It has become painfully obvious, even to those immersed in the vulgar pursuit of profit, that finding genuine value in this market is akin to discovering a sincere compliment. The hyperscalers – Microsoft, Meta, Amazon, Alphabet, Tesla, and Apple – are embarking on a spending spree of nearly $700 billion for capital expenditures. A rather ostentatious display, wouldn’t you agree? The consequence, naturally, is a certain… correction in the valuations of those companies promising to unlock the secrets of artificial intelligence. A predictable outcome, really; enthusiasm, like champagne, rarely improves with age.

The truly discerning investor, however, does not chase the fleeting mirage of hype. They observe the currents beneath the surface. The current sell-off, while dramatic to the uninitiated, merely exposes the underlying truth: software, in its current form, is becoming… common. The real opportunity lies in those facilitating the infrastructure upon which this digital ambition is built. To focus solely on the brilliant minds crafting the algorithms is to mistake the portrait for the painter.

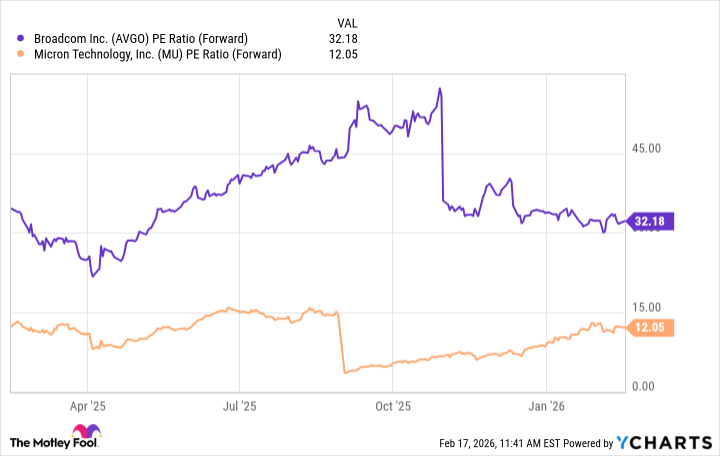

Let us, therefore, turn our attention to two enterprises that are quietly, and with a commendable lack of fanfare, positioning themselves to benefit from this burgeoning revolution.

Broadcom: The Unseen Architect

One might assume, with the current fervor surrounding Nvidia and Advanced Micro Devices, that these are the sole beneficiaries of this technological gold rush. After all, their GPUs are, for the moment, the darlings of the data center. But to assume so is to succumb to the tyranny of the obvious. The truly elegant solutions are rarely those most loudly proclaimed.

Even the titans of industry are beginning to question their reliance on external suppliers. Meta and Alphabet, for instance, are designing their own custom AI accelerators – a rather bold move, and one that speaks volumes about their long-term ambitions. And who, pray tell, is assisting them in this endeavor? Broadcom, of course. A company that understands the art of quiet competence.

Consider this: these hyperscalers aren’t merely purchasing GPUs; they are procuring them by the hundreds of thousands. But a collection of brilliant processors is, without the proper connections, merely a rather expensive paperweight. Broadcom’s networking solutions – their Tomahawk and Jericho chips – are the very arteries and veins of this digital infrastructure, ensuring that data flows with the speed and efficiency it demands. To build a magnificent palace and then furnish it with straw chairs is a folly few can afford.

Broadcom, in essence, is not merely selling components; it is selling the capacity for scale. And in this age of insatiable demand, that is a commodity more precious than gold.

Micron Technology: The Repository of Intelligence

For nearly three years, generative AI has been the subject of much breathless pronouncements. Chatbots, large language models, the endless quest to create a digital simulacrum of human intelligence. But let us not mistake the symptom for the disease. The true potential of AI lies not in replicating conversation, but in solving problems.

The hyperscalers are now focused on far more ambitious applications – autonomous vehicles, agentic AI, humanoid robots. These endeavors require not merely processing power, but an exponential increase in data storage and memory capacity. And that, my dear friends, is where Micron Technology comes into play.

Compute capacity is no longer the primary obstacle. The bottleneck has shifted to memory and storage. Micron’s high-bandwidth memory (HBM) chips are, quite simply, essential. To believe otherwise is to imagine a mind without a memory – a rather unsettling thought, wouldn’t you agree?

The anticipated rise in DRAM and NAND chip prices – up to 60% and 38%, respectively – is a testament to this growing demand. And with Micron’s HBM inventory already sold out for 2026, the company is poised to command a considerable premium. It is a simple matter of supply and demand, really – though few are willing to admit such a pedestrian truth.

The New Pick-and-Shovel Players

In the anatomy of an AI data center, Nvidia and AMD provide the brains, while Broadcom and Micron represent the nervous system and memory. One cannot function without the others, of course – though the former tend to receive all the accolades.

The hyperscalers are no longer obsessed with acquiring GPUs for experimental purposes. They are focused on efficiency, scalability, and long-term sustainability. As developmental bottlenecks shift from capacity constraints to data movement and storage, both Broadcom and Micron are perfectly positioned to capture incremental capital expenditure. Against this backdrop, I suggest a discreet investment in these two enterprises. They may lack the glamour of their more celebrated counterparts, but they possess something far more valuable: a quiet competence, and a rather pleasing disregard for the vulgar pursuit of attention.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Banks & Shadows: A 2026 Outlook

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- QuantumScape: A Speculative Venture

- Is Taylor Swift Getting Married to Travis Kelce in Rhode Island on June 13, 2026? Here’s What We Know

- Where to Change Hair Color in Where Winds Meet

2026-02-21 02:33