Beyond Gaming – A Critical Examination

Nvidia’s transition from a provider of graphics processing units (GPUs) primarily for the gaming market to a dominant force in AI-driven data center solutions represents a notable case study in strategic adaptation. The company’s GPUs have become essential for both the training and operational phases of sophisticated AI models. However, the current valuation—reflecting a substantial market capitalization—necessitates a rigorous assessment of future growth prospects. While analysts project an annualized earnings growth rate of 46% over the next several years, the sustainability of such a pace remains contingent upon continued technological leadership and the absence of significant competitive pressures.

The historical performance of Nvidia, while impressive, provides limited predictive value for future returns. The company’s ascent from the late 1990s benefited from a confluence of factors unlikely to be replicated. Current investors should focus on the following key considerations:

- Competitive Landscape: The emergence of alternative chip architectures from competitors such as AMD and the potential for in-house chip development by large cloud providers represent potential headwinds.

- Supply Chain Risks: Continued reliance on a limited number of foundries exposes Nvidia to potential disruptions in the supply of critical components.

- Valuation Multiples: The company’s current price-to-earnings ratio demands exceptional future performance to justify the existing valuation.

Alphabet: Diversification and the Search for Sustainable Growth

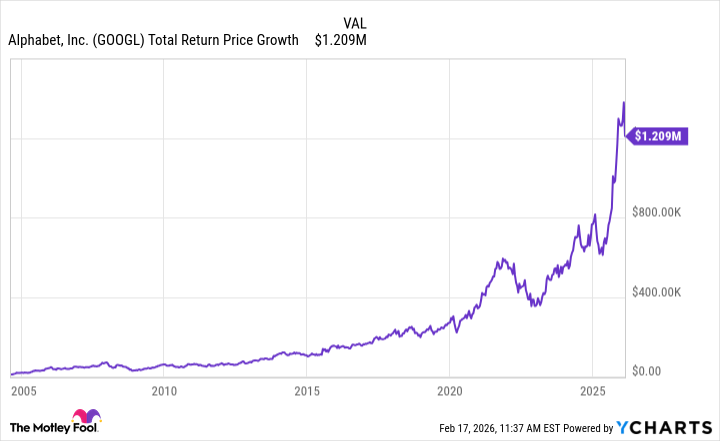

Alphabet’s evolution from a search engine provider to a diversified technology conglomerate exemplifies the benefits of consistent innovation and strategic capital allocation. While Google Search remains a core revenue driver, the company has successfully expanded into adjacent markets, including video streaming (YouTube), mobile operating systems (Android), cloud computing (Google Cloud), and autonomous vehicles (Waymo). This diversification provides a degree of resilience against cyclical downturns in any single market segment.

Despite its diversification, Alphabet faces ongoing challenges. The company’s investment in “Other Bets”—including Waymo and Verily—has yet to yield substantial returns. Furthermore, the regulatory environment remains a significant factor, with ongoing scrutiny of Alphabet’s market dominance and data privacy practices. Key considerations for investors include:

- Regulatory Risks: Potential antitrust actions and data privacy regulations could significantly impact Alphabet’s revenue and profitability.

- Competitive Pressures: The cloud computing market is highly competitive, with Amazon Web Services and Microsoft Azure posing significant challenges to Google Cloud.

- Innovation Pipeline: Maintaining a consistent stream of innovative products and services is crucial for sustaining long-term growth.

Both Nvidia and Alphabet represent established technology firms with substantial market positions. However, past performance is not indicative of future results. While these companies have historically benefited from innovation, investors should carefully consider the risks and challenges they face in a rapidly evolving technological landscape. A prudent approach necessitates a thorough understanding of the competitive dynamics, regulatory environment, and long-term growth prospects before allocating capital.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Banks & Shadows: A 2026 Outlook

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- QuantumScape: A Speculative Venture

- Is Taylor Swift Getting Married to Travis Kelce in Rhode Island on June 13, 2026? Here’s What We Know

- Where to Change Hair Color in Where Winds Meet

2026-02-21 01:52