The market, you see, has been exhibiting a touch of the doldrums lately. The S&P 500, that rather important barometer of financial cheerfulness, has been dawdling along, up a mere fraction since the year commenced. A situation, one might say, that has the more excitable investors in a bit of a fluster. Indeed, a recent survey reveals a rather divided camp – a good thirty-five percent are feeling optimistic, while a decidedly gloomy thirty-seven percent are anticipating a spot of bother. A most curious state of affairs, don’t you agree?

So, the question arises: is now the moment to plunge into the stock market, or would it be wiser to remain on the sidelines, sipping a lemonade and observing the proceedings? History, my dear fellow, offers a surprisingly clear answer, and it’s not quite the doom and gloom some are predicting.

History’s Encouraging Nod

Many a chap, having witnessed stocks scaling heights previously undreamt of, fears a precipitous decline. But the market, bless its unpredictable heart, has a knack for proving the pessimists wrong. It consistently demonstrates an ability to absorb shocks and, ultimately, to climb ever higher, provided one possesses the patience of a saint and a long-term perspective.

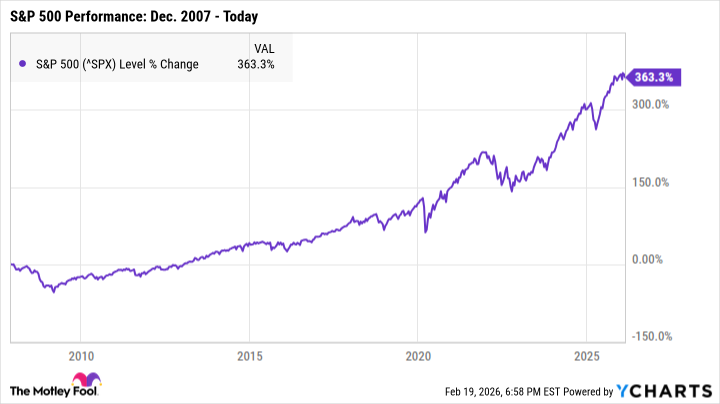

The truly remarkable thing is this: it scarcely matters when you invest, so long as you do invest. Imagine, if you will, a fellow who, in December of 2007, decided to put his shillings into an S&P 500 index fund. A rather unfortunate timing, what with the Great Recession looming like a particularly unpleasant aunt. The market, naturally, took a bit of a tumble, and it wasn’t until 2013 that things began to look up again.

Buying at such a peak, just before a financial squall, might seem the height of folly. And it would be, if one were to panic and sell at the first sign of trouble. But those who held firm, through thick and thin, have been handsomely rewarded. By today, that initial investment has blossomed into a return of over 363 percent! A most agreeable outcome, wouldn’t you say?

Now, one might argue that waiting until 2009, when prices were at rock bottom, would have yielded even greater returns. And, of course, that’s perfectly true. But attempting to time the market is a decidedly risky game, akin to trying to predict the whims of a particularly capricious dowager. Wait too long, and you might miss out on the most substantial gains.

In most cases, a far more sensible strategy is to continue investing consistently, regardless of the market’s mood. Even if you happen to buy at a less-than-ideal moment, you can still accumulate a considerable fortune over time. A bit like steadily adding pennies to a savings account – small contributions, consistently made, can add up to a surprising sum.

Fortifying Your Portfolio Against the Elements

The overall market, you see, is remarkably resilient and capable of weathering even the most turbulent economic storms. However, not all individual companies are quite so fortunate. Some, alas, are rather like poorly constructed castles – prone to crumbling at the first sign of trouble. These unstable entities are more likely to succumb to the pressures of a downturn.

Companies with solid foundations, on the other hand, possess a far greater chance of survival. They are like sturdy oaks, capable of withstanding even the fiercest gales. The more of these dependable stocks you own, the better protected your portfolio will be against volatility.

Therefore, now is an excellent time to review your holdings and ensure that each company deserves its place in your portfolio. If you discover any that are looking a bit shaky, it might be wise to sell while the going is still good. And if you can manage it, increasing your investment can set you up for significant long-term earnings. A bit of prudence, combined with a dash of optimism, is a most potent combination, wouldn’t you agree?

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Gold Rate Forecast

- Wuchang Fallen Feathers Save File Location on PC

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Exit Strategy: A Biotech Farce

- MicroStrategy’s $1.44B Cash Wall: Panic Room or Party Fund? 🎉💰

- QuantumScape: A Speculative Venture

2026-02-21 15:02