They say a new kind of hunger is upon us, a hunger for calculation, for the swift sorting of data. This artificial intelligence, they call it. The fields are being sown with silicon, and the promise is a harvest beyond imagining. But a man who’s seen a few seasons knows that even the most promising bloom can wither under a sudden frost. The money flows, yes, a great river of it, but rivers can swell and break their banks, leaving ruin in their wake.

There’s talk of fortunes to be made, of stocks to climb like Jacob’s ladder. I’ve looked at the names they whisper – the ones they say will carry us to this new Eden – and I’ve tried to see past the shine, to the hard ground beneath. Here’s what I’ve found, not a promise of riches, but a reckoning of risks.

Nvidia: The Toolmaker

Nvidia, they say, is the shovel in this digital gold rush. Nearly every claim requires one of their chips, and for that, they ask a steep price. It’s a good business, making the tools others use to dream. But a tool is only as good as the hand that wields it, and the market has a way of discarding even the finest implements when the work slows. They speak of growth, of projections reaching for the sky. But I’ve seen enough booms to know that what goes up must eventually come down, and the higher it climbs, the harder the fall.

The numbers are impressive, yes. Analysts predict a climb, a surge. But numbers are just shadows on the wall, easily distorted by the flickering light of hope and fear.

Taiwan Semiconductor: The Earth Beneath

Taiwan Semiconductor, now, that’s a different sort of beast. They don’t build the dream, they build the foundation. They make the chips for nearly everyone, spreading the risk, but also diluting the reward. It’s a steady business, like farming, but even the most fertile land can be exhausted. They say AI spending will keep them busy, and that may be true. But a farmer doesn’t plant a field expecting a miracle, he expects hard work and a fair price. And fair prices are becoming a rare commodity these days.

They’re not beholden to one company, one vision. That’s a strength, but it also means they lack the singular focus that can drive true innovation. They’re a necessary piece, but not the engine.

Broadcom: The Artisan

Broadcom is attempting a different path, crafting specialized chips for specific tasks. It’s like a skilled artisan, building a tool for a single purpose. Some customers, they say, are tired of paying a premium for features they don’t need. That’s a sensible sentiment. But specialization comes at a cost. If the task changes, the tool becomes useless. It’s a gamble, betting on a narrow lane in a rapidly changing race.

The demand is there, for now. But the world doesn’t stand still. New needs arise, new technologies emerge. And the artisan must adapt, or be left behind.

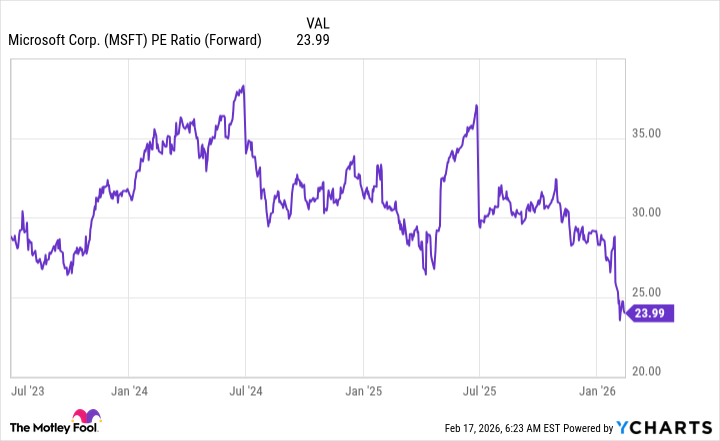

Microsoft: The Old Guard

Microsoft, once a titan, now seems… cautious. The stock has cooled, the premium diminished. Some see this as an opportunity, a chance to buy low. Perhaps. But a seasoned traveler knows that a sudden stillness can precede a storm. Nothing fundamental has changed, they say. But the market doesn’t always reward logic. It rewards perception. And right now, perception seems to be turning against them.

It’s a company built on solid ground, yes. But even the strongest foundations can crumble under the weight of shifting tides.

Alphabet: The Newcomer

Alphabet, rising in Microsoft’s place, is a curious case. They’ve clawed their way back from the brink, their Gemini model gaining recognition. It’s a testament to their resources, their resilience. But even a strong climber can stumble on treacherous terrain. The generative AI race is a marathon, not a sprint. And the finish line is still a long way off.

They have the potential, undoubtedly. But potential is just a seed. It needs nurturing, patience, and a little bit of luck to blossom into something truly remarkable. It’s a bedrock, perhaps, but a bedrock that still needs to weather the storm.

So here we are, standing on the edge of a new era, seduced by the promise of artificial intelligence. There will be winners, undoubtedly. But there will also be losses. And the line between the two is often thinner than we imagine. Remember this: the market is a harsh mistress. She rewards boldness, but she punishes recklessness. And in the end, the only true reward is a life lived with dignity and purpose, regardless of the fortunes of silicon and code.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Banks & Shadows: A 2026 Outlook

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- QuantumScape: A Speculative Venture

- MicroStrategy’s $1.44B Cash Wall: Panic Room or Party Fund? 🎉💰

- Where to Change Hair Color in Where Winds Meet

2026-02-21 08:33