Apple TV+ remains a major player in the world of streaming, offering a strong selection of films with big names and unique creative visions. This weekend, you’ll find a wide variety of choices, including exciting sports dramas, sci-fi love stories, gripping thrillers, and feel-good comedies. Whether you’re after the newest hits or critically acclaimed movies, Apple TV+ has something for every film fan. Here are the must-watch movies you should add to your list now.

‘Eternity’ (2025)

Elizabeth Olsen leads this clever and heartwarming romantic comedy about love and life after death. The film follows a woman who has to choose between staying with her husband of 65 years or reconnecting with a passionate love from her past. It blends a creative and imaginative world with deep thoughts about soulmates and what it truly means to commit to someone. Strong performances from Miles Teller and Callum Turner add even more emotional weight to her difficult decision.

‘F1’ (2025)

I was completely hooked by this new movie! Brad Pitt is fantastic as a former Formula 1 racer who comes back to help a young, up-and-coming driver, but he’s also dealing with his own personal struggles. What really blew me away were the racing scenes – they filmed them during actual Grand Prix races, so it felt incredibly real and immersive. It’s not just fast cars and action, though; it’s a really compelling story about what it means to leave a legacy and the burning desire to win.

‘Highest 2 Lowest’ (2025)

Spike Lee and Denzel Washington team up again in this intense thriller, a modern take on Kurosawa’s ‘High and Low’. The story moves to the competitive world of music, where a powerful executive’s life is thrown into chaos when the wrong person is kidnapped. Denzel Washington gives a compelling performance as a man struggling with his conscience and his business during a high-pressure rescue attempt. Set in present-day New York City, the film examines issues of social class and what people are willing to give up for what they believe in.

‘The Family Plan 2’ (2025)

Mark Wahlberg returns as Dan Morgan, a former government assassin, in this thrilling sequel that moves the action to Europe. He tries to give his family a quiet vacation in London, but gets pulled back into a dangerous world by his brother, who seeks revenge. The movie mixes exciting car chases through London with the funny challenges of family life. Expect even more impressive action and bigger risks as the Morgans confront their most formidable enemy yet.

‘The Lost Bus’ (2025)

This survival drama features a powerful performance from Matthew McConaughey, based on the true story of the 2018 California Camp Fire. He plays a brave bus driver tasked with guiding a bus full of children through a quickly escalating wildfire. The film realistically depicts the horror of the disaster, emphasizing the courage of everyday people facing impossible situations. It’s a gripping and moving story that honors the strength of the affected community.

‘The Gorge’ (2025)

Miles Teller and Anya Taylor-Joy star in a unique film that mixes action, horror, and romance. They play highly skilled snipers stationed in towers above a strange canyon, where they’re meant to protect the world from hidden dangers. As they grow closer while working apart, they start to discover the frightening reality of what’s hidden in the canyon below. The movie is full of suspense and creates a chilling atmosphere, all thanks to the strong connection between the two main actors.

‘Fountain of Youth’ (2025)

Directed by Guy Ritchie, this exciting adventure follows estranged siblings John Krasinski and Natalie Portman on a worldwide quest for the legendary Fountain of Youth. They must work together, beating a dangerous rival group along the way. The film is packed with Ritchie’s trademark fast action, clever twists, and takes place in beautiful, far-off places. It’s a thrilling and funny take on the classic treasure hunt story, boosted by its charismatic stars.

‘Come See Me in the Good Light’ (2025)

A.V. Rockwell’s new film is a beautiful and moving drama that explores what it means to find yourself and overcome hardship. The story follows a character on a powerful journey of self-discovery, and the film’s striking visuals reflect their inner world. Rockwell focuses on the small, meaningful moments between people, making for a story that feels both personal and relatable. Reviewers have applauded the film’s honesty and the director’s talent for capturing the delicate nature of life.

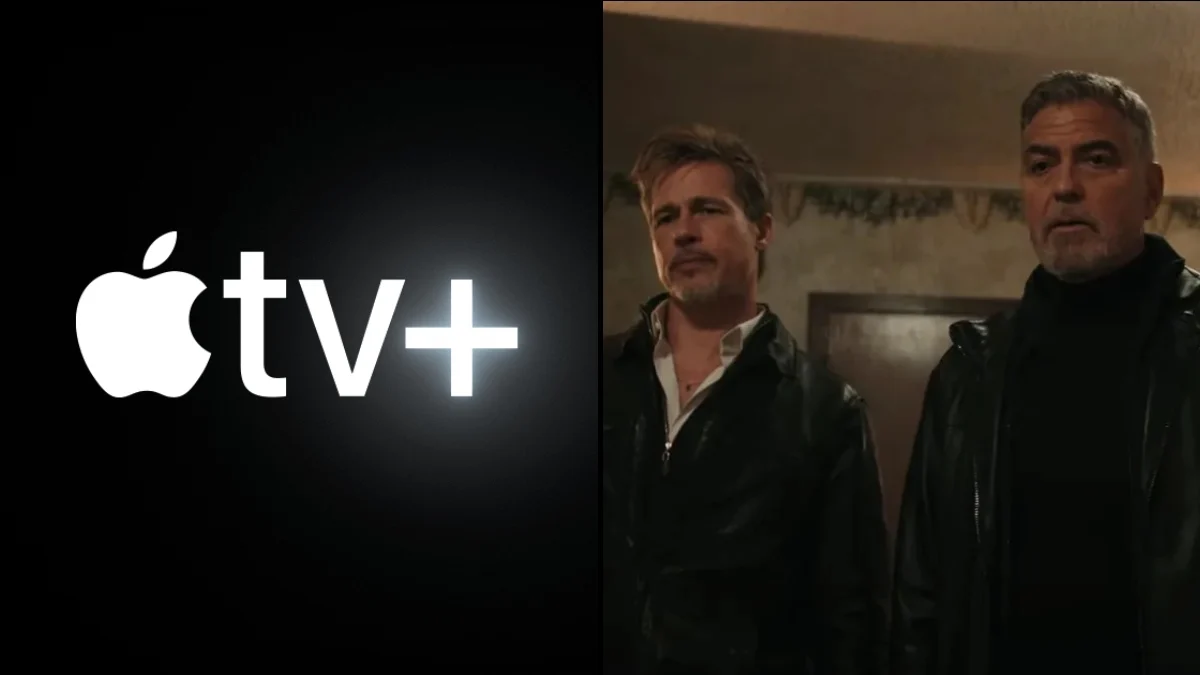

‘Wolfs’ (2024)

George Clooney and Brad Pitt team up again in a new movie, playing two independent problem-solvers who unexpectedly end up working on the same assignment. As things quickly fall apart, they’re forced to collaborate during a wild night in New York City. The film combines exciting action with witty dialogue, and really benefits from the natural chemistry and real-life friendship between the two stars. It’s a funny and original take on crime comedies, showing just how ridiculous the world of crime can be.

‘Fly Me to the Moon’ (2024)

This charming romantic comedy is set during the exciting 1960s space race. Scarlett Johansson plays a clever marketing expert, and Channing Tatum is a NASA director who likes to follow the rules. As they work on the Apollo 11 mission, they disagree about how to present it to the public, and sparks fly! The movie blends historical details with lighthearted humor, and makes you think about how the media shapes what we believe. It’s a beautiful and nostalgic look back at a huge moment in human history.

Share your top pick for this weekend’s movie marathon in the comments.

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- EUR UAH PREDICTION

- DOT PREDICTION. DOT cryptocurrency

- Silver Rate Forecast

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2026-02-21 02:45