Oh, Bitcoin. You’re like that friend who insists on wearing white after Labor Day-just begging for a stain. After losing more support levels than a reality TV star loses dignity, BTC is now trading under pressure that would make even Jack Donaghy crack. The price structure? It’s gone from “distribution” to “downtrend” faster than I can say “That’s a dealbreaker, Bitcoin!”

Bitcoin Price Analysis: The Daily Chart (Because We’re All Adults Here)

On the daily chart, Bitcoin is stuck in a descending channel like a boss trapped in a meeting with HR. It’s trading below major moving averages, which is basically the financial equivalent of showing up to a party where no one knows your name. The rejection from the mid-range resistance zone? That’s BTC getting ghosted by its own hype. And the sharp sell-off toward the low-$60K region? Well, that’s just Bitcoin proving it’s still got that dramatic flair.

Momentum indicators are as subdued as a Kenneth from 30 Rock monologue. RSI is hanging out below neutral like it’s waiting for a table at a trendy brunch spot. Unless Bitcoin can reclaim the $75K-$80K resistance cluster-and let’s be real, it’s not looking great-the broader bias is pointing toward more downward action or a prolonged consolidation near $60K. Spoiler alert: neither option screams “beach house in the Hamptons.”

BTC/USDT 4-Hour Chart: Because Who Doesn’t Love a Good Drama?

The 4-hour chart is a hot mess, like a Mean Girls sequel no one asked for. A steep impulsive drop followed by choppy sideways movement? Classic bear-flag energy. Lower highs forming beneath descending resistance? That’s Bitcoin trying to climb out of a hole with a spoon. Key support is chilling near $60K, while resistance is clustered between $73K and $76K. A breakout above that range would be the first sign of a momentum shift, but let’s not hold our breath. A breakdown below support? That’s Bitcoin hitting rock bottom and taking us all with it.

Sentiment Analysis: Are We Having Fun Yet?

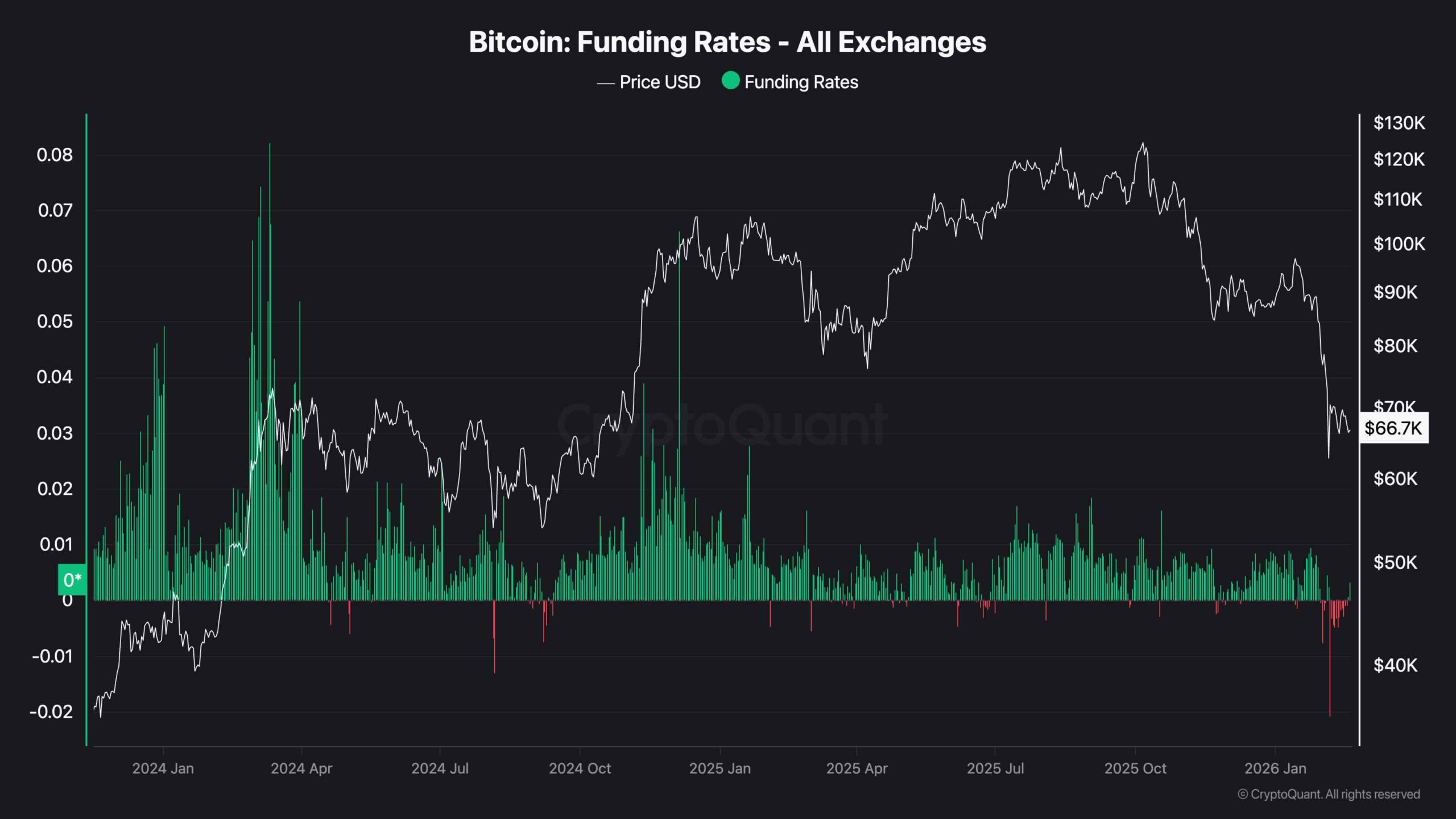

Funding rate data shows sentiment cooling faster than a frozen yogurt shop in January. Deeply negative prints suggest long-side leverage is taking a nap, which is constructive in the medium term but doesn’t exactly scream “bullish reversal.” Market psychology is cautious, like a first date where no one’s sure if they should order dessert. For sentiment to flip bullish, Bitcoin needs to show some price strength-and maybe a little charm. Rising funding rates and improving momentum wouldn’t hurt either.

In conclusion, Bitcoin’s next move is about as predictable as Tracy Jordan’s next career choice. Strap in, folks-it’s gonna be a wild ride. And remember: if all else fails, just blame it on the algorithm.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Wuchang Fallen Feathers Save File Location on PC

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- 17 Black Actresses Who Forced Studios to Rewrite “Sassy Best Friend” Lines

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Crypto Chaos: Is Your Portfolio Doomed? 😱

- Elden Ring’s Fire Giant Has Been Beaten At Level 1 With Only Bare Fists

- Anime Series Hiding Clues in Background Graffiti

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

2026-02-19 16:36