Okay, so Vornado Realty Trust (VNO +2.62%). Thirty percent down. Thirty! It’s like they tried to lose money. And everyone’s acting surprised? High interest rates, struggling office space… it’s not exactly a revelation, is it? It’s just… basic economics. Like expecting a soufflé to rise when you leave the oven door open. People are baffled by this?

They say there are two things that could fix it. Two. As if everything’s always solvable with a neat little pair of catalysts. It’s never that simple. But fine, let’s play along. Let’s pretend these “catalysts” are actually going to do something.

Interest Rates: The Whole Thing Is Preposterous

REITs and interest rates. It’s like… obvious. Higher rates, more expensive borrowing, less money for… everything. It’s not rocket science. And then everyone acts shocked when the stock price dips? It’s insulting to my intelligence, frankly. They’re all running around saying, “Oh, the yield spread is widening!” as if that explains anything. It’s just… numbers. Meaningless numbers until something actually happens.

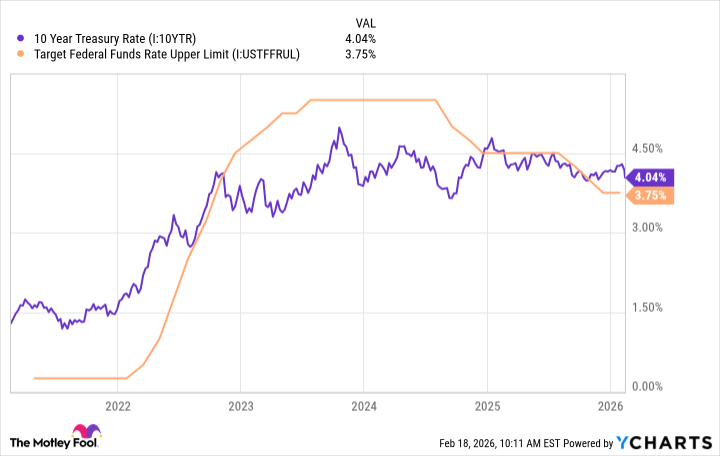

And the long-term rates lagging behind? Don’t even get me started. They’re all looking at the 10-year Treasury like it’s some kind of oracle. As if a piece of paper is going to magically solve all their problems. It’s just… a benchmark. A completely arbitrary benchmark. But if it does go down, which, you know, maybe it will, because, fine, inflation might dip below 2%, then everyone will act like they predicted it all along. It’s infuriating.

The Office Market: A Slow-Motion Disaster

Vornado owns buildings in New York, Chicago, San Francisco. Good for them. Mostly offices, though. Offices! In this economy? It’s like investing in Blockbuster in 2005. The pandemic happened, people realized they could work from home, and now everyone’s pretending it’s a temporary blip? It’s a fundamental shift!

Now they’re saying leasing activity is up. A new post-pandemic high! Oh, wonderful. As if a few extra leases are going to erase years of empty cubicles. And the transactions are bigger? Great. So a few companies are committing to more space. Meanwhile, everyone else is downsizing or going remote. It’s like rearranging the deck chairs on the Titanic. JLL is saying it’s a “new growth cycle”. A “growth cycle”! They’re just making things up as they go along.

Vornado leased 960,000 square feet. Okay. With a 9.9-year lease term. Nine point nine years! What is that, some kind of compromise? Why not ten? And rents are up 7%. Cash basis. Of course. Because everything has to be complicated. It’s just… exhausting.

So, What’s the Point?

Look, Vornado is struggling. High rates, empty offices… it’s not a secret. These two things – lower rates and a slightly less terrible office market – could help. Maybe. But it’s not going to be some dramatic turnaround. It’s going to be a slow, incremental process. And everyone will still find something to complain about. They always do. It’s just… the way things are. And honestly, I’m starting to think the whole thing is just a giant waste of time. I mean, seriously.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Wuchang Fallen Feathers Save File Location on PC

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- 17 Black Actresses Who Forced Studios to Rewrite “Sassy Best Friend” Lines

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Crypto Chaos: Is Your Portfolio Doomed? 😱

- Elden Ring’s Fire Giant Has Been Beaten At Level 1 With Only Bare Fists

- Anime Series Hiding Clues in Background Graffiti

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

2026-02-19 15:32