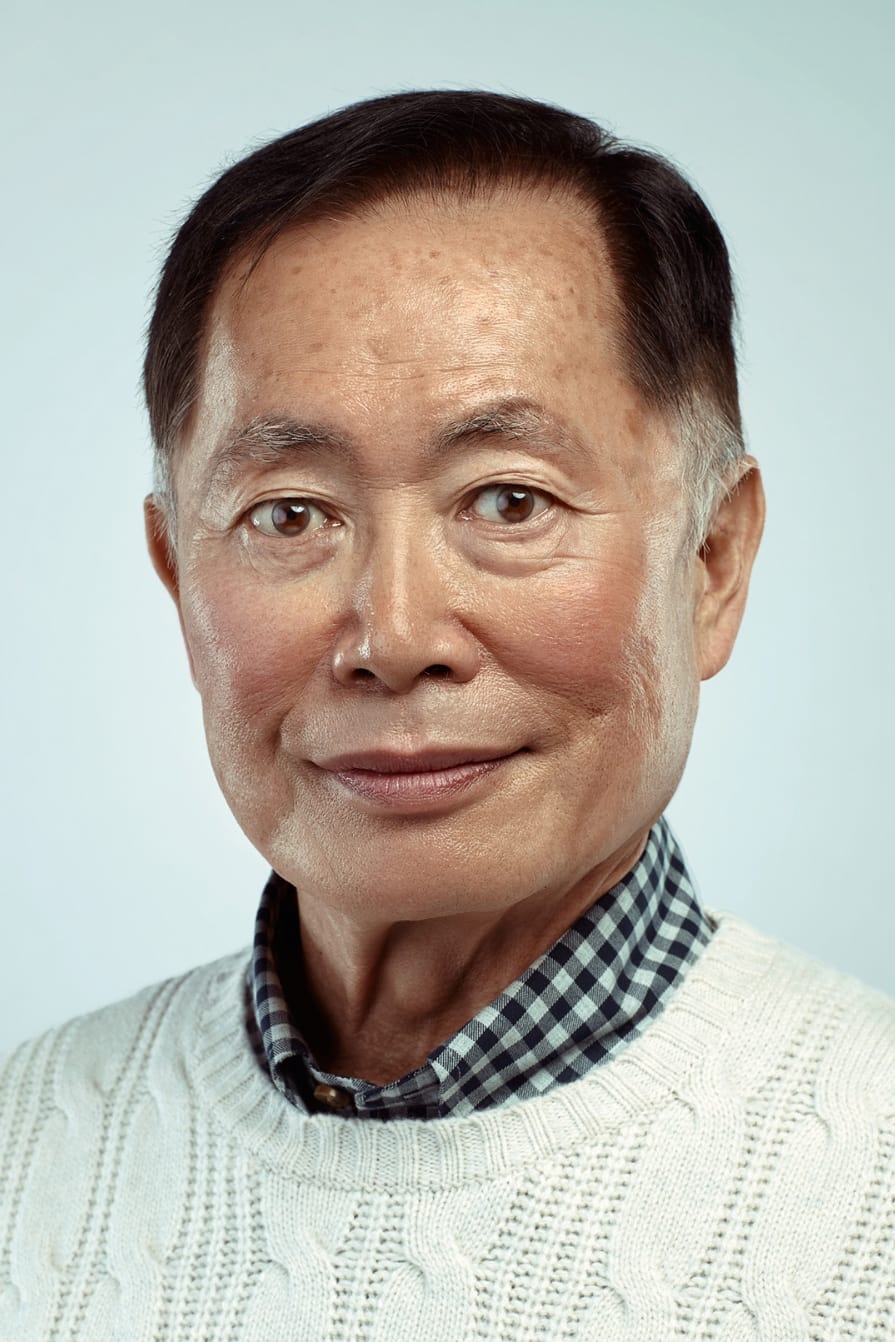

George Takei

George Takei is best known for playing Hikaru Sulu in the original ‘Star Trek.’ He publicly came out as gay in 2005, at age 68, after California lawmakers blocked same-sex marriage. Since then, he’s become a leading voice for civil rights and social justice, and he continues to connect with millions of fans worldwide through his work and online presence.

Jim Nabors

Jim Nabors, best known for his roles in ‘Gomer Pyle, U.S.M.C.’ and ‘The Andy Griffith Show,’ publicly came out as gay in 2013 when he married his partner of many years at the age of eighty-two. Despite his fame, Nabors had always kept his personal life private, living in Hawaii while continuing to perform. The announcement was warmly received by both his fellow actors and his fans.

Kevin Spacey

Kevin Spacey, a celebrated actor famous for roles in films like ‘The Usual Suspects’ and the TV series ‘House of Cards’, publicly came out as gay in 2017 at the age of 58. This announcement happened during a time of considerable public scrutiny regarding his behavior. He shared his decision to live openly as a gay man, which sparked widespread conversation within the entertainment industry.

Tab Hunter

Tab Hunter was a popular actor during Hollywood’s golden age, known for movies like ‘Damn Yankees’. He didn’t publicly share he was gay until his 2005 autobiography, when he was seventy-four years old. For years, he carefully maintained a conventional public persona while keeping his private life hidden. Later in life, he created a documentary called ‘Tab Hunter Confidential’ which revealed the significant pressures faced by actors who had to hide their sexuality in mid-20th century Hollywood.

Dick Sargent

Dick Sargent is most famous for his role as Darrin Stephens in the popular TV show ‘Bewitched.’ He publicly came out as gay in 1991 when he was 61 years old, intentionally timing the announcement to coincide with National Coming Out Day to raise awareness. For the rest of his life, he passionately supported LGBTQ+ rights and became a strong advocate for the community. Sargent was widely admired for his courage in speaking openly about his identity at a time when it was less common on television.

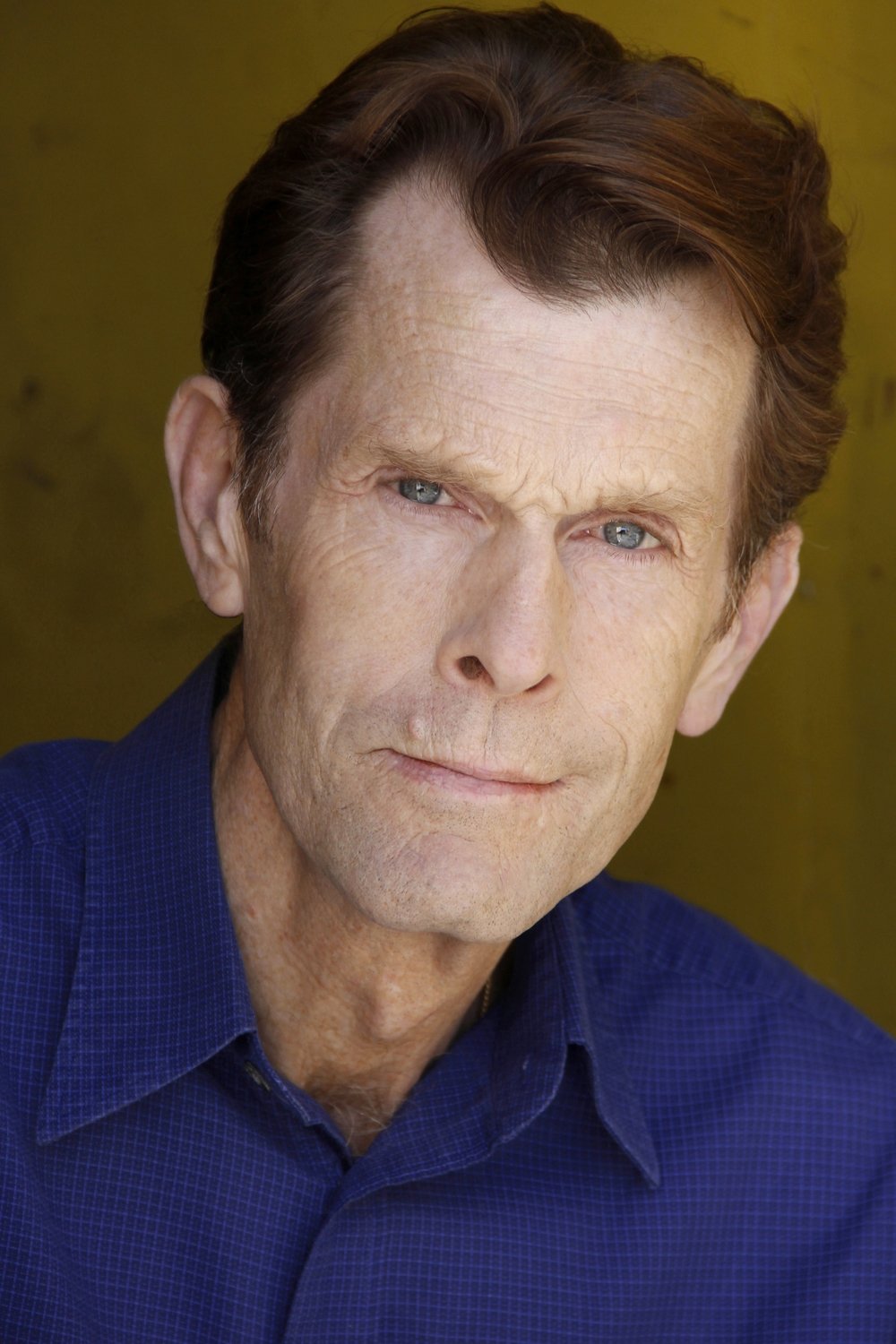

Kevin Conroy

For many years, Kevin Conroy was the beloved voice of Batman, most famously in ‘Batman: The Animated Series.’ In 2022, at the age of sixty-six, he shared his personal story as a gay man in a comic book, detailing the difficulties he faced early in his career before achieving success as a voice actor. His openness resonated deeply with fans who had cherished his iconic performance for years. He is widely considered the definitive voice of Batman for multiple generations.

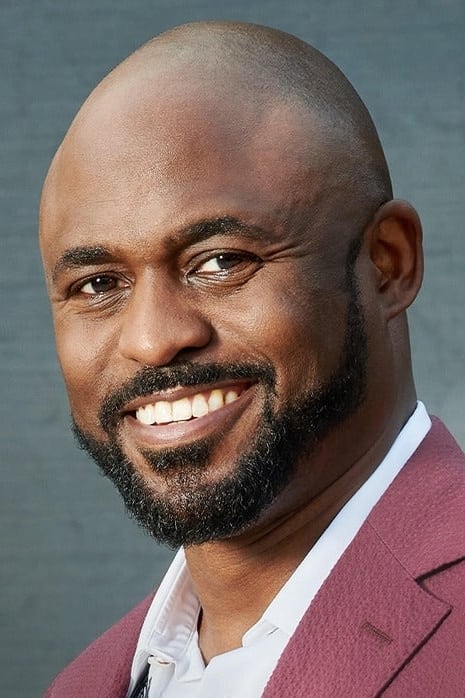

Wayne Brady

Wayne Brady, famous for his work on ‘Whose Line Is It Anyway?’ and other projects, publicly shared in 2023 that he identifies as pansexual. The 51-year-old entertainer explained he’d spent time thinking about who he is and prioritizing his mental well-being. He received a lot of positive support from fans and fellow performers, and continues to be a prominent figure in television and theater.

Rock Hudson

Rock Hudson was a famous Hollywood actor, known for films like ‘Giant’ and ‘Pillow Talk’. In 1985, at age 59, he publicly revealed he was gay and had been diagnosed with a serious illness. This news was groundbreaking and changed how the public thought about both health and the private lives of actors. Hudson is remembered as an important figure in bringing LGBTQ+ representation to the world of film.

Nigel Hawthorne

As a lifelong movie fan, I always admired Nigel Hawthorne – he was such a classy British actor, and unforgettable as King George! It was really shocking when a journalist outed him in 1995, especially at sixty-six. I was heartened to see him attend the Oscars that year with his partner; it felt like a brave statement. It wasn’t until after his death that he truly shared his full story in his autobiography. He was just a phenomenal actor with an amazing presence, and I’ll always remember his incredible range.

Charles Nelson Reilly

Charles Nelson Reilly was a talented actor and comedian best known for his hilarious appearances on ‘The Match Game’. He enjoyed a long and successful career in theater and television, where he was celebrated for his unique personality and sharp sense of humor. Later in life, at age 71, he began to more openly share his life story, including his experiences with his sexuality, in a 2002 one-man show.

Marlon Brando

Marlon Brando, famous for his role in ‘The Godfather’, is often ranked among the best actors ever. In a 1976 interview, when he was 52 years old, he openly discussed his relationships with both men and women. Brando said he wasn’t embarrassed by his past and saw his sexuality as a natural part of being human. This honesty was unusual for a celebrity of his fame at the time, and he continued to push boundaries throughout his remarkable life.

Brian Boitano

Brian Boitano, famous for winning an Olympic gold medal, later became an actor and TV host. He publicly came out as gay in 2013 when he was fifty years old. This announcement happened right before he represented the United States at an important international event. Boitano said he felt it was important to be a role model, which motivated him to share his story. Since then, he’s continued to appear on TV in various shows and specials.

Arthur Laurents

Arthur Laurents was a talented playwright and screenwriter who also occasionally acted and directed. He publicly shared that he was gay in his 2000 autobiography when he was eighty-three years old, detailing his relationships and the difficulties faced by gay people in Hollywood during the blacklist period. Best known for co-creating classics like ‘West Side Story’ and ‘Gypsy’, Laurents continued to be a major figure in theater until his death.

George Maharis

George Maharis, best known for his role in the TV show ‘Route 66’, was a popular actor and teen idol in the 1960s. For many years, he kept his personal life private, only publicly sharing his sexual orientation later in life. At age eighty-two, he spoke about how his identity affected his career. He is remembered for his contributions to both television and music.

Thom Christopher

Thom Christopher is an actor most famous for playing Hawk in the sci-fi series ‘Buck Rogers in the 25th Century’. He also appeared on the soap opera ‘One Life to Live’ and became well-known for that role. Later in his career, Christopher publicly shared that he is gay and spoke about his long-term relationship in interviews after the age of fifty. He continues to work in theater and television today.

Mark Patton

Mark Patton is best known for playing a role in ‘A Nightmare on Elm Street 2: Freddy’s Revenge’. After leaving acting for a long time, he came back to share his story as a gay man. He appeared in the documentary ‘Scream, Queen! My Nightmare on Elm Street’ at age fifty-five, where he discussed how the themes of his famous role connected to his life. Today, he’s admired by horror fans for being so open and honest.

Cesar Romero

Cesar Romero was a talented actor best known for his role as the Joker in the ‘Batman’ TV show. He had a successful career in film and television and famously never married. Later in life, he spoke with biographers about his sexuality. Romero lived to be eighty-six years old and stayed involved in Hollywood’s social scene, remembered for his charm and unique voice.

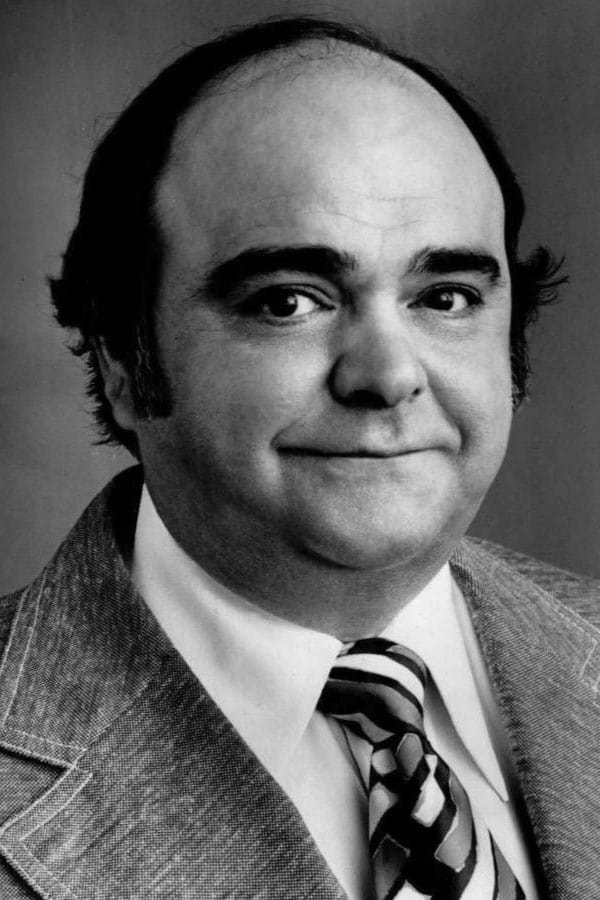

James Coco

James Coco was a gifted character actor who earned an Academy Award nomination for his role in ‘Only When I Laugh’. Though known to those in the entertainment industry as gay, he became more public about his personal life later in his life. Throughout his successful career, he excelled in both stage and film roles. He died at the age of 56, leaving behind a memorable body of work that showcased both his comedic and dramatic talents. Coco is fondly remembered for his distinctive personality and impeccable timing as an actor.

Alec Guinness

Alec Guinness, a celebrated actor best known for playing Obi-Wan Kenobi in ‘Star Wars,’ lived a long and private life. However, after his death at the age of eighty-six, journals and biographies revealed details about his personal life, including his same-sex attractions. Despite maintaining privacy for much of his life, this aspect of his identity has become part of his lasting legacy. Guinness is remembered as one of the greatest actors of the twentieth century, praised for his range and skill.

Tell me what you think about these stories in the comments.

Read More

- Gold Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- Silver Rate Forecast

- EUR UAH PREDICTION

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2026-02-21 16:17