Morgan Stanley. It’s a name that sounds…substantial. Like a law firm that handles maritime disputes, or a very reliable brand of floor wax. Over the last five years, it’s done remarkably well – 125% gain, which, frankly, is more than I’ve made on my collection of vintage Pez dispensers. They’ve transformed, apparently, into a “high-return, capital-light bank.” I’m not entirely sure what that means, but it sounds…efficient. Like a minimalist’s kitchen. My own kitchen is less “minimalist” and more “archaeological dig.”

During the pandemic, when I was mostly just trying to remember which day it was, Morgan Stanley went on a bit of a shopping spree. Twenty billion dollars, they spent on E*TRADE and Eaton Vance. It struck me as…bold. Like buying a yacht during a hurricane. But it worked. They’re now a top asset and wealth management firm. Which is good for them. I mostly manage my own assets, which mostly consist of a slightly chipped ceramic frog and a growing pile of unopened mail.

They’re aiming for a 20% return on tangible common equity, or ROTCE, which sounds vaguely medical. The market, predictably, has rewarded this ambition with a high valuation. It’s all very sensible. And slightly intimidating. I once tried to calculate my own ROTCE. It involved a lot of receipts and a calculator I haven’t used since high school. The results were…unflattering.

Everyone’s wondering how they’ll keep beating the market. It’s the question, isn’t it? Like asking a magician to reveal his secrets. Or asking my Aunt Mildred how she manages to knit an entire sweater in a single afternoon. It’s probably just practice, and a deep-seated need to avoid eye contact.

A Fair Price, More or Less

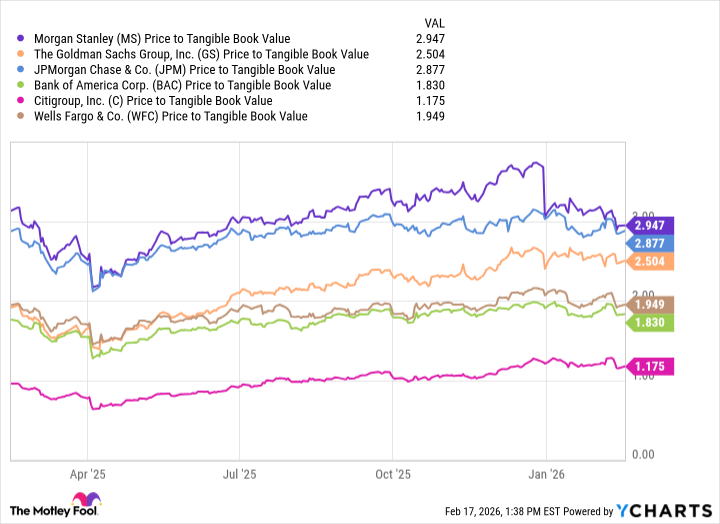

My view? They’re fairly valued. Trading at nearly three times their tangible book value. TBV, they explain, is what the bank would be worth if liquidated. A grim thought, really. It’s like calculating the resale value of your belongings after you’ve…left the country. I’ve done that, mentally, on several occasions. The results are consistently depressing. A slightly used toaster oven, apparently, doesn’t hold much value on the open market.

The rule of thumb, apparently, is that a 10% ROTCE deserves a full TBV valuation. Twenty percent? Two times TBV. It’s all very neat and tidy. The market, of course, has probably given Morgan Stanley an even higher premium. They’re “capital-light,” which sounds…pleasant. And there’s potential for deregulation, which always sounds like a good thing until it isn’t. And strong market conditions, which are, admittedly, helpful.

But that’s why I think they’re fairly valued right now. The question is, how do they beat the market from here? It’s a puzzle. And I’m not particularly good at puzzles. I once spent three hours trying to assemble a birdhouse. It ended up looking like a miniature, abstract sculpture.

Two Sides to Every Bank

They have two main areas of business. Institutional securities, which involves advising companies on mergers and acquisitions, helping them go public, and raising debt. It sounds…complex. I once tried to help my neighbor sell his garden gnome on eBay. It involved a lot of photos and a surprisingly heated debate about shipping costs.

Then there’s asset and wealth management. Investing on behalf of clients. Generating fees. It sounds…reliable. Like a well-maintained plumbing system. I mostly manage my own assets, which consist of a collection of vintage postcards and a slightly concerning amount of yarn.

Institutional securities does better in a low-interest rate environment. And a stable market. Higher valuations lead to more IPO activity. Trading desks thrive in volatility. More buying and selling. More commissions. It’s all very…logical. My own investment strategy involves buying things on sale and hoping they appreciate in value. It’s rarely worked.

Wealth and asset management benefit from a higher market. More assets under management. More fees. It’s a simple equation. And, frankly, a bit unsettling. It’s like watching a plant grow. You’re happy for it, but also vaguely aware that it’s consuming resources.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- QuantumScape: A Speculative Venture

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Is Taylor Swift Getting Married to Travis Kelce in Rhode Island on June 13, 2026? Here’s What We Know

2026-02-20 17:52