They speak of wealth, these gentlemen in their towers. Of ‘building’ it, as if it weren’t simply shifting it from one pocket to another. The market… it’s a relentless mill, grinding the hopes of some into the fortunes of others. But even a man with calloused hands can, with patience, coax a little something from its gears.

The Vanguard S&P 500 ETF… a mouthful, isn’t it? Just a collection of the largest companies, the ones that already have everything. But it’s a vessel, and a predictable one. It holds the weight of American industry, and for a time, that weight can lift those who dare to hitch a ride. Fifteen years ago, five thousand dollars… a decent sum, enough to keep a family fed for a season. To put it into this… this engine of speculation… well, it’s a gamble, isn’t it? A calculated one, perhaps, but a gamble nonetheless.

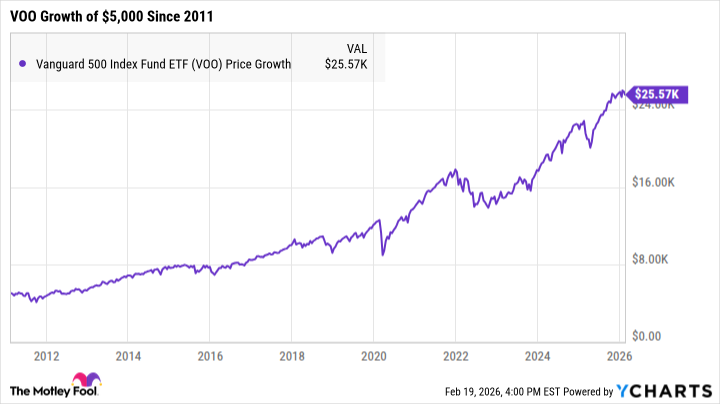

Let’s be clear. Fifteen years. That’s a lifetime for some, a blink for others. If a man put five thousand dollars into this ETF then, and simply… waited… he’d have nearly twenty-six thousand dollars now. A tidy sum. Enough to ease the burden, perhaps. But remember, this isn’t magic. It’s the accumulation of countless small transactions, each one representing someone else’s labor, someone else’s risk.

The smooth talkers will tell you about ‘consistent contributions.’ A hundred dollars a month. They make it sound so simple. But a hundred dollars is a week’s worth of bread and milk for many. Still, if a man could scrape together that much, consistently, for fifteen years… the numbers are… impressive. Over fifty-six thousand dollars. A small independence, perhaps. But it demands discipline, a relentless denial of immediate needs. And in this world, that’s a rare and precious commodity.

Time… they say it’s money. A trite saying, but true. The market doesn’t care for sentiment, for hardship, for the dreams of ordinary men. It simply rewards patience. But don’t mistake patience for virtue. It’s merely a strategy. A way to navigate a system designed to benefit those who already have the upper hand. Still, even a man with empty pockets can learn to play the game. To coax a little warmth from the cold machinery of wealth. It’s a hard-earned sum, whatever it amounts to.

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- DOT PREDICTION. DOT cryptocurrency

- Silver Rate Forecast

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2026-02-21 14:32