Now, listen closely, because this is a tale of enormous sums of money and tiny, glittering things. Four colossal companies – Amazon, Microsoft, Alphabet, and Meta Platforms – are planning to spend a gobstopping $650 billion in the coming year on building these… well, imagine enormous, humming sheds filled with brains. Data centers, they call them. And these brains need feeding. Not with biscuits, mind you, but with chips. Mountains of them.

Some folks are scratching their heads, wondering if all this spending is sensible. But let me tell you, these companies aren’t known for tossing money about like confetti. They smell opportunity, and this opportunity smells strongly of… artificial intelligence. Any company dawdling, refusing to pile in and grab a slice of this pie, is about to find itself looking rather foolish indeed.

There are several ways to benefit from this chip-gobbling frenzy, but my favorite, by a country mile, is Taiwan Semiconductor (TSM +2.68%). This isn’t about picking a winner; it’s about recognizing the chap who makes the winners possible. Regardless of which clever bits and bobs these tech giants cram into their humming sheds, chances are, Taiwan Semiconductor had a hand in their creation. A rather large hand, in fact.

Chip Foundries: A Rare Breed

You see, building these tiny, intricate chips isn’t child’s play. It requires a special kind of magic, a secret recipe known to only a handful of companies. Intel (INTC 1.22%) used to be one of the masters, but lately, they’ve been… well, let’s just say their chip-making mojo has gone a bit wobbly. They’re struggling to keep up with the Taiwanese wizards. And now, with Taiwan Semiconductor building factories right here in the good ol’ US of A, Intel’s chances are looking slimmer than a stick insect.

Samsung is another contender, certainly. They’re quite capable, but they simply haven’t got the capacity to churn out chips at the same dizzying rate as Taiwan Semiconductor. It’s like asking a hamster to build a skyscraper – admirable effort, but ultimately… unrealistic.

This leaves Taiwan Semiconductor as the only truly viable option. That’s why the biggest players – Nvidia, AMD, and Broadcom – all flock to them. Whether these tech giants are filling their sheds with powerful graphics processing units (GPUs) from Nvidia or custom-designed chips from Broadcom, the odds are stacked in Taiwan Semiconductor’s favor. They’re the secret ingredient, the hidden power behind the whole operation.

This makes Taiwan Semiconductor the safest, most sensible way to play the AI buildout. As long as these companies keep spending, Taiwan Semiconductor will continue to thrive. And from what the folks in charge are saying, this spending isn’t likely to slow down anytime soon.

They reckon that between now and 2029, revenue from AI chips will grow at a whopping 60% per year! That’s a truly astonishing rate of growth, a clear indication of just how massive and enduring this AI revolution will be.

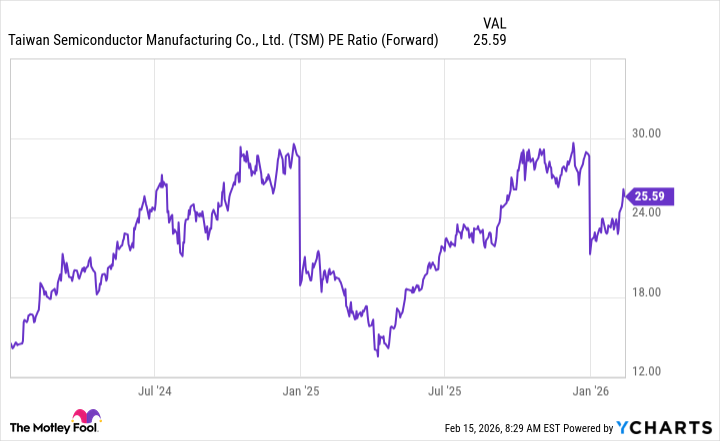

Now, you might expect a company with such bright prospects to be trading at a sky-high price. But surprisingly, Taiwan Semiconductor’s stock isn’t ridiculously expensive. It’s currently trading at 26 times forward earnings, which is only slightly more than the S&P 500 (^GSPC +0.69%), which is priced at 22 times. It’s not exactly a bargain basement price, but it’s still a very sensible investment, a clever way to capitalize on the AI buildout.

So, there you have it. A tale of humming sheds, glittering chips, and a company poised to profit from it all. A rather delightful prospect, wouldn’t you agree?

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- QuantumScape: A Speculative Venture

- MicroStrategy’s $1.44B Cash Wall: Panic Room or Party Fund? 🎉💰

- Exit Strategy: A Biotech Farce

2026-02-21 10:24