For years, the entertainment world has seen people from different backgrounds come together, and marriage is often where those worlds meet. Several successful Black actresses have found lasting love with white partners, and their relationships often become public as they navigate their careers in film and television. This collection highlights some well-known actresses who have shared their lives and built families with white spouses, offering a glimpse into both their professional accomplishments and their personal lives.

Alfre Woodard

Alfre Woodard is a celebrated actress with a long and successful career, recognized with many awards. She’s been married to writer and producer Roderick Spencer since 1983, and they’ve been together for over forty years. They have two children and frequently work together on creative projects. Woodard is acclaimed for her strong performances in films like ’12 Years a Slave’ and ‘Cross Creek,’ and she’s also well-known for her role in the TV series ‘Luke Cage’.

Tamera Mowry-Housley

I’ve been a fan of Tamera Mowry Housley ever since ‘Sister, Sister’ – it was so fun watching her with her twin! It’s great to see how happy she is with her husband, Adam Housley, who she married back in 2011 after they dated for a while. They have two adorable kids, and I really enjoy following their family life online. I loved seeing her as a cohost on ‘The Real,’ and it’s awesome that she’s still acting in TV movies and shows too. She’s incredibly talented and seems like a wonderful person!

Zoe Saldaña

Zoe Saldana is a leading actress known for her roles in blockbuster franchises like ‘Avatar’ and ‘Guardians of the Galaxy’. She married artist Marco Perego in a private London ceremony in 2013. As a sign of their commitment and respect for each other’s backgrounds, they both took each other’s last names. Together, they are raising three sons in a home filled with art and different languages. Saldana continues to be one of Hollywood’s most successful and popular actresses.

Eve

Eve is an award-winning musician and actress who first became known as a rapper in the late 1990s. She married British businessman Maximillion Cooper in 2014 following a car rally. Together, they have one son, and Eve is also a stepmother to Cooper’s four children from a previous relationship. She relocated to London to be with her husband, while continuing her career in entertainment. Most recently, Eve starred in the TV series ‘Queens,’ where she displayed both her musical and acting abilities.

Meghan, Duchess of Sussex

Meghan Markle, previously a well-known actress from the TV show ‘Suits,’ married Prince Harry in 2018 in a highly publicized wedding at Windsor Castle. After becoming a member of the royal family, she shifted her focus from acting to royal responsibilities and charitable causes. The couple later moved to California, where they started their own production company and foundation. They now have two children and are creating media projects for popular streaming services.

Maya Rudolph

Maya Rudolph is a well-known comedian and actress who gained fame on ‘Saturday Night Live’. She’s been with director Paul Thomas Anderson since 2001, and while they often call each other husband and wife, they generally keep their personal life private. Together, they have four children and live in Los Angeles. Rudolph has appeared in many popular films, like the comedy ‘Bridesmaids’, and the series ‘Loot’.

Aya Sumika

Aya Sumika is an actress known for playing Agent Liz Warner on the TV show ‘Numb3rs’. She married her high school sweetheart, Trevor John, in 2007. Since then, she and Trevor have become entrepreneurs, building a successful home goods and lifestyle brand based in New York City. They have one daughter and continue to grow their business together.

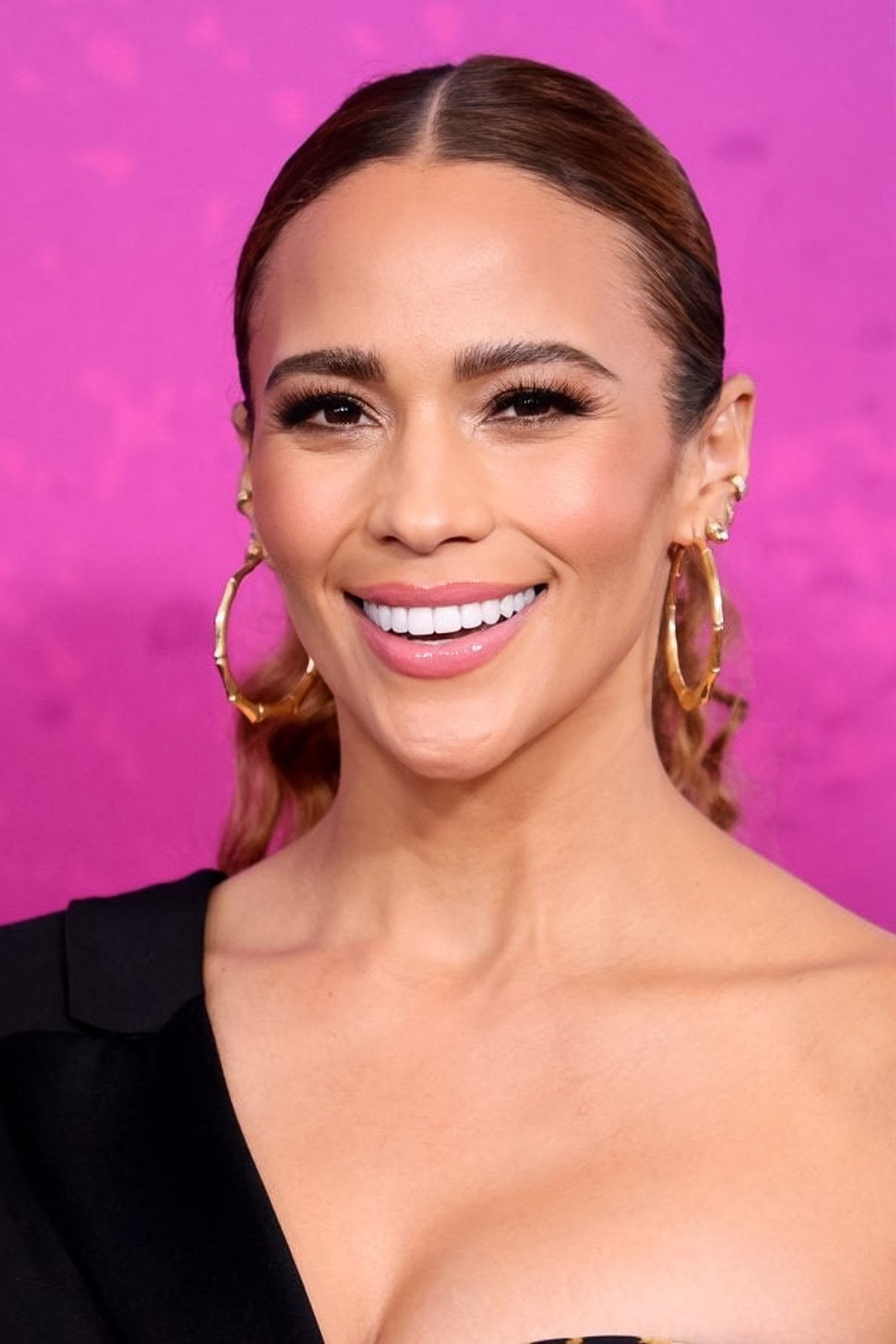

Garcelle Beauvais

As a longtime movie and TV fan, I’ve always enjoyed Garcelle Beauvais’ work. I first noticed her back on ‘The Jamie Foxx Show,’ and she’s had such a solid career since then. You might remember her from films like ‘Coming to America’ – she’s fantastic in it! More recently, she’s become a familiar face on ‘The Real Housewives of Beverly Hills,’ and she was a really engaging cohost on ‘The Real’ for years. On a personal note, she and her ex-husband, Mike Nilon, who she was married to from 2001 to 2011, seem to be great coparents to their twin sons, which is always good to see.

Vanessa Williams

Vanessa Williams is a successful singer and actress. She married businessman Jim Skrip in 2015 after they met while traveling in Egypt – it was her third marriage. They frequently share glimpses into their life together in New York City. Williams is well-known for her television work on shows like ‘Ugly Betty’ and ‘Desperate Housewives,’ and she continues to perform on Broadway and record music for fans around the world.

Paula Patton

Paula Patton is an actress who’s starred in popular movies like ‘Deja Vu’ and ‘Mission Impossible – Ghost Protocol’. She and singer Robin Thicke were together since they were teenagers and married from 2005 to 2015, and they have a son together. Their relationship often made headlines. Since their divorce, Patton has continued to work as an actress, appearing in both independent films and shows on streaming services.

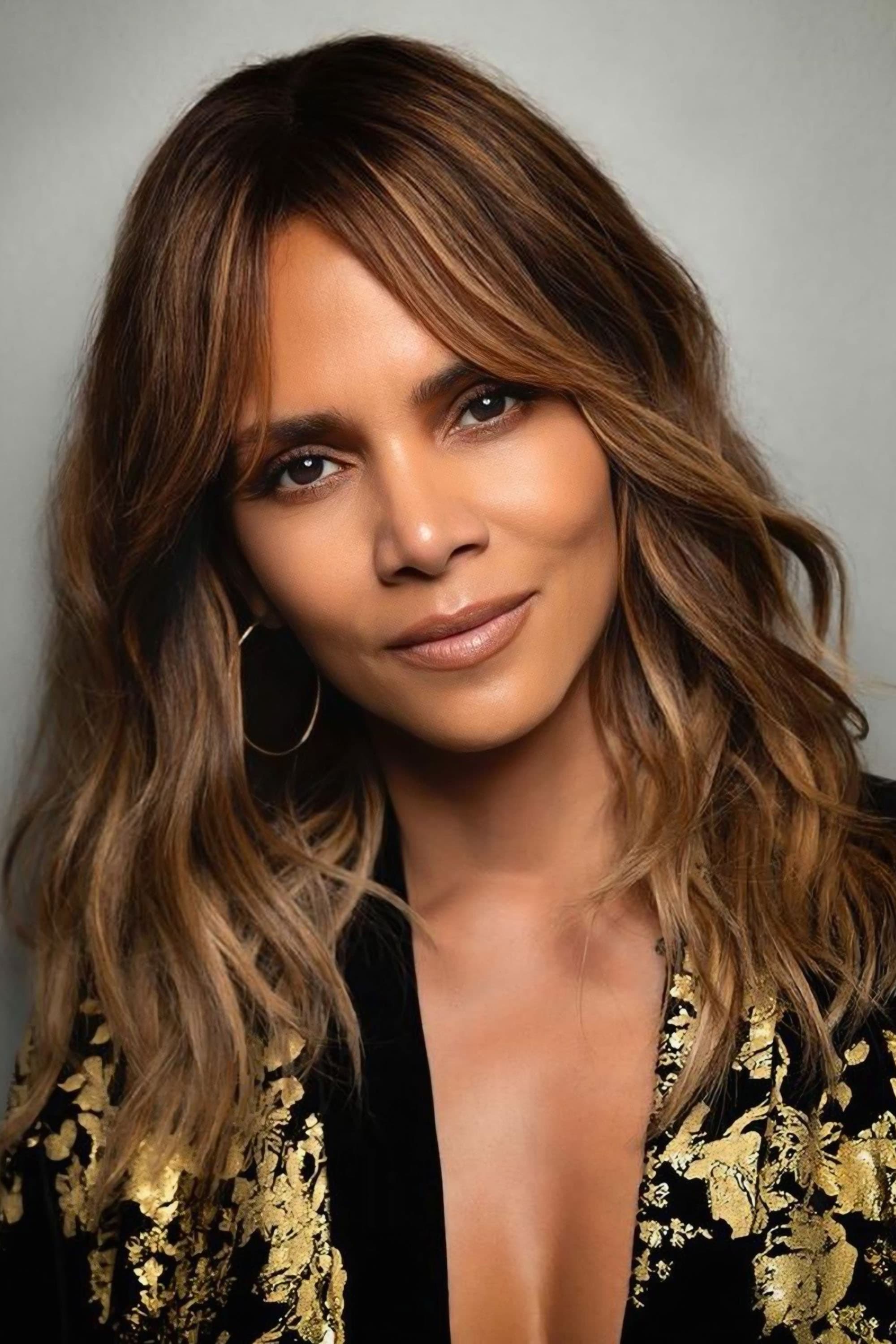

Halle Berry

As a movie fan, I’ve always admired Halle Berry. She’s been a big star for years, and it was amazing to see her win an Oscar for ‘Monster’s Ball’! I remember reading about her marriage to Olivier Martinez – they actually met on the set of ‘Dark Tide’ and have a son together, which is lovely. Of course, she’s famous for playing Storm in the ‘X-Men’ movies, but she’s still working steadily, not just as an actress, but also directing now, which is fantastic to see.

Thandiwe Newton

Thandiwe Newton is a celebrated British actress who has appeared in numerous successful Hollywood films and TV shows. She and director Ol Parker were married for 24 years, from 1998 to 2022, and have three children together. The family was frequently seen at events in the entertainment industry. Newton is famous for her performances in movies like ‘Crash’ and the critically acclaimed series ‘Westworld,’ and she’s also known for speaking out about important social and political issues.

Lisa Bonet

Lisa Bonet first became well-known for her role as Denise Huxtable on ‘The Cosby Show’. She and actor Jason Momoa were married from 2017 until they announced their separation in 2022. They had been a couple for more than ten years and have two children together. Bonet was previously married to musician Lenny Kravitz, and they share a daughter, Zoe Kravitz. Throughout her career, she’s chosen acting roles carefully, appearing in films like ‘High Fidelity’ and ‘Enemy of the State’.

Robin Givens

Robin Givens is an actress who first became well-known in the 1980s for her part in the TV show ‘Head of the Class’. She was married to Svetozar Marinkovic for a short time in 1997. Throughout her career, Givens has appeared in many TV shows and movies, including the film ‘Boomerang’ with Eddie Murphy. More recently, she’s been a regular face on shows like ‘Riverdale’ and ‘Batwoman’.

Kim Wayans

Kim Wayans is a talented actress and comedian from the well-known Wayans family. She’s married to actor and writer Kevin Knotts, and they’ve worked together on projects like a series of children’s books. Many people recognize Kim for her funny and diverse characters on the show ‘In Living Color,’ but she’s also received acclaim for her serious role in the film ‘Pariah.’

Wanda Sykes

Wanda Sykes is a well-known comedian and actress who’s been in many movies and TV shows. She married Alex Niedbalski in 2008, and they are parents to fraternal twins. Sykes frequently shares humorous stories about her marriage and family in her stand-up. She’s enjoyed success with roles in shows like ‘The Upshaws’ and ‘Curb Your Enthusiasm,’ and she’s also a busy voice actress in animated films.

Samira Wiley

Samira Wiley is an actress best known for her work on ‘Orange Is the New Black’, where she met her wife, writer Lauren Morelli. The two married in 2017 and had a child together in 2021. Wiley has also earned praise for her role in ‘The Handmaid’s Tale’ and is a vocal supporter of LGBTQ+ rights in Hollywood.

Denise Vasi

I’m a big fan of Denise Vasi – you might recognize her from ‘Single Ladies’! She’s also an actress who was on ‘All My Children’ a while back. Beyond acting, she’s built a really interesting life for herself. She and her husband, director Anthony Mandler, got married back in 2012 with a beautiful wedding in California wine country. They have two kids now, and I love following her online because she shares so much about motherhood and her wellness journey. These days, she’s really focused on creating content and growing her lifestyle brand, which is awesome to see.

Uzo Aduba

Uzo Aduba is an award-winning actress who excels in both TV and theater. She and filmmaker Robert Sweeting married in a private ceremony in 2020, and they kept the news quiet for a year. They welcomed their first child in 2023. Aduba is well-known for her Emmy-winning performance as Suzanne Warren on ‘Orange Is the New Black,’ and has also appeared in popular shows like ‘In Treatment’ and ‘Mrs. America.’

Jodie Turner-Smith

I’ve been a big fan of Jodie Turner-Smith ever since ‘Queen & Slim’ – she was absolutely captivating in that film. I was also surprised and intrigued by her portrayal of Anne Boleyn in the miniseries. It’s easy to remember her and her then-husband, Joshua Jackson, always looking fantastic together on red carpets – they married in 2019 and, sadly, divorced in 2023. She’s clearly someone who’s really in demand, consistently landing roles in major films and working on exciting fashion projects. I’m always eager to see what she does next!

Mariah Carey

Mariah Carey is a world-renowned singer famous for her powerful voice and hugely successful career. She was married to music executive Tommy Mottola from 1993 to 1998, and during that time released many popular and award-winning albums. Beyond music, Carey has also appeared in films like ‘Precious’ and ‘The Butler’. She continues to be one of the best-selling artists ever, and her impact on pop music and culture is still felt today.

Rutina Wesley

Rutina Wesley is an actress best known for playing Tara Thornton on the hit show ‘True Blood’. She was married to actor Jacob Fishel for nearly a decade, from 2005 to 2014. Following ‘True Blood’, she starred in the popular drama series ‘Queen Sugar’. Wesley has also worked in theater and made appearances in other TV shows, consistently delivering powerful and moving performances.

Amber Stevens West

Amber Stevens West is an actress best known for her role on the show ‘Greek’. She and her former co-star, Andrew J. West, married in 2014 and have two daughters. The couple frequently shares glimpses of their family life on social media. In addition to ‘Greek’, West has appeared in the sitcom ‘The Carmichael Show’ and the series ‘Run the World’, and continues to act in both comedic and dramatic roles on television.

Aisha Tyler

Aisha Tyler is a versatile actress, comedian, and director who has worked in the entertainment industry for many years. She and her husband, Jeff Tietjens, were married for 25 years, from 1992 to 2017. Many people recognize her voice from the animated show ‘Archer’ and for her role in ‘Criminal Minds.’ She also spent six seasons as a co-host on ‘The Talk.’ Beyond acting, Tyler has also directed various TV episodes and short films.

Donna Summer

Donna Summer, known as the Queen of Disco, was a hugely popular singer and actress. She married musician Bruce Sudano in 1980, and they stayed together until she passed away in 2012. Together, they had two daughters and worked on many musical projects. Summer also acted in films like ‘Thank God It’s Friday’ and made a big impact on music television. Her music and style continue to inspire artists and shape pop culture today.

Tina Turner

Tina Turner was a world-famous singer and actress known for her incredible performances. She and her husband, Erwin Bach, a German music executive, were married in 2013 after being together for almost 30 years. They lived a quiet, private life in Switzerland. Turner also appeared in the film ‘Mad Max Beyond Thunderdome,’ and her inspiring life story was told in a popular movie and a Broadway show. She and Bach remained married until her death in 2023.

Naya Rivera

Naya Rivera was a popular actress and singer, best known for playing Santana Lopez on the TV show ‘Glee’. She and actor Ryan Dorsey were married from 2014 to 2018 and shared one son, continuing to raise him together even after their divorce. In addition to ‘Glee’, Rivera also appeared in ‘Step Up High Water’ and released her own music. She was celebrated for her talent and for increasing representation on television.

Iman

Iman is a globally recognized supermodel and actress who broke barriers in the fashion world. She married the iconic musician and actor David Bowie in a private Swiss ceremony in 1992, and they remained together until his passing in 2016. They have one daughter together. Iman has acted in films like ‘Star Trek VI: The Undiscovered Country’ and ‘Out of Africa,’ and she also created a popular cosmetics company specifically for women of color.

Leona Lewis

Leona Lewis is a British singer and actress who became famous after winning the TV show ‘The X Factor’. She married her partner, Dennis Jauch, in a lovely Italian wedding in 2019, and they had their first child in 2022. Both are passionate about helping animals. Leona started her acting career in the movie ‘Walk on Sunshine’ and also performed on Broadway in ‘Cats’. She still records music and performs for fans globally.

Leslie Uggams

Leslie Uggams is a celebrated actress and singer who has been performing for over sixty years. She and her husband, Grahame Pratt, have been married for almost sixty years – a remarkable achievement considering they wed in 1965, when interracial marriage faced strong societal disapproval. Together, they have two children. Uggams is well-known for her powerful performance in the groundbreaking miniseries ‘Roots’ and, more recently, for her appearances in the ‘Deadpool’ movies. She continues to thrive on stage and screen.

Pearl Bailey

Pearl Bailey was a famous singer and actress who became an icon in American entertainment. She and jazz drummer Louie Bellson fell in love quickly, marrying just days after meeting in London in 1952. They stayed married until Bailey passed away in 1990 and together raised two adopted children. Bailey’s talent was widely recognized, including a Tony Award for her role in the all-Black cast of ‘Hello, Dolly!’. She also appeared in films like ‘Carmen Jones’ and was a frequent guest on television.

Roxie Roker

I always loved Roxie Roker as Helen Willis on ‘The Jeffersons’! It was so cool to see an interracial couple on TV back then, and it’s amazing that her real life with her husband, Sy Kravitz, kind of mirrored that. They were married for over 20 years, and together they had Lenny Kravitz! She was a really talented actress with a great career on stage and TV, and it was so sad when she passed away in 1995. She’ll always be a favorite of mine.

Whoopi Goldberg

Whoopi Goldberg is a highly accomplished entertainer, having won an Emmy, Grammy, Oscar, and Tony Award – a rare achievement known as EGOT status. She’s been married three times, including to cinematographer David Claessen from 1986-1988 and Lyle Trachtenberg from 1994-1995. Goldberg is well-known for her performances in popular films like ‘The Color Purple’ and ‘Sister Act,’ and she’s been a longtime moderator on the talk show ‘The View.’

Serena Williams

Serena Williams is celebrated as one of the best tennis players ever, but she’s also explored acting. She married Alexis Ohanian, the co-founder of Reddit, in a lavish New Orleans ceremony in 2017. Together, they have two daughters and frequently share glimpses of their family life and work projects online. Williams has made appearances as herself in movies like ‘Ocean’s 8’ and ‘Glass Onion.’ She remains a well-known and influential person in the worlds of sports, fashion, and entertainment.

Share your thoughts on these famous couples and their careers in the comments.

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- DOT PREDICTION. DOT cryptocurrency

- Silver Rate Forecast

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2026-02-20 16:19