Now, listen closely. We’re not talking about turning lead into gold here, though some venture capitalists do seem to operate on that principle. We’re discussing NuScale Power (SMR 8.20%), a company attempting something rather ambitious: shrinking a nuclear reactor down to a size that doesn’t require its own postcode. It’s a bit like trying to fit a dragon into a teacup, really. A very expensive teacup.

Based in Portland, Oregon – a place known for its coffee and, increasingly, its attempts to solve the world’s energy problems – NuScale currently holds the singular honour (and, let’s be frank, the considerable pressure) of being the only U.S. nuclear firm with approval from the Nuclear Regulatory Commission (NRC) for these Small Modular Reactors, or SMRs. There’s a whole host of other startups – Oklo, Nano Nuclear Energy, and a few others operating on what can only be described as optimistic projections – but NuScale is the only one with a license to actually deploy the things on a commercial scale. It’s a bit like being the only blacksmith in a town that’s suddenly decided everyone needs swords. Good for business, potentially. But also a lot of responsibility.

So far, this first-mover advantage hasn’t translated into a fortune. The shares are currently bobbing around the $14 mark, which, let’s be honest, barely covers the cost of the paperwork. They’ve secured agreements to deploy their technology for the Tennessee Valley Authority (TVA) and a Romanian power plant – commendable, certainly – but actual, firm sales? Still waiting. It’s a bit like building a magnificent clockwork automaton and then discovering nobody needs to tell the time anymore.

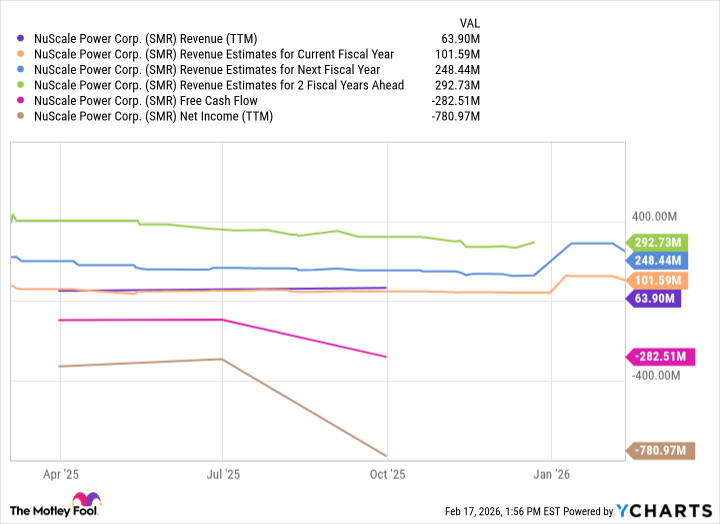

Consequently, the company is operating at a loss and burning cash at a rate that would make a dragon blush. Profitability? Several years away, at best. It’s a high-risk gamble, a long-term investment predicated on the assumption that the world will suddenly and desperately need lots of small nuclear reactors. Which, to be fair, isn’t entirely unreasonable. But it’s still a gamble.

However, the potential upside is… significant. Goldman Sachs estimates that the demand for power from data centres could increase by a staggering 175% by 2030. 175%! That’s enough to power a small country, or at least a very enthusiastic collection of servers. The existing power grid, much of which dates back to the post-war era, is simply not equipped to handle such a surge. It’s like trying to run a modern highway system on roads designed for horse-drawn carriages. Something has to give.

NuScale’s factory-assembled reactors – the idea being that they can be built more efficiently and deployed more quickly than traditional nuclear plants – could alleviate some of that burden. It’s an elegant solution, in theory. But elegant solutions often come with a hefty price tag. The company currently has a market cap of $4.3 billion, but with trailing-12-month revenue of around $64 million, it’s trading at roughly 68 times sales. That’s… ambitious. It’s the sort of valuation that makes even seasoned alchemists raise an eyebrow.1

NuScale could change the way the world generates nuclear energy. But turning $14 a share into a million dollars isn’t going to happen overnight. Even with a long-term horizon, investors should carefully weigh the potential reward against the near-term volatility, which is likely to be… considerable. It’s a fascinating company, a bold undertaking, and a potentially lucrative investment. But remember, even dragons sometimes lose their fire.

1 The Guild of Alchemists and Venture Capitalists have a long-standing agreement: anything trading at more than 50 times sales is considered “optimistically priced” and requires a minimum of three enchanted accounting ledgers.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- MicroStrategy’s $1.44B Cash Wall: Panic Room or Party Fund? 🎉💰

- QuantumScape: A Speculative Venture

- 20 Movies That Glorified Real-Life Criminals (And Got Away With It)

2026-02-21 05:32