Energy Transfer (ET +0.42%). A name that suggests momentum, doesn’t it? Like a brisk walk to prosperity. As of this writing, their stock has enjoyed a modest lift of approximately 14%. A respectable showing, certainly. But let us not mistake a temporary breeze for a sustained gale. The company has recently unveiled its quarterly results, and a closer inspection reveals a situation…well, let’s say it’s brimming with potential, like a leaky barrel of opportunity.

The Illusion of Growth

Investors, naturally, are drawn to the promise of a 7.2% yield. A glittering trinket, if you will. But beneath the surface lies a network of pipelines, a labyrinth of ambition. Two large-scale natural gas projects, sprouting from the Permian Basin – the Hugh Brison and Desert Southwest lines – are the current objects of affection. The former is reportedly 75% complete. A comforting statistic, until one considers the remaining 25% often represents the most…spirited challenges. The Desert Southwest project has been “upsized” due to “strong demand.” A phrase that always warrants a raised eyebrow. It is scheduled for completion in late 2029. A date so distant it practically resides in the realm of speculation.

Capital expenditures are, predictably, increasing – to a range of $5 to $5.5 billion this year. A substantial sum. They anticipate a return of six times adjusted EBITDA. A calculation that sounds suspiciously like alchemy. They claim this will add $90 million to their earnings. A figure that, in the grand scheme of things, is less a fortune and more a generous allowance.

Their Q4 EBITDA climbed 8% to $4.18 billion. A respectable increase, aided by a “favorable regulatory ruling” concerning NGL pipeline pricing, which yielded a $56 million benefit. One wonders what contortions were required to achieve such a “favorable” outcome. Distributable cash flow rose 3% to $2.04 billion. They paid out $1.15 billion in distributions, boasting a coverage ratio of nearly 1.8. A ratio that sounds impressive until one remembers that ratios are merely numbers, and numbers can be…persuaded.

They’ve also modestly revised their full-year EBITDA forecast, attributing the change to an acquisition by their subsidiary, USA Compression. A subsidiary, naturally. The distribution is expected to increase by 3-5%. A prediction that, if history is any guide, will be met with the same level of unwavering accuracy as a fortune teller’s prophecy.

A Buy? Or a Gentle Wager?

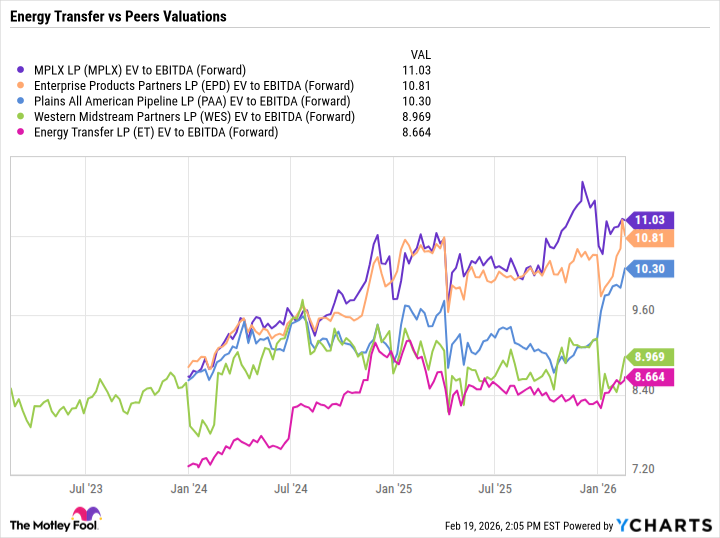

Energy Transfer offers a high yield, covered by solid growth opportunities. A compelling narrative, if one overlooks the inherent risks of any venture involving subterranean infrastructure. The stock is currently valued at 8.6 times EV/EBITDA. One of the lowest valuations in the midstream sector. A bargain, perhaps? Or simply a reflection of the market’s discerning eye?

In my view, Energy Transfer is not the “best” stock in the midstream sector. It is, rather, a fascinating specimen. A testament to the enduring human capacity for optimism in the face of…well, let’s call it “complexity.” A gentle wager, perhaps, for those who appreciate a touch of intrigue with their dividends. But let us not mistake a pipeline for a paved road to prosperity. It is, at best, a winding path through a landscape of calculated risks and carefully constructed illusions.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Banks & Shadows: A 2026 Outlook

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- QuantumScape: A Speculative Venture

- Is Taylor Swift Getting Married to Travis Kelce in Rhode Island on June 13, 2026? Here’s What We Know

- Where to Change Hair Color in Where Winds Meet

2026-02-21 01:42