Now, one occasionally encounters a company that presents a bit of a puzzle, and Oklo, my dear reader, is decidedly one of those. Investing a thousand dollars in this particular concern is rather like backing a spirited but unproven racehorse – a dashedly risky proposition, certainly, but with a potential upside that could, if things fall just so, leave one feeling rather pleased with oneself. The matter, however, requires a spot of preliminary investigation, you see.

A Revenue Situation That’s, Well, Developing

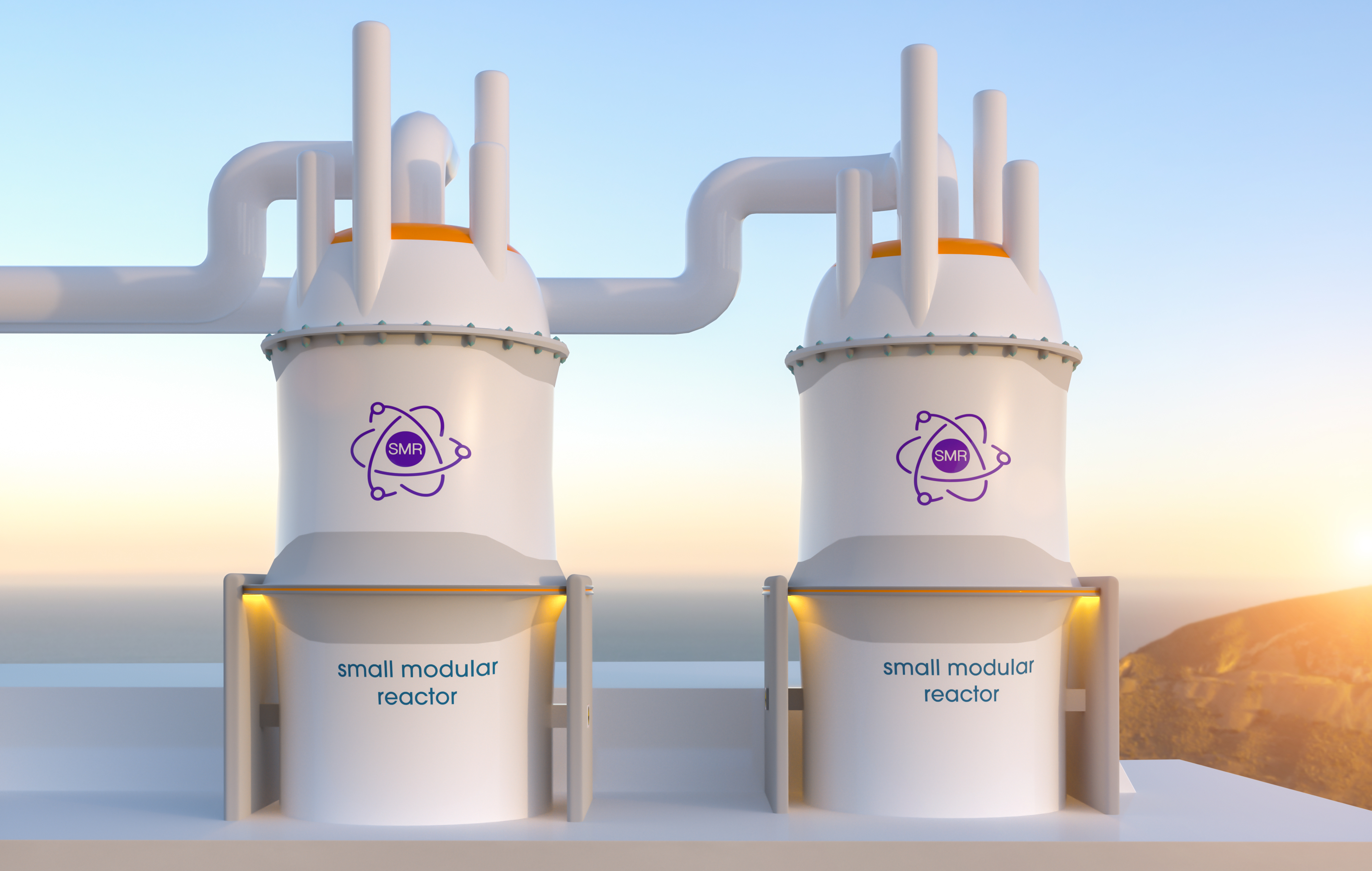

Oklo, you see, is currently engaged in the noble pursuit of constructing advanced fission reactors – rather ingenious contraptions called Aurora powerhouses, no less. These are intended to supply the ever-increasing energy demands of data centres and various industrial enterprises. A perfectly sensible idea, naturally.

They’ve already secured a number of binding agreements and partnerships with rather substantial firms – Meta Platforms, Siemens Energy, and Liberty Energy amongst them. They anticipate, with a degree of optimism that one finds rather charming, deploying their first reactors sometime in 2027. A date which, one hopes, won’t be subject to too much shifting about.

Once these reactors are up and running, the letters of intent and power purchase agreements will, presumably, transform into actual, tangible revenue. But it’s a process that will likely require a good deal of patience, a quality that, alas, seems to be in increasingly short supply these days.

The Stock’s Valuation: A Touch Optimistic, Perhaps?

Because Oklo hasn’t, as yet, actually earned any revenue, the stock is currently trading at a premium that could generously be described as enthusiastic. In 2025, it experienced a surge that was, frankly, rather startling, briefly soaring to heights that left onlookers slightly breathless. It ended the year up a considerable 240%. If one were basing investment decisions solely on fundamental analysis, one might conclude that the whole affair is a bit on the extravagant side.

Investors will be relieved to note that the stock has retreated somewhat from its earlier exuberance, currently hovering around the $65 mark as of February 19th, a considerable drop from its 52-week high of $193. A sensible correction, one might say.

However, one can’t entirely dismiss the momentum the company is generating and the deals it’s managing to secure. And, of course, there’s the rather intriguing connection to Sam Altman, the founder of OpenAI, who previously served as chairman of the board and remains a significant investor. A dash of stardust, if you will, that lends the company a certain credibility.

Real Demand Underpinning the Hype

Oklo is currently awaiting licensing approval from the U.S. Nuclear Regulatory Commission (NRC). A decision is expected imminently, and one hopes the NRC will view the application with a benevolent eye. Assuming Oklo receives the green light and manages to deploy its reactors on schedule in 2027, one anticipates a veritable flurry of new business. A delightful prospect, wouldn’t you agree?

Naturally, there’s always the risk of denials or delays, but the demand for Oklo’s reactors is growing in tandem with the ever-increasing power requirements of artificial intelligence. A rather convenient synergy, wouldn’t you say?

Should One Invest? A Question of Temperament

Even a modest investment of a thousand dollars in Oklo stock will necessitate a lengthy and patient outlook. Given the risks associated with awaiting licensing approval and the deployment timeline, it’s essential that investors possess a higher risk appetite and the ability to withstand a degree of volatility. If Oklo receives the green light in 2026 and deploys its reactors in 2027, one might reasonably expect to see substantial revenue and a corresponding surge in the stock price. A most agreeable outcome, wouldn’t you say? But one must approach the matter with a healthy dose of caution, naturally. After all, one wouldn’t want to find oneself in a bit of a pickle, would one?

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- QuantumScape: A Speculative Venture

- MicroStrategy’s $1.44B Cash Wall: Panic Room or Party Fund? 🎉💰

- Here Are the Best TV Shows to Stream this Weekend on Hulu, Including ‘Fire Force’

2026-02-21 07:12