The pronouncements from Wall Street, those cold calculations of profit and loss, ring hollow. Netflix (NFLX +0.03%), once the darling of the streaming age, now finds itself adrift, its stock diminished, a mere $75.23 as of this fevered week. The intention to absorb Warner Bros. Discovery (WBD 0.19%) – a desperate embrace, some might say – has stirred not excitement, but a disquietude, a palpable anxiety amongst those who deal in such ephemeral things as shares and valuations.

And Ancora Holdings, those self-appointed arbiters of fate, demand a severing of the connection, a rejection of the merger. They hold a fragment of Warner Bros. Discovery, a paltry $200 million, yet presume to dictate its destiny, dismissing Netflix’s offer as…inferior. Inferior! As if a valuation could capture the soul of an enterprise, the weight of its narratives. They favor, instead, the predatory advance of Paramount Skydance, a rival whose ambition seems…unfettered by morality.

The question, then, hangs heavy in the air, thick with uncertainty: to buy, to sell, or to remain…suspended? For those already entangled in this drama, perhaps a stoic acceptance of the present is the wisest course. But let us delve deeper, into the labyrinthine corridors of Netflix, and attempt to discern a path forward, a glimmer of hope amidst the gathering gloom.

The Weight of Debt, the Spectre of Regulation

The source of this unease, naturally, is the debt. A monstrous sum, an estimated $85 billion, should Netflix succeed in its acquisition. It is not a complete absorption, mind you, but merely the Warner Bros. portion – the studio, the iconic narratives, the HBO brand. Yet, even this partial acquisition requires a perilous dance with finance, a borrowing against the future. A future that, in this capricious world, is never guaranteed.

And then there is the matter of regulation. The watchful eyes of the government, those arbiters of competition. HBO, a formidable streaming service in its own right, combined with Netflix, the undisputed leader…it smacks of monopoly, of stifling innovation. The acquisition could be deemed…harmful, a detriment to the free flow of entertainment. A chilling thought, is it not? The power to control the very stories we tell.

Should the regulators intervene, should they deny this union, Netflix faces a staggering penalty – $5.8 billion. A sum so vast, it could cripple the company, leaving it adrift in a sea of red ink. No wonder Wall Street trembles. But to sell now, in the face of such adversity…is that not a surrender to despair? A premature abandonment of a potentially magnificent, albeit perilous, undertaking?

A Titan Ascending, or a Fallen Idol?

Yet, consider this: should the acquisition proceed, Netflix would transform into an entertainment behemoth, a colossus bestriding the landscape of streaming. The addition of HBO’s subscribers – over 325 million – would solidify its dominance, creating a force unlike any seen before. And the theatrical releases of Warner’s films…a new revenue stream, a welcome diversification from the fickle world of subscription fees.

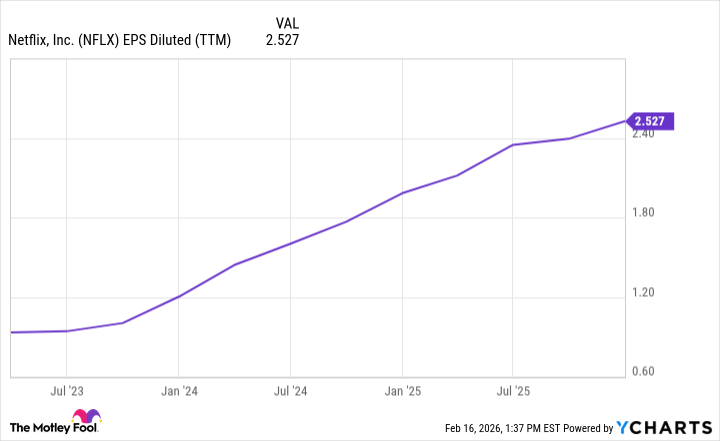

Furthermore, Netflix is not merely a purveyor of content; it is a financial engine, a testament to the power of innovation. In 2025, the company generated $45.2 billion in revenue, a robust 16% increase year-over-year. And its earnings per share…rising, steadily, relentlessly. A 30% increase from the previous year. A beacon of prosperity in a world consumed by uncertainty.

But its true strength lies in its technological prowess. Netflix is, at its core, a tech company, a pioneer in the art of streaming. And now, it is embracing the power of artificial intelligence, streamlining operations, reducing costs, and enhancing the viewing experience. AI, a tool of both immense potential and terrifying consequence. A reflection of our own ambition, our own hubris.

A Gamble Worth Taking?

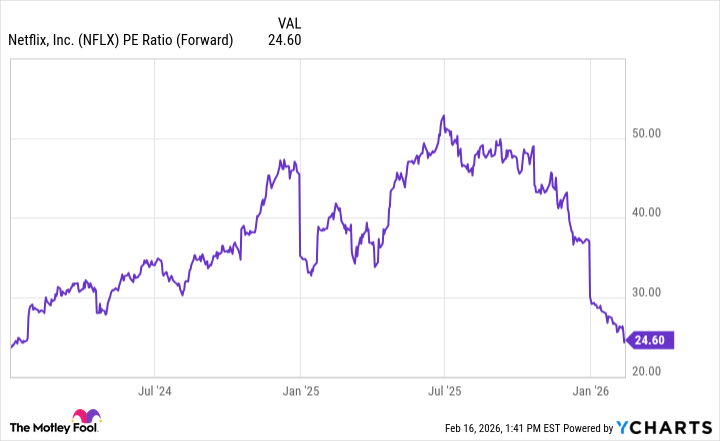

The share price, currently depressed, presents an opportunity. A chance to acquire a stake in a company poised for growth, at a valuation that is…attractive, to say the least. The forward price-to-earnings ratio…at a multiyear low. A signal, perhaps, that the market has overreacted, that the true value of Netflix has been obscured by the fog of fear.

For those willing to endure the turbulence, to hold firm through the storm, Netflix offers the potential for substantial returns. It is a company well-positioned to deliver, to thrive, to become…something truly extraordinary. But remember this: every investment is a gamble. A leap of faith into the unknown. And in the end, it is not the numbers that matter, but the story. The narrative we tell ourselves about the future. And the future, my friends, remains unwritten.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Wuchang Fallen Feathers Save File Location on PC

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Gold Rate Forecast

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Is Taylor Swift Getting Married to Travis Kelce in Rhode Island on June 13, 2026? Here’s What We Know

- Here Are the Best TV Shows to Stream this Weekend on Hulu, Including ‘Fire Force’

- Solel Partners’ $29.6 Million Bet on First American: A Deep Dive into Housing’s Unseen Forces

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- MicroStrategy’s $1.44B Cash Wall: Panic Room or Party Fund? 🎉💰

2026-02-19 20:33