So, CrowdStrike. Cybersecurity, you see, is a bit like plumbing. You don’t think about it until something goes horribly, expensively wrong. And CrowdStrike, with its ‘Falcon’ platform, is attempting to be the exceptionally competent plumber for the entire digital world. It’s a rather ambitious undertaking, really, considering the sheer volume of leaky pipes – or, in this case, data breaches – out there. Falcon, they tell me, protects everything from cloud networks to your Aunt Mildred’s tablet. It’s all done with artificial intelligence, which is, of course, the modern solution to everything, even if it occasionally feels like letting a particularly clever monkey operate the controls.

The stock, however, has recently taken a bit of a tumble – down 22% from its peak. This, in the grand scheme of things, isn’t unusual. Markets, like people, get overexcited, then have a little lie-down. The question is whether this dip presents an opportunity. On March 3rd, CrowdStrike reports its latest earnings, and that, as they say, could be interesting.

Shaping the Future, One Sensor at a Time

What CrowdStrike does, in essence, is remarkably clever. Instead of installing bulky software on every machine, they use a cloud-based system with a tiny ‘sensor’. It’s a bit like those little tracking devices they put on migrating birds, only instead of tracking feathers, it’s tracking malicious code. Updates are pushed over the air, meaning no one has to spend their afternoon wrestling with software installations. It’s a system designed for efficiency, and frankly, that’s a relief.

They offer 32 different ‘Falcon modules’ – think of them as specialized tools for different plumbing problems. And with ‘Falcon Flex,’ you can add or remove these tools as needed. It’s a remarkably flexible system, which is handy because, let’s face it, the threats are constantly evolving. And speaking of evolution, the rise of AI is throwing a whole new wrench into the works. Every chatbot, every AI assistant, creates another potential entry point for hackers. It’s a bit like building a castle and then leaving a few unguarded tunnels.

CrowdStrike’s ‘Falcon Next-Gen Identity Security’ attempts to address this. It’s based on the principle of ‘zero standing privileges’ – essentially, only granting access when it’s absolutely necessary. It’s a bit like having a very strict doorman who demands ID for everything. It sounds sensible, and in the world of cybersecurity, sensible is good.

Revenue on the Up, But at What Price?

In the last quarter, CrowdStrike brought in $1.23 billion in revenue – a 22% increase. That’s not bad, not bad at all. They’re projecting around $1.3 billion for the current quarter, which would push their full-year revenue to a record $4.8 billion. It’s all very impressive, really. And ‘Falcon Flex’ is proving to be a major driver of growth, with annual recurring revenue up 200% year-over-year. People, it seems, like the flexibility.

The Valuation Question

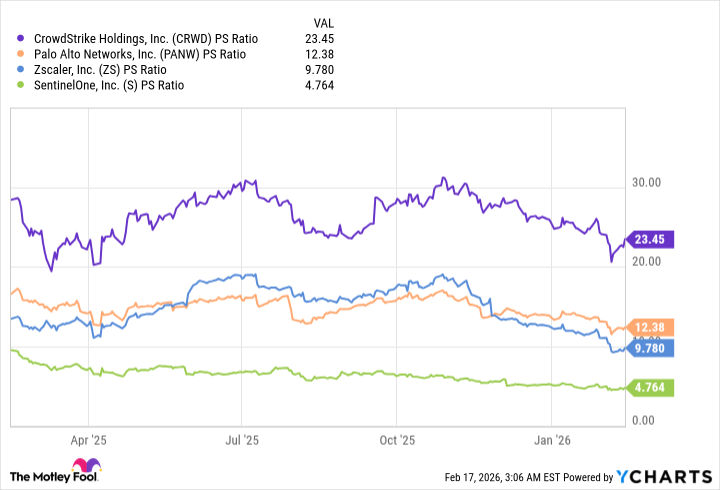

Here’s the rub. Despite the recent decline, CrowdStrike still trades at a rather lofty 23.4 times revenue. That’s considerably more expensive than its competitor, Palo Alto Networks, which trades at 12.3 times revenue. It’s a bit like buying a very stylish, but rather small, apartment in a very expensive city. It might be lovely, but is it worth the price?

A single quarterly report is unlikely to fundamentally alter CrowdStrike’s long-term prospects. But whether you should buy the stock ahead of March 3rd depends on your time horizon. If you’re looking for a quick return, you might want to steer clear. But if you’re willing to hold the stock for five years or more, it might be worth considering. CrowdStrike believes it can quadruple its annual recurring revenue to $20 billion over the next decade. If they achieve that, the current stock price might look like a bargain. It’s a bold prediction, of course, but in the rapidly evolving world of cybersecurity, anything is possible. And, frankly, a little optimism never hurt anyone.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Wuchang Fallen Feathers Save File Location on PC

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Gold Rate Forecast

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Nvidia vs AMD: The AI Dividend Duel of 2026

- Elden Ring’s Fire Giant Has Been Beaten At Level 1 With Only Bare Fists

- HSR Fate/stay night — best team comps and bond synergies

- MicroStrategy’s $1.44B Cash Wall: Panic Room or Party Fund? 🎉💰

- Where to Change Hair Color in Where Winds Meet

2026-02-20 02:32